XRP Gains Momentum: Analyzing The Ripple Lawsuit's Impact On The Crypto Market And ETF Applications

Table of Contents

The Ripple Lawsuit: A Turning Point for XRP?

The legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has been a defining moment for XRP. Understanding the key events and their consequences is crucial to grasping XRP's current trajectory.

The SEC vs. Ripple: A Summary of the Key Events and Rulings.

The SEC filed its lawsuit against Ripple in December 2020, alleging that Ripple's sale of XRP constituted an unregistered securities offering. Key events and rulings include:

- July 2023: Judge Analisa Torres ruled that programmatic sales of XRP did not constitute the sale of unregistered securities. This was a partial victory for Ripple.

- July 2023: The judge ruled that institutional sales of XRP did constitute the sale of unregistered securities.

- Ongoing: Both sides are considering appeals, and the legal battle continues to unfold. The outcome of these appeals could significantly impact the future of XRP.

This landmark ruling created a clear distinction: programmatic sales, representing a significant portion of XRP distribution, were deemed not to be securities. However, the ruling against institutional sales leaves some uncertainty.

Market Sentiment Shift Following the Ruling.

The partial victory for Ripple triggered a significant shift in market sentiment.

- Price Fluctuations: XRP's price experienced considerable volatility throughout the lawsuit. The July 2023 ruling led to a substantial price surge, reflecting improved investor confidence.

- Trading Volume: Trading volume increased dramatically following the positive aspects of the ruling, demonstrating heightened market activity and interest in XRP.

- Market Capitalization: XRP's market capitalization also saw a boost after the ruling, reinforcing its position in the cryptocurrency market. This shows the impact that positive legal outcomes can have on a cryptocurrency's market standing.

XRP and the Growing Crypto ETF Landscape

The potential approval of an XRP ETF is another significant factor driving XRP's momentum. The emergence of crypto ETFs is transforming the investment landscape, and XRP could be a key beneficiary.

The Potential for an XRP ETF.

The SEC's stance on crypto ETFs remains cautious, creating hurdles for XRP and other cryptocurrencies seeking ETF approval. However, the growing acceptance of Bitcoin and Ether ETFs suggests a potential pathway for XRP in the future.

- Benefits of an XRP ETF: An XRP ETF would offer increased accessibility and liquidity for investors, potentially attracting significant institutional investment.

- Comparison to other Crypto ETFs: The success of other crypto ETFs, like those tracking Bitcoin and Ethereum, provides a positive precedent and showcases the potential demand for a regulated XRP investment vehicle.

- Regulatory Hurdles: The SEC's concerns regarding market manipulation and investor protection remain a key obstacle, making the path to XRP ETF approval uncertain.

Impact of ETF Approval on XRP Price and Adoption.

Approval of an XRP ETF could have a profound impact on its price and adoption.

- Potential Price Increases: Increased accessibility and institutional investment are likely to drive demand, resulting in potential significant price appreciation for XRP.

- Increased Institutional Investment: ETFs provide a regulated and convenient entry point for institutional investors, potentially leading to substantial inflows of capital into XRP.

- Enhanced Market Position: ETF approval would elevate XRP's profile, visibility, and credibility within the broader financial market.

Beyond the Lawsuit: Factors Contributing to XRP's Momentum

The Ripple lawsuit is not the only factor influencing XRP's resurgence. Technological advancements and growing institutional interest also play crucial roles.

Technological Advancements and Ripple's Ecosystem.

Ripple continues to develop its blockchain technology, expanding its functionality and use cases.

- RippleNet and On-Demand Liquidity (ODL): RippleNet, a global payments network using XRP, facilitates faster and more cost-effective cross-border transactions. ODL further enhances this efficiency.

- Partnerships and Collaborations: Ripple continues to forge partnerships with financial institutions, expanding the reach and adoption of XRP.

- Technological Innovation: Continuous improvements to Ripple's technology and its integration with other systems demonstrate ongoing development and innovation.

Growing Institutional Interest in XRP.

The partial court victory has reignited institutional interest in XRP.

- Diversification Strategies: Institutional investors may view XRP as a valuable addition to their portfolios, offering diversification benefits within the crypto space.

- Strategic Partnerships: Several financial institutions are actively involved in exploring XRP's potential applications, suggesting a growing confidence in the cryptocurrency's future.

- Long-term Potential: Many see XRP as having long-term potential in the rapidly evolving payments and finance sectors.

Conclusion

The Ripple lawsuit has undeniably shaped XRP's trajectory, but the recent developments point towards a positive outlook. A partial court victory, coupled with growing interest in crypto ETFs and technological advancements, suggests XRP is regaining momentum. The potential for an XRP ETF could further propel its growth and solidify its position in the crypto market.

Call to Action: Stay informed about the latest developments surrounding the Ripple lawsuit and the potential for XRP ETFs. Understanding these factors is crucial for anyone interested in investing in or learning more about XRP, a cryptocurrency with a potentially bright future. Continue researching XRP to make informed investment decisions. Keep an eye on the ongoing legal proceedings and the evolving regulatory landscape for XRP and other cryptocurrencies. This will be key to navigating this dynamic market and making smart investment choices around XRP in the future.

Featured Posts

-

Mqbwdh Kshmyr Eyd Ky Khwshywn Myn Bhy Bharty Mzalm Nwjwan Shhyd

May 02, 2025

Mqbwdh Kshmyr Eyd Ky Khwshywn Myn Bhy Bharty Mzalm Nwjwan Shhyd

May 02, 2025 -

Understanding The Value Of Middle Managers Benefits For Employees And Organizations

May 02, 2025

Understanding The Value Of Middle Managers Benefits For Employees And Organizations

May 02, 2025 -

Rosie Huntington Whiteleys White Lingerie A Breathtaking Ensemble

May 02, 2025

Rosie Huntington Whiteleys White Lingerie A Breathtaking Ensemble

May 02, 2025 -

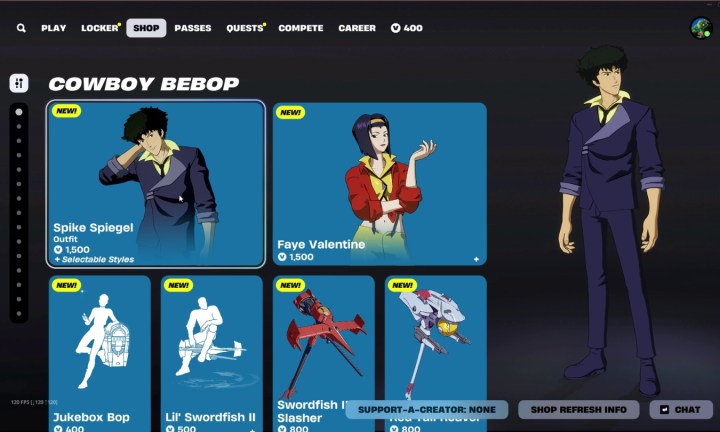

Grab The Cowboy Bebop Fortnite Skins Before They Re Gone

May 02, 2025

Grab The Cowboy Bebop Fortnite Skins Before They Re Gone

May 02, 2025 -

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025