XRP News Today: Ripple Lawsuit Update And US ETF Prospects

Table of Contents

Ripple Lawsuit Update: A Turning Point?

The Ripple lawsuit against the SEC remains a pivotal event shaping the XRP price and the broader cryptocurrency market. This protracted legal battle centers around the SEC's classification of XRP as an unregistered security. Recent developments could signal a turning point in this critical case. Key aspects to consider include:

-

Key Recent Court Events: Recent filings have included [insert specific details about recent court filings, motions, or hearings. Mention specific dates and key arguments. E.g., "On October 26th, 2023, Judge Analisa Torres issued a ruling on...", or "Ripple filed a motion for summary judgment on..."]. These events significantly impact the overall trajectory of the case.

-

Potential Impact on XRP's Future: The outcome of the lawsuit will profoundly affect XRP's regulatory clarity and market acceptance. A favorable ruling for Ripple could lead to increased institutional investment and potentially boost XRP's price. Conversely, an unfavorable ruling could negatively impact XRP's price and adoption.

-

Expert Opinions and Predictions: Legal experts [cite specific experts or law firms if possible] offer differing opinions on the likely outcome. Some believe a settlement is likely, while others predict a definitive court decision in favor of either Ripple or the SEC. These predictions heavily influence market sentiment and trading activity.

-

Impact on XRP Price and Trading Volume: The Ripple lawsuit has significantly impacted XRP's price volatility. Positive news tends to drive price increases and higher trading volume, while negative news often triggers price drops and decreased trading activity. Analyzing the correlation between court events and XRP's price action is crucial for investors.

-

Significant Legal Arguments: Both sides have presented compelling legal arguments. The SEC argues that XRP's sales constituted an unregistered securities offering, while Ripple counters that XRP is a decentralized digital asset not subject to securities laws. Understanding these arguments is vital for comprehending the complexities of the case.

The Rise of XRP ETFs: A Catalyst for Growth?

The prospect of XRP ETFs gaining approval in the US represents a significant potential catalyst for growth. The approval of a Bitcoin ETF has already spurred increased interest in the crypto market, and a similar approval for XRP could follow suit. Key factors to consider include:

-

Current Regulatory Landscape: The SEC's stance on cryptocurrency ETFs remains cautious, but recent approvals of Bitcoin ETFs signal a potential shift in regulatory approach. The approval process for an XRP ETF would likely involve a similar rigorous review process.

-

Attractiveness of an XRP ETF: An XRP ETF would offer investors a regulated and convenient way to gain exposure to XRP, potentially attracting institutional investors and increasing liquidity in the XRP market.

-

Comparison with Other Crypto ETFs: Comparing the approval processes and market reactions to Bitcoin and Ethereum ETFs provides valuable insight into the potential trajectory for an XRP ETF. Analyzing the differences in regulatory scrutiny and market sentiment will provide a clearer picture.

-

Impact on XRP Price and Market Cap: The approval of an XRP ETF could significantly increase demand, potentially driving up XRP's price and market capitalization. Increased accessibility through ETFs often leads to higher trading volumes and broader market adoption.

-

Prominent Firms Pursuing XRP ETF Applications: [Mention any companies actively working on XRP ETF applications, if any exist. This adds credibility and relevance to the article].

Understanding the Implications of ETF Approval for XRP

The approval of an XRP ETF would have far-reaching implications for investors:

-

Impact on Price Volatility: While an ETF could increase liquidity, it may not completely eliminate XRP's inherent volatility. Understanding the potential impact on price fluctuations is crucial for risk management.

-

Investment Strategies: The increased accessibility provided by an ETF could create opportunities for both short-term trading and long-term investment strategies. However, it's essential to develop a strategy aligned with personal risk tolerance.

-

Risk Assessment: Investing in XRP, even through an ETF, carries inherent risks. Market volatility, regulatory uncertainty, and potential security breaches are all factors to consider.

Conclusion

The Ripple lawsuit and the potential for XRP ETFs are intertwined factors shaping the future of XRP. A positive resolution in the lawsuit combined with ETF approval could significantly boost XRP's price and adoption. However, it is crucial to acknowledge and assess the inherent risks involved in any cryptocurrency investment. Stay informed about the latest XRP news and developments by continuously researching and monitoring the progress of both the Ripple lawsuit and potential ETF applications. Remember to always conduct thorough due diligence before investing in XRP or any other cryptocurrency. Follow our updates on XRP News for the latest information.

Featured Posts

-

Northumberland Mans Diy Globe Circling Voyage A Boat Built From Scratch

May 01, 2025

Northumberland Mans Diy Globe Circling Voyage A Boat Built From Scratch

May 01, 2025 -

Horoscope Today April 17 2025 Detailed Predictions By Zodiac Sign

May 01, 2025

Horoscope Today April 17 2025 Detailed Predictions By Zodiac Sign

May 01, 2025 -

Patienten Wachten Langer Dan Een Jaar Op Tbs Opname

May 01, 2025

Patienten Wachten Langer Dan Een Jaar Op Tbs Opname

May 01, 2025 -

Becciu Deve Risarcire 40 000 Euro La Sentenza Del Tribunale

May 01, 2025

Becciu Deve Risarcire 40 000 Euro La Sentenza Del Tribunale

May 01, 2025 -

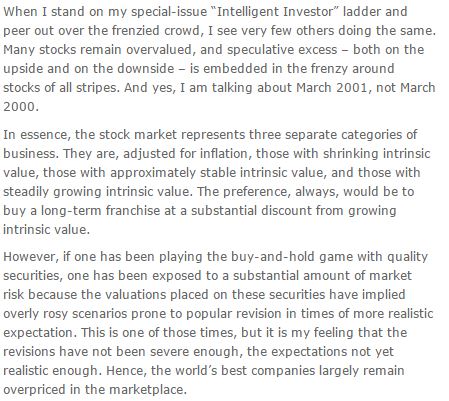

Addressing High Stock Market Valuations Insights From Bof A

May 01, 2025

Addressing High Stock Market Valuations Insights From Bof A

May 01, 2025