XRP Price Surge: Grayscale ETF Filing Fuels Record High Hopes

Table of Contents

The Grayscale Effect: How a Bitcoin ETF Filing Impacts XRP

The Grayscale Bitcoin ETF filing, while focused on Bitcoin, has had a profound impact on the broader cryptocurrency market, including XRP. This indirect correlation stems from several key factors.

Indirect Correlation and Market Sentiment

A successful Bitcoin ETF approval would signal a significant shift in regulatory acceptance of cryptocurrencies. This positive sentiment isn't confined to Bitcoin; it typically boosts investor confidence across the entire crypto market, including altcoins like XRP.

- Increased institutional investment in Bitcoin can lead to spillover effects into the altcoin market. Large institutional investors, having gained regulatory approval for Bitcoin exposure through an ETF, may diversify their portfolios into other promising crypto assets like XRP.

- Positive regulatory developments for Bitcoin often precede similar developments for other cryptocurrencies. A successful Bitcoin ETF could pave the way for regulatory clarity and potential future ETFs for other cryptocurrencies, reducing the risk profile associated with XRP investment.

- Improved market liquidity and trading volume for Bitcoin can positively affect XRP's trading dynamics. Increased trading activity in the Bitcoin market often translates into greater overall market liquidity, allowing for easier and more efficient trading of XRP.

Increased Institutional Interest in Crypto

Grayscale's filing is a powerful indicator of growing institutional acceptance of cryptocurrencies. Their substantial assets under management (AUM) demonstrate a considerable appetite for regulated crypto investment. This trend indirectly benefits XRP.

- Grayscale's significant assets under management (AUM) signal a growing appetite for regulated crypto investment. This indicates a shift towards institutional adoption, making cryptocurrencies, including XRP, more appealing to institutional investors seeking regulated exposure.

- The potential approval of the Grayscale Bitcoin ETF could pave the way for similar ETFs encompassing other cryptocurrencies, including XRP. This would significantly increase accessibility and liquidity for XRP, potentially driving price appreciation.

- Increased institutional participation generally leads to greater price stability and potentially higher valuations. Institutional investors often bring a more disciplined and long-term investment approach, which can lead to more stable and potentially higher prices.

XRP's Fundamental Strengths Amidst the Price Surge

While the Grayscale effect is a significant catalyst, the recent XRP price surge also reflects XRP's intrinsic strengths and ongoing developments.

Ongoing Ripple Legal Developments

The ongoing Ripple vs. SEC lawsuit has been a major factor influencing XRP's price. Recent positive developments in the case have contributed to the increased optimism surrounding the cryptocurrency.

- Highlight any positive rulings or news that might contribute to the price increase. (Note: Always cite reputable news sources for any legal updates.) Positive legal interpretations or procedural victories can significantly boost investor confidence.

- Discuss the potential impact of a favorable court ruling on future XRP adoption and price. A favorable outcome could remove significant regulatory uncertainty, potentially leading to wider adoption and price appreciation.

- Mention the ongoing regulatory uncertainty and its influence on price volatility. While positive news is driving the price up, it's important to acknowledge the ongoing uncertainty and its potential impact on price fluctuations.

XRP's Utility and Adoption

XRP's practical applications in the payments industry and its growing adoption by various companies and financial institutions are contributing to its price appreciation.

- Mention specific use cases and partnerships that demonstrate XRP's real-world utility. Highlighting real-world applications showcasing speed, efficiency, and cost-effectiveness strengthens the case for investment.

- Emphasize the advantages of XRP's speed and low transaction fees compared to other cryptocurrencies. These are key selling points that differentiate XRP in the competitive cryptocurrency market.

- Discuss potential future applications and expansion in the payments sector. Future growth potential increases investor interest and supports higher valuations.

XRP Price Prediction and Future Outlook

Predicting the future price of XRP is inherently speculative. However, analyzing technical indicators and market sentiment can provide insights into potential price movements.

Technical Analysis

Technical analysis of XRP's charts can offer clues about potential future price movements. (Disclaimer: This is not financial advice.)

- Mention key support and resistance levels. Identifying these levels helps understand potential price ranges.

- Discuss potential price targets based on technical analysis (with appropriate disclaimers). Present potential targets cautiously and clearly state that this is not financial advice.

- Analyze trading volume and market capitalization trends. These metrics provide context for price movements and potential future direction.

Market Sentiment and Investor Confidence

Market sentiment plays a crucial role in XRP's price. Positive news and social media discussions can fuel price increases, while negative sentiment can lead to declines.

- Discuss social media sentiment and news coverage impacting XRP price. Analyzing online discussions and news reports provides a sense of current investor sentiment.

- Analyze the influence of whale activity and large institutional trades on the market. Large transactions can influence price movements significantly.

- Assess the overall risk tolerance of investors towards XRP. Investor sentiment is closely tied to risk appetite; increased risk tolerance generally leads to higher price action.

Conclusion

The recent surge in XRP price is a multifaceted event, significantly influenced by the Grayscale Bitcoin ETF filing, positive developments in the Ripple lawsuit, and the growing recognition of XRP's utility. While the future is uncertain, the current positive sentiment and XRP's fundamental strengths position it for continued growth. However, remember to always conduct thorough research and consider your risk tolerance before investing in any cryptocurrency, including XRP. Stay informed about the latest XRP price movements and developments by following reputable news sources and analytical platforms. Understanding the interplay between the Grayscale ETF filing, Ripple's legal battles, and XRP's practical applications is key to navigating the XRP market effectively.

Featured Posts

-

Ayesha Currys Marriage First Philosophy Reactions And Analysis

May 07, 2025

Ayesha Currys Marriage First Philosophy Reactions And Analysis

May 07, 2025 -

Nhl Konflikt En Ny Stoerre Turnering Som Loesning

May 07, 2025

Nhl Konflikt En Ny Stoerre Turnering Som Loesning

May 07, 2025 -

Alex Ovechkins Take Will He Watch The 4 Nations Face Off Without Russia

May 07, 2025

Alex Ovechkins Take Will He Watch The 4 Nations Face Off Without Russia

May 07, 2025 -

Golden State Warriors Curry Injury Return Timeline And Coach Kerrs Comments

May 07, 2025

Golden State Warriors Curry Injury Return Timeline And Coach Kerrs Comments

May 07, 2025 -

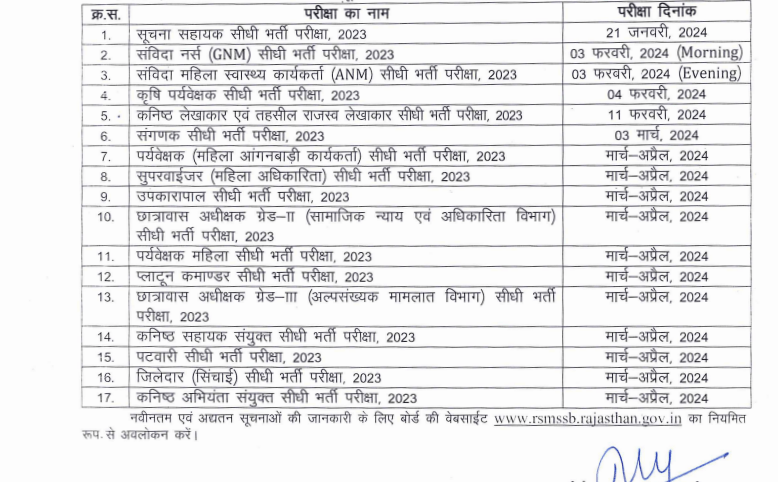

Check The Latest Rsmssb Exam Calendar For 2025 26

May 07, 2025

Check The Latest Rsmssb Exam Calendar For 2025 26

May 07, 2025