Yes Bank And SMFG: A Strategic Partnership On The Horizon?

Table of Contents

SMFG's Global Reach and Investment Strategy

SMFG, a global financial giant, boasts a robust international expansion strategy and a proven track record of successful investments and acquisitions. Understanding their global investment strategy is crucial to assessing the potential partnership with Yes Bank.

SMFG's Track Record in International Acquisitions

SMFG's history is replete with strategic acquisitions and partnerships that have broadened its global reach and strengthened its position in diverse financial sectors. Their strategic approach focuses on identifying and investing in institutions with strong growth potential in emerging markets.

- Successful Partnerships in Emerging Markets: SMFG has successfully partnered with and invested in financial institutions across Asia, Europe, and the Americas, showcasing their expertise in navigating complex regulatory environments and integrating diverse business models. Specific examples, while needing further research for precise details due to confidentiality, could include past acquisitions and joint ventures in regions experiencing rapid economic growth.

- Expertise Across Financial Sectors: Their expertise extends across investment banking, retail banking, asset management, and other financial services. This diversified experience offers a significant advantage in supporting a potential partner like Yes Bank.

- Strategic Goals and Interest in India: SMFG's strategic goals clearly indicate an interest in expanding their presence in key growth markets, and India, with its burgeoning economy and large, underbanked population, presents an attractive opportunity.

Yes Bank's Current Situation and Potential for Growth

Yes Bank, after undergoing significant financial restructuring, is poised for a period of growth and consolidation within the Indian banking sector. A strategic partnership could accelerate this recovery and unlock further potential.

Yes Bank's Restructuring and Recovery

Yes Bank's recent history includes a period of financial challenges followed by a government-led rescue and subsequent restructuring. While the bank has made significant strides in stabilizing its operations, strategic collaborations could significantly boost its future prospects.

- Strengths and Weaknesses: Yes Bank possesses a strong brand recognition and an established customer base in India. However, areas requiring improvement include technological infrastructure and risk management capabilities.

- Growth Potential in the Indian Market: The Indian banking sector offers immense growth potential, fueled by increasing digital adoption and a rising middle class. Yes Bank is well-positioned to capitalize on these trends.

- Areas Where SMFG's Expertise Could Be Beneficial: SMFG's expertise in technology, risk management, and international banking operations could significantly enhance Yes Bank's capabilities and operational efficiency.

Potential Synergies and Benefits of a Partnership

A strategic alliance between Yes Bank and SMFG presents a unique opportunity for mutual benefits, accelerating growth for Yes Bank while providing SMFG with access to the lucrative Indian market.

Mutual Benefits for Yes Bank and SMFG

The potential synergies are compelling, promising a win-win situation for both partners.

- Benefits for Yes Bank: Access to capital infusion, advanced technology platforms, and enhanced risk management frameworks from SMFG could significantly strengthen Yes Bank's financial position and market competitiveness.

- Benefits for SMFG: This partnership provides SMFG with immediate access to the rapidly growing Indian market, diversifying their investment portfolio and potentially increasing their market share in a crucial region.

- Potential Challenges and Risks: Cultural differences, regulatory hurdles, and integration challenges are potential risks that need careful consideration and mitigation strategies.

Regulatory and Political Landscape

Navigating the regulatory landscape in both India and Japan is crucial for the success of any potential Yes Bank and SMFG strategic partnership.

Navigating the Regulatory Hurdles

The regulatory environment plays a significant role in determining the feasibility and structure of such a partnership.

- Indian and Japanese Regulations on Foreign Investment: Both countries have regulations governing foreign investment in the banking sector, which need careful consideration and compliance.

- Potential Political Implications: The political relationship between India and Japan, and the broader geopolitical context, will influence the reception and approval process for this potential deal.

- Role of Regulatory Bodies: Regulatory bodies in both countries will play a pivotal role in reviewing and approving the partnership, ensuring compliance with all relevant regulations.

Conclusion

The potential strategic partnership between Yes Bank and SMFG presents an exciting opportunity for both institutions. The synergies are clear: Yes Bank gains access to capital, technology, and expertise, while SMFG gains a significant foothold in the Indian market. However, navigating the regulatory and political landscapes will be critical. The success of this potential "Yes Bank and SMFG strategic partnership" hinges on effective collaboration, careful planning, and a shared vision. This could significantly impact the Indian and global financial landscapes. We encourage readers to share their perspectives on this potential partnership and engage in further discussion and analysis. What are your thoughts on the potential impact of this strategic alliance? Let's continue the conversation and explore the possibilities further!

Featured Posts

-

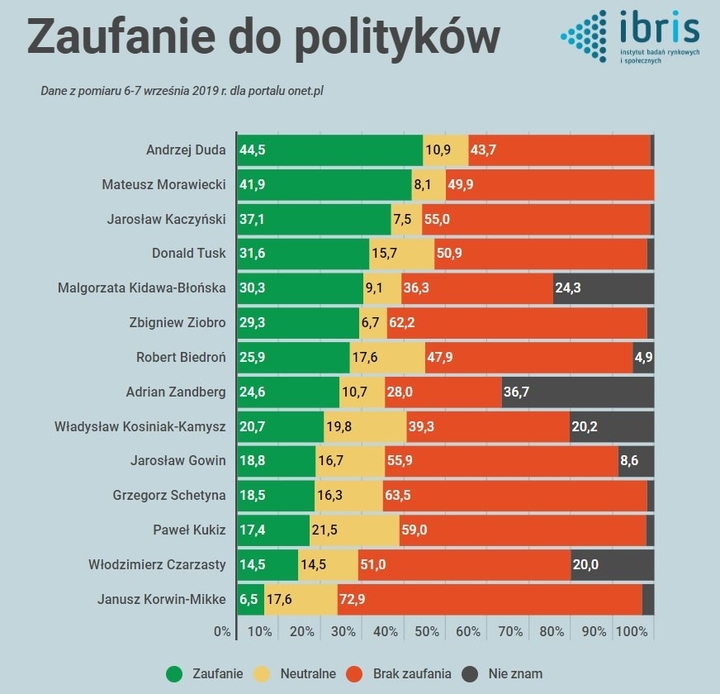

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025 -

Met Gala 2025 Red Carpets Most Stunning Fashion Moments

May 07, 2025

Met Gala 2025 Red Carpets Most Stunning Fashion Moments

May 07, 2025 -

Alex Ovechkins Future With Dynamo Moscow President Comments On Advisory Role And Management Possibilities

May 07, 2025

Alex Ovechkins Future With Dynamo Moscow President Comments On Advisory Role And Management Possibilities

May 07, 2025 -

Understanding The Wnba Draft Lottery And Order

May 07, 2025

Understanding The Wnba Draft Lottery And Order

May 07, 2025 -

Bitcoin Price Rally Analysis Of The Recent 10 Week High And Path To 100 000

May 07, 2025

Bitcoin Price Rally Analysis Of The Recent 10 Week High And Path To 100 000

May 07, 2025