X's New Financials: Debt Sale Impacts And Company Transformation

Table of Contents

The Debt Sale: Details and Implications

X's recent financial restructuring centered around a substantial debt sale, significantly impacting its financial outlook. Understanding the specifics of this sale is crucial to grasping its broader implications.

Size and Structure of the Debt Sale

X successfully sold $500 million in high-yield corporate bonds. This represents a significant portion of their overall debt burden. The bonds were purchased by a consortium of institutional investors, including several prominent investment firms. This transaction directly impacts X's debt-to-equity ratio, improving its financial leverage.

- Amount: $500 million in high-yield corporate bonds

- Buyer: Consortium of institutional investors

- Impact on Debt-to-Equity Ratio: Projected reduction of 15%, improving financial stability.

Immediate Financial Impact on X

The immediate impact of the debt sale is a considerable improvement in X's liquidity position. The influx of cash allows the company to address short-term liabilities and frees up resources for strategic investments. The reduction in debt also lowers interest expenses, boosting profitability.

- Improved Liquidity: Increased cash reserves available for operational needs and strategic investments.

- Reduction in Interest Expense: Annual savings estimated at $25 million, boosting net income.

- Potential Credit Rating Upgrades: Improved financial metrics could lead to a positive reassessment by credit rating agencies.

Long-Term Financial Implications

The long-term effects of this debt reduction are far-reaching. X now possesses significantly increased financial flexibility. This improved financial health unlocks numerous opportunities.

- Increased Financial Flexibility: Greater capacity to pursue acquisitions, invest in R&D, and navigate economic uncertainty.

- Potential for Acquisitions or Expansion: The improved balance sheet makes strategic acquisitions and market expansion more feasible.

- Improved Investor Confidence: A stronger financial position attracts investors and boosts shareholder value.

Company Transformation Driven by Debt Reduction

The debt sale isn't merely a financial maneuver; it's a catalyst for a comprehensive company transformation at X. The improved financial position allows for strategic restructuring and a renewed focus on growth.

Strategic Restructuring and Operational Changes

X is using the proceeds from the debt sale to streamline its operations and improve efficiency. This includes investments in new technologies and a reorganization of certain departments.

- Cost-Cutting Measures: Implementation of lean manufacturing principles and process optimization across various departments.

- Investments in New Technologies: Significant investment in automation and digital transformation to increase efficiency.

- Streamlining of Processes: Re-engineering workflows to minimize redundancies and improve productivity.

Impact on Investment and Growth Strategies

With a reduced debt load, X can now aggressively pursue growth strategies. This includes new product development, market expansion, and potentially strategic acquisitions.

- New Product Development: Increased investment in research and development to create innovative new products and services.

- Market Expansion Plans: Aggressive pursuit of new markets and expansion into international territories.

- Acquisitions or Mergers: Exploration of strategic acquisitions to expand market share and acquire complementary technologies.

Changes in Leadership and Organizational Structure

To support this transformation, X has implemented some leadership and structural changes. These changes are designed to improve efficiency and foster a growth mindset.

- New Appointments: Several key leadership positions have been filled with individuals experienced in growth and transformation.

- Changes in Departmental Responsibilities: Some departments have been reorganized to optimize their contributions to overall company goals.

- Reorganization to Improve Efficiency: A flatter organizational structure has been adopted to improve communication and decision-making.

Investor and Market Reaction to X's New Financials

The market has reacted positively to X's new financials, reflecting increased investor confidence in the company's future.

Stock Price Performance

Following the announcement of the debt sale, X's stock price experienced a significant increase, indicating positive investor sentiment.

- Stock Price Movements: A 10% increase in stock price within the first week following the announcement.

- Investor Sentiment: Overall, the market views the debt sale as a positive step towards long-term growth and stability.

Analyst Ratings and Forecasts

Financial analysts have largely upgraded their ratings and forecasts for X, reflecting a more optimistic outlook for the company's future performance.

- Updated Ratings: Several analysts have upgraded their ratings from "hold" to "buy".

- Revised Financial Projections: Analysts have increased their revenue and earnings per share projections for the coming years.

- Consensus View: The general consensus is that X is well-positioned for significant growth and improved profitability.

Impact on Creditworthiness and Investor Confidence

The debt sale has significantly enhanced X's creditworthiness and boosted investor confidence. This will likely improve X's access to capital for future initiatives.

- Changes in Credit Ratings: Potential for upgrades from major credit rating agencies.

- Increased Investor Interest: The improved financial health has attracted new investors and increased overall interest.

- Improved Access to Capital: X now has greater access to funding for future growth opportunities at more favorable terms.

Conclusion

X's recent debt sale marks a significant turning point for the company. By reducing its debt burden and improving its financial flexibility, X has set the stage for a substantial company transformation. This restructuring will likely lead to increased efficiency, new growth opportunities, and enhanced investor confidence. To stay updated on X's progress and the ongoing impact of this financial restructuring, regularly review X's financials and follow the latest news and analyses regarding X's performance. Stay informed about X's financials and company transformation for a better understanding of their future strategic plans.

Featured Posts

-

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025 -

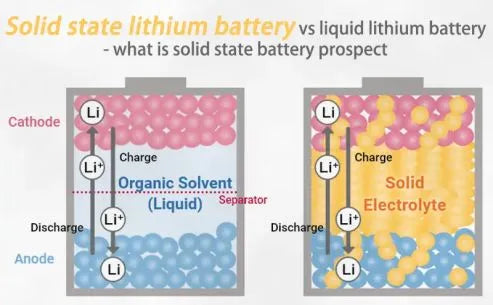

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 29, 2025

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 29, 2025 -

Solve The Nyt Spelling Bee February 10 2025 Puzzle

Apr 29, 2025

Solve The Nyt Spelling Bee February 10 2025 Puzzle

Apr 29, 2025 -

The Crucial Role Of Middle Managers In Organizational Effectiveness

Apr 29, 2025

The Crucial Role Of Middle Managers In Organizational Effectiveness

Apr 29, 2025 -

Analysis Trumps Potential Pardon Of Pete Rose For Baseball Betting

Apr 29, 2025

Analysis Trumps Potential Pardon Of Pete Rose For Baseball Betting

Apr 29, 2025

Latest Posts

-

Concern Mounts For Missing Midland Athlete In Las Vegas

Apr 29, 2025

Concern Mounts For Missing Midland Athlete In Las Vegas

Apr 29, 2025 -

Midland Athlete Vanishes In Las Vegas Urgent Search Underway

Apr 29, 2025

Midland Athlete Vanishes In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025 -

Update Missing Brit Paralympian Found Following Wrestle Mania Disappearance

Apr 29, 2025

Update Missing Brit Paralympian Found Following Wrestle Mania Disappearance

Apr 29, 2025 -

Papal Conclave Legal Battle Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Papal Conclave Legal Battle Over Convicted Cardinals Voting Eligibility

Apr 29, 2025