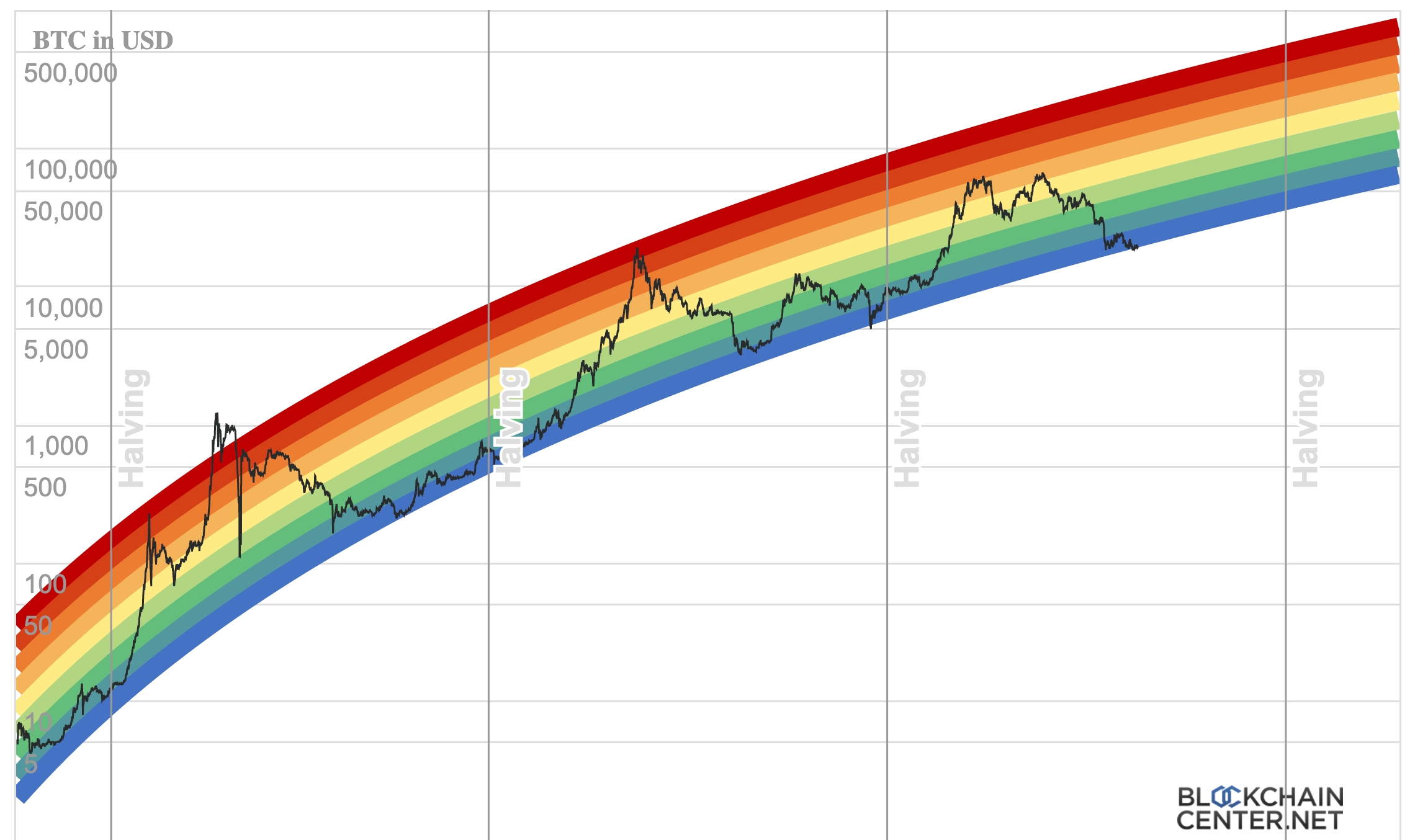

10x Bitcoin Multiplier: A Chart Of The Week Analysis

Table of Contents

Historical Precedents of Bitcoin Price Surges

Understanding past Bitcoin price movements is crucial for predicting future potential. Let's analyze significant historical surges to identify recurring patterns and potential indicators for a future 10x Bitcoin multiplier.

The 2017 Bull Run: A Case Study

The 2017 bull run saw Bitcoin's price increase dramatically. Several factors contributed to this rapid growth:

- Increased mainstream media coverage: Widespread media attention fueled public interest and increased demand.

- Growing institutional interest: Early institutional adoption signaled legitimacy and attracted further investment.

- Technological advancements: Improvements in the Bitcoin ecosystem, such as the SegWit upgrade, enhanced scalability and efficiency.

Comparing the 2017 surge to current market conditions reveals similarities and differences. While mainstream media attention is present, the level of institutional adoption is significantly higher today. This suggests a potentially more sustainable and less volatile growth trajectory, although the ultimate outcome remains uncertain.

Previous Market Cycles and Their Implications

Analyzing Bitcoin's previous price cycles reveals several recurring patterns:

- Halving events: The halving of Bitcoin's block reward has historically preceded significant price increases due to reduced supply.

- Adoption rate: Increased adoption, both in terms of users and merchants, usually correlates with price appreciation.

- Support and resistance levels: Identifying historical support and resistance levels can help predict future price movements. These levels represent price points where buying or selling pressure has been particularly strong in the past.

Analyzing Current Market Indicators

Analyzing current market indicators provides a crucial perspective on the potential for a 10x Bitcoin multiplier. Several key factors must be considered.

On-Chain Metrics and Their Predictive Power

On-chain data, such as transaction volume, active addresses, and mining difficulty, offer valuable insights into Bitcoin's network activity and potential price movements.

- Transaction volume: High transaction volume suggests increased usage and potential price growth.

- Active addresses: A growing number of active addresses indicates expanding user base and network adoption.

- Mining difficulty: Increased mining difficulty reflects a healthier, more secure network, often correlated with price stability or growth.

Analyzing these metrics alongside historical price charts helps identify potential correlations and predict future trends.

Macroeconomic Factors and Bitcoin's Correlation

Global economic events significantly impact Bitcoin's price.

- Inflation: Bitcoin is often seen as a hedge against inflation, leading to increased demand during periods of high inflation.

- Recessionary fears: During times of economic uncertainty, investors may seek refuge in Bitcoin's perceived safe-haven status.

- Geopolitical instability: Global instability can increase demand for Bitcoin as a decentralized, non-sovereign asset.

Understanding these macroeconomic influences is critical for predicting Bitcoin's price movements.

Regulatory Landscape and its Effect on Bitcoin Price

Governmental regulations profoundly influence Bitcoin's price and adoption.

- Positive regulations: Clear and favorable regulatory frameworks can increase institutional investment and public confidence.

- Negative regulations: Restrictive regulations can stifle adoption and lead to price declines.

- Jurisdictional differences: Differing regulatory approaches across countries create varying levels of risk and opportunity.

Navigating the regulatory landscape is crucial for understanding Bitcoin's potential for growth.

Potential Catalysts for a 10x Bitcoin Multiplier

Several factors could potentially trigger a 10x Bitcoin multiplier.

Technological Developments

Advancements in Bitcoin technology could significantly boost its adoption and price.

- Lightning Network: This layer-2 scaling solution promises faster and cheaper transactions, enhancing usability.

- Layer-2 scaling solutions: These solutions aim to improve Bitcoin's scalability and transaction throughput.

These advancements could lead to wider adoption and increased demand, potentially driving significant price growth.

Increased Institutional Adoption

Growing interest from institutional investors is a significant catalyst for price appreciation.

- Large-scale institutional investment: Significant investments from corporations and hedge funds can inject massive liquidity into the market.

- Impact on liquidity and volatility: Increased institutional participation could reduce volatility and create a more stable market.

This increased participation is likely to fuel further growth in Bitcoin's price.

Mainstream Media Attention and Public Perception

Positive media coverage plays a crucial role in driving public interest and adoption.

- Positive media coverage: Favorable news stories can increase public awareness and demand, pushing prices higher.

- Negative media coverage: Negative narratives can discourage investment and lead to price drops.

Managing public perception through strategic communication is crucial for driving continued growth.

Conclusion

The possibility of a 10x Bitcoin multiplier is a complex issue. While not guaranteed, understanding historical patterns, current market indicators, and potential future developments allows for a more informed assessment of the possibilities. By carefully analyzing charts and considering the various factors discussed, investors can make more strategic decisions regarding their Bitcoin holdings. Continue researching and monitoring the market to stay informed about the potential for a 10x Bitcoin multiplier and to navigate the dynamic world of cryptocurrency investments. Remember to conduct your own thorough research and consult with financial advisors before making any investment decisions related to the 10x Bitcoin multiplier or any cryptocurrency.

Featured Posts

-

Revolutionizing Voice Assistant Development Open Ais Latest Tools

May 08, 2025

Revolutionizing Voice Assistant Development Open Ais Latest Tools

May 08, 2025 -

Recent Ethereum Price Trends Analyzing The Resilience

May 08, 2025

Recent Ethereum Price Trends Analyzing The Resilience

May 08, 2025 -

Restaurante Cantina Canalla Resena Y Guia Completa En Malaga

May 08, 2025

Restaurante Cantina Canalla Resena Y Guia Completa En Malaga

May 08, 2025 -

Thunder Vs Pacers Injury Report March 29th Game Update

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Update

May 08, 2025 -

Dodgers Superaran El Record De Los Yankees Historico Inicio De Temporada

May 08, 2025

Dodgers Superaran El Record De Los Yankees Historico Inicio De Temporada

May 08, 2025

Latest Posts

-

5 Must See Military Films Where Action Meets Emotion

May 08, 2025

5 Must See Military Films Where Action Meets Emotion

May 08, 2025 -

Saving Private Ryan 20 Facts You Probably Didnt Know

May 08, 2025

Saving Private Ryan 20 Facts You Probably Didnt Know

May 08, 2025 -

5 Military Movies Blending Heart And Action Warfare On Screen

May 08, 2025

5 Military Movies Blending Heart And Action Warfare On Screen

May 08, 2025 -

Saving Private Ryan How Unscripted Moments Elevated The Films Realism

May 08, 2025

Saving Private Ryan How Unscripted Moments Elevated The Films Realism

May 08, 2025 -

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025