$174 Billion Lost: How Trump's Tariffs Impacted Top Billionaires

Table of Contents

Sectors Most Affected by Trump's Tariffs

Trump's tariffs impacted various sectors, but some felt the brunt more than others. The resulting economic disruption cascaded through supply chains and significantly impacted the bottom lines of major corporations, ultimately affecting the net worth of many billionaires invested in these companies.

Retail and Consumer Goods

Tariffs on imported goods led to increased prices for consumers, dampening spending and hurting the profitability of retail giants. This created a domino effect, influencing everything from shareholder value to employment levels.

- Examples of specific companies impacted: Walmart, Target, and numerous smaller retailers saw decreased profits and reduced consumer demand.

- Quantification of losses: While precise figures for billionaire losses tied directly to specific tariffs are difficult to isolate, the overall decline in retail sector valuations was substantial.

- Impact on supply chains: Increased costs of goods sold squeezed profit margins and forced retailers to adjust pricing strategies, potentially impacting consumer confidence and overall spending.

Technology and Manufacturing

The technology and manufacturing sectors were significantly disrupted. Tariffs on imported components and finished goods created significant challenges in supply chain management. This led to increased production costs and hampered innovation.

- Examples of specific companies: Apple, Intel, and other tech companies reliant on global supply chains experienced increased production costs due to tariffs on imported components.

- Specific tariffs imposed and their impact: Tariffs on various electronic components and finished goods led to higher prices for consumers and reduced profitability for manufacturers.

- Impact on innovation and competition: The increased costs and uncertainty associated with tariffs hindered investment in research and development, potentially impacting future technological advancements and hindering competition.

Agriculture

Trump's tariffs sparked retaliatory measures from other countries, severely impacting American agricultural exports. This had a devastating effect on farmers and the businesses associated with the agricultural sector.

- Specific examples of agricultural products affected: Soybeans and corn were particularly hard hit, facing significant declines in export demand due to retaliatory tariffs imposed by China and other nations.

- Quantification of export losses: Billions of dollars in agricultural exports were lost, leading to financial hardship for farmers and impacting the wealth of those invested in the sector.

- Long-term effects on American agricultural competitiveness: The trade war damaged the long-term competitiveness of American agriculture in the global market.

Mechanisms of Tariff-Induced Losses for Billionaires

The impact of Trump's tariffs on billionaire wealth wasn't direct; it was felt through various mechanisms, all contributing to a significant overall loss.

Decreased Stock Prices

The uncertainty and negative economic consequences of the tariffs led to decreased stock prices for companies in affected sectors. This directly impacted the net worth of billionaire investors holding significant shares in these companies.

- Examples of specific billionaires: Many billionaires with investments in retail, technology, and agriculture saw their net worth decline as a result of falling stock prices.

- Correlation between tariff implementation and stock market performance: Studies show a negative correlation between the implementation of specific tariffs and the stock performance of companies heavily reliant on international trade.

Reduced Corporate Profits

Tariffs increased production costs, leading to reduced corporate profits for companies owned or heavily invested in by billionaires. This resulted in lower dividends and decreased investor confidence.

- Examples of companies with decreased profits: Numerous companies across affected sectors experienced decreased profits directly attributable to increased costs and reduced demand.

- Impact on dividend payouts and investor confidence: Reduced profitability led to lower dividend payouts, diminishing returns for billionaire investors and further impacting investor confidence.

Supply Chain Disruptions

Trump's tariffs created complexities and inefficiencies in global supply chains, leading to lost revenue and reduced profitability for businesses owned by billionaires. This involved not just financial losses but also damage to reputation and overall company performance.

- Examples of supply chain disruptions: Delays in production, increased logistics costs, and difficulties in sourcing raw materials all contributed to supply chain disruptions, reducing efficiency and profitability.

- Increased logistics costs, delays in production and delivery: The added complexity of navigating tariffs resulted in increased logistical costs, production delays, and disruptions to delivery schedules, reducing efficiency and profits.

The Broader Economic Implications of Trump's Tariffs

The economic impact of Trump's tariffs extended far beyond billionaire wealth. The effects on the overall US economy and global trade relations were profound and long-lasting.

- Impact on the US economy: The tariffs contributed to inflation, job losses in some sectors, and potentially increased trade deficits in others.

- Global implications: Retaliatory measures from other countries damaged international trade relations, creating global economic uncertainty and impacting countries beyond the US.

- Long-term consequences for American businesses and consumers: The long-term consequences include a potentially diminished competitive edge for American businesses in the global market and higher prices for consumers.

Conclusion

Trump's tariffs, intended to bolster American industry, resulted in a substantial financial hit for top billionaires, with estimates reaching $174 billion in losses. This analysis highlights the intricate web of global trade and finance, demonstrating how seemingly targeted policies can have far-reaching and unforeseen consequences. Understanding the mechanisms through which Trump's tariffs impacted billionaire wealth offers crucial insight into the complexities of trade policy and its effects on both individual fortunes and the broader economy. Further research into the long-term effects of these policies is essential to inform future trade negotiations and prevent similar widespread economic disruptions. To further investigate the intricacies of Trump's tariffs and their impact on global wealth distribution, continue exploring reputable sources and economic analysis on the subject of Trump's tariffs and their long-term effects.

Featured Posts

-

Nyt Strands Crossword Puzzle April 12 2025 Theme Clues And Solutions

May 10, 2025

Nyt Strands Crossword Puzzle April 12 2025 Theme Clues And Solutions

May 10, 2025 -

Under 5 Hours The Best Stephen King Show For A Quick Binge

May 10, 2025

Under 5 Hours The Best Stephen King Show For A Quick Binge

May 10, 2025 -

Caravans And Conflict The Uk City Battling Ghetto Perceptions

May 10, 2025

Caravans And Conflict The Uk City Battling Ghetto Perceptions

May 10, 2025 -

Elon Musks Influence Tesla Stock Decline And The Impact On Dogecoin

May 10, 2025

Elon Musks Influence Tesla Stock Decline And The Impact On Dogecoin

May 10, 2025 -

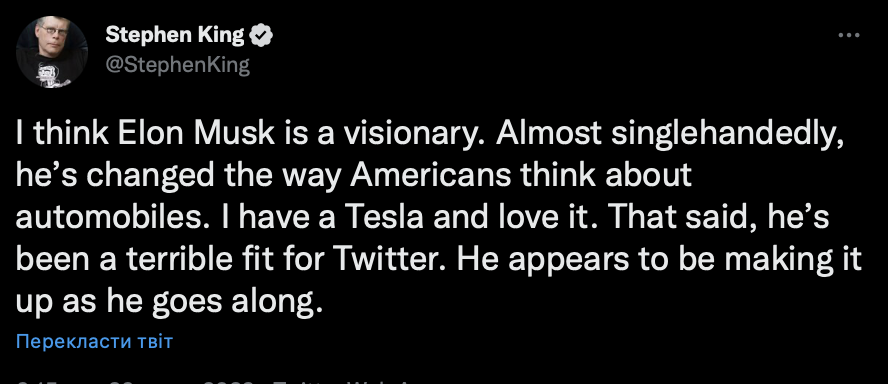

Stiven King Obrushilsya S Kritikoy Na Ilona Maska Na Platforme X

May 10, 2025

Stiven King Obrushilsya S Kritikoy Na Ilona Maska Na Platforme X

May 10, 2025