XRP Explained: Everything You Need To Know

Table of Contents

XRP, the native cryptocurrency of the Ripple network, has become a prominent player in the world of digital assets. But what exactly is XRP, and how does it work? This comprehensive guide will unravel the complexities of XRP, exploring its features, functionalities, and potential impact on the future of finance. We'll cover everything from its core technology to its current market standing and future prospects.

Understanding XRP's Core Functionality

What is XRP and how does it differ from Bitcoin and Ethereum?

XRP's primary function is to act as a bridge currency, facilitating fast and efficient cross-border transactions between different currencies. Unlike Bitcoin, which uses a Proof-of-Work (PoW) consensus mechanism, and Ethereum, which utilizes Proof-of-Stake (PoS) in its later versions, XRP employs the Ripple Protocol Consensus Algorithm (RPCA). This unique algorithm enables significantly faster transaction speeds and lower fees compared to its competitors.

- Faster transaction speeds: XRP transactions are processed in a matter of seconds, unlike Bitcoin and Ethereum, which can take minutes or even hours.

- Lower fees: Transaction fees for XRP are significantly lower than those for Bitcoin and Ethereum, making it a more cost-effective solution for high-volume transactions.

- Focus on institutional adoption: Ripple has focused its efforts on attracting financial institutions and banks, aiming to integrate XRP into their existing payment infrastructure. This differs from Bitcoin and Ethereum's more decentralized and retail-focused approaches.

The Ripple Network and its Role in XRP's Ecosystem

The RippleNet is a global network of banks and financial institutions utilizing Ripple's technology to streamline cross-border payments. It leverages XRP to facilitate these transactions, enabling real-time settlement and significantly reduced costs. This network provides a crucial ecosystem for XRP, driving demand and adoption.

- Cross-border payments: RippleNet simplifies and accelerates international money transfers, reducing processing times and eliminating intermediary banks.

- Real-time settlement: Transactions are settled almost instantly, offering speed and efficiency unavailable with traditional banking systems.

- Reduced costs: By using XRP, financial institutions can lower their transaction costs compared to traditional methods, improving profitability.

- Increased efficiency: Automation and streamlined processes within RippleNet contribute to significantly increased efficiency in international payments.

Investing in XRP: Risks and Rewards

Market Volatility and Price Fluctuations

Investing in XRP, like any cryptocurrency, carries inherent risks due to its volatile nature. The price of XRP can fluctuate dramatically in short periods, influenced by various factors including regulatory news, market sentiment, and adoption rates by financial institutions.

- High risk, high reward: The potential for significant returns is balanced by the possibility of substantial losses.

- Subject to market fluctuations: XRP's price is highly sensitive to market trends and overall cryptocurrency market sentiment.

- Influenced by regulatory developments: Regulatory decisions and legal challenges significantly impact XRP's price and overall market perception.

Storage and Security of XRP

Securely storing your XRP is paramount. Several options exist, each with varying levels of security:

-

Hardware wallets: These physical devices offer the highest level of security, storing your private keys offline and protecting against hacking.

-

Software wallets: These digital wallets are convenient but require strong security practices, including strong passwords and two-factor authentication.

-

Exchanges: While convenient for trading, storing significant amounts of XRP on exchanges carries greater risk due to the potential for hacking and exchange vulnerabilities.

-

Two-factor authentication: Always enable two-factor authentication (2FA) for added security on exchanges and software wallets.

-

Private key management: Securely store and protect your private keys; losing them means losing access to your XRP.

The Future of XRP and its Potential

Regulatory Landscape and Legal Challenges

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's future. The outcome of this case will likely have a profound effect on XRP's price and regulatory clarity within the United States and globally.

- Regulatory uncertainty: The SEC lawsuit creates uncertainty about XRP's legal status and future regulatory landscape.

- Ongoing legal proceedings: The outcome of the case remains uncertain, creating volatility and impacting investor confidence.

- Potential for future clarity: A resolution to the lawsuit, regardless of the outcome, could bring much-needed regulatory clarity to the XRP market.

Adoption by Financial Institutions and its Long-Term Outlook

Despite the regulatory challenges, many financial institutions are increasingly showing interest in XRP and Ripple's technology. The potential for widespread adoption as a bridge currency for international payments remains significant, suggesting a promising long-term outlook.

- Increasing institutional interest: More banks and financial institutions are exploring XRP's potential for improving their cross-border payment systems.

- Potential for mass adoption: If regulatory hurdles are overcome, XRP could experience significant growth and become a widely used currency for international transactions.

- Long-term growth potential: The long-term outlook for XRP is dependent on various factors including regulatory developments and continued adoption by financial institutions.

Conclusion

This guide has provided a comprehensive overview of XRP, its functionality, investment aspects, and future prospects. Understanding XRP involves navigating its unique role in the financial landscape and acknowledging the associated risks and rewards. While the regulatory environment remains a key factor, the potential for widespread adoption within the financial sector is undeniable.

Call to Action: Want to learn more about the intricacies of XRP and its potential? Continue your research, stay updated on market trends, and make informed decisions about investing in XRP. Remember to always conduct thorough research before making any investment decisions involving XRP or any cryptocurrency.

Featured Posts

-

Savo Vardo Turnyras Vilniuje Mato Buzelio Tylos Priezastys

May 01, 2025

Savo Vardo Turnyras Vilniuje Mato Buzelio Tylos Priezastys

May 01, 2025 -

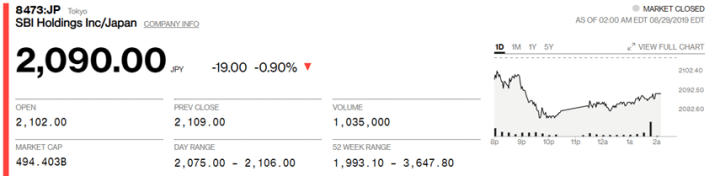

Japanese Financial Giant Sbi Holdings Distributes Xrp To Shareholders

May 01, 2025

Japanese Financial Giant Sbi Holdings Distributes Xrp To Shareholders

May 01, 2025 -

Sedlacek Da Li Ce Jokic I Jovic Igrati Na Evrobasketu

May 01, 2025

Sedlacek Da Li Ce Jokic I Jovic Igrati Na Evrobasketu

May 01, 2025 -

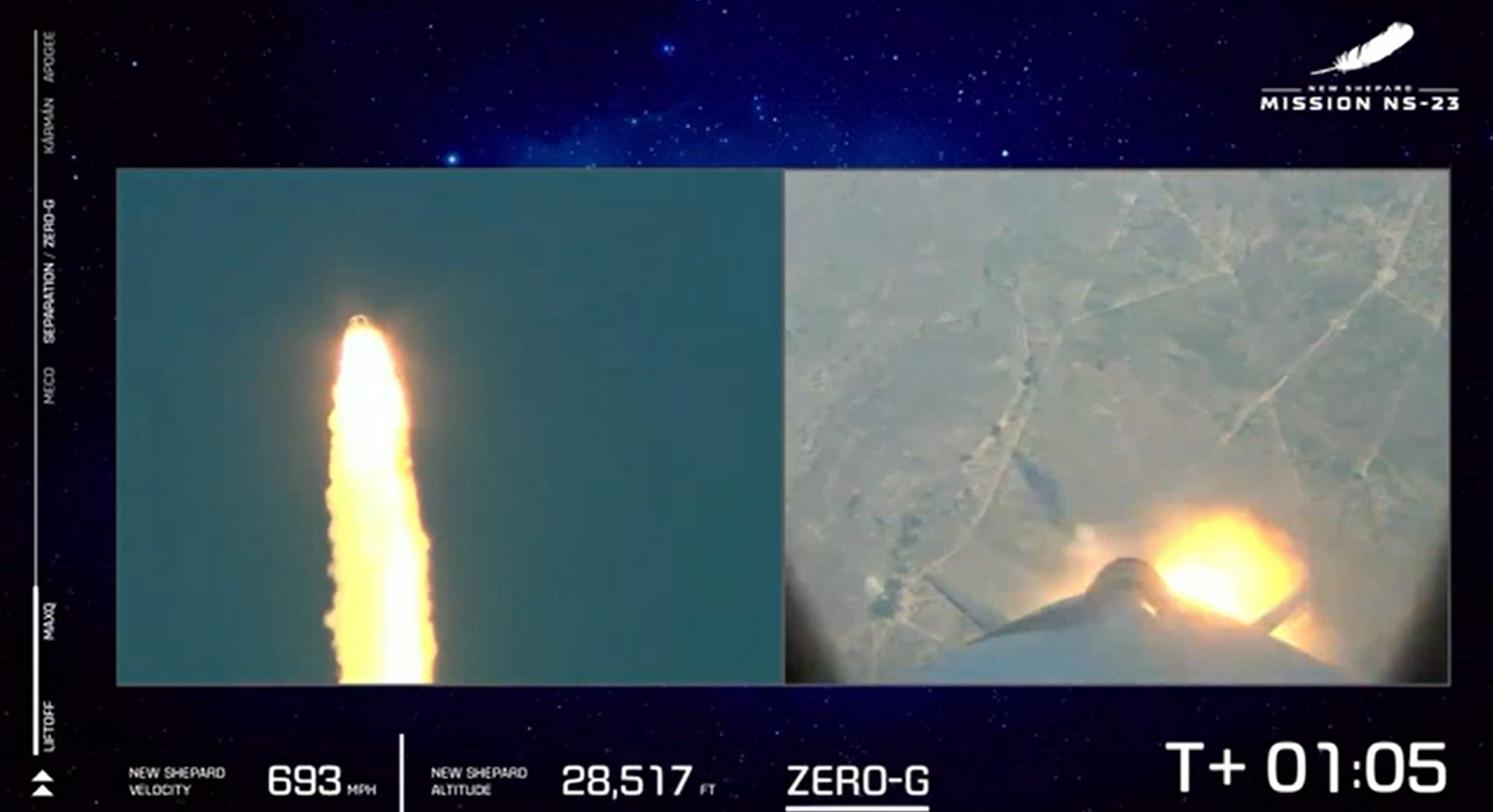

Technical Glitch Forces Blue Origin To Abort Rocket Launch

May 01, 2025

Technical Glitch Forces Blue Origin To Abort Rocket Launch

May 01, 2025 -

Best In Klas Nrc Health Leads In Healthcare Experience Management

May 01, 2025

Best In Klas Nrc Health Leads In Healthcare Experience Management

May 01, 2025