XRP Up 400% In Three Months: Investment Analysis And Risks.

Table of Contents

Factors Contributing to XRP's 400% Price Surge

Several factors have converged to propel XRP's price to unprecedented heights. Understanding these contributing elements is crucial for any investor considering entering the market.

Increased Institutional Interest

Growing adoption by financial institutions for cross-border payments has significantly boosted XRP's value. Ripple, the company behind XRP, has been actively forging partnerships with major banks and financial services providers, leveraging its blockchain technology to facilitate faster and cheaper international transactions.

- Examples of partnerships: Ripple has collaborated with numerous banks globally, including Santander, SBI Holdings, and many others, integrating XRP into their remittance systems.

- Faster and cheaper transactions: XRP's speed and low transaction costs make it an attractive alternative to traditional methods, reducing processing times and fees for cross-border payments.

- Impact on investor sentiment: The increasing adoption by institutional investors signals a growing confidence in XRP's utility and long-term potential, driving up market demand. This influx of institutional money has been a major catalyst for the price surge.

Positive Legal Developments

The ongoing legal battle between Ripple and the SEC has significantly impacted XRP's price. Recent court rulings and developments have improved investor sentiment. While the case remains unresolved, positive interpretations and legal opinions have lessened the uncertainty surrounding XRP's regulatory status.

- Impact of court rulings: Favorable court decisions or procedural wins for Ripple have injected renewed confidence in the market.

- Shift in investor sentiment: Positive legal developments have helped alleviate concerns about potential regulatory crackdowns, leading to increased investor confidence and higher trading volumes.

- Moving towards regulatory clarity: While uncertainty remains, the legal process itself is contributing to a clearer picture of XRP's regulatory landscape, ultimately benefitting investors.

Growing Market Demand and Speculation

Increased market demand, fueled by speculation and the fear of missing out (FOMO), has played a critical role in XRP's price surge. Positive news coverage, social media hype, and overall cryptocurrency market trends have contributed to this surge.

- Social media influence: The amplification effect of social media can quickly drive up demand, pushing prices higher.

- Speculative trading: Many investors are drawn to XRP's potential for high returns, increasing speculative trading activity.

- Pump and dump risks: While the recent surge might not be a classic "pump and dump" scheme, the potential for such manipulation always exists in volatile markets. Investors need to be cautious.

Technological Advancements

Ongoing improvements and upgrades to the XRP Ledger contribute to its efficiency and appeal. These advancements enhance the platform's scalability, transaction speed, and overall functionality.

- XRP Ledger upgrades: Ripple consistently improves the XRP Ledger, addressing scalability challenges and enhancing its overall performance.

- Enhanced transaction speed: Faster transaction speeds attract more users and institutions, further boosting demand for XRP.

- Improved energy efficiency: The XRP Ledger is known for its relatively low energy consumption compared to some other cryptocurrencies.

Assessing the Risks of Investing in XRP

Despite the impressive price surge, investing in XRP carries significant risks that potential investors must carefully consider.

Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price is susceptible to dramatic swings, both upward and downward.

- High-risk investment: XRP is a highly speculative asset, and investors should be prepared for substantial price fluctuations.

- Risk management strategies: Implementing effective risk management strategies, including diversification and stop-loss orders, is crucial.

- Emotional decision-making: Avoid emotional decision-making based on short-term price movements.

Regulatory Uncertainty

The ongoing legal battle with the SEC creates significant regulatory uncertainty. The outcome of this lawsuit will have a substantial impact on XRP's future.

- Potential regulatory crackdowns: Negative legal decisions could significantly impact XRP's price and adoption.

- Compliance risks: Investors need to understand the legal and compliance risks associated with holding and trading XRP.

- Impact on investor confidence: Regulatory uncertainty can erode investor confidence, leading to price declines.

Security Risks

Holding XRP on exchanges or in personal wallets carries inherent security risks. Hacking, scams, and loss of private keys are potential threats.

- Secure wallet selection: Use only reputable and secure wallets for storing XRP.

- Best security practices: Employ strong passwords, two-factor authentication, and other security measures.

- Exchange security: Choose reputable cryptocurrency exchanges with robust security measures.

Market Manipulation

XRP, with its relatively high market capitalization, could be susceptible to market manipulation by large investors ("whales").

- Artificial price influence: Large holders can artificially influence XRP's price through coordinated trading activities.

- Trading volume analysis: Monitor trading volume and other market indicators to identify potential manipulation attempts.

- Diversification as a safeguard: Diversifying your investment portfolio helps mitigate the risk of market manipulation affecting a single asset.

Conclusion: Should You Invest in XRP After its 400% Surge?

XRP's recent 400% surge is undeniably impressive, driven by increased institutional interest, positive legal developments, growing market demand, and technological advancements. However, significant risks remain, including inherent volatility, regulatory uncertainty, security concerns, and the potential for market manipulation. A comprehensive understanding of this XRP investment analysis, including its inherent risks, is paramount. While the potential for high returns exists, investors should exercise caution. Conduct thorough research and consult with financial advisors before making any XRP investment decisions.

Featured Posts

-

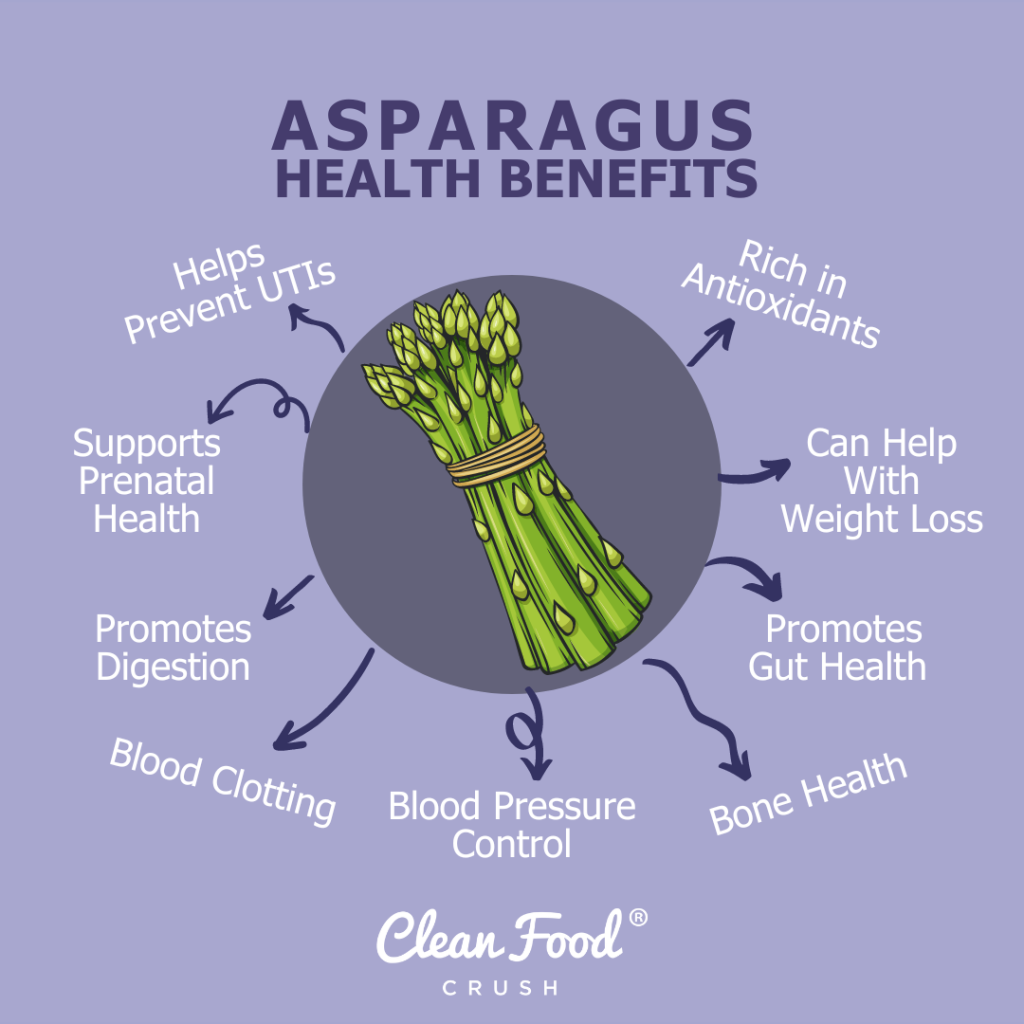

The Nutritional Value Of Asparagus And Its Impact On Your Well Being

May 01, 2025

The Nutritional Value Of Asparagus And Its Impact On Your Well Being

May 01, 2025 -

Actor Michael Sheens Generosity 1 Million Debt Relief In Port Talbot

May 01, 2025

Actor Michael Sheens Generosity 1 Million Debt Relief In Port Talbot

May 01, 2025 -

Holocaust Memorial Council Trump Fires Doug Emhoff

May 01, 2025

Holocaust Memorial Council Trump Fires Doug Emhoff

May 01, 2025 -

Un Accompagnement Numerique Pour Vos Thes Dansants Guide Complet

May 01, 2025

Un Accompagnement Numerique Pour Vos Thes Dansants Guide Complet

May 01, 2025 -

Enexis Laadpunten In Noord Nederland Buiten Piektijden Opladen Voor Maximale Besparingen

May 01, 2025

Enexis Laadpunten In Noord Nederland Buiten Piektijden Opladen Voor Maximale Besparingen

May 01, 2025