XRP's Uncertain Future: A Look At The Derivatives Market And Price Action

Table of Contents

The Ripple Lawsuit's Impact on XRP Derivatives

The SEC's lawsuit against Ripple, alleging the unregistered sale of XRP as a security, has profoundly affected XRP's price and trading volume. This uncertainty creates a complex landscape for investors and traders operating in the XRP derivatives market. The fluctuating legal developments directly influence investor sentiment, prompting shifts in trading strategies and risk assessments.

-

Increased Volatility: Legal updates consistently trigger significant price swings in XRP, making it a highly volatile asset. Positive news can lead to substantial price increases, while negative developments cause sharp drops.

-

Impact on Open Interest: The uncertainty surrounding the lawsuit's outcome affects the open interest in XRP futures and options contracts. Periods of heightened uncertainty often lead to decreased open interest as traders become hesitant to take on substantial risk.

-

Changes in Premium Pricing: The premium pricing on XRP derivatives reflects the market's assessment of the risk associated with the asset. During periods of heightened legal uncertainty, the premium often increases, reflecting the higher perceived risk.

-

Effect on Liquidity: The legal battle can impact the liquidity of XRP derivative markets. Periods of intense uncertainty can cause a decrease in liquidity as market participants become more cautious.

-

Price Swings and Legal Updates: For example, positive court rulings have historically been followed by significant surges in XRP's price, while negative rulings have resulted in considerable price drops. This illustrates the direct correlation between legal developments and XRP price action.

Analyzing XRP Price Action and Market Sentiment

Analyzing recent XRP price movements reveals a clear correlation with events in the derivatives market and broader market sentiment. Technical analysis, focusing on key indicators, helps us understand these patterns.

-

Key Technical Indicators: Studying technical indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and various moving averages can help identify potential trends and reversals in XRP's price.

-

Support and Resistance Levels: Identifying support and resistance levels on XRP's price charts provides insights into potential price boundaries and potential breakout points.

-

Correlation Between Spot and Derivative Prices: A strong correlation usually exists between XRP's spot price (the price on exchanges) and the prices of its derivatives. Analyzing this correlation can offer valuable insights into market sentiment and future price movements.

-

Trading Volume Analysis: Examining trading volume in both spot and derivatives markets provides crucial information about the strength of price movements and overall market participation.

-

News Events and Their Effect: Major news events, such as court hearings or regulatory announcements, significantly influence market sentiment and consequently affect both XRP's spot price and derivatives pricing.

The Role of XRP Derivatives in Price Discovery

XRP derivatives markets, like those for other cryptocurrencies, play a vital role in price discovery. Futures contracts and options, in particular, can serve as leading indicators of future price movements.

-

Types of XRP Derivatives: XRP derivatives include futures contracts (agreements to buy or sell XRP at a future date), options contracts (giving the holder the right, but not the obligation, to buy or sell XRP at a specific price), and swaps (exchanging cash flows based on the price of XRP).

-

Open Interest and Volume as Indicators: High open interest and trading volume in XRP derivatives markets often suggest strong market expectations and potential for significant price movements.

-

Impact of Institutional Investors: Large institutional investors often utilize derivatives for hedging and speculation, significantly influencing price action in both spot and derivatives markets.

-

Arbitrage Opportunities: Arbitrage opportunities frequently exist between spot and derivatives markets, further contributing to price discovery and market efficiency.

Future Predictions and Investment Strategies for XRP

Predicting XRP's future price with certainty is impossible. However, by analyzing price action and derivatives market activity, we can explore potential scenarios and discuss appropriate investment strategies. It is crucial to remember that investing in cryptocurrencies involves significant risk.

-

Potential Price Scenarios: Depending on the outcome of the SEC lawsuit, different price scenarios are possible. A favorable ruling could lead to a significant price surge, while an unfavorable outcome could result in further price declines.

-

Hedging Strategies: XRP derivatives can be used to hedge against potential price declines. For example, shorting XRP futures contracts could protect against losses if the price falls.

-

Investment Strategies: Long-term holders might view the current uncertainty as a buying opportunity, while short-term traders may prefer to focus on shorter-term price swings and utilize derivatives for leveraged trading.

-

Risk Management and Diversification: Regardless of the chosen investment strategy, effective risk management and portfolio diversification are essential to mitigate potential losses.

Conclusion: Understanding XRP's Uncertain Future – A Call to Action

The Ripple lawsuit and the dynamics of the XRP derivatives market significantly impact XRP's price and overall market behavior. Understanding both the spot and derivatives markets is vital for making informed investment decisions. Continuous monitoring of legal developments, market sentiment, and technical indicators is crucial. Before investing in XRP or trading its derivatives, conduct thorough research, carefully assess the risks involved, and consider seeking professional financial advice. Stay informed on XRP's future, analyze XRP price action and derivatives diligently, and navigate the uncertain future of XRP cautiously.

Featured Posts

-

How To Watch Cavaliers Vs Heat Nba Playoffs Game 2 Time Tv Channel And Free Live Stream Options

May 07, 2025

How To Watch Cavaliers Vs Heat Nba Playoffs Game 2 Time Tv Channel And Free Live Stream Options

May 07, 2025 -

Millionaire Contestant Criticized For Hesitation On Easy Question

May 07, 2025

Millionaire Contestant Criticized For Hesitation On Easy Question

May 07, 2025 -

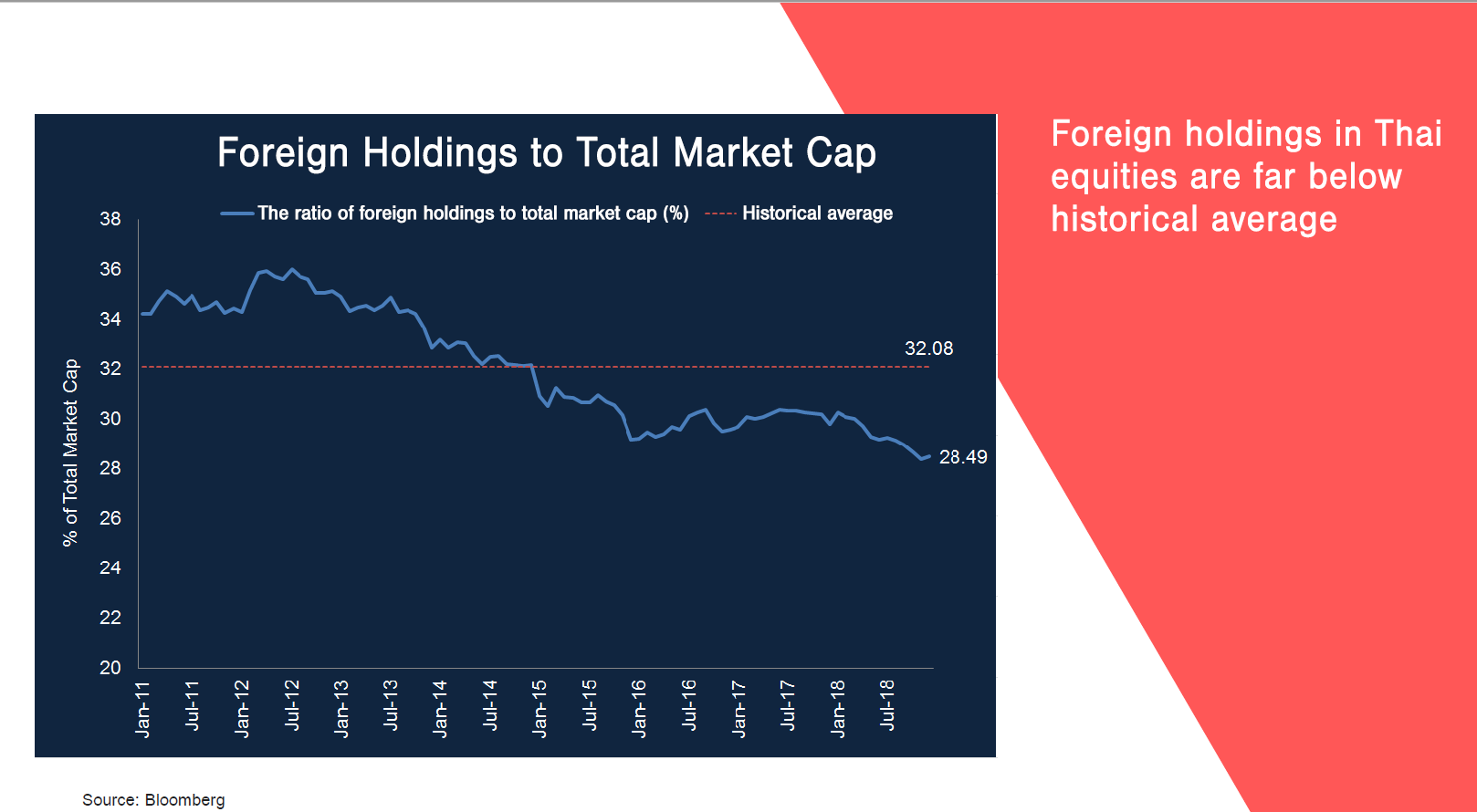

Thailands Economic Outlook Analyzing The Impact Of Negative Inflation

May 07, 2025

Thailands Economic Outlook Analyzing The Impact Of Negative Inflation

May 07, 2025 -

Is George Pickens Time With The Steelers Over Ex Gms Comments Spark Debate

May 07, 2025

Is George Pickens Time With The Steelers Over Ex Gms Comments Spark Debate

May 07, 2025 -

Christophe Mali Concert De Cloture A Onet Le Chateau

May 07, 2025

Christophe Mali Concert De Cloture A Onet Le Chateau

May 07, 2025