Analysis: Trump Tariffs And The $174 Billion Hit To Top Wealth

Table of Contents

What were the Trump Tariffs? The Trump administration implemented a series of tariffs, primarily on goods imported from China, aiming to protect American industries from foreign competition and reduce the trade deficit. These tariffs, ranging from a few percent to as high as 25%, added significant costs to imported goods.

This article aims to analyze the impact of these tariffs on high-net-worth individuals and the broader economy, exploring both the immediate financial consequences and the lingering effects on various sectors and economic classes.

The Mechanism of Tariff Impact on High-Net-Worth Individuals

Tariffs function as taxes on imported goods. When tariffs are imposed, the price of imported goods increases, impacting businesses involved in importing and exporting. For high-net-worth individuals, the effects are multifaceted:

- Impact on Import/Export Businesses: Many high-net-worth individuals own stakes in businesses heavily reliant on international trade. Tariffs increased their operational costs, reducing profitability and impacting their overall investment returns.

- Impact on Investment Portfolios: High-net-worth individuals often hold globally diversified investment portfolios including stocks, bonds, and other assets. Tariffs negatively impacted the value of companies involved in international trade, leading to losses in their investment portfolios.

- Specific Industries Impacted:

- Manufacturing: Companies heavily reliant on imported components saw increased production costs, reducing competitiveness and profits.

- Technology: The tech sector, dependent on global supply chains for components and manufacturing, faced significant disruptions and increased costs.

- Finance: Financial institutions experienced reduced investment returns due to the negative impact on global markets and the increased volatility caused by trade uncertainty.

- Supply Chain Disruptions: Tariffs caused widespread supply chain disruptions, leading to delays, increased costs, and shortages, negatively affecting businesses owned by high-net-worth individuals.

Sectors Most Affected by the Trump Tariffs

Certain sectors were disproportionately affected by the Trump tariffs:

- Agriculture: Farmers experienced significant losses due to retaliatory tariffs imposed by other countries on US agricultural exports.

- Real Estate: The real estate market felt the impact through decreased demand for commercial properties and increased construction costs due to tariffs on imported materials.

- International Trade: Businesses involved in international trade faced substantial challenges due to increased costs, reduced competitiveness, and supply chain disruptions.

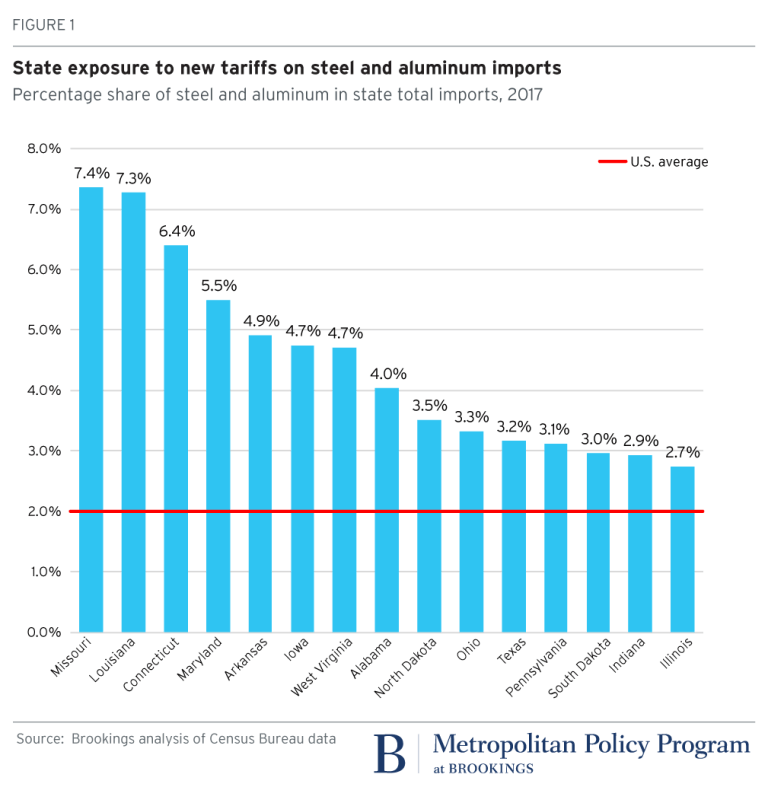

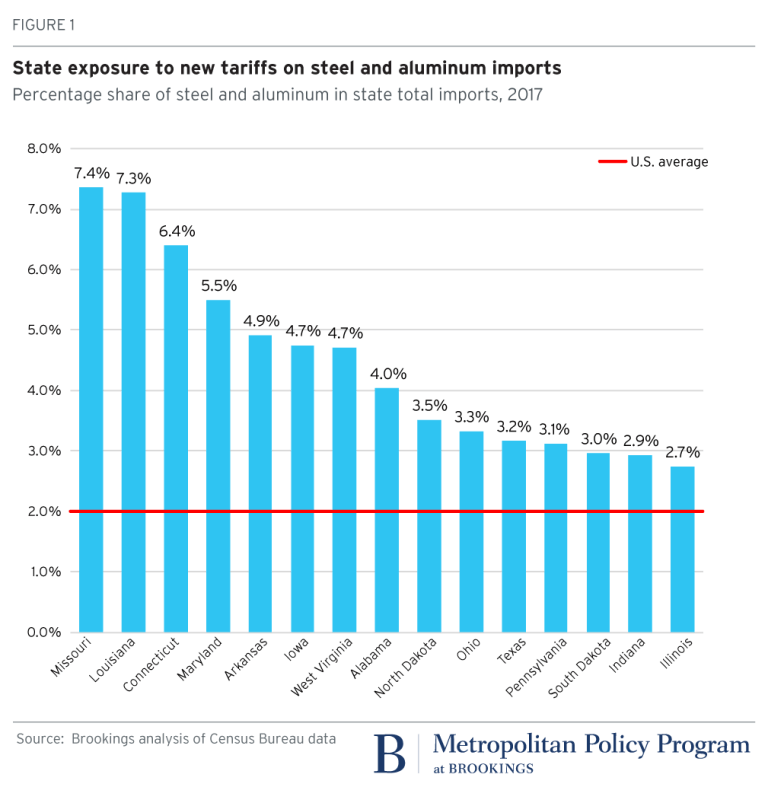

Data and Statistics: (Note: This section would ideally include charts and graphs illustrating the financial losses in each sector. Data sources like the Congressional Budget Office, Bureau of Economic Analysis, and academic studies should be cited). For example, one could show a decline in agricultural exports correlated with the imposition of specific tariffs.

- Financial Losses: The precise financial losses varied across sectors but contributed to the overall $174 billion loss impacting high-net-worth individuals. Specific data illustrating these losses should be included here with proper sourcing.

- Ripple Effect: The negative impact on these key sectors created a ripple effect, impacting related industries and the wider economy, leading to job losses and reduced economic growth.

The Distributional Effects: Who Bore the Brunt?

The economic burden of the Trump tariffs wasn't evenly distributed. While high-net-worth individuals suffered significant financial losses, the impact on middle- and lower-income groups was also considerable.

- Unequal Distribution: High-net-worth individuals, while impacted significantly, often have the resources to mitigate losses through diversification and financial strategies. Lower-income groups, however, faced increased prices for consumer goods without the means to offset these costs.

- Mitigating Factors: Some industries received government support, but this was often insufficient to fully offset the negative impacts of the tariffs.

- Disproportionate Effect: The tariffs disproportionately affected workers in specific sectors, leading to job losses and economic hardship, particularly affecting blue-collar workers and those in import-reliant industries.

Long-Term Economic Consequences of the Trump Tariffs

The long-term consequences of the Trump tariffs are still unfolding:

- Lingering Effects: The tariffs contributed to increased trade tensions and uncertainty, negatively impacting global trade and economic growth.

- Inflation and Consumer Prices: Tariffs contributed to higher prices for consumer goods, impacting household budgets and contributing to inflation.

- International Relations: The tariffs strained international relations and damaged relationships with key trading partners.

- Predicted Long-Term Impacts: These could include reduced global trade, slower economic growth, increased protectionism, and lasting damage to international cooperation. (Specific predictions from economic models should be cited here).

Understanding the Long Shadow of Trump Tariffs on Top Wealth

In summary, the Trump tariffs resulted in a substantial $174 billion loss impacting the wealth of America's wealthiest individuals. The sectors most affected were agriculture, real estate, and international trade, while the distributional effects were highly unequal. The long-term consequences include lingering economic uncertainty, increased inflation, and strained international relations. This analysis underscores the complex and far-reaching impacts of trade policy decisions, highlighting the unintended consequences that can arise from seemingly targeted economic strategies.

Continue your exploration into the complexities of Trump's tariffs and their lasting impact on the economy by researching further studies on the subject. Understanding the full ramifications of these trade policies is crucial for informing future economic decisions and ensuring a more equitable distribution of economic burdens.

Featured Posts

-

Abrz Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn Drast Fy Tathyr Altdkhyn Ela Aladae

May 10, 2025

Abrz Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn Drast Fy Tathyr Altdkhyn Ela Aladae

May 10, 2025 -

Tesla Stock Decline And Tariffs Contribute To Elon Musks Reduced Net Worth

May 10, 2025

Tesla Stock Decline And Tariffs Contribute To Elon Musks Reduced Net Worth

May 10, 2025 -

Trumps Transgender Military Ban Fact Vs Fiction

May 10, 2025

Trumps Transgender Military Ban Fact Vs Fiction

May 10, 2025 -

Discovering Untapped Potential The Countrys New Business Hot Spots

May 10, 2025

Discovering Untapped Potential The Countrys New Business Hot Spots

May 10, 2025 -

Kreischers Netflix Comedy How His Wife Feels About His Adult Jokes

May 10, 2025

Kreischers Netflix Comedy How His Wife Feels About His Adult Jokes

May 10, 2025