XRP (Ripple) Investment: Potential For Long-Term Growth

Table of Contents

Understanding XRP (Ripple) and its Technology

What is XRP and how does it work?

XRP is the native cryptocurrency of the Ripple network, a blockchain-based payment processing system. Unlike Bitcoin or Ethereum, which rely on Proof-of-Work or Proof-of-Stake consensus mechanisms, Ripple uses a unique consensus mechanism allowing for incredibly fast and low-cost transactions. XRP acts as a bridge currency, facilitating the exchange of various fiat currencies and other cryptocurrencies within the Ripple network. This efficiency is a key factor contributing to its appeal as a viable alternative in the global payments landscape.

RippleNet and its global reach

RippleNet is a global network of financial institutions using Ripple's technology for cross-border payments. This adoption is crucial to XRP's value proposition. By facilitating faster, cheaper, and more transparent international money transfers, RippleNet is steadily gaining traction, potentially driving significant demand for XRP. Key partners include major players:

- Major banks like Santander and SBI Holdings utilize RippleNet. These established institutions validate Ripple's technology and its potential for widespread adoption.

- RippleNet facilitates faster and cheaper international money transfers. This translates to significant cost savings and efficiency gains for banks and their customers.

- Many other financial institutions and payment providers are also part of the RippleNet ecosystem. This growing network effect strengthens the long-term prospects of XRP.

XRP's Scalability and Efficiency

XRP's transaction speed and processing capabilities far exceed those of many other cryptocurrencies. This scalability is critical for handling the high transaction volumes expected in a global payment system. Compared to Bitcoin's relatively slow transaction times and Ethereum's high gas fees, XRP offers a significant advantage, making it a more practical solution for large-scale financial transactions.

Analyzing the Potential for Long-Term Growth of XRP (Ripple) Investment

Market Adoption and Future Potential

The ongoing adoption of XRP by financial institutions is a strong indicator of its potential for long-term growth. As more banks and payment providers integrate RippleNet into their operations, the demand for XRP is likely to increase, potentially driving its price upward. However, regulatory developments and technological advancements will also play a significant role in shaping XRP's future. Continued innovation and positive regulatory outcomes could significantly boost its value.

Risk Assessment and Mitigation

Investing in cryptocurrencies, including XRP, carries inherent risks. It's essential to understand these risks before committing any capital.

- Market volatility can lead to significant price swings. Cryptocurrency prices are notoriously volatile, and XRP is no exception.

- Regulatory changes could impact XRP's value. Uncertainty surrounding regulations in different jurisdictions poses a risk.

- Diversification is crucial for managing risk. Don't put all your eggs in one basket. Diversify your investment portfolio.

Comparing XRP to other Cryptocurrencies

Compared to Bitcoin and Ethereum, XRP occupies a different niche. While Bitcoin focuses on decentralization and store-of-value, and Ethereum on smart contracts and decentralized applications (dApps), XRP's primary focus is on facilitating fast and efficient cross-border payments. This targeted utility could lead to substantial growth if RippleNet continues its expansion. However, Bitcoin and Ethereum have established themselves as market leaders with significantly larger market capitalization, representing both opportunities and risks in the long term.

Making Informed Decisions about XRP (Ripple) Investment

Due Diligence and Research

Thorough research is paramount before investing in any cryptocurrency. Review Ripple's whitepaper, stay updated on financial news related to XRP and Ripple, and consult independent analysis from reputable sources. Understanding the technology, the market, and the risks involved is essential for making informed decisions.

Investment Strategies and Risk Tolerance

Consider your investment goals and risk tolerance. Long-term holding strategies are generally favored for cryptocurrencies with strong underlying technology and adoption potential. Short-term trading, however, involves higher risk due to market volatility. Only invest what you can afford to lose.

Secure Storage and Management of XRP

Securely storing your XRP is crucial. Hardware wallets offer the highest level of security compared to software wallets or exchanges. Be aware of the risks associated with keeping your XRP on exchanges, as these platforms are vulnerable to hacking.

Conclusion

XRP (Ripple) investment offers a compelling proposition for those seeking long-term growth potential in the cryptocurrency market. Its speed, efficiency, and growing adoption within the financial sector make it a unique asset. However, the inherent risks of cryptocurrency investments must not be underestimated. Market volatility, regulatory uncertainty, and the competitive landscape need careful consideration. Remember, diversification is key to mitigating risk.

Reiterate Key Takeaways: Thorough research, understanding your risk tolerance, and diversifying your portfolio are crucial elements of responsible XRP (Ripple) investment.

Call to Action: Explore the potential of XRP (Ripple) investment further. Start your research today and consider XRP as part of a carefully considered, diversified investment strategy, but only after conducting thorough due diligence and understanding the associated risks. Learn more about investing in XRP (Ripple) and make informed decisions for your financial future.

Featured Posts

-

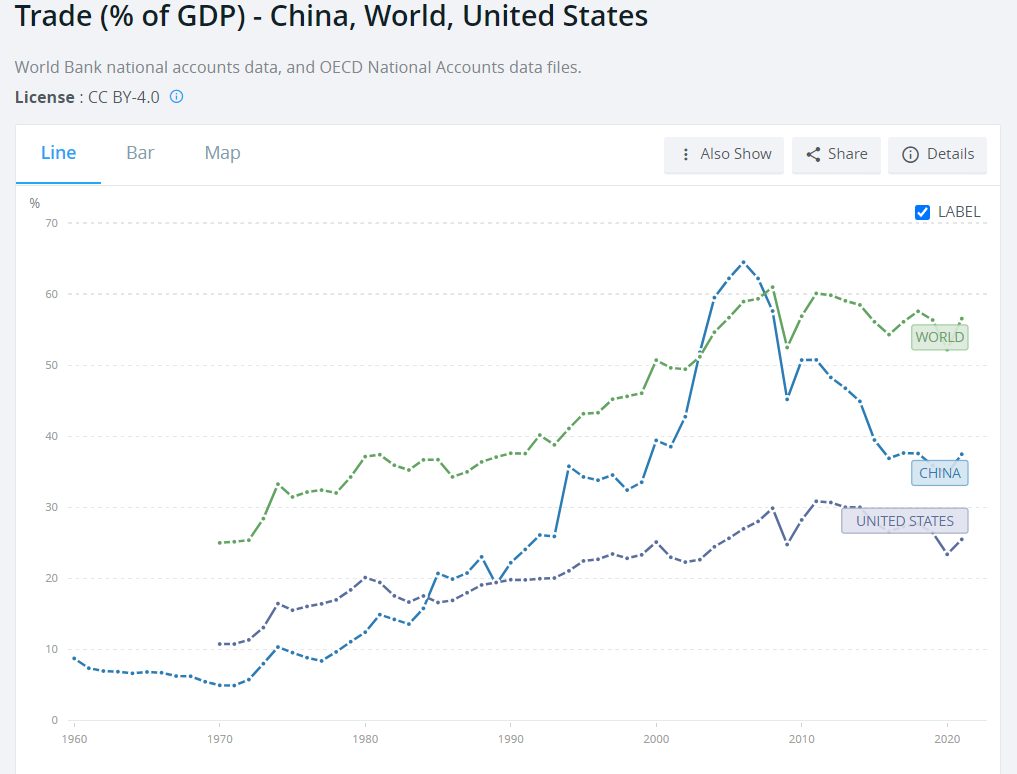

The Great Decoupling And The Future Of Globalization

May 08, 2025

The Great Decoupling And The Future Of Globalization

May 08, 2025 -

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025 -

Saving Private Ryan 20 Behind The Scenes Facts

May 08, 2025

Saving Private Ryan 20 Behind The Scenes Facts

May 08, 2025 -

Collymore Calls For Artetas Accountability Latest Arsenal News

May 08, 2025

Collymore Calls For Artetas Accountability Latest Arsenal News

May 08, 2025 -

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Lottery Results

May 08, 2025

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Lottery Results

May 08, 2025

Latest Posts

-

April 5th Dwp Changes Impact On Benefit Claims And Support

May 08, 2025

April 5th Dwp Changes Impact On Benefit Claims And Support

May 08, 2025 -

Updated Universal Credit Claim Verification Procedures From The Dwp

May 08, 2025

Updated Universal Credit Claim Verification Procedures From The Dwp

May 08, 2025 -

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025 -

Dwp Benefit Claim Update Important Information For April 5th

May 08, 2025

Dwp Benefit Claim Update Important Information For April 5th

May 08, 2025 -

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025