XRP's Future Uncertain: Commodity Classification Possible Following Ripple Settlement

Table of Contents

Potential Commodity Classification of XRP

SEC's Stance and the Ripple Settlement

The SEC's initial claim against Ripple alleged that XRP was sold as an unregistered security, violating federal securities laws. The subsequent settlement, while avoiding a full admission of guilt by Ripple, didn't definitively classify XRP as a security or a commodity. This ambiguity is central to the ongoing debate surrounding XRP classification.

- SEC's Argument: The SEC argued that XRP's sale and distribution resembled an investment contract, meeting the Howey Test criteria, thereby classifying it as a security.

- Settlement Ambiguity: The settlement focused on financial penalties and didn't provide a clear legal definition of XRP's status. This leaves the door open for future legal challenges and interpretations.

- Dissenting Opinions: Legal experts and commentators have pointed out aspects of the settlement that could be interpreted as supporting a commodity classification, particularly regarding XRP's use in decentralized transactions.

Implications of Commodity Status

A commodity classification for XRP could significantly alter its trajectory.

- Regulatory Easing: Exchanges might face reduced compliance burdens if XRP is deemed a commodity, potentially leading to increased listings and accessibility. This could positively impact XRP trading volume and liquidity.

- Price Volatility: The shift in regulatory status could affect investor sentiment and, consequently, XRP price volatility. A commodity classification might attract different types of investors, potentially leading to increased price stability or heightened volatility depending on market reactions.

- Adoption Impact: Clearer regulatory status could accelerate XRP adoption in DeFi and cross-border payments. Businesses might be more inclined to integrate XRP into their systems if regulatory hurdles are lowered.

The Ongoing Regulatory Uncertainty

Jurisdictional Differences

The lack of a unified global stance on XRP classification introduces significant complexities.

- Varying Regulatory Approaches: The US, EU, and Asian markets might adopt different regulatory approaches to XRP, depending on their existing cryptocurrency frameworks and interpretations of the Ripple settlement.

- Legal Challenges: Different jurisdictions could face legal challenges regarding the interpretation and enforcement of the Ripple settlement's implications for XRP's status within their respective borders. This could lead to a patchwork of regulatory environments for XRP.

Impact on Exchanges and Investors

The regulatory uncertainty significantly impacts cryptocurrency exchanges and individual XRP holders.

- Delisting Concerns: Exchanges might delist XRP in jurisdictions with stricter interpretations of the settlement, fearing potential regulatory repercussions.

- Investor Confidence: Uncertainty creates hesitancy among investors, potentially leading to capital flight from XRP and decreased market capitalization.

- Investment Decisions: Future investment decisions will heavily depend on how different jurisdictions classify XRP. Investors need to understand the jurisdictional nuances and potential legal risks before investing.

Future Outlook and Predictions for XRP

Price Volatility and Market Sentiment

XRP's price will likely remain volatile until its regulatory status is clarified.

- Historical Price Trends: Analyzing XRP's historical price reactions to regulatory news and announcements can provide valuable insights into potential future price movements.

- Expert Opinions: Market analysts and experts offer diverse predictions, emphasizing the importance of monitoring ongoing developments and legal challenges surrounding XRP.

Technological Advancements and Adoption

Technological improvements and increased network adoption could positively influence XRP's future, regardless of its regulatory classification.

- XRP Ledger Updates: Continued development and enhancements to the XRP Ledger could increase its efficiency, security, and utility, driving adoption even in uncertain regulatory conditions.

- Payment Industry Adoption: Despite the regulatory uncertainty, the potential benefits of XRP for cross-border payments could lead to continued adoption within the payments industry.

Conclusion

The Ripple settlement leaves the XRP classification in a state of flux, creating significant uncertainty for the cryptocurrency's future. While a commodity classification presents potential advantages like reduced regulatory burdens, the lingering jurisdictional inconsistencies and ongoing legal battles demand caution. Investors need to carefully monitor the evolving regulatory landscape and assess the risks involved before making any decisions regarding XRP. Staying informed about the ongoing developments surrounding XRP classification and its potential implications for different regulatory outcomes is crucial for navigating this uncertain period and for developing a sound investment strategy. Continue to research and understand the complexities of XRP classification to make informed decisions.

Featured Posts

-

Win Big At Eurovision 2025 Comprehensive Betting Guide

May 01, 2025

Win Big At Eurovision 2025 Comprehensive Betting Guide

May 01, 2025 -

Can Cruise Lines Ban You For Complaining A Look At Passenger Rights

May 01, 2025

Can Cruise Lines Ban You For Complaining A Look At Passenger Rights

May 01, 2025 -

Nuclear Power And The Law Examining Current Litigation And Future Implications

May 01, 2025

Nuclear Power And The Law Examining Current Litigation And Future Implications

May 01, 2025 -

Navigating The Dragons Den Tips For Entrepreneurs

May 01, 2025

Navigating The Dragons Den Tips For Entrepreneurs

May 01, 2025 -

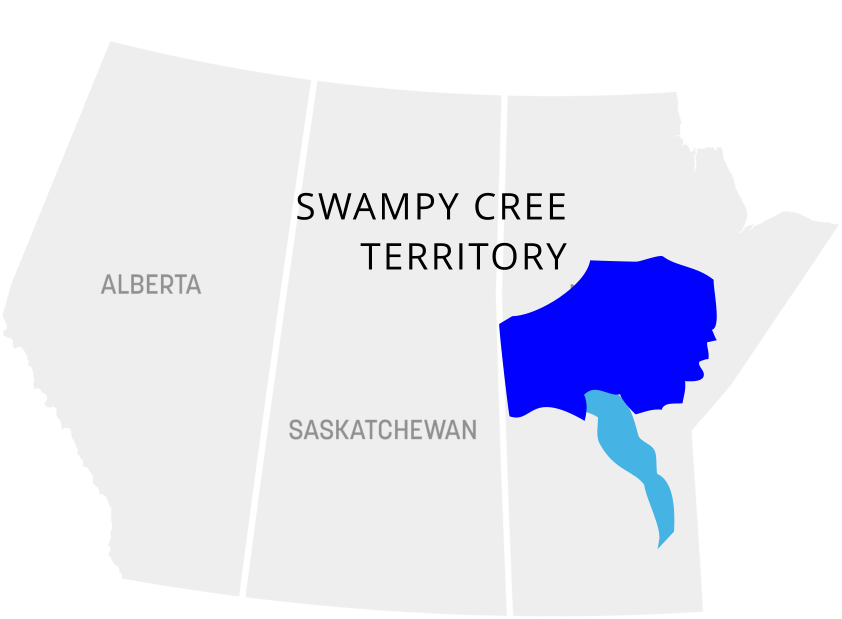

Mathias Colomb Cree Nation New Boxing And Survival Programs Launched

May 01, 2025

Mathias Colomb Cree Nation New Boxing And Survival Programs Launched

May 01, 2025