XRP's Strong Performance: Outpacing Bitcoin And Other Cryptocurrencies After SEC Action

Table of Contents

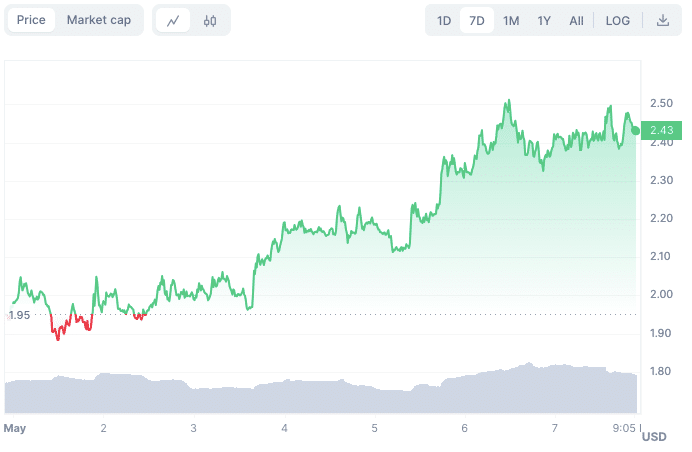

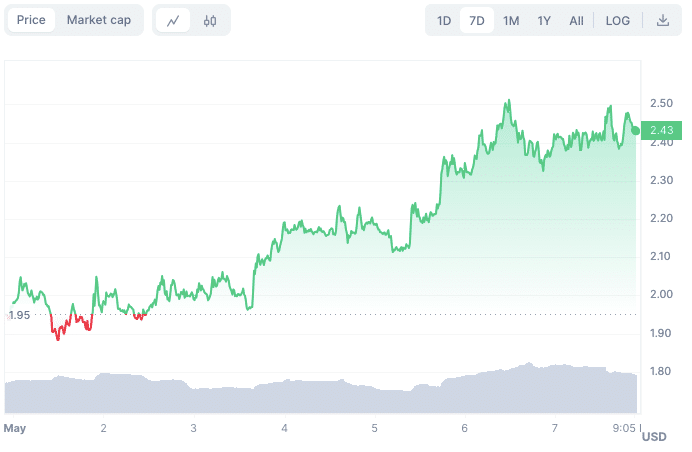

The Ripple Effect: Analyzing XRP's Price Increase Post-SEC Lawsuit

XRP's recent price action presents a fascinating case study in market dynamics. Understanding its movement requires looking beyond the simple narrative of a cryptocurrency embroiled in legal trouble.

Decoupling from Market Sentiment

One of the most striking aspects of XRP's performance is its decreasing correlation with the overall cryptocurrency market. This decoupling suggests a unique trajectory, independent of Bitcoin's price fluctuations or broader market trends.

- Specific Instances: There have been several instances where XRP showed positive growth even amidst significant downturns in the broader crypto market, highlighting its resilience and independent price movement. For example, [insert specific example with date and price data].

- Decreased Correlation: Analyzing the correlation coefficient between XRP and other major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) reveals a decreasing dependency. [Insert data or source supporting this claim]. This suggests that XRP's price is becoming increasingly driven by factors specific to its own ecosystem and legal situation.

- Reasons for Decoupling: This decoupling is likely due to several factors, including increased institutional interest, positive legal developments, and growing adoption within specific payment solutions.

Increased Institutional Adoption and Trading Volume

The surge in XRP's price can also be attributed to a noticeable increase in institutional adoption and trading volume. This signifies growing confidence in the cryptocurrency's long-term potential, despite the ongoing SEC lawsuit.

- Institutional Investors: Several reports indicate increased interest from institutional investors, although concrete naming of these entities may be limited due to confidentiality agreements. [Cite reputable sources if available].

- Trading Volume Increase: Data from major cryptocurrency exchanges shows a significant rise in XRP trading volume, suggesting higher liquidity and increased investor activity. [Include data from reliable exchanges].

- Impact of Liquidity: Increased liquidity contributes to greater price stability and facilitates smoother price discovery, making XRP a more attractive asset for both short-term and long-term investors.

Ripple's Legal Strategy and Positive Developments

Ripple's legal strategy and any positive developments in the SEC lawsuit have undoubtedly influenced XRP's price. While uncertainty remains, certain aspects have played a crucial role.

Favorable Court Rulings and Expert Testimony

Ripple's defense strategy, which focuses on arguing that XRP is not a security, has yielded some positive developments.

- Key Arguments: Ripple's key arguments center around the functionality of XRP within its ecosystem and its decentralized nature, emphasizing its use for cross-border payments. [Summarize key arguments concisely].

- Favorable Judgments: [Mention any specific favorable rulings or decisions that have been made in the case, citing sources]. These rulings have boosted investor confidence.

- Expert Testimony: Expert testimony supporting Ripple's position has helped shape public perception and strengthen its legal arguments. [Mention key experts and their testimonies].

Impact of Ongoing Regulatory Uncertainty

Despite positive developments, the ongoing regulatory uncertainty continues to impact XRP's price. The outcome of the SEC lawsuit remains a significant factor influencing investor sentiment.

- Potential Implications: Different court rulings could have dramatically different consequences on XRP's future. A ruling in Ripple's favor could see a significant price surge, while an unfavorable ruling could lead to a substantial drop.

- Regulatory Clarity: A lack of regulatory clarity creates volatility. Increased regulatory clarity, regardless of the outcome, could ultimately benefit XRP's stability and attract more investors.

- Long-Term Effects: The long-term effects on XRP's adoption and price will heavily depend on the final resolution of the SEC lawsuit and subsequent regulatory actions.

Technical Analysis and Market Factors

Analyzing XRP's price action requires considering technical indicators and macroeconomic factors influencing the broader cryptocurrency market.

Technical Indicators and Chart Patterns

Technical analysis offers insights into potential price trends.

- Key Indicators: Bullish indicators such as a rising Relative Strength Index (RSI), a positive Moving Average Convergence Divergence (MACD), and sustained price action above key moving averages suggest bullish momentum. [Cite specific data or charts].

- Chart Patterns: Certain chart patterns, like breakouts from consolidation periods, indicate potential price increases. [Include specific examples with relevant charts].

- Limitations: It's crucial to remember that technical analysis is not foolproof and should be considered alongside fundamental analysis and market context.

Macroeconomic Factors

Broader economic conditions significantly impact cryptocurrency markets, including XRP.

- Investor Risk Appetite: Factors such as inflation, interest rates, and geopolitical events affect investor risk appetite. Periods of economic uncertainty can lead to investors moving towards safer assets, while times of stability may encourage higher risk investments.

- Correlation with Macro Events: [Analyze any observable correlation between specific macroeconomic events and XRP's price movements].

- Alternative Investments: The attractiveness of alternative investment options, such as bonds or traditional stocks, can influence the flow of capital into the cryptocurrency market and affect XRP's price.

Conclusion

XRP's performance in the face of the SEC lawsuit has been remarkable. While the legal battle continues, increased institutional adoption, positive legal developments, and potentially favorable technical indicators have contributed to its strong performance relative to Bitcoin and other cryptocurrencies. The future of XRP remains uncertain, contingent upon the resolution of the SEC case, but current trends suggest potential for continued growth. It's crucial to conduct thorough research and understand the inherent risks associated with cryptocurrency investment before considering any XRP investment. Stay informed about further developments in the XRP and SEC case to make informed decisions regarding your XRP portfolio. Understanding the nuances of XRP's market position and the ongoing legal battle is vital for navigating the complexities of this exciting asset.

Featured Posts

-

Charles Barkleys Bold Prediction Cleveland Cavaliers Future

May 07, 2025

Charles Barkleys Bold Prediction Cleveland Cavaliers Future

May 07, 2025 -

Lotto Results Check The Latest Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 07, 2025

Lotto Results Check The Latest Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 07, 2025 -

Alex Ovechkins Take Will He Watch The 4 Nations Face Off Without Russia

May 07, 2025

Alex Ovechkins Take Will He Watch The 4 Nations Face Off Without Russia

May 07, 2025 -

Alex Ovechkins Florida Workout Partner Revealed Former Nhl Star Darius Kasparaitis

May 07, 2025

Alex Ovechkins Florida Workout Partner Revealed Former Nhl Star Darius Kasparaitis

May 07, 2025 -

Knicks Fall To Cavs High Scoring Offense

May 07, 2025

Knicks Fall To Cavs High Scoring Offense

May 07, 2025