XRP Price Prediction 2024: Boom Or Bust After SEC Case?

Table of Contents

The SEC lawsuit against Ripple Labs has cast a long shadow over XRP's price. As 2024 approaches, investors are grappling with uncertainty: will XRP experience a significant price boom, or will the ongoing legal battle result in a bust? This comprehensive analysis delves into the key factors shaping the XRP price prediction for 2024, exploring both bullish and bearish scenarios. We'll examine the impact of the SEC case, technological advancements, market sentiment, and regulatory developments on XRP's potential future value.

The Ripple-SEC Lawsuit: A Defining Factor in XRP Price Prediction

The Ripple-SEC lawsuit is undeniably the most significant factor influencing XRP price predictions for 2024. The outcome will drastically affect investor confidence and regulatory clarity surrounding XRP.

Potential Outcomes and Their Impact on XRP Price:

-

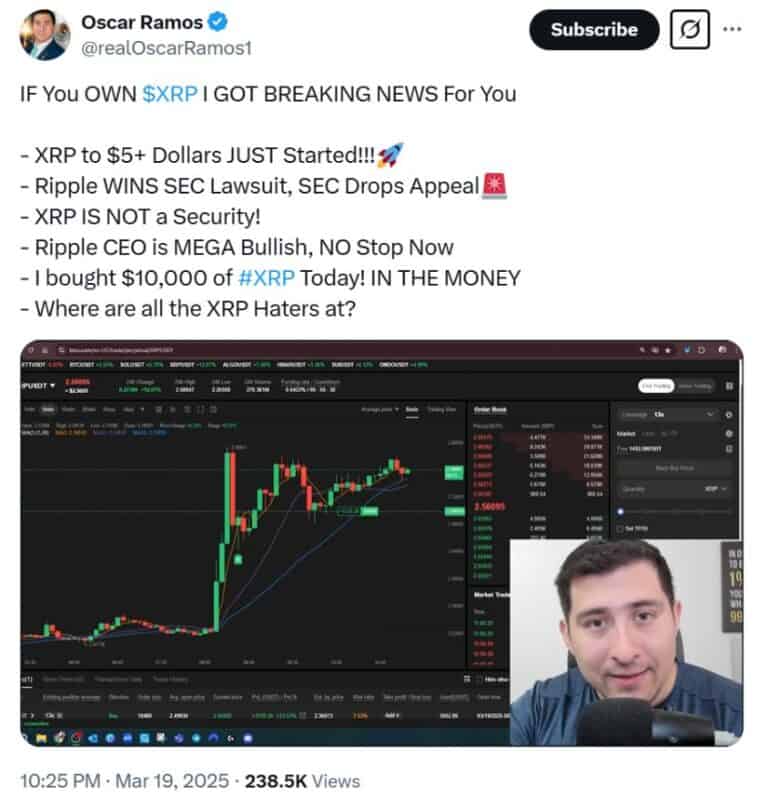

Favorable ruling: A favorable ruling for Ripple would likely trigger a significant XRP price surge. Increased investor confidence, coupled with reduced regulatory uncertainty, could lead to a substantial influx of capital into the XRP market. Keywords: XRP price surge, Ripple lawsuit outcome, positive Ripple news. The potential for unlocking institutional investment would be a major catalyst. We could see XRP reclaim its position among the top cryptocurrencies by market capitalization.

-

Unfavorable ruling: Conversely, an unfavorable ruling could result in a short-term XRP price drop. Negative Ripple news often leads to immediate sell-offs as investors react to perceived risk. However, the long-term impact would depend heavily on Ripple's response and the broader cryptocurrency market sentiment. Keywords: XRP price drop, negative Ripple news, regulatory uncertainty. A well-executed appeal strategy could mitigate the negative effects.

-

Settlement: A negotiated settlement between Ripple and the SEC could lead to a mixed market reaction. The terms of the settlement would be crucial. A favorable settlement could lead to a gradual price increase, while an unfavorable one might cause continued uncertainty and price volatility. Keywords: XRP settlement, Ripple SEC settlement, impact of settlement on XRP price. The speed and clarity of the settlement's terms would impact market sentiment.

Analyzing Public Sentiment and Media Coverage:

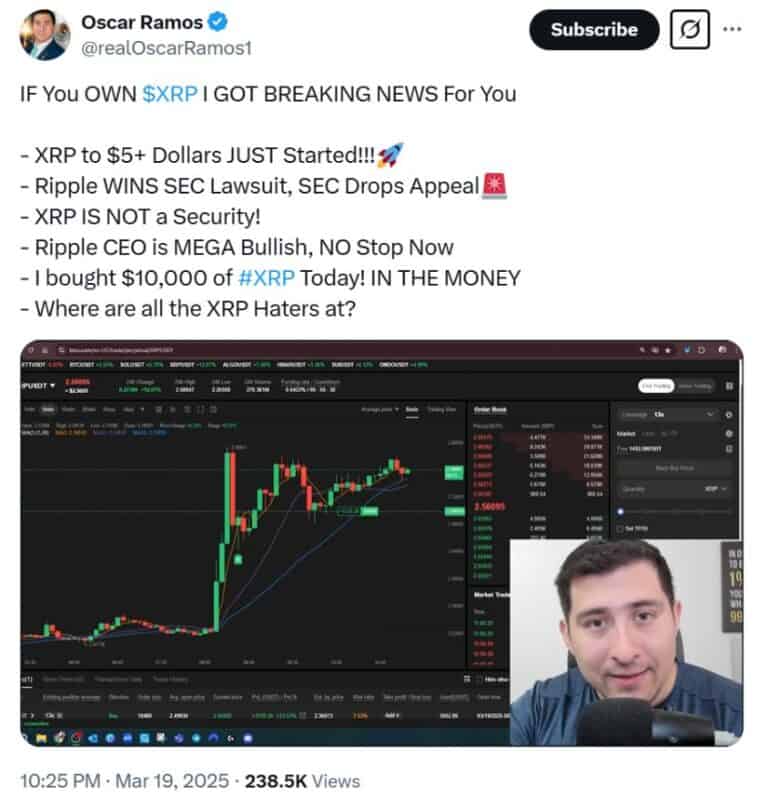

Media portrayal significantly influences public perception and, consequently, XRP's price. Positive media coverage highlighting Ripple's technological advancements or a potential positive court outcome fuels optimism and buying pressure. Conversely, negative or sensationalized coverage can spark fear, uncertainty, and doubt (FUD), leading to price drops. Keywords: XRP media coverage, public opinion on XRP, Ripple lawsuit news. Monitoring social media sentiment and news coverage is crucial for assessing the prevailing market narrative.

Technological Advancements and XRP's Utility

Beyond the legal battles, XRP's technological advancements and expanding utility play a crucial role in its long-term price prediction.

XRP Ledger (XRPL) Developments:

The XRP Ledger (XRPL) is constantly evolving. Updates and improvements, such as enhanced scalability, increased transaction speed, and new features, contribute to XRP's attractiveness as a payment solution. Keywords: XRP Ledger upgrades, XRPL improvements, XRP utility. These enhancements directly address some of the challenges faced by other blockchain networks, making XRP a more competitive option.

Adoption and Partnerships:

New partnerships and integrations drive demand for XRP. Collaborations with financial institutions, payment processors, and other businesses expand XRP's use cases and increase its adoption rate. Keywords: XRP adoption, XRP partnerships, XRP use cases. The more widespread the adoption, the higher the potential for price appreciation.

XRP's Role in Cross-Border Payments:

XRP's potential as a solution for fast, efficient, and cost-effective cross-border payments is a significant factor. Its speed and low transaction fees make it a compelling alternative to traditional methods. Keywords: XRP cross-border payments, XRP remittance, XRP international payments. Increased adoption in this area could significantly boost XRP's price.

Macroeconomic Factors and Market Sentiment

External factors significantly influence XRP's price.

Overall Crypto Market Trends:

The overall cryptocurrency market's performance heavily influences XRP's price. A bullish Bitcoin market often leads to positive sentiment across the altcoin market, including XRP. Conversely, a bearish Bitcoin market can result in significant price corrections. Keywords: Cryptocurrency market trends, Bitcoin price, altcoin market. Correlation with Bitcoin's price remains a significant factor.

Regulatory Landscape:

The evolving regulatory landscape for cryptocurrencies globally directly impacts XRP's price. Clear and favorable regulations could lead to increased institutional investment, while harsh or unclear regulations can stifle growth. Keywords: Crypto regulation, global crypto regulations, SEC regulations. Regulatory clarity is crucial for long-term stability and growth.

Investor Sentiment and Whale Activity:

Investor sentiment and the actions of large XRP holders ("whales") significantly influence price fluctuations. Positive investor sentiment and strategic accumulation by whales can drive prices up, while fear and selling pressure can lead to sharp declines. Keywords: XRP investor sentiment, XRP whale activity, XRP trading volume. Monitoring these trends is vital for understanding short-term price movements.

Conclusion:

The XRP price prediction for 2024 remains highly dependent on the resolution of the Ripple-SEC lawsuit, alongside broader market trends and technological advancements within the XRPL. A positive outcome in the legal battle could trigger a significant price surge, while an unfavorable outcome might lead to short-term volatility. However, the long-term potential of XRP as a cross-border payment solution and its ongoing development should be considered.

Call to Action: Stay informed about the latest developments in the Ripple-SEC case and the XRP ecosystem to make informed decisions regarding your XRP investments. Continue researching XRP price prediction analysis to navigate the evolving landscape of the cryptocurrency market. Conduct thorough due diligence before investing in XRP or any other cryptocurrency.

Featured Posts

-

Enexis En Kampen In Juridisch Conflict Aansluiting Duurzaam Schoolgebouw

May 02, 2025

Enexis En Kampen In Juridisch Conflict Aansluiting Duurzaam Schoolgebouw

May 02, 2025 -

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025 -

Aedae Aljmahyr Qaymt B 30 Shkhsyt Mthyrt Lljdl Fy Ealm Krt Alqdm

May 02, 2025

Aedae Aljmahyr Qaymt B 30 Shkhsyt Mthyrt Lljdl Fy Ealm Krt Alqdm

May 02, 2025 -

Millions In Losses After Office365 Executive Account Compromise

May 02, 2025

Millions In Losses After Office365 Executive Account Compromise

May 02, 2025 -

Cooper Siblings Ditch Celeb Traitors For New Bbc Series

May 02, 2025

Cooper Siblings Ditch Celeb Traitors For New Bbc Series

May 02, 2025