XRP Price Prediction: Analyzing The Post-SEC Lawsuit Market

Table of Contents

The Ripple-SEC Lawsuit Verdict and its Impact

The Ripple-SEC lawsuit concluded with a partial victory for Ripple, significantly impacting XRP's price and market sentiment. The court ruled that XRP sales on exchanges constituted unregistered securities offerings, but programmatic sales did not. This mixed ruling created uncertainty, influencing the short-term and long-term trajectory of XRP.

- Immediate price reaction following the ruling: The price of XRP initially surged following the partial victory, showing a positive market response to the lessened severity of the ruling than some had feared.

- Short-term volatility and price fluctuations: Following the initial surge, XRP experienced significant short-term volatility, reflecting the ongoing uncertainty and varied interpretations of the court's decision.

- Impact on trading volume: Trading volume increased considerably around the time of the verdict, indicating heightened investor activity and interest in the aftermath of the legal battle.

- Changes in investor sentiment: Investor sentiment shifted from largely negative during the lawsuit to a mix of cautious optimism and uncertainty following the mixed ruling.

- Legal implications for other cryptocurrencies: The lawsuit's outcome set a precedent, potentially influencing how other cryptocurrencies are regulated and impacting the legal landscape for the broader digital asset market.

Analyzing Current Market Sentiment Towards XRP

Current market sentiment towards XRP remains mixed. While the partial victory provided a boost, regulatory uncertainty and ongoing legal battles continue to impact investor confidence.

- Social media sentiment analysis: Social media platforms reveal a diverse range of opinions, with some expressing bullish sentiment based on the lawsuit's outcome, while others remain cautious.

- News coverage and its effect on public opinion: News coverage plays a crucial role in shaping public perception, with positive narratives potentially driving increased adoption and investment, while negative coverage could lead to decreased interest.

- Institutional investor interest and participation: Institutional investor participation is crucial for long-term price stability and growth. The court decision might encourage further institutional investment, but regulatory clarity is still needed.

- Retail investor behavior and trading patterns: Retail investors often react to market news and sentiment swiftly, potentially causing short-term price fluctuations. Monitoring their activity is essential for understanding price movement.

- Impact of regulatory uncertainty on market sentiment: Regulatory uncertainty remains a significant factor influencing investor sentiment. Clearer regulatory frameworks in major jurisdictions would likely boost investor confidence and XRP's price.

Technical Analysis: Chart Patterns and Indicators for XRP Price Prediction

Technical analysis of XRP's price charts offers insights into potential future price movements. Analyzing key indicators helps predict short-term price action.

- Moving averages (MA) analysis: Examining moving averages, like the 50-day and 200-day MA, can reveal potential support and resistance levels and identify trends.

- Relative Strength Index (RSI) analysis: The RSI indicator helps determine if XRP is overbought or oversold, suggesting potential price reversals.

- Support and resistance levels: Identifying crucial support and resistance levels on the chart helps anticipate potential price bounces or breakouts.

- Chart patterns (e.g., head and shoulders, triangles): Recognizing chart patterns can provide clues about future price direction.

- Volume analysis: Analyzing trading volume alongside price movements offers valuable context and confirms trends or potential reversals.

Fundamental Analysis: Factors Influencing Future XRP Price

Beyond technical analysis, several fundamental factors influence XRP's long-term price trajectory.

- Ripple's ongoing development and partnerships: Ripple's continued development of its technology and strategic partnerships with financial institutions are crucial for increasing XRP adoption.

- Adoption by financial institutions and payment processors: Wider adoption by financial institutions and payment processors will significantly impact XRP's price and legitimacy.

- Regulatory clarity in different jurisdictions: Regulatory clarity in key markets like the US and EU is crucial for fostering investor confidence and reducing volatility.

- Competition from other cryptocurrencies: Competition from other cryptocurrencies and stablecoins influences XRP's market share and overall price.

- Overall market conditions and cryptocurrency trends: The overall health of the cryptocurrency market and broader economic conditions play a significant role in influencing XRP's price.

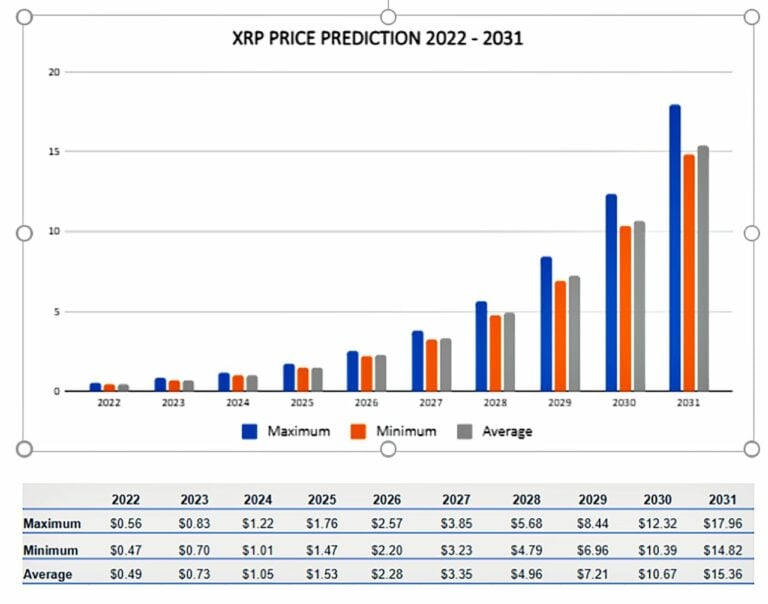

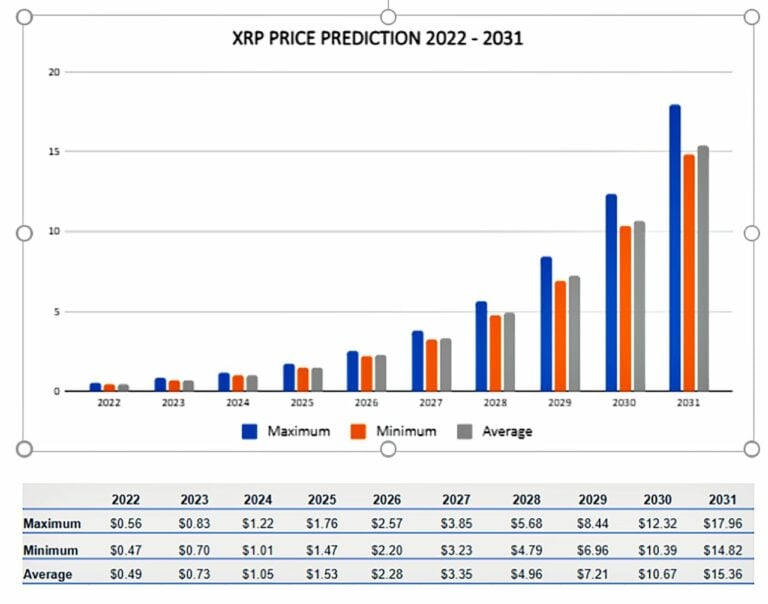

Potential XRP Price Predictions (Short-Term, Mid-Term, Long-Term)

Providing an exact XRP price prediction is inherently risky. However, based on the above analysis, we can outline potential scenarios:

- Conservative price prediction scenarios: A cautious approach suggests a gradual increase in price, influenced by slow adoption and ongoing regulatory uncertainty.

- Bullish price prediction scenarios: A bullish outlook anticipates significant price appreciation driven by increased institutional adoption, regulatory clarity, and positive market sentiment.

- Bearish price prediction scenarios: A bearish scenario considers factors such as continued regulatory hurdles and increased competition, potentially leading to price stagnation or decline.

- Factors driving each prediction: Each prediction scenario is influenced by the interplay of the factors discussed earlier, including legal developments, market sentiment, technical indicators, and fundamental factors.

- Disclaimer about the inherent risk in cryptocurrency investments: Cryptocurrency investments are inherently risky, and price predictions should not be considered financial advice. Always conduct thorough due diligence before investing.

Conclusion

Predicting the XRP price is complex, influenced by the lingering effects of the SEC lawsuit, fluctuating market sentiment, technical indicators, and fundamental factors. While the partial victory brought some relief, regulatory uncertainty and competition remain significant challenges. Understanding these factors is key to navigating the XRP market effectively. While an accurate XRP price prediction is impossible, understanding these elements allows for more informed investment decisions. Continue your research and stay updated on the latest news and developments surrounding XRP to make well-informed decisions regarding your investment strategy. Conduct thorough due diligence before investing in XRP or any other cryptocurrency. Remember that all cryptocurrency investments involve significant risk.

Featured Posts

-

Eurovision 2025 Bbc Confirms United Kingdoms Participant

May 01, 2025

Eurovision 2025 Bbc Confirms United Kingdoms Participant

May 01, 2025 -

Disneys Alaska 2026 Two Cruise Ships Set Sail

May 01, 2025

Disneys Alaska 2026 Two Cruise Ships Set Sail

May 01, 2025 -

Assessing Nvidias Vulnerability In A Shifting Geopolitical Climate

May 01, 2025

Assessing Nvidias Vulnerability In A Shifting Geopolitical Climate

May 01, 2025 -

Bkpm Rp3 6 Triliun Investasi Ditargetkan Di Pekanbaru Pada Tahun Ini

May 01, 2025

Bkpm Rp3 6 Triliun Investasi Ditargetkan Di Pekanbaru Pada Tahun Ini

May 01, 2025 -

La Flaminia Scala La Classifica Un Passo Avanti Decisivo

May 01, 2025

La Flaminia Scala La Classifica Un Passo Avanti Decisivo

May 01, 2025