The Great Decoupling: Economic Implications And Global Shifts

Table of Contents

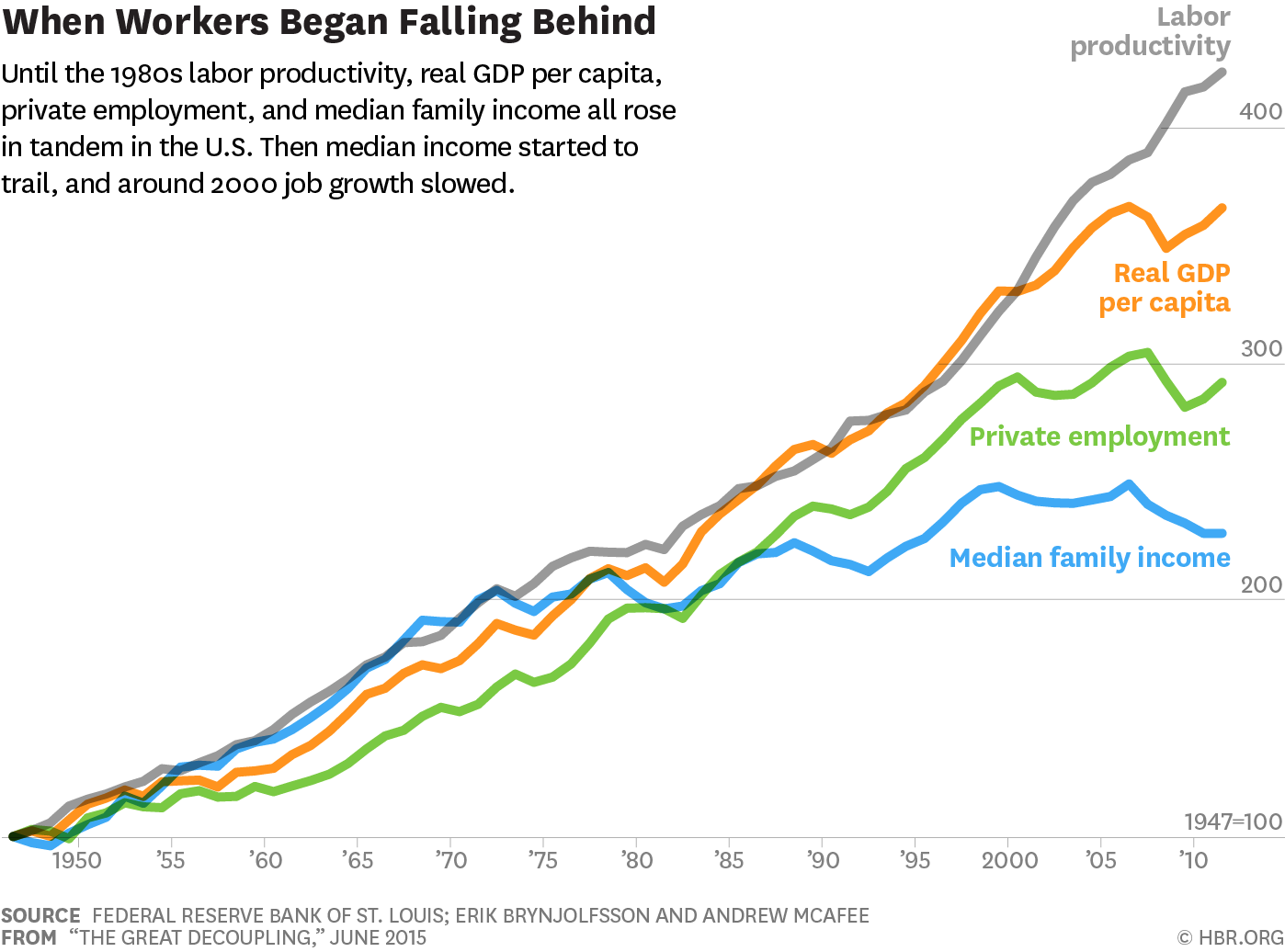

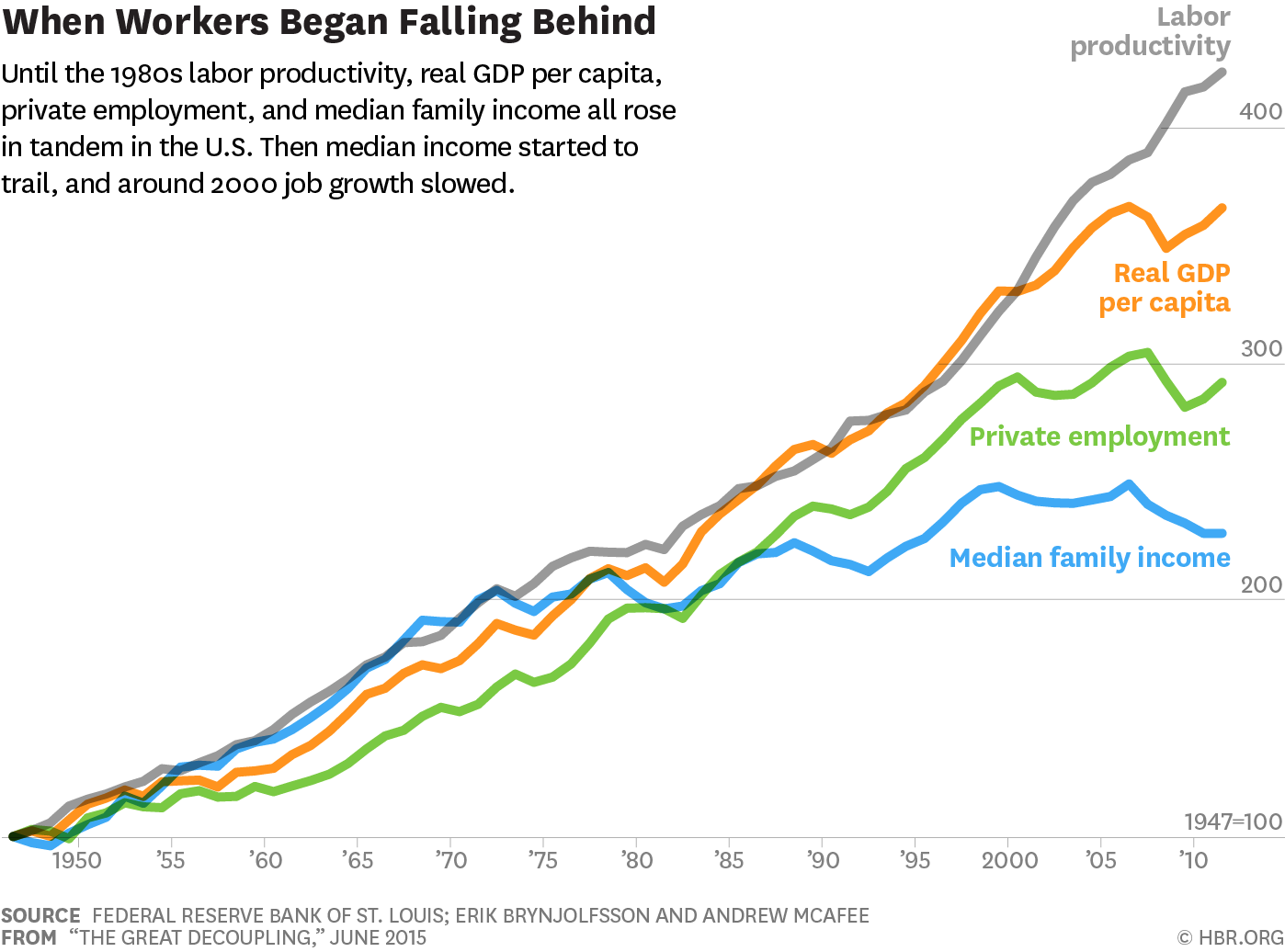

Defining the Great Decoupling

The Great Decoupling refers to the increasing economic separation between the US and China, driven by geopolitical tensions, trade disputes, technological rivalry, and diverging ideological approaches. It signifies a slowdown in globalization, characterized by economic fragmentation and a rise in geopolitical risks. This isn't simply a reduction in trade; it's a fundamental shift away from the highly integrated global supply chains and interconnected economies that characterized the past few decades. This decoupling involves not only reduced trade volumes but also limitations on technology transfer, investment restrictions, and the development of parallel technological and economic systems.

Economic Impacts of Decoupling on the US

Supply Chain Disruptions

The Great Decoupling has severely disrupted US supply chains heavily reliant on Chinese manufacturing. Businesses face increased costs, extended lead times, and the challenge of finding reliable alternative suppliers.

- Affected Industries: The electronics, textiles, and consumer goods industries have been particularly hard hit.

- Increased Costs: Transportation costs have skyrocketed due to longer shipping distances and increased logistical complexity. The search for nearshoring and friend-shoring options adds further expense.

- Challenges in Finding Alternatives: Identifying and vetting new suppliers requires significant time and resources, impacting production schedules and profitability. Building supply chain resilience is a critical priority for US businesses navigating this new environment. Reshoring and friend-shoring, while offering solutions, present their own complexities, including higher labor costs and potential infrastructure limitations.

Inflationary Pressures

Decoupling significantly contributes to inflationary pressures. Reduced competition due to severed supply chains, increased production costs from relocating manufacturing, and the implementation of tariffs and sanctions all push prices higher.

- Impact on Consumer Prices: Consumers face higher prices for a wide range of goods, impacting their purchasing power and overall economic well-being.

- Trade Wars: The risk of further trade wars exacerbates these inflationary pressures, as retaliatory tariffs and sanctions further restrict trade and increase costs.

- The Role of Tariffs and Sanctions: These measures, while intended to protect domestic industries, can inadvertently fuel inflation by reducing supply and increasing prices.

Impact on US-China Trade Relations

Bilateral trade and investment between the US and China are undergoing a dramatic transformation. The once-unfettered flow of goods and capital is now subject to increased scrutiny and restrictions.

- Reduced Trade Volume: Trade volumes between the two countries have declined, signaling a weakening of their economic interdependence.

- Increased Scrutiny of Foreign Investment: Both countries are increasingly scrutinizing foreign investment, limiting opportunities for cross-border capital flows.

- Potential for Further Trade Restrictions: The risk of further trade restrictions and sanctions remains high, potentially further disrupting economic ties. Understanding the implications of a shrinking trade deficit becomes increasingly crucial for policymakers.

Economic Impacts of Decoupling on China

Reduced Access to Western Markets

Decoupling significantly impacts China's access to Western markets. Reduced exports to the US and other Western nations force China to seek diversification.

- Impact on Chinese Industries: Industries heavily reliant on exports to the West are experiencing significant challenges.

- Need for Export Diversification: China is actively pursuing new export markets in Asia, Africa, and Latin America to mitigate the impact of reduced access to Western markets.

- Challenges in Attracting Foreign Investment: The geopolitical tensions and increased uncertainty are making it more challenging for China to attract foreign investment.

Technological Dependence

China's reliance on Western technology poses significant challenges in the context of decoupling. Restrictions on technology transfer necessitate increased investment in domestic research and development.

- Restrictions on Technology Transfer: The flow of advanced technologies from the West to China is becoming increasingly restricted, hampering its technological advancement.

- Increased Investment in Domestic R&D: China is investing heavily in domestic research and development to reduce its dependence on foreign technology.

- Development of Indigenous Technologies: The push for technological self-reliance is driving the development of indigenous technologies in key sectors.

Impact on Chinese Economic Growth

The Great Decoupling is likely to impact China's economic growth rate. While China is focusing on domestic consumption, the overall effect remains complex.

- Potential Slowdown in Growth: The reduced access to Western markets and the challenges in attracting foreign investment could lead to a slowdown in China's economic growth.

- Increased Focus on Domestic Consumption: China is increasingly focusing on stimulating domestic consumption to offset the impact of reduced exports.

- Belt and Road Initiative as a Countermeasure: The Belt and Road Initiative is seen as a strategy to create new economic partnerships and reduce reliance on Western markets.

Global Implications of the Great Decoupling

Geopolitical Fragmentation

The Great Decoupling is leading to geopolitical fragmentation, with the emergence of competing economic and political blocs.

- Formation of Economic Alliances: Countries are forming new economic alliances to reduce their dependence on either the US or China.

- Increased Military Spending: Geopolitical tensions are driving increased military spending globally.

- Potential for Regional Conflicts: The risk of regional conflicts and increased international instability remains a significant concern.

Reshaping of Global Supply Chains

The decoupling process is reshaping global supply chains, leading to increased regionalization and a shift away from globally integrated networks.

- Rise of Regional Trade Agreements: Regional trade agreements are proliferating as countries seek to strengthen economic ties within their respective regions.

- Increased Regionalization of Manufacturing: Companies are increasingly relocating manufacturing closer to their key markets to reduce supply chain risks.

- The Role of Automation: Automation is playing an increasingly important role in mitigating the challenges of regionalized supply chains.

Conclusion: Understanding and Navigating the Great Decoupling

The Great Decoupling is a complex and multifaceted phenomenon with profound economic implications and global shifts. Its impact on both the US and China, as well as the broader global economy, is undeniable. Understanding the dynamics of this decoupling is crucial for businesses, policymakers, and individuals alike. Supply chain resilience, inflationary pressures, and geopolitical risks are key elements to consider. The reshaping of global supply chains and the rise of regional trade agreements signal a profound change in the global economic order.

Stay ahead of the curve by following the latest developments in the Great Decoupling and understanding its impact on global markets. The future of the global economy hinges on navigating this complex transition effectively.

Featured Posts

-

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025 -

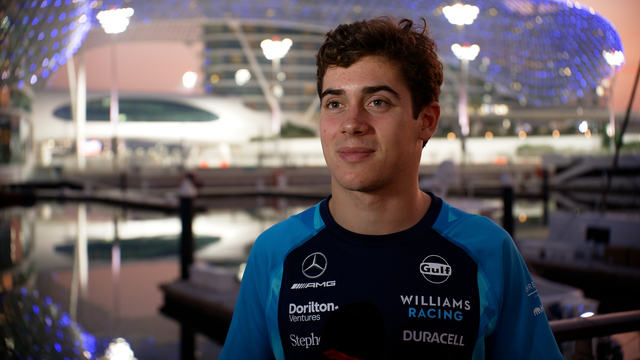

Formula 1s Next Star Colapinto Emerges As Strong Contender

May 09, 2025

Formula 1s Next Star Colapinto Emerges As Strong Contender

May 09, 2025 -

Kaitlin Olson And The High Potential Repeats On Abc In March 2025

May 09, 2025

Kaitlin Olson And The High Potential Repeats On Abc In March 2025

May 09, 2025 -

X Blocks Jailed Turkish Mayors Social Media Opposition Backlash

May 09, 2025

X Blocks Jailed Turkish Mayors Social Media Opposition Backlash

May 09, 2025 -

So Very Fragile A Parenting Expert Explains The Risks Of Early Daycare

May 09, 2025

So Very Fragile A Parenting Expert Explains The Risks Of Early Daycare

May 09, 2025

Latest Posts

-

High Potential Episode 13 The Significance Of Davids Actor

May 09, 2025

High Potential Episode 13 The Significance Of Davids Actor

May 09, 2025 -

He Morgan Brother Deciphering Davids Identity In High Potential 5 Leading Theories

May 09, 2025

He Morgan Brother Deciphering Davids Identity In High Potential 5 Leading Theories

May 09, 2025 -

Public Reaction To Pam Bondis Statements On Killing American Citizens

May 09, 2025

Public Reaction To Pam Bondis Statements On Killing American Citizens

May 09, 2025 -

David In High Potential Episode 13 Casting And Character Analysis

May 09, 2025

David In High Potential Episode 13 Casting And Character Analysis

May 09, 2025 -

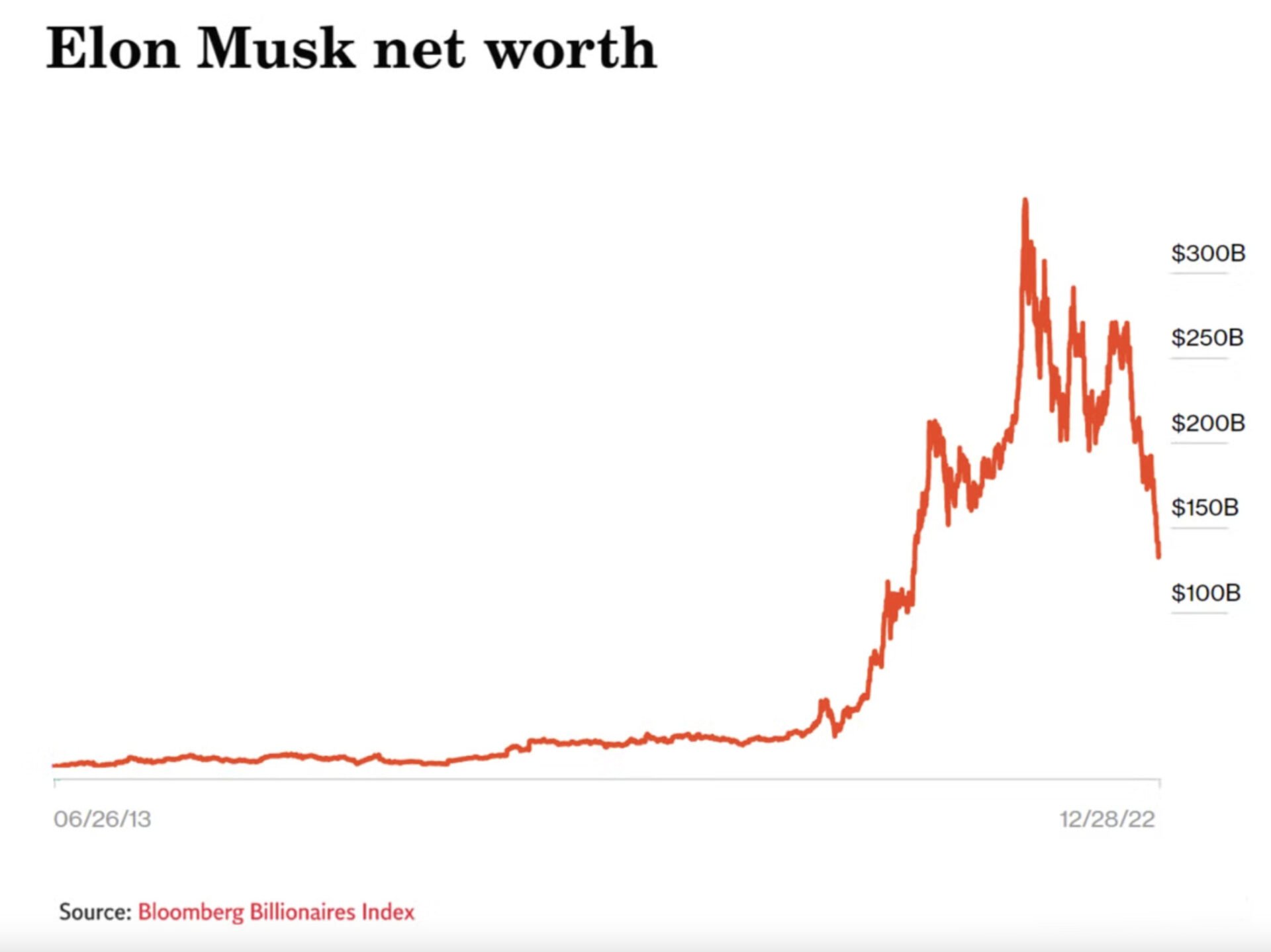

Market Downturn Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025

Market Downturn Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025