XRP Price Prediction: Will XRP Hit $10? Ripple's Dubai License And Resistance Break

Table of Contents

Ripple's Dubai License and its Impact on XRP Price

Ripple's strategic expansion into Dubai holds significant implications for XRP's price trajectory. The acquisition of a license to operate in the region represents a major step towards increased legitimacy and broader market adoption.

Increased Market Adoption and Liquidity

The Dubai license enhances Ripple's credibility and opens doors to a new wave of partnerships and collaborations within the Middle East and beyond. This increased access to new markets will likely translate into:

- Higher demand for XRP: As more businesses and financial institutions in Dubai and other regions adopt Ripple's technology for cross-border payments, the demand for XRP, its native token, is expected to increase.

- Improved liquidity: Greater trading volume stemming from increased adoption will lead to improved liquidity in XRP markets, reducing price volatility and potentially facilitating larger price movements.

- Strategic partnerships: The Dubai license could pave the way for partnerships with major financial players in the region, further boosting XRP's adoption and market capitalization. These partnerships could significantly impact the XRP price prediction.

Regulatory Clarity and Reduced Uncertainty

The regulatory landscape for cryptocurrencies remains complex and often uncertain. However, Dubai's progressive approach to regulating blockchain technology and cryptocurrencies could provide a much-needed boost to investor confidence.

- Reduced regulatory risk: The Dubai license offers a degree of regulatory clarity for Ripple and XRP, mitigating the risks associated with operating in jurisdictions with ambiguous or hostile regulatory environments.

- Positive comparison to other jurisdictions: Dubai's supportive regulatory framework contrasts sharply with the regulatory uncertainty faced by Ripple in other jurisdictions, such as the ongoing SEC lawsuit in the United States. This difference could drive capital flows towards XRP.

- Potential for global regulatory influence: Dubai's positive stance on Ripple and XRP could encourage other countries to adopt more favorable regulatory frameworks, creating a more positive global environment for XRP's growth.

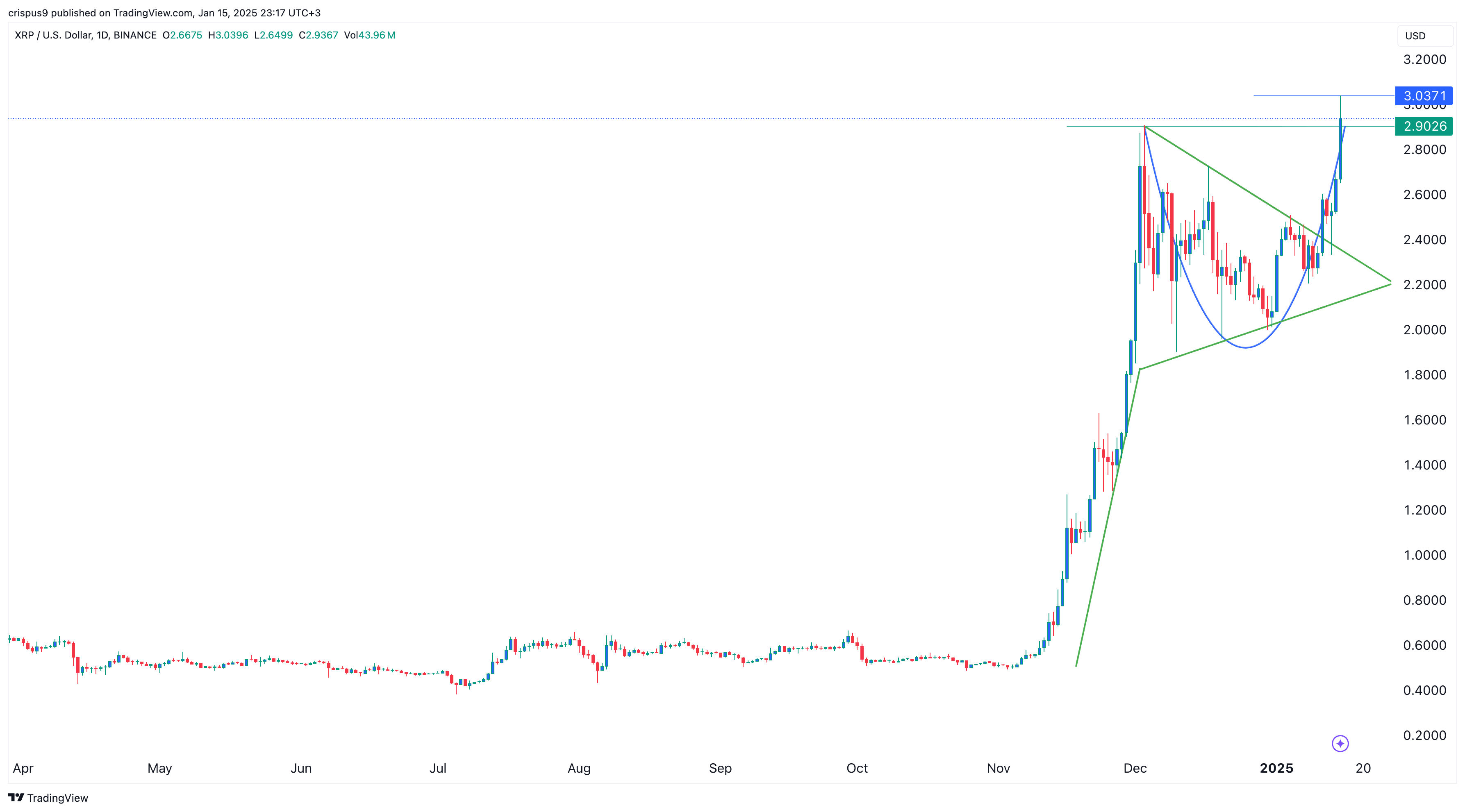

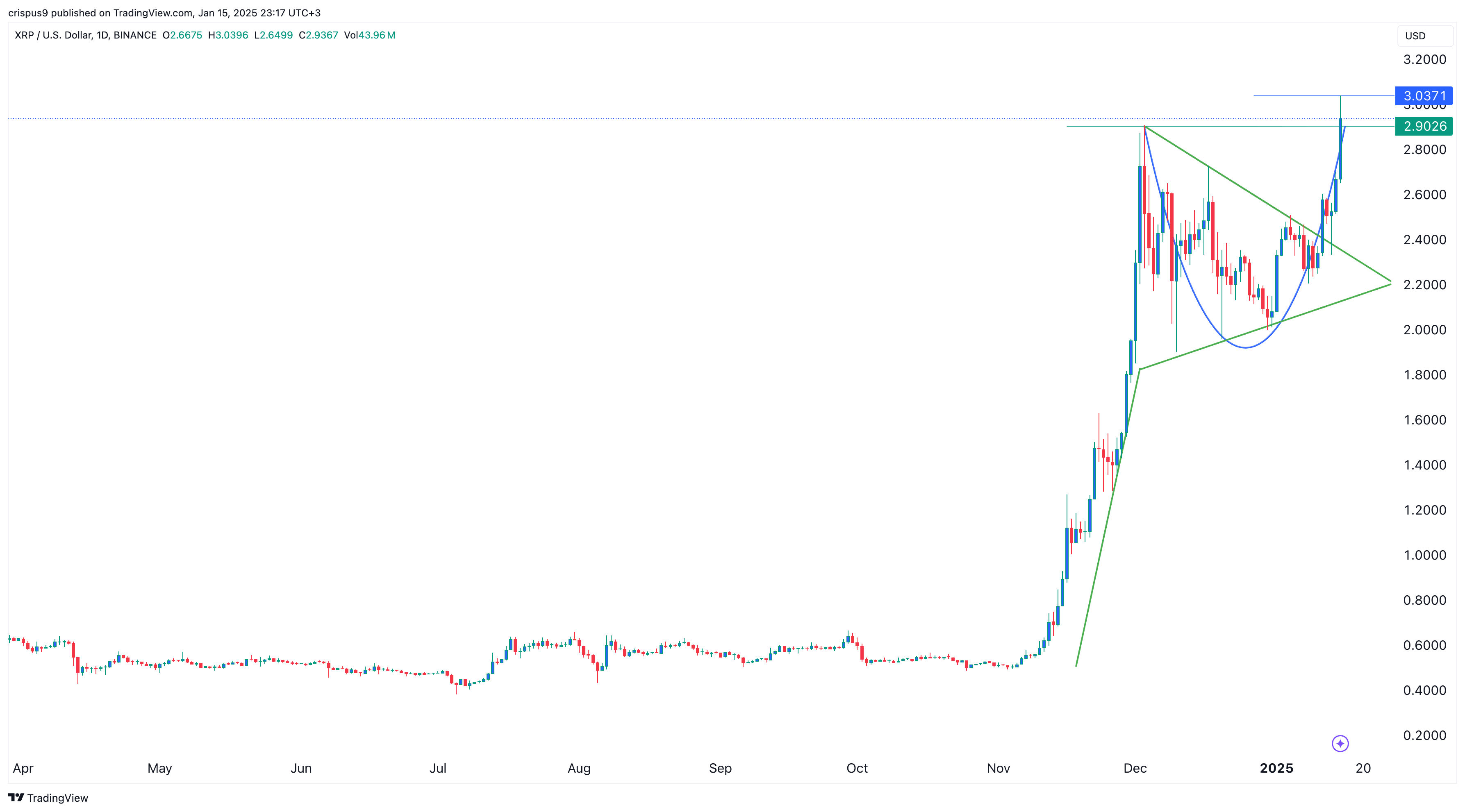

Technical Analysis: Breaking Key Resistance Levels

Technical analysis provides valuable insights into potential price movements. To reach $10, XRP needs to overcome several significant resistance levels.

Identifying Crucial Resistance Levels

Chart analysis reveals several key resistance levels that XRP must break through to achieve the $10 target. These levels are often characterized by previous price highs where selling pressure overwhelmed buying pressure.

- Identifying key resistance levels: [Insert chart/graph here illustrating key resistance levels]. Technical indicators like moving averages (e.g., 20-day, 50-day, 200-day MA) and the Relative Strength Index (RSI) can help identify these levels and potential breakout points.

- Historical price action: Studying past price movements helps gauge the strength of these resistance levels. A significant break above a key resistance level, confirmed by strong trading volume, is a bullish sign.

- Support levels: While focusing on resistance, understanding support levels (price floors) is equally important. Strong support levels can act as a cushion against sharp price declines.

Volume and Market Sentiment

The volume of trading accompanying a price breakout is critical. High volume confirms the strength of the move, indicating that the breakout is likely sustainable.

- Volume confirmation: A breakout above a resistance level with high trading volume significantly increases the likelihood of a sustained price increase. Low volume breakouts are often short-lived.

- Market sentiment: Bullish sentiment, driven by positive news, partnerships, or regulatory developments, is essential for a successful price surge. Social media sentiment analysis can offer insights into market sentiment.

- Catalysts for price increase: Positive news, such as major partnerships, successful regulatory outcomes, or increased adoption by large financial institutions, can act as significant catalysts for a price surge.

Factors that Could Hinder XRP Reaching $10

Despite the positive factors, several challenges could hinder XRP's ascent to $10.

Ongoing SEC Lawsuit

The SEC lawsuit against Ripple remains a significant uncertainty. The outcome could have a dramatic impact on XRP's price.

- Potential outcomes and their impact: A favorable ruling could significantly boost XRP's price. An unfavorable ruling could severely depress its price. A settlement could have a mixed impact depending on its terms.

- Impact on investor confidence: Uncertainty surrounding the lawsuit affects investor confidence, potentially limiting the upward price momentum.

- Market reaction to developments: News and updates related to the lawsuit will likely cause significant price fluctuations.

Market Volatility and Crypto Regulations

The cryptocurrency market is inherently volatile. Broader regulatory changes worldwide could further influence XRP's price.

- Market volatility: External factors, like macroeconomic conditions or other significant events in the crypto market, can drastically affect XRP's price.

- Global regulatory landscape: Changes in crypto regulations globally could either hinder or boost XRP's growth. Different regulatory environments across countries create complexity and uncertainty.

- Investment risks: Investing in cryptocurrencies involves significant risk. It's crucial to conduct thorough research and understand the potential for both significant gains and losses before investing.

Conclusion

Reaching a $10 XRP price is a bold prediction. While Ripple's Dubai license and potential technical breakouts offer compelling reasons for optimism, the ongoing SEC lawsuit and the inherent volatility of the cryptocurrency market introduce significant challenges. The combination of strategic moves by Ripple and potential technical breakouts provides a compelling case for continued monitoring of the XRP price. However, investors must carefully weigh the potential gains against the considerable risks involved.

Call to Action: While predicting the future price of XRP with absolute certainty is impossible, stay informed on the latest news and analysis regarding XRP price prediction. Conduct thorough research and make informed investment decisions based on your own risk tolerance and understanding of the market. Remember, investing in cryptocurrencies like XRP involves significant risk.

Featured Posts

-

Should You Buy Xrp Now A Deep Dive Into The Recent 400 Price Increase

May 02, 2025

Should You Buy Xrp Now A Deep Dive Into The Recent 400 Price Increase

May 02, 2025 -

Avrupa Ile Is Birligimizi Gueclendirecegiz Son Dakika Gelismeleri

May 02, 2025

Avrupa Ile Is Birligimizi Gueclendirecegiz Son Dakika Gelismeleri

May 02, 2025 -

Tulsa Pre Treats Roads Ahead Of Midnight Sleet And Snow Storm

May 02, 2025

Tulsa Pre Treats Roads Ahead Of Midnight Sleet And Snow Storm

May 02, 2025 -

Belgium Vs England Womens Football Tv Broadcast Details And Kick Off

May 02, 2025

Belgium Vs England Womens Football Tv Broadcast Details And Kick Off

May 02, 2025 -

La Laport

May 02, 2025

La Laport

May 02, 2025