XRP Surges: Outpacing Bitcoin After SEC Acknowledges Grayscale XRP ETF Application

Table of Contents

The SEC's Acknowledgment: A Catalyst for XRP's Rise

The Securities and Exchange Commission (SEC) plays a crucial role in regulating the cryptocurrency market and the approval of exchange-traded funds (ETFs). Their acknowledgment of Grayscale's application for an XRP ETF is a significant step. While not an approval, it signifies the SEC is actively considering the application, reducing the uncertainty surrounding XRP's regulatory status. This positive development has far-reaching implications:

- Increased investor confidence: The SEC's acknowledgement signals a degree of acceptance for XRP, encouraging more investors to enter the market.

- Potential for increased trading volume: Increased investor confidence is likely to lead to higher trading volumes, further fueling price appreciation.

- Reduced regulatory uncertainty: Clarity on the regulatory landscape reduces risk, making XRP a more attractive investment for both institutional and retail investors.

- Positive market sentiment towards XRP: The overall market sentiment toward XRP has shifted considerably, leading to a more bullish outlook.

This move by the SEC could pave the way for other cryptocurrency ETF approvals, potentially transforming the cryptocurrency investment landscape.

XRP's Outperformance Against Bitcoin: A Deeper Dive

XRP's recent price performance has dramatically outpaced Bitcoin's, a noteworthy development considering Bitcoin's long-standing dominance in the crypto market. Several factors contribute to this divergence:

- Bitcoin's current market dominance and saturation: Bitcoin's established market position might be contributing to slower growth as it's already widely adopted.

- Differences in technological underpinnings and use cases: XRP's focus on payments and its faster transaction speeds differentiate it from Bitcoin, attracting investors seeking alternative solutions.

- The impact of regulatory scrutiny on both cryptocurrencies: While both face regulatory scrutiny, the SEC's acknowledgment of the Grayscale XRP ETF application has given XRP a positive boost.

- Speculative investment driving XRP's price: Anticipation of ETF approval has fueled speculation, driving up the price.

Understanding these differing factors is key to interpreting the contrasting price movements of these two major cryptocurrencies.

Analyzing the Potential Impact of an XRP ETF

The potential approval of an XRP ETF carries significant implications for the cryptocurrency market.

Potential Benefits:

- Increased liquidity: An ETF would increase the liquidity of XRP, making it easier to buy and sell.

- Increased accessibility: ETFs are accessible to a wider range of investors, including those who are not comfortable directly investing in cryptocurrencies.

Potential Risks:

- Market volatility: ETF approval could lead to increased volatility in XRP's price.

- Regulatory changes: Future regulatory changes could impact the performance of the ETF and XRP itself.

Long-Term Implications:

- Increased institutional investment: ETFs often attract institutional investors, potentially leading to increased investment in XRP.

- Price stabilization or volatility?: The effect on price stability is uncertain; it could either stabilize or increase volatility depending on various market factors.

- Wider adoption and mainstream acceptance: An ETF would likely increase XRP's mainstream adoption.

- Impact on other cryptocurrencies: The success of an XRP ETF could influence the development and adoption of ETFs for other cryptocurrencies.

Grayscale's Strategy and its Significance for XRP

Grayscale Investments, a prominent player in the digital asset management space, holds a significant position in the crypto market. Their strategy in applying for an XRP ETF is a calculated move, aiming to capitalize on the growing demand for regulated crypto investment vehicles. The success (or failure) of their application could significantly impact the XRP ecosystem:

- Grayscale's track record with other crypto ETFs: Their experience with other ETF applications provides valuable insight into the regulatory process.

- The potential for other firms to follow suit: If Grayscale succeeds, other firms may follow suit, leading to a wave of new crypto ETFs.

- The impact on XRP's overall market capitalization: A successful ETF could lead to a substantial increase in XRP's market cap.

- The effect on XRP's long-term price prediction: A positive outcome will likely have a positive impact on XRP's long-term price.

The strategic significance of Grayscale's move underscores the importance of regulatory clarity and the potential for institutional investment in the cryptocurrency market.

Conclusion: Investing in XRP After the Surge: A Cautious Approach

XRP's recent price surge is largely attributed to the SEC's acknowledgment of Grayscale's XRP ETF application, injecting optimism into the market. However, investors should approach this development with caution. While the potential rewards are significant, risks remain. Thorough research and a diversified investment strategy are crucial before making any investment decisions. Remember that the cryptocurrency market is inherently volatile, and regulatory changes can significantly impact prices.

Stay informed about the latest developments surrounding XRP and consider its potential as a part of a diversified cryptocurrency portfolio, but always conduct your own research before investing in any cryptocurrency, including XRP.

Featured Posts

-

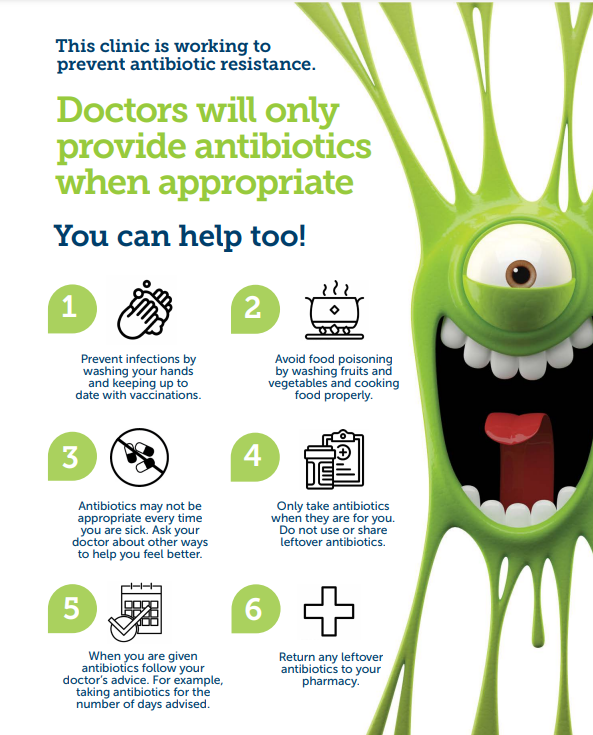

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

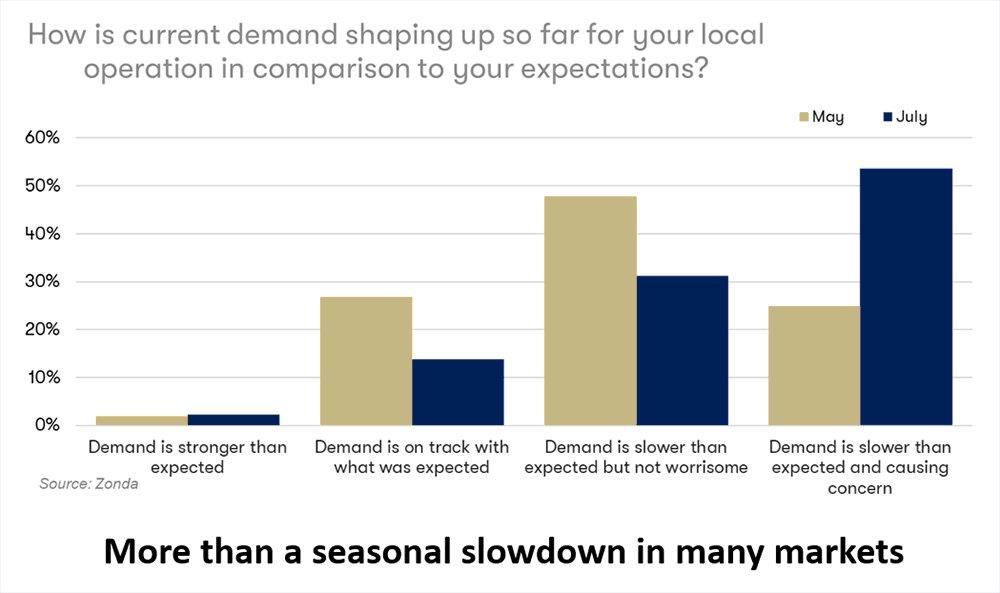

Toronto Housing Market Slowdown Sales Fall 23 Average Prices Down 4

May 08, 2025

Toronto Housing Market Slowdown Sales Fall 23 Average Prices Down 4

May 08, 2025 -

Intelligence Des Corneilles Une Prouesse Geometrique Remarquable

May 08, 2025

Intelligence Des Corneilles Une Prouesse Geometrique Remarquable

May 08, 2025 -

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025 -

A Comprehensive Look At The Best Krypto Stories

May 08, 2025

A Comprehensive Look At The Best Krypto Stories

May 08, 2025

Latest Posts

-

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025 -

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025 -

Dwp Reforms What Universal Credit Claimants Need To Know

May 08, 2025

Dwp Reforms What Universal Credit Claimants Need To Know

May 08, 2025 -

Dwp Warning 12 Benefits At Risk Urgent Bank Account Check Needed

May 08, 2025

Dwp Warning 12 Benefits At Risk Urgent Bank Account Check Needed

May 08, 2025 -

Warning Dwp Changes Could Leave Universal Credit Claimants Worse Off

May 08, 2025

Warning Dwp Changes Could Leave Universal Credit Claimants Worse Off

May 08, 2025