Elon Musk's Influence: Tesla Stock Decline And The Impact On Dogecoin

Table of Contents

Tesla Stock Decline: Understanding the Factors

The Correlation Between Musk's Actions and Tesla Stock Price

A clear correlation exists between Elon Musk's actions and Tesla's stock price. His tweets, often unpredictable and sometimes controversial, can trigger significant market reactions. For example, his announcement of the Twitter acquisition caused a considerable dip in Tesla's share price, as investors worried about his focus being diverted from the electric vehicle company. Similarly, his public criticism of the Federal Reserve or his involvement in other ventures have, at times, negatively impacted investor sentiment towards Tesla.

- Specific tweets or actions impacting Tesla stock: Musk's sale of Tesla shares, his comments on cryptocurrency, and his pronouncements regarding production targets are all examples of actions that have directly affected Tesla's valuation.

- Market analysis and expert opinions: Numerous financial analysts have commented on the direct impact of Musk's actions on Tesla's stock performance, often highlighting the unpredictable nature of this influence. [Link to relevant financial news article 1] [Link to relevant financial news article 2]

- Recent examples: [Insert specific recent examples of Musk's actions and their immediate impact on Tesla stock prices with links to supporting articles.]

Beyond Musk: Other Factors Affecting Tesla's Stock Performance

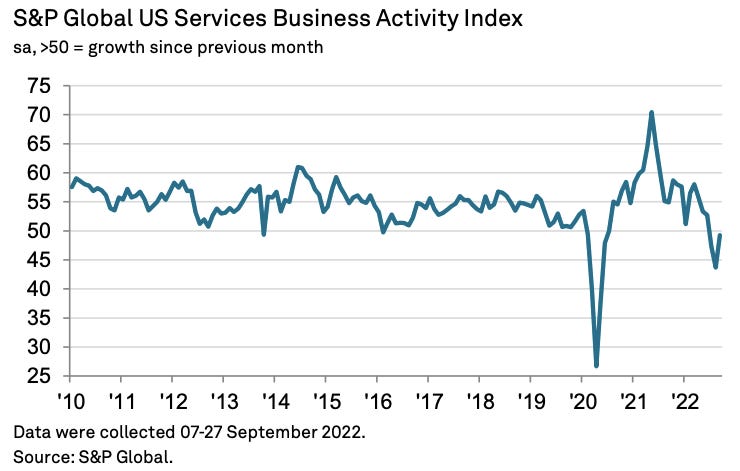

While Elon Musk's influence is undeniable, other factors also affect Tesla's stock performance. These include macroeconomic trends and industry-specific challenges.

- Competition in the EV market: The rise of competitors like Rivian and Lucid Motors, along with established automakers investing heavily in electric vehicles, puts pressure on Tesla's market share and profitability.

- Global economic conditions: Recessions, inflation, and rising interest rates can all negatively impact investor confidence in growth stocks like Tesla.

- Supply chain disruptions: Global supply chain issues, particularly related to semiconductor chips, have affected Tesla's production capacity and profitability.

- Regulatory changes: Government regulations and policies concerning electric vehicles and autonomous driving technology can impact Tesla's operations and future prospects.

Investor Sentiment and Tesla's Future

Investor confidence in Tesla is inextricably linked to Elon Musk's perceived leadership and the company's overall performance. Any negative news related to either can significantly impact the stock price.

- Analyst predictions and ratings: Analyst ratings for Tesla's stock often fluctuate based on various factors, including Musk's actions and the company's financial performance.

- Long-term growth prospects for Tesla: Despite short-term volatility, Tesla maintains significant long-term growth potential in the burgeoning electric vehicle market.

- Risks and challenges facing Tesla: Competition, regulatory hurdles, and production challenges remain significant risks for Tesla's future performance.

Dogecoin's Volatility: A Reflection of Musk's Influence

Musk's "Dogefather" Role and its Impact on Dogecoin's Price

Elon Musk's self-proclaimed title of "Dogefather" aptly describes his impact on Dogecoin's price. His tweets endorsing or mentioning the cryptocurrency have consistently triggered dramatic price swings.

- Examples of Musk's tweets or statements about Dogecoin: [Include specific examples of Musk's tweets and their immediate effect on Dogecoin's price, with links to supporting evidence].

- Price charts illustrating the correlation: [Insert relevant price charts visually demonstrating the correlation between Musk's tweets and Dogecoin's price movements].

- Discussion of the "meme coin" phenomenon: Dogecoin's success exemplifies the "meme coin" phenomenon, where social media trends and influencer endorsements drive market speculation.

The Risks of Cryptocurrency Investment Tied to a Single Influencer

Relying on a single influencer's pronouncements for investment decisions is inherently risky. Dogecoin's volatility demonstrates the dangers of this approach.

- Risks of market manipulation and pump-and-dump schemes: The susceptibility of Dogecoin to market manipulation highlights the risks of investing in cryptocurrencies based on hype rather than fundamental analysis.

- Importance of diversification in cryptocurrency portfolios: Diversifying investments across various cryptocurrencies and asset classes mitigates the risk associated with individual coin volatility.

- Importance of understanding the underlying technology: Investors should thoroughly understand the technology behind cryptocurrencies before making investment decisions.

Dogecoin's Long-Term Prospects and Future Volatility

Dogecoin's long-term prospects remain uncertain. While its community is strong, its future value depends on several factors beyond Elon Musk's influence.

- Adoption by businesses or institutions: Widespread adoption by businesses and institutions could increase Dogecoin's value and stability.

- Technological advancements in the Dogecoin network: Improvements to the Dogecoin network's scalability and transaction speed could enhance its appeal.

- Changes in regulatory landscape: Government regulations concerning cryptocurrencies will play a crucial role in shaping Dogecoin's future.

Conclusion: Navigating the Complex Landscape of Elon Musk's Influence

Elon Musk's actions significantly impact both Tesla's stock price and Dogecoin's volatility. His influence, while powerful, is not the sole determinant of these assets' performance. External factors, including market conditions and industry-specific challenges, also play crucial roles. The key takeaway is that basing investment decisions solely on the pronouncements of a single influential figure is exceptionally risky.

Understanding Elon Musk's influence requires a nuanced approach. Analyzing Tesla stock and Dogecoin necessitates considering multiple factors beyond his tweets and actions. Managing risk in Elon Musk-related investments demands thorough research, diversification, and a realistic assessment of potential outcomes. Before investing in any asset significantly influenced by Elon Musk, conduct independent research and consult with qualified financial advisors.

Featured Posts

-

Bbc Strictly Come Dancing Wynne Evans Statement On Potential Return

May 10, 2025

Bbc Strictly Come Dancing Wynne Evans Statement On Potential Return

May 10, 2025 -

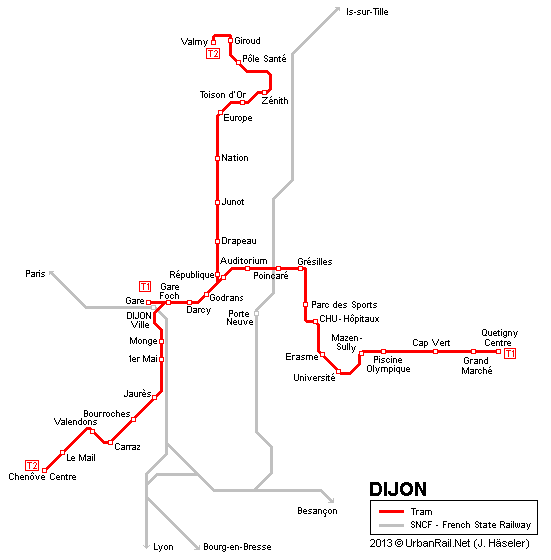

Le Projet De 3e Ligne De Tram A Dijon Concertation Et Decisions Du Conseil Metropolitain

May 10, 2025

Le Projet De 3e Ligne De Tram A Dijon Concertation Et Decisions Du Conseil Metropolitain

May 10, 2025 -

Stock Market Report 500 Point Sensex Gain Niftys Strong Performance

May 10, 2025

Stock Market Report 500 Point Sensex Gain Niftys Strong Performance

May 10, 2025 -

Investigation Into Police Conduct After Nottingham Tragedy

May 10, 2025

Investigation Into Police Conduct After Nottingham Tragedy

May 10, 2025 -

Changes To Uk Visa System Aimed At Reducing Visa Misuse

May 10, 2025

Changes To Uk Visa System Aimed At Reducing Visa Misuse

May 10, 2025