XRP's Future: The Impact Of SEC's Commodity Debate

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP

The SEC lawsuit against Ripple alleges that XRP is an unregistered security, arguing that Ripple's sales of XRP constituted an offering of investment contracts under the Howey Test. This legal test defines an investment contract based on whether an investment of money is made in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

-

The SEC's Argument: The SEC contends that Ripple sold XRP to raise capital, promising investors profits based on Ripple's efforts to develop and promote the cryptocurrency. They argue that XRP lacks the decentralized characteristics of a true cryptocurrency.

-

Ripple's Counterarguments: Ripple counters that XRP is a decentralized digital asset, operating independently of Ripple's control. They emphasize its use as a payment token on the XRP Ledger, a public and open-source blockchain. Ripple points to the significant trading volume and decentralization of XRP as evidence against its characterization as a security.

-

Key Legal Precedents and Arguments: Both sides have presented numerous legal precedents and arguments, relying on interpretations of existing securities laws and applying them to the unique context of cryptocurrencies. The case hinges on whether XRP's decentralized nature and utility outweigh the perceived influence of Ripple's actions.

-

Impact on Other Cryptocurrencies: The outcome of this case will undoubtedly set a precedent for how other cryptocurrencies are regulated, potentially affecting the entire cryptocurrency market and the classification of similar digital assets.

-

Expert Opinions and Legal Analysis: Legal experts are divided, with some supporting the SEC's position and others siding with Ripple's arguments. This highlights the complexity of applying established securities law to the novel technology of cryptocurrencies.

Potential Outcomes of the Lawsuit and their Impact on XRP's Price

The Ripple vs. SEC lawsuit could result in several scenarios: a win for the SEC, a win for Ripple, or a settlement. Each outcome will significantly impact XRP's price and the broader cryptocurrency market.

-

SEC Victory: An SEC victory could lead to a significant drop in XRP's price, possibly delisting from major exchanges and impacting investor confidence severely. Regulatory uncertainty would likely persist.

-

Ripple Victory: A victory for Ripple would likely result in a surge in XRP's price, boosting investor confidence and potentially attracting new investment. This would provide much-needed regulatory clarity, at least for XRP.

-

Settlement: A settlement could result in a mixed outcome, potentially involving penalties for Ripple and some concessions regarding XRP's future usage and regulation. The price impact would depend heavily on the terms of the settlement.

-

Market Volatility: Regardless of the outcome, significant volatility is expected in the XRP market leading up to and following the court's decision. Investor sentiment will play a crucial role in determining the price fluctuations.

The Broader Impact on Cryptocurrency Regulation

The Ripple case is far more than just a legal battle between two entities; it has vast implications for the entire cryptocurrency landscape.

-

Precedent for Future Regulations: The ruling will establish a significant precedent for future cryptocurrency regulations, globally influencing how governments and regulatory bodies classify and regulate digital assets.

-

Impact on Other Crypto Projects: The outcome will influence the legal and regulatory status of similar cryptocurrencies and projects, potentially impacting their development and adoption.

-

Implications for DeFi: The decision could affect the growth and development of decentralized finance (DeFi) projects, influencing their regulatory compliance and operational structures.

-

Global Regulatory Landscape: The case highlights the inconsistencies and challenges of navigating a fragmented global regulatory landscape for cryptocurrencies. International coordination will become increasingly vital.

-

Regulatory Clarity (or Lack Thereof): The outcome, regardless of the winner, has the potential to bring much-needed regulatory clarity or to further exacerbate the uncertainty within the cryptocurrency market.

XRP's Technological Advancements and Future Development

Despite the legal uncertainties, XRP's underlying technology continues to evolve and offers potential for future growth.

-

Technological Advantages: XRP boasts several technological advantages, such as its speed, scalability, and low transaction fees, making it attractive for cross-border payments.

-

RippleNet Adoption: RippleNet, Ripple's network for global payments, has been increasingly adopted by financial institutions, demonstrating XRP's practical utility.

-

Future Development and Upgrades: The XRP Ledger is continually undergoing development and upgrades, enhancing its functionality and efficiency.

-

Role in Blockchain Technology: XRP plays a significant role in the broader blockchain ecosystem and the development of innovative financial technologies.

-

Partnerships and Collaborations: Future partnerships and collaborations could significantly drive the adoption and expansion of XRP’s utility and usage.

Conclusion

The SEC's commodity debate surrounding XRP has significant implications for its future, the broader cryptocurrency market, and the development of regulatory frameworks for digital assets. The outcome of the Ripple lawsuit will likely have far-reaching consequences, affecting XRP's price, investor sentiment, and the overall trajectory of the crypto industry. The technological advancements of XRP, however, continue to offer potential for long-term growth regardless of the legal outcome.

Call to Action: Stay informed about the latest developments in the XRP and SEC case, and continue to research and evaluate the potential of XRP as an investment, keeping in mind the inherent risks associated with all cryptocurrencies. Understanding the XRP's future requires continuous monitoring of the legal battles and technological progress. Understanding the nuances of the XRP's legal battle is crucial for informed investment decisions in the cryptocurrency market.

Featured Posts

-

Superiorite Geometrique Des Corneilles Sur Les Babouins Etude Fascinante

May 08, 2025

Superiorite Geometrique Des Corneilles Sur Les Babouins Etude Fascinante

May 08, 2025 -

Psg Launches Research Facility In Doha Expanding Global Reach

May 08, 2025

Psg Launches Research Facility In Doha Expanding Global Reach

May 08, 2025 -

5880 Potential Is This Altcoin The Next Xrp Analysis And Prediction

May 08, 2025

5880 Potential Is This Altcoin The Next Xrp Analysis And Prediction

May 08, 2025 -

360

May 08, 2025

360

May 08, 2025 -

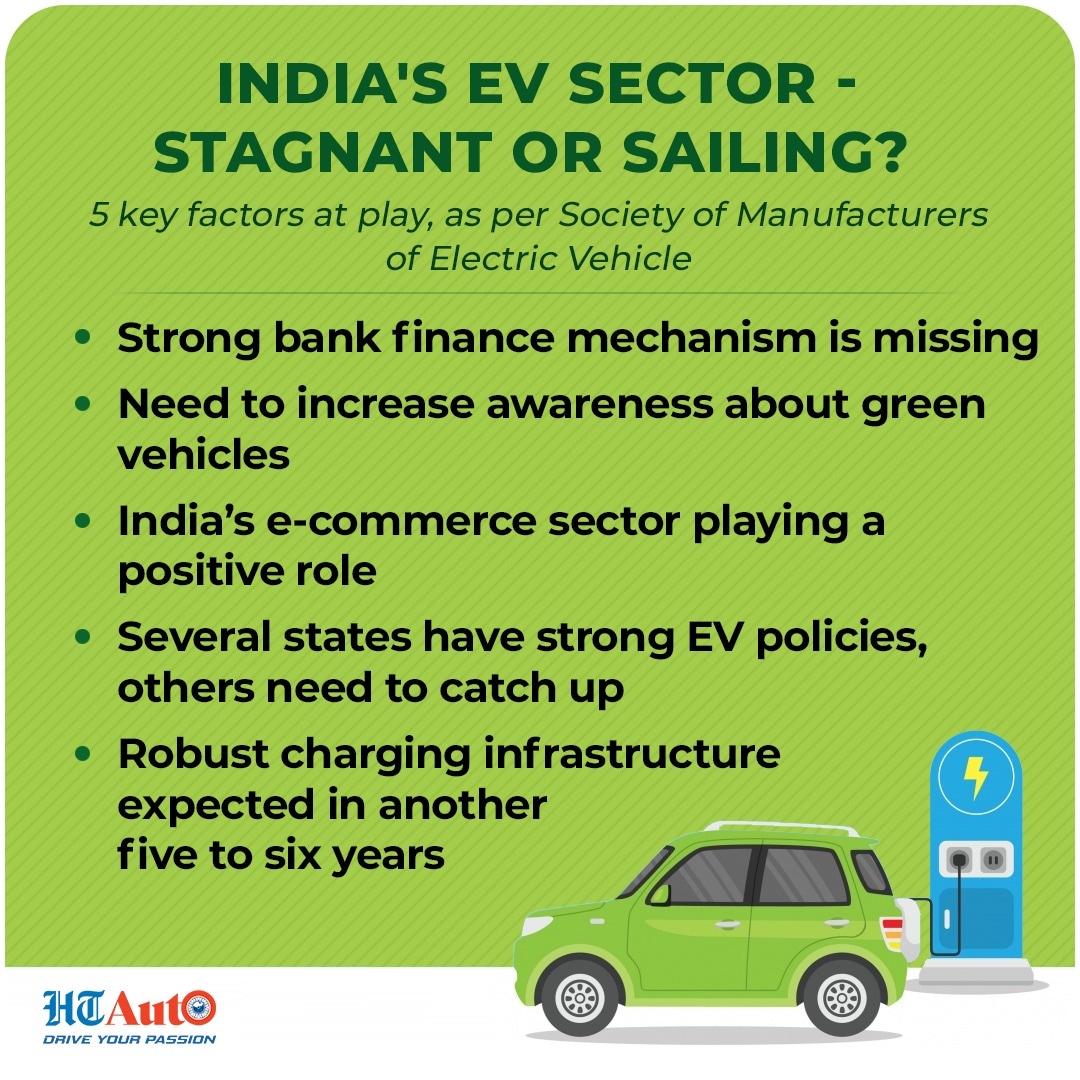

Auto Dealers Intensify Fight Against Ev Sales Requirements

May 08, 2025

Auto Dealers Intensify Fight Against Ev Sales Requirements

May 08, 2025

Latest Posts

-

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025 -

Significant Rise In Dwp Home Visits Concerns For Benefit System

May 08, 2025

Significant Rise In Dwp Home Visits Concerns For Benefit System

May 08, 2025 -

Dwp Increases Home Visits Impact On Benefit Claimants

May 08, 2025

Dwp Increases Home Visits Impact On Benefit Claimants

May 08, 2025 -

Dwp Doubles Home Visits For Benefit Recipients Thousands Affected

May 08, 2025

Dwp Doubles Home Visits For Benefit Recipients Thousands Affected

May 08, 2025 -

3 Month Warning Dwp To Stop Benefits For 355 000 People

May 08, 2025

3 Month Warning Dwp To Stop Benefits For 355 000 People

May 08, 2025