Recent Ethereum Price Trends: Analyzing The Resilience

Table of Contents

Short-Term Price Volatility and Market Sentiment

Recent Ethereum price fluctuations have been significant, reflecting the inherent volatility of the cryptocurrency market. Daily and weekly changes can be dramatic, influenced by a complex interplay of news events, technological developments, and overall market sentiment. For example, a sudden regulatory announcement concerning cryptocurrencies can trigger a sharp price drop, while positive news about Ethereum 2.0 progress might lead to a surge.

-

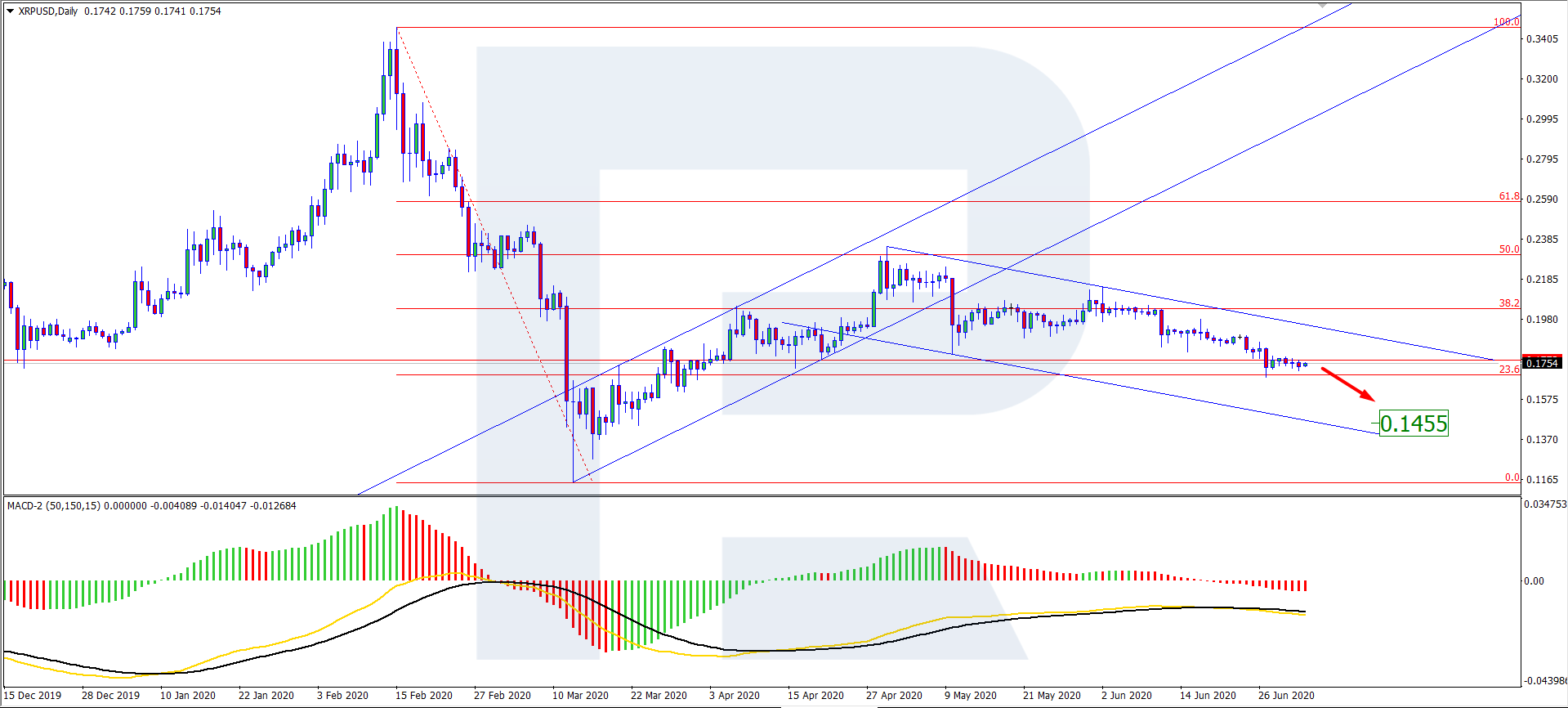

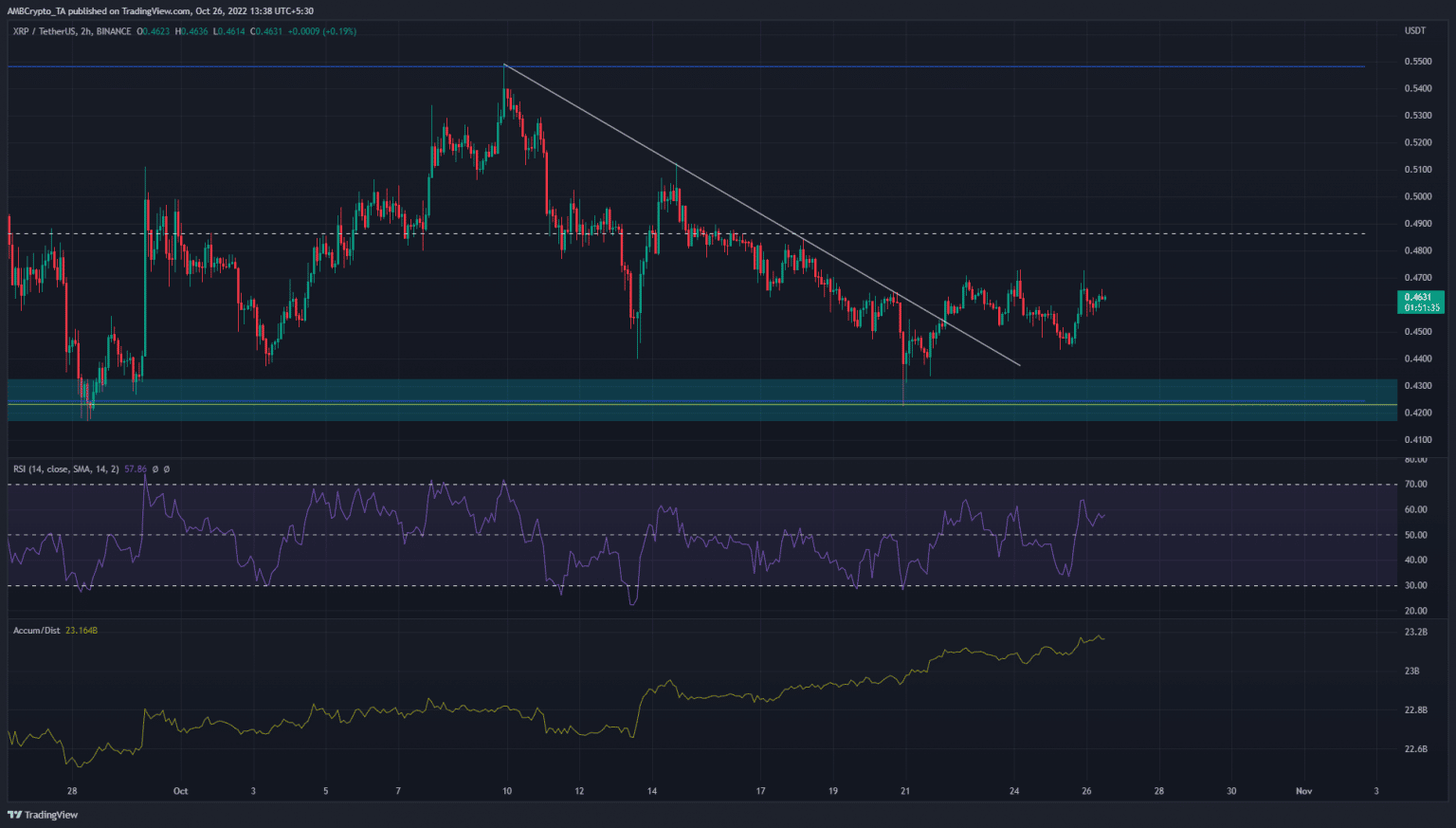

Analyzing recent price highs and lows: Tracking these points helps identify potential support and resistance levels, offering insights into price momentum. A recent high might indicate a potential ceiling for the short term, while a recent low could be a point of support for a price rebound. Looking at price charts with various timeframes (daily, weekly, monthly) provides a comprehensive view of these fluctuations.

-

The role of social media sentiment and news coverage: Positive or negative news coverage and social media sentiment significantly impact Ethereum price trends. A surge in positive sentiment on platforms like Twitter or Reddit can drive demand and push the price higher, while negative news or FUD (fear, uncertainty, and doubt) can trigger sell-offs. Sentiment analysis tools can help gauge public opinion surrounding Ethereum.

-

Impact of Bitcoin's price movements on Ethereum: As the leading cryptocurrency, Bitcoin's price often influences the entire crypto market, including Ethereum. A significant Bitcoin price increase usually leads to positive sentiment spilling over into altcoins like Ethereum, driving up its price. Conversely, a Bitcoin price decline can trigger a general sell-off, impacting Ethereum negatively. Correlation analysis between Bitcoin and Ethereum prices can reveal the strength of this relationship.

(Insert relevant charts and graphs showcasing price volatility here)

Long-Term Ethereum Price Trends and Growth Factors

Despite short-term volatility, Ethereum's price has shown a remarkable upward trend over the long term. Several fundamental factors underpin this growth:

-

Increasing adoption of Ethereum in decentralized finance (DeFi): DeFi applications built on Ethereum have exploded in popularity, driving demand for ETH. The total value locked (TVL) in DeFi protocols is a crucial indicator of this growth.

-

Growing usage of Ethereum for non-fungible tokens (NFTs): The NFT boom has significantly increased the demand for Ethereum, as it's the primary blockchain for many NFT marketplaces. The volume of NFT trades and the market capitalization of leading NFT collections directly impact Ethereum price trends.

-

Development and implementation of Ethereum 2.0: The transition to a Proof-of-Stake (PoS) consensus mechanism is a significant upgrade, aiming to improve scalability, security, and efficiency. This has positive implications for Ethereum price trends, as it addresses some of the long-standing criticisms of the network.

-

Institutional investment in Ethereum: Major financial institutions are increasingly investing in Ethereum, recognizing its potential as a foundational technology for the future of finance. This institutional interest provides a strong support base for the price.

-

Increased demand from developers and businesses: Ethereum's robust developer ecosystem and the wide range of applications built on it attract increasing numbers of developers and businesses, further fueling demand for ETH.

The Impact of Ethereum 2.0 on Price

Ethereum 2.0 is a game-changer. The shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS) is expected to significantly enhance Ethereum's scalability and efficiency, potentially reducing transaction fees and improving processing speed.

-

Shift from Proof-of-Work to Proof-of-Stake: PoS significantly reduces energy consumption compared to PoW, addressing environmental concerns and potentially making Ethereum more attractive to environmentally conscious investors.

-

Increased efficiency impacting transaction fees and speed: Faster transaction speeds and lower fees make Ethereum more competitive, attracting a wider range of users and applications.

-

Potential effects on energy consumption and environmental concerns: The move to PoS makes Ethereum far more energy-efficient, alleviating concerns about its environmental footprint and attracting environmentally conscious investors.

Analyzing Key Technical Indicators

Technical indicators provide valuable insights into short-term price movements. Analyzing indicators like moving averages (e.g., 50-day MA, 200-day MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify potential price trends.

-

Use of support and resistance levels in price prediction: Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels indicate the opposite. Identifying these levels can help predict potential price reversals.

-

Other technical analysis tools relevant to cryptocurrency markets: Various other indicators, such as Bollinger Bands and Fibonacci retracements, can supplement the analysis.

-

Cautious interpretation – emphasizing the limitations of technical analysis: Technical analysis is not foolproof. It should be used in conjunction with fundamental analysis and considered alongside other factors. Market sentiment and unforeseen events can easily invalidate technical predictions.

Risks and Challenges Facing Ethereum

Despite its strengths, Ethereum faces several risks and challenges that could impact its price:

-

Competition from other layer-1 blockchains: New blockchain platforms are constantly emerging, competing with Ethereum for market share and developer attention.

-

Regulatory uncertainty and potential government intervention: The regulatory landscape for cryptocurrencies remains uncertain, and potential government intervention could negatively impact Ethereum's price.

-

Scalability challenges even with Ethereum 2.0: While Ethereum 2.0 addresses some scalability issues, challenges may still persist, potentially affecting transaction speeds and fees.

-

Security vulnerabilities and potential hacking risks: All blockchain networks are susceptible to security vulnerabilities, and any major security breach could negatively impact Ethereum's price and reputation.

Conclusion

Recent Ethereum price trends demonstrate its resilience, with long-term growth driven by factors such as DeFi adoption, NFT popularity, and the upcoming Ethereum 2.0 upgrade. However, short-term volatility remains, influenced by market sentiment and external factors. Understanding both short-term fluctuations and long-term trends is crucial for navigating the dynamic cryptocurrency market. While technical indicators can offer insights, they should be interpreted cautiously. The risks and challenges facing Ethereum should also be considered.

Call to Action: Stay informed about the ever-evolving landscape of Ethereum price trends. Continue researching and analyzing market indicators to make informed decisions regarding your investments in Ethereum and other cryptocurrencies. Understanding Ethereum price trends is crucial for navigating the dynamic cryptocurrency market.

Featured Posts

-

Prove Your Nba Knowledge The Triple Doubles Playoffs Quiz

May 08, 2025

Prove Your Nba Knowledge The Triple Doubles Playoffs Quiz

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025 -

Arsenal Vs Psg Champions League Semi Final Preview A Tactical Breakdown

May 08, 2025

Arsenal Vs Psg Champions League Semi Final Preview A Tactical Breakdown

May 08, 2025 -

Kryptos Starring Role A Look At The New Superman Film Footage

May 08, 2025

Kryptos Starring Role A Look At The New Superman Film Footage

May 08, 2025 -

Brezilya Nin Bitcoin Maas Oedemelerine Iliskin Yeni Yasasi

May 08, 2025

Brezilya Nin Bitcoin Maas Oedemelerine Iliskin Yeni Yasasi

May 08, 2025

Latest Posts

-

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025