2 Stocks Predicted To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: Datadog – Disrupting Cloud Monitoring with Innovative SaaS Solutions

Datadog is a leading provider of cloud monitoring and analytics software-as-a-service (SaaS). Its platform provides comprehensive visibility into the performance of cloud-based applications and infrastructure, helping businesses optimize their operations and reduce downtime.

Market Opportunity and Growth Potential

The cloud monitoring market is experiencing explosive growth, driven by the increasing adoption of cloud computing and the need for robust performance monitoring solutions. Datadog's market position is incredibly strong.

- Massive Addressable Market: The global cloud monitoring market is projected to reach $XX billion by 2028, representing a significant opportunity for Datadog.

- High Growth Trajectory: Datadog's revenue has been growing at a phenomenal rate, exceeding expectations year after year. This is fueled by increasing demand from both small and large enterprises.

- Expanding Product Portfolio: Datadog continually expands its product offerings, adding new features and capabilities to maintain a competitive edge and attract new customers. This keeps its revenue growth strong and its market share healthy.

Financial Strength and Competitive Advantages

Datadog boasts impressive financial performance, demonstrating strong profitability and robust revenue streams.

- High Revenue Growth: Consistent double-digit revenue growth showcases significant market demand.

- Improving Profit Margins: Datadog’s operational efficiency is improving, increasing profitability.

- Strong Customer Base: A diverse and expanding customer base across various industries demonstrates the broad appeal of its solutions.

- Strategic Acquisitions: Strategic acquisitions expand capabilities and strengthen market position.

Why it Could Surpass Palantir

While Palantir focuses on data analytics for government and enterprise clients, Datadog addresses a broader, faster-growing market in cloud monitoring. Datadog's superior scalability and recurring revenue model positions it for sustained, rapid growth, potentially outpacing Palantir’s trajectory. The company’s focus on innovation and expansion into adjacent markets ensures continuous expansion. This allows it to capture a larger market share and maintain a competitive advantage, making a Palantir comparison favorable for Datadog.

Stock #2: CrowdStrike – Leading the Charge in Cybersecurity with AI-Powered Threat Protection

CrowdStrike is a leading provider of cloud-delivered endpoint protection solutions. Leveraging cutting-edge artificial intelligence (AI), its platform provides comprehensive protection against sophisticated cyber threats.

Market Opportunity and Growth Potential

The cybersecurity market is another rapidly expanding sector, with a pressing need for robust and adaptable threat protection solutions.

- Growing Cyber Threats: The increasing frequency and sophistication of cyberattacks fuel the demand for effective cybersecurity solutions.

- Cloud-Based Security: The shift to cloud computing increases the demand for cloud-based security solutions like CrowdStrike's.

- AI-Powered Advantage: CrowdStrike's AI-driven platform provides a significant competitive advantage, enabling faster threat detection and response.

Financial Strength and Competitive Advantages

CrowdStrike's financial performance mirrors Datadog's impressive growth, pointing to similar potential.

- Strong Revenue Growth: Consistent, high revenue growth highlights strong market adoption and recurring revenue streams.

- Expanding Gross Margins: Increasing gross margins demonstrate efficiency in operations and a strong value proposition.

- Strategic Partnerships: Strategic partnerships enhance reach and market penetration.

Why it Could Surpass Palantir

CrowdStrike operates in a vital and expanding market with a compelling value proposition. Unlike Palantir, CrowdStrike's solution is cloud-based, scalable, and easily integrated into existing IT infrastructures. Its AI-powered threat detection and response capabilities provide a crucial edge in the cybersecurity landscape. This superior performance compared to Palantir, combined with strong financial performance, puts CrowdStrike in a very competitive position.

Conclusion: Investing in the Future: Identifying Stocks to Outperform Palantir

Both Datadog and CrowdStrike represent compelling investment opportunities in high-growth sectors with strong competitive advantages. While Palantir has demonstrated success, the rapid growth and innovative solutions of these two companies suggest a potential to surpass Palantir's market cap in the next three years. However, it is crucial to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions. Investing in the stock market always involves risk, and past performance is not indicative of future results. Start your research on these promising stocks predicted to surpass Palantir’s market cap in the next three years.

Featured Posts

-

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025 -

Dozens Of Cars Broken Into Elizabeth City Apartment Complex Crime Spree

May 09, 2025

Dozens Of Cars Broken Into Elizabeth City Apartment Complex Crime Spree

May 09, 2025 -

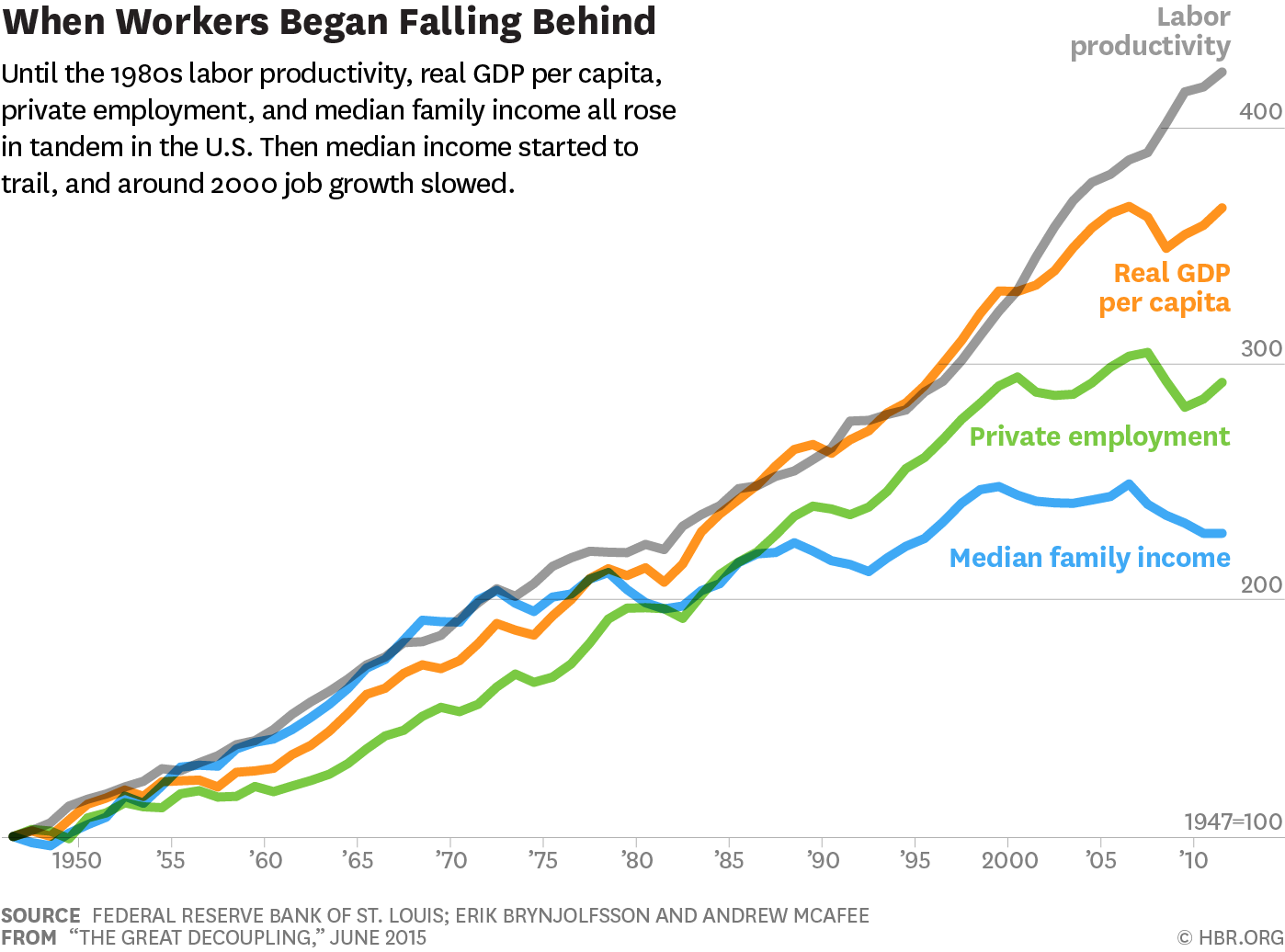

The Great Decoupling Economic Implications And Global Shifts

May 09, 2025

The Great Decoupling Economic Implications And Global Shifts

May 09, 2025 -

Jeanine Pirros Background Exploring Her Education Net Worth And Public Life

May 09, 2025

Jeanine Pirros Background Exploring Her Education Net Worth And Public Life

May 09, 2025 -

The Abrego Garcia Case Examining The Complexities Of Us Asylum Policy

May 09, 2025

The Abrego Garcia Case Examining The Complexities Of Us Asylum Policy

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025 -

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025