XRP On The Brink: ETF Approvals, SEC Case Update, And Ripple's Next Chapter

Table of Contents

H2: The Ripple vs. SEC Lawsuit: A Turning Point for XRP?

The Ripple SEC lawsuit has cast a long shadow over XRP's price and adoption. The Securities and Exchange Commission (SEC) alleges that Ripple illegally sold XRP as an unregistered security. This legal battle has far-reaching implications for the entire cryptocurrency industry, setting a precedent for how digital assets are classified and regulated.

-

Summary of the SEC's allegations against Ripple: The SEC claims Ripple conducted unregistered securities offerings through the sale of XRP to institutional and retail investors. They argue that XRP functions as an investment contract, meeting the Howey Test criteria.

-

Key arguments presented by Ripple's defense team: Ripple's defense centers on the argument that XRP is a currency, not a security, and that its sales did not constitute investment contracts. They highlight XRP's utility within the RippleNet payment system and its decentralized nature.

-

Analysis of the potential outcomes and their impact on XRP's price and regulatory landscape: A favorable ruling for Ripple could significantly boost XRP's price and potentially pave the way for clearer regulatory frameworks for other cryptocurrencies. Conversely, an SEC victory could severely impact XRP's value and potentially chill innovation in the crypto space.

-

Discussion of recent court proceedings and significant developments: Recent court filings and expert testimony have provided further insights into the legal arguments on both sides. The judge's decisions on various motions have offered clues about the potential direction of the case.

-

Expert opinions and predictions on the likely outcome of the case: Legal experts offer varying opinions on the outcome. Some predict a settlement, while others foresee a decisive victory for either side. The uncertainty surrounding the outcome adds to the volatility of XRP's price.

H2: The Rise of XRP ETFs: A Catalyst for Growth?

The potential approval of XRP exchange-traded funds (ETFs) could be a major catalyst for XRP's growth. ETFs provide a regulated and accessible way for institutional and retail investors to gain exposure to XRP, increasing liquidity and potentially driving price appreciation.

-

Exploration of the potential benefits of XRP ETF approval for investors and market liquidity: ETF approval would make XRP more accessible to a broader range of investors, boosting liquidity and potentially stabilizing its price. This would be a significant step towards mainstream adoption.

-

Comparison to the approval process and impact of Bitcoin and Ethereum ETFs: The approval of Bitcoin and Ethereum ETFs has demonstrably increased the mainstream awareness and accessibility of these cryptocurrencies. An XRP ETF would follow a similar trajectory, although the SEC lawsuit adds an extra layer of complexity.

-

Analysis of the potential impact on XRP's price and trading volume: The increased demand from institutional investors through ETFs could lead to a substantial increase in XRP's price and trading volume.

-

Discussion of the regulatory hurdles and challenges associated with XRP ETF applications: The SEC's scrutiny of XRP, due to the ongoing lawsuit, presents a significant hurdle for ETF approval. Clear regulatory guidance on XRP's classification is essential for approval.

-

Overview of current applications and potential timelines for approval: While there are no currently approved XRP ETFs, the possibility remains a significant factor influencing investor sentiment and market speculation. The timeline for any potential approval is uncertain and depends heavily on the outcome of the Ripple vs. SEC lawsuit.

H2: Ripple's Strategic Initiatives and the Future of XRP

Beyond the legal battles and ETF speculation, Ripple's technological advancements and strategic initiatives are vital to XRP's long-term viability. The utility of XRP within RippleNet, coupled with ongoing technological innovation, underpins the company's belief in its future.

-

Discussion of Ripple's ongoing efforts to expand its RippleNet network and On-Demand Liquidity (ODL) solutions: RippleNet facilitates faster and cheaper cross-border payments, and ODL leverages XRP to enhance efficiency. The expansion of these services drives real-world adoption and demand for XRP.

-

Analysis of the role of XRP in Ripple's ecosystem and its utility beyond speculation: XRP serves as a bridge currency within RippleNet, facilitating faster and more cost-effective transactions. This practical utility distinguishes it from many other cryptocurrencies solely focused on speculation.

-

Examination of strategic partnerships and collaborations that could drive XRP adoption: Ripple's partnerships with financial institutions across the globe are expanding the reach and adoption of its payment solutions and, consequently, XRP.

-

Overview of Ripple's technological advancements and their implications for the future of XRP: Continuous improvements to RippleNet and ODL, including increased scalability and efficiency, further solidify XRP's role within the system.

-

Assessment of the long-term potential and viability of XRP in the cryptocurrency market: While the legal and regulatory landscape remains uncertain, Ripple's strategic focus on practical applications and technological advancements provides a strong foundation for XRP's long-term potential.

3. Conclusion:

The future of XRP hinges on the outcome of the SEC lawsuit and the potential approval of XRP ETFs. While the legal battles present considerable risks, Ripple's strategic initiatives to expand RippleNet and ODL offer a compelling case for increased adoption and utility. The interplay of legal battles, regulatory developments, and technological progress will ultimately determine XRP's next chapter. Investing in XRP requires careful consideration of the inherent volatility and risks associated with the cryptocurrency market, especially given the ongoing regulatory uncertainty.

Call to Action: Stay informed on the latest developments regarding the SEC lawsuit and potential ETF approvals. Thoroughly research before investing in XRP, understanding the inherent risks and potential rewards in this volatile market. Learn more about XRP and its potential by following reputable news sources and engaging in informed discussions within the cryptocurrency community. Understanding the nuances of XRP’s position, including the ongoing SEC case and potential ETF listings, is crucial for making well-informed investment decisions.

Featured Posts

-

Fieis Dormem Nas Ruas Do Vaticano Para A Missa De Funeral Do Papa Francisco

May 07, 2025

Fieis Dormem Nas Ruas Do Vaticano Para A Missa De Funeral Do Papa Francisco

May 07, 2025 -

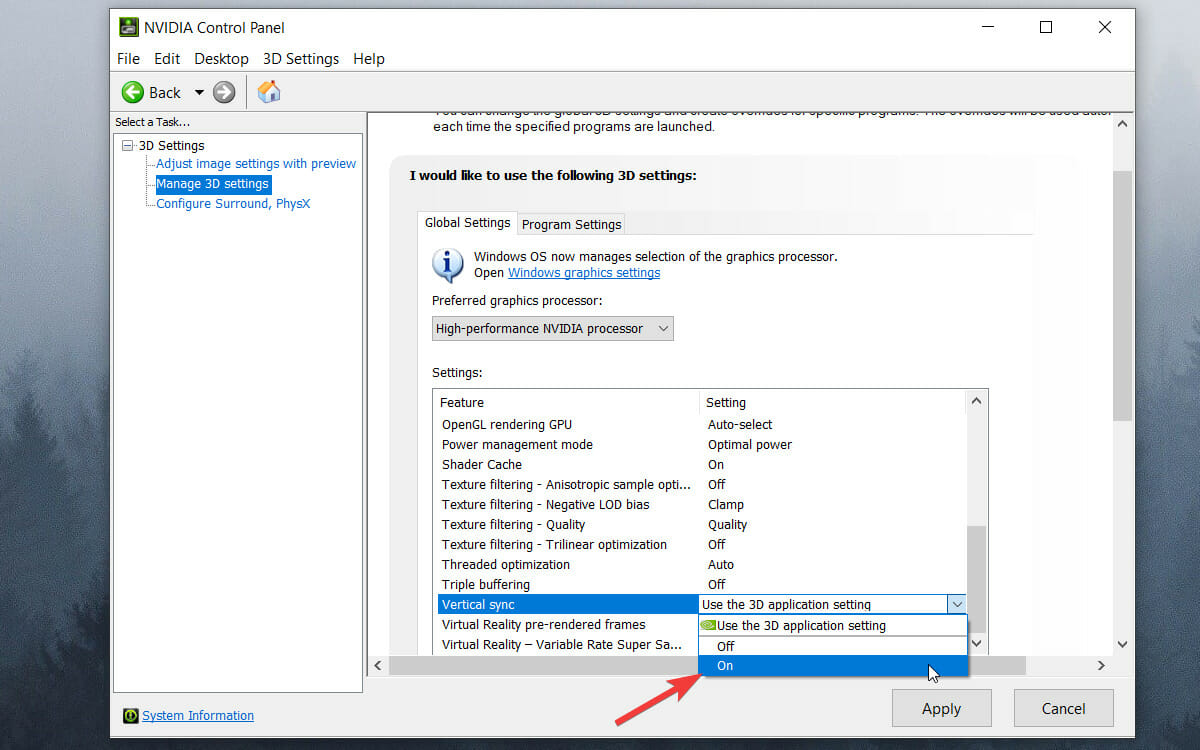

Why Is My Ps 5 Stuttering Troubleshooting Performance Problems In Games

May 07, 2025

Why Is My Ps 5 Stuttering Troubleshooting Performance Problems In Games

May 07, 2025 -

Julius Randles Impact A Shift In Timberwolves Fan Sentiment

May 07, 2025

Julius Randles Impact A Shift In Timberwolves Fan Sentiment

May 07, 2025 -

Simone Biles To Deliver Commencement Address At Washington University In St Louis

May 07, 2025

Simone Biles To Deliver Commencement Address At Washington University In St Louis

May 07, 2025 -

Historys Funniest April Fools Day Hoaxes

May 07, 2025

Historys Funniest April Fools Day Hoaxes

May 07, 2025