$417.5 Million Stalking Horse Bid: Village Roadshow's Sale To Alcon Complete

Table of Contents

Understanding the $417.5 Million Stalking Horse Bid

A stalking horse bid, in essence, is an initial bid in an auction or sale process, typically used in bankruptcy or distressed asset sales. It acts as an anchor, setting a minimum price and providing a framework for subsequent bidding. In the Village Roadshow sale, Alcon Entertainment’s $417.5 million offer served precisely this purpose.

- Definition of a stalking horse bid: A stalking horse bid is a pre-arranged offer made by a bidder to initiate a competitive bidding process for a distressed asset. It provides a baseline valuation and encourages other potential buyers to participate.

- Advantages of using a stalking horse bid: It reduces uncertainty, attracts more bidders, and ultimately helps to maximize the sale price. It also provides a degree of certainty for the seller, particularly in situations with financial distress.

- How the $417.5 million bid set the floor: Alcon's bid established a minimum acceptable price, ensuring that any competing offers would need to exceed this substantial amount. This minimized the risk of the sale failing to achieve a satisfactory price for Village Roadshow's assets.

- Legal complexities: Negotiating and structuring a stalking horse bid involves complex legal considerations, including the terms of the agreement, the protection afforded to the stalking horse bidder, and the management of competing bids.

Village Roadshow's Financial Situation Leading to the Sale

Village Roadshow's journey to this sale was paved with financial challenges. The company, a major player in film production and distribution, faced mounting debts and struggled with the changing dynamics of the entertainment industry.

- Recent financial performance: Village Roadshow experienced declining revenues and profitability in recent years, partly due to the changing landscape of film distribution and exhibition.

- Debts and liabilities: The company carried significant debt obligations, impacting its financial flexibility and operational efficiency.

- Impact of the pandemic: The COVID-19 pandemic significantly exacerbated the company’s financial difficulties, with cinema closures and production delays creating substantial revenue losses.

- Restructuring efforts: Prior to the sale, Village Roadshow may have undertaken various restructuring attempts, including cost-cutting measures and asset sales, to improve its financial position.

Alcon Entertainment: The Acquiring Company and its Future Plans

Alcon Entertainment, known for its successful films such as "Blade Runner 2049" and "The Blind Side," emerged as the winning bidder. Their acquisition of Village Roadshow signifies a strategic move to expand their portfolio and consolidate their position in the industry.

- Profile of Alcon Entertainment: Alcon Entertainment is a well-established film production and distribution company with a history of producing critically acclaimed and commercially successful films.

- Alcon's track record: Alcon has a proven track record in developing, producing, and distributing high-quality films across various genres.

- Potential synergies: The acquisition may allow for synergies in film production, distribution, and marketing, potentially leading to increased efficiency and profitability.

- Alcon’s intentions: Alcon's future plans for Village Roadshow’s operations likely include integrating its assets into their existing structure and leveraging its existing distribution network for greater market reach.

Implications of the Village Roadshow Sale on the Entertainment Industry

The Village Roadshow sale has significant implications for the broader entertainment industry, particularly concerning market consolidation and future film production.

- Effects on film distribution and exhibition: The acquisition may alter the landscape of film distribution and exhibition, leading to potential changes in how films reach audiences.

- Competitive landscape changes: This acquisition represents a significant shift in the competitive landscape, with larger companies consolidating their power and potentially influencing the types of films that get made.

- Long-term consequences: The long-term effects might include changes in film production, content creation, and the overall diversity of films available to consumers.

- Regulatory scrutiny: The deal may face regulatory scrutiny or antitrust concerns depending on the specific details and potential impact on market competition.

Conclusion

The successful completion of the Village Roadshow sale to Alcon Entertainment for $417.5 million, facilitated by a strategically deployed stalking horse bid, marks a defining moment in the entertainment industry. The acquisition has significant implications for both companies and the broader competitive landscape. Alcon's acquisition of Village Roadshow’s substantial asset portfolio undoubtedly reshapes the industry’s competitive dynamics.

Stay updated on the latest developments in the Village Roadshow sale and other significant entertainment industry acquisitions. Learn more about the impact of stalking horse bids in corporate restructuring and their role in navigating complex financial situations within the entertainment sector.

Featured Posts

-

White House Announces Decline In Canada U S Border Apprehensions

Apr 24, 2025

White House Announces Decline In Canada U S Border Apprehensions

Apr 24, 2025 -

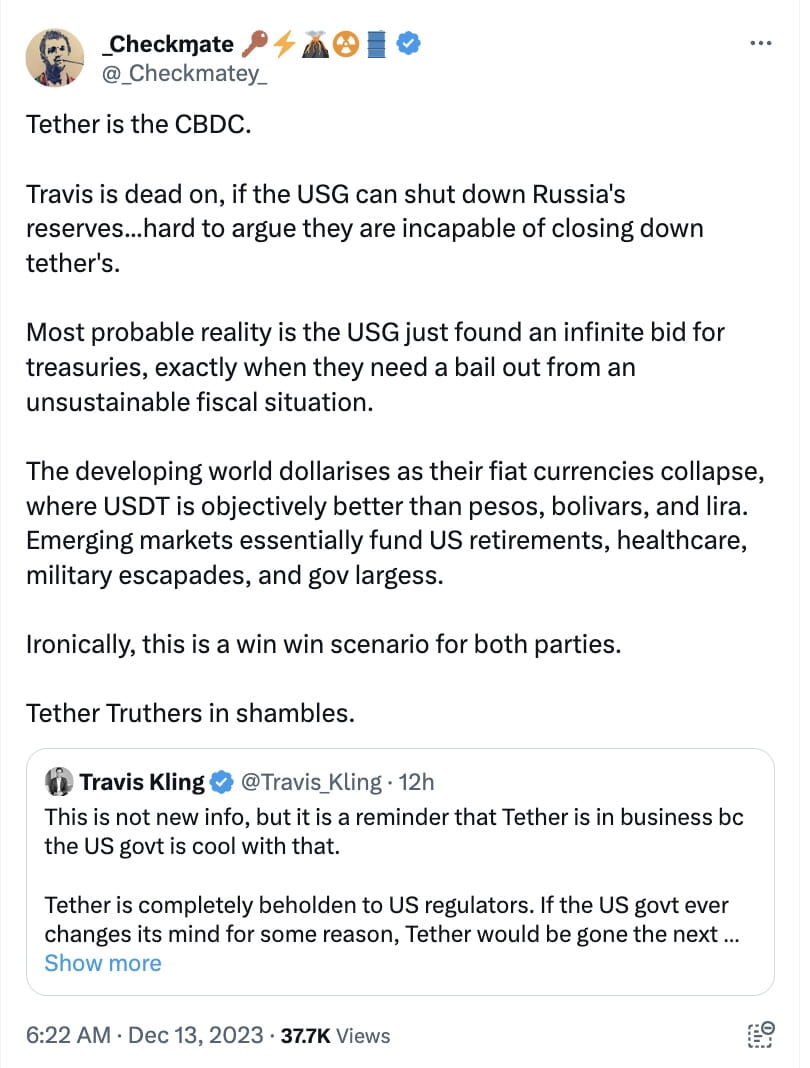

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025 -

Access To Birth Control The Impact Of Over The Counter Options In A Post Roe World

Apr 24, 2025

Access To Birth Control The Impact Of Over The Counter Options In A Post Roe World

Apr 24, 2025 -

Kci Johna Travolte Nevjerojatna Transformacija

Apr 24, 2025

Kci Johna Travolte Nevjerojatna Transformacija

Apr 24, 2025