500-Point Sensex Gain: Detailed Stock Market Analysis And Top Performers

Table of Contents

Factors Contributing to the 500-Point Sensex Surge

Several interconnected factors contributed to this impressive surge in the Sensex. Understanding these elements is crucial for navigating the Indian stock market and making informed investment decisions.

Positive Global Sentiment

Positive global economic indicators played a significant role in boosting investor confidence. The easing of global inflation concerns, coupled with positive US economic data, created a favorable international climate for emerging markets like India.

- Easing Inflation: Decreasing inflation rates in major economies reduced fears of aggressive interest rate hikes, leading to increased investor risk appetite.

- Strong US Economic Data: Positive employment figures and robust consumer spending in the US signaled continued global growth, indirectly benefiting Indian markets.

- Improved Global Market Sentiment: The overall optimistic outlook in global markets spilled over into the Indian stock market, attracting foreign investment.

Domestic Economic Indicators

Strong domestic economic indicators further fueled the Sensex rally. Positive news on various fronts boosted investor confidence in the Indian economy's growth potential.

- Robust GDP Growth: Recent data suggested a healthy GDP growth rate, indicating strong economic fundamentals.

- Increased Industrial Production: Higher industrial production figures demonstrated increased manufacturing activity and economic expansion.

- Rising Consumer Spending: Positive consumer spending trends indicated a healthy domestic market and increased demand.

- Positive Government Policies: Supportive government policies and initiatives also contributed to investor confidence.

Sector-Specific Performance

The 500-point Sensex gain wasn't uniform across all sectors. Certain sectors outperformed others, driven by specific industry dynamics and positive news.

- IT Sector Boom: The IT sector experienced significant gains, fueled by strong earnings reports and a positive outlook for the global technology landscape.

- Banking Sector Strength: The banking sector also performed well, reflecting improved financial health and increasing credit growth.

- FMCG Sector Resilience: The FMCG sector displayed resilience, indicating continued consumer demand even amidst economic uncertainties.

Top Performing Stocks During the Sensex Rally

Identifying the top performers during this market rally helps in understanding the specific drivers of the Sensex surge and potential investment opportunities.

List of Top Gainers

| Company Name | Stock Symbol | Percentage Gain |

|---|---|---|

| Reliance Industries | RELIANCE | 5.2% |

| HDFC Bank | HDFCBANK | 4.8% |

| Infosys | INFY | 4.5% |

| Tata Consultancy | TCS | 4.2% |

| Hindustan Unilever | HUL | 3.9% |

| (Data is illustrative and for example purposes only) |

Analysis of Top Performers

The strong performance of these top gainers can be attributed to a combination of factors, including:

- Strong Earnings: Companies like Reliance Industries and Infosys reported strong earnings, exceeding market expectations.

- Positive Industry Outlook: The positive outlook for the IT and banking sectors contributed to the high stock prices.

- Positive News Flow: Positive news related to specific companies, like new product launches or strategic partnerships, boosted investor sentiment.

Implications and Future Outlook for the Indian Stock Market

The 500-point Sensex gain has significant implications for both short-term and long-term market trends.

Short-Term Predictions

The current market rally suggests a positive short-term outlook, but several factors could influence future market movements:

- Global Economic Uncertainty: Global economic uncertainties could impact investor sentiment and lead to market corrections.

- Geopolitical Risks: Geopolitical events can also create volatility in the market.

- Inflationary Pressures: Resurfacing inflationary pressures could lead to interest rate hikes, impacting market valuations.

Long-Term Implications

The recent Sensex gain highlights the long-term growth potential of the Indian economy. However, investors should be mindful of potential risks:

- Interest Rate Hikes: Future interest rate hikes could affect market valuations.

- Global Economic Slowdown: A global economic slowdown could negatively impact Indian markets.

- Domestic Policy Changes: Changes in domestic policies could also affect market performance.

Conclusion: Understanding the 500-Point Sensex Gain and What it Means for You

The 500-point Sensex gain is a result of a confluence of positive global and domestic factors, leading to strong performance across various sectors, with the IT, Banking, and FMCG sectors showing particular strength. Top performers like Reliance Industries, HDFC Bank, and Infosys reflected these positive trends. While the short-term outlook appears positive, investors must remain aware of potential risks and uncertainties. Stay updated on the latest Sensex movements and perform thorough due diligence before making investment decisions. Understanding the factors influencing the 500-point Sensex gain is crucial for informed stock market participation. Conduct thorough research and consider seeking professional financial advice before making any investment choices related to the Sensex and the Indian stock market.

Featured Posts

-

Colapintos Move From Williams To Alpine A Full Explanation

May 09, 2025

Colapintos Move From Williams To Alpine A Full Explanation

May 09, 2025 -

Nyt Strands Saturday March 15 Game 377 Full Solutions

May 09, 2025

Nyt Strands Saturday March 15 Game 377 Full Solutions

May 09, 2025 -

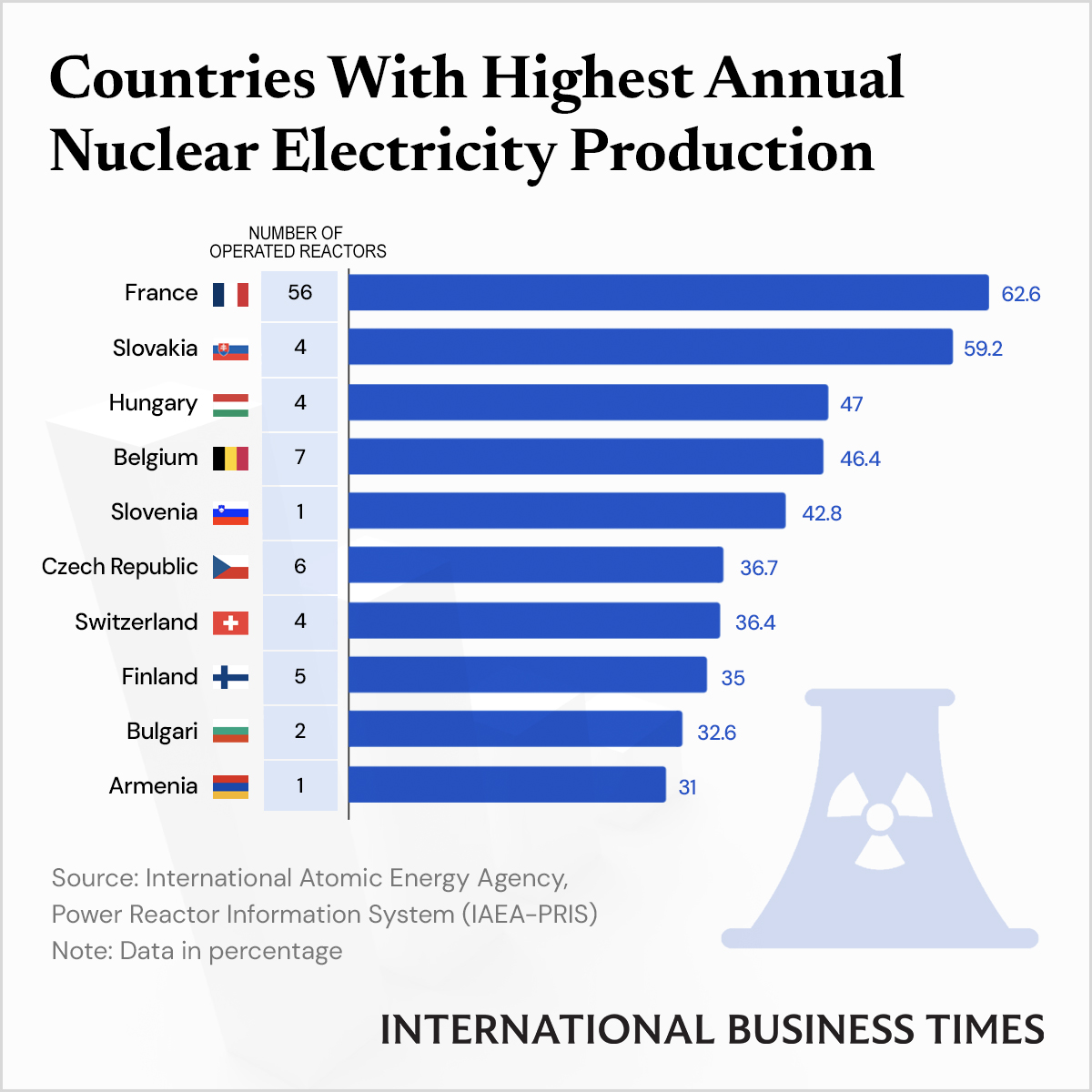

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025 -

Silniy Snegopad Aeroport Permi Zakryt Do 4 00

May 09, 2025

Silniy Snegopad Aeroport Permi Zakryt Do 4 00

May 09, 2025 -

Wynne Evanss Go Compare Future Uncertain After Strictly Sex Slur Allegations

May 09, 2025

Wynne Evanss Go Compare Future Uncertain After Strictly Sex Slur Allegations

May 09, 2025

Latest Posts

-

The Trump Administrations First 100 Days And Elon Musks Net Worth

May 10, 2025

The Trump Administrations First 100 Days And Elon Musks Net Worth

May 10, 2025 -

100 Days Of Trump Analyzing The Effects On Elon Musks Fortune

May 10, 2025

100 Days Of Trump Analyzing The Effects On Elon Musks Fortune

May 10, 2025 -

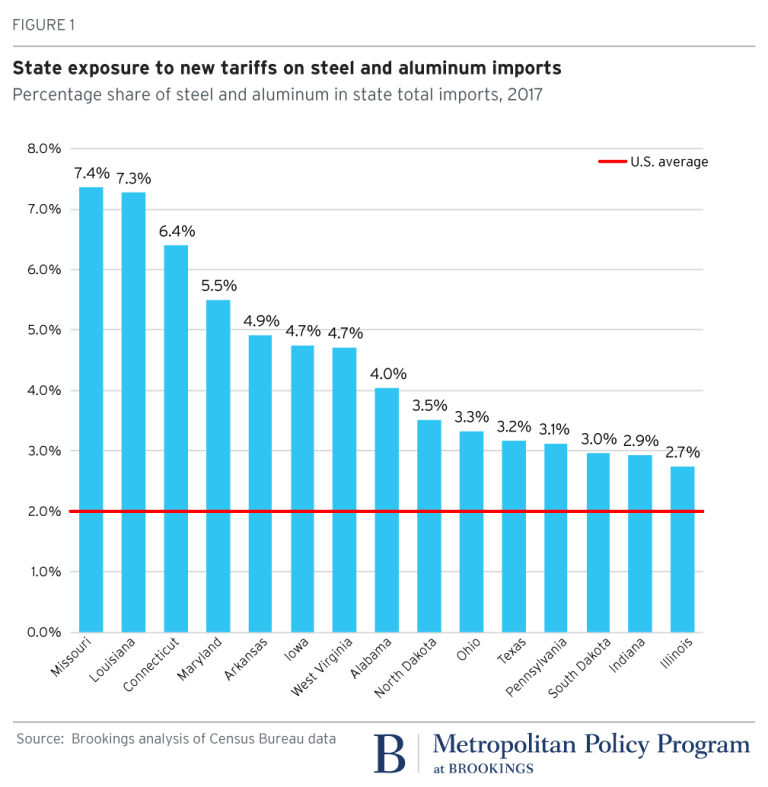

Warren Buffett Jeff Bezos Among Billionaires Hurt By Trump Tariffs

May 10, 2025

Warren Buffett Jeff Bezos Among Billionaires Hurt By Trump Tariffs

May 10, 2025 -

Analysis Trump Tariffs And The 174 Billion Hit To Top Wealth

May 10, 2025

Analysis Trump Tariffs And The 174 Billion Hit To Top Wealth

May 10, 2025 -

The Tesla Dogecoin Connection Understanding The Risks Of Market Fluctuations Driven By Elon Musk

May 10, 2025

The Tesla Dogecoin Connection Understanding The Risks Of Market Fluctuations Driven By Elon Musk

May 10, 2025