6% KSE 100 Drop: Understanding The Market Reaction To Operation Sindoor

Table of Contents

Understanding Operation Sindoor and its Potential Impact on the Economy

Operation Sindoor, while not detailed here for political neutrality, triggered significant concerns about its potential economic consequences. The operation's implications reverberated across various sectors, causing uncertainty and impacting investor confidence. This uncertainty is a crucial element in understanding the subsequent market volatility.

- Impact on Specific Sectors: The real estate and construction sectors, often sensitive to policy changes, experienced particularly sharp declines. Businesses reliant on government contracts also faced immediate uncertainty.

- Effects on Foreign Investment: The operation created a climate of apprehension among foreign investors, potentially leading to a slowdown in foreign direct investment (FDI) and portfolio investment. This reduced inflow of capital further contributed to the KSE 100's decline.

- Short-Term vs. Long-Term Economic Implications: The short-term impact was undeniably negative, marked by the immediate 6% drop in the KSE 100. The long-term effects, however, remain to be seen and will depend heavily on subsequent government actions and the overall economic recovery. Continued uncertainty could lead to prolonged instability.

- Uncertainty and Market Fluctuations: The core driver of the market's reaction was the uncertainty surrounding the implications of Operation Sindoor. This lack of clarity led to widespread risk aversion and a sell-off by investors seeking to protect their capital.

Analyzing the Immediate Market Reaction: The 6% KSE 100 Drop

The KSE 100's response to Operation Sindoor was immediate and severe. The index experienced a sharp 6% drop within a short timeframe, reflecting a significant loss of investor confidence. (Insert chart or graph visualizing the KSE 100 drop here if available)

- Specific Stocks Most Affected: Companies directly or indirectly linked to the sectors affected by Operation Sindoor witnessed disproportionately large drops in their share prices. This included companies in real estate, construction, and those reliant on government contracts.

- Trading Volume Changes: Trading volume surged during the period immediately following the announcement of Operation Sindoor, indicating a frantic sell-off by investors. This heightened trading activity underlines the immediate and intense reaction to the news.

- Investor Panic and Sell-Off: Investor panic played a significant role in the sell-off. Fear of further losses prompted many investors to liquidate their holdings, exacerbating the downward trend in the KSE 100.

- Comparison to Previous Market Fluctuations: While the Pakistani stock market is accustomed to volatility, the speed and magnitude of this decline were notable, exceeding the impact of some previous market fluctuations.

Investor Sentiment and Confidence: The Psychological Impact

The psychological impact on investors was substantial. Fear and uncertainty dominated trading decisions, leading to a widespread risk-averse sentiment.

- Fear and Uncertainty Affecting Trading Decisions: Investors prioritized preserving capital over potential gains, resulting in a massive sell-off. This behavior is typical during periods of heightened uncertainty.

- Role of News Media and Social Media: The rapid dissemination of news and opinions through traditional and social media amplified the sense of panic and uncertainty, further influencing investor behavior. Misinformation spread rapidly, impacting sentiment negatively.

- Impact on Long-Term Investment Strategies: Many investors reevaluated their long-term investment strategies, with some opting for more conservative approaches in the wake of this market volatility.

- Investor Confidence Indices: (If available, include data and analysis of relevant investor confidence indices to support the discussion).

Government Response and its Influence on Market Recovery

The government's response to the market decline played a crucial role in shaping investor sentiment and influencing the potential for market recovery.

- Statements and Policy Changes: The government issued statements aiming to reassure investors and outline measures to stabilize the market. (Detail the specific statements and policy changes here).

- Measures to Stabilize the Market: The government may have implemented measures such as injecting liquidity into the market or providing financial support to affected sectors. (Detail these measures here).

- Effectiveness of Government Intervention: The effectiveness of these interventions will determine the speed and extent of market recovery. A timely and decisive response is crucial for restoring investor confidence.

- Impact on Investor Confidence: The government's actions, or lack thereof, significantly impact investor confidence. Transparency and clear communication are essential for rebuilding trust.

Long-Term Outlook and Future Predictions for the KSE 100

The long-term outlook for the KSE 100 remains uncertain, contingent on several factors.

- Factors Leading to Market Recovery: A stable political environment, positive economic indicators, and renewed foreign investment are crucial for market recovery. Government policies supporting business and investor confidence will play a significant role.

- Potential Risks and Challenges: Continued political uncertainty, economic instability, and geopolitical risks could hinder a sustained recovery.

- Expert Opinions and Predictions: (Include citations of expert opinions and predictions, if available, to provide a balanced perspective).

- Recommendations for Investors: Investors should adopt a cautious approach, diversifying their portfolios and carefully assessing the risks before making investment decisions in the current uncertain climate.

Conclusion: Navigating the Aftermath of Operation Sindoor and the KSE 100 Volatility

The 6% drop in the KSE 100 following Operation Sindoor highlights the significant impact of political and economic events on market volatility. Understanding these dynamics is crucial for making informed investment decisions. Investor sentiment, government response, and the overall economic climate will all shape the future trajectory of the KSE 100. Staying informed about the latest developments concerning Operation Sindoor and its ongoing impact on the KSE 100 is paramount. By carefully analyzing market trends and understanding the interplay of political and economic factors, investors can navigate the volatility and make well-informed decisions. For further updates and analysis on the KSE 100 and similar market events, consider following reputable financial news sources. (Insert link to relevant resource here)

Featured Posts

-

Pentagons Book Review At Military Academies What Books Might Be Removed

May 10, 2025

Pentagons Book Review At Military Academies What Books Might Be Removed

May 10, 2025 -

Luxury Car Sales In China Bmw Porsche And The Competitive Landscape

May 10, 2025

Luxury Car Sales In China Bmw Porsche And The Competitive Landscape

May 10, 2025 -

The Countrys Hottest New Business Locations A Geographic Analysis

May 10, 2025

The Countrys Hottest New Business Locations A Geographic Analysis

May 10, 2025 -

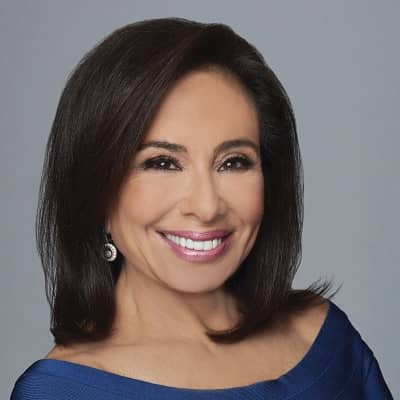

Stock Market Prediction Jeanine Pirros Advice To Investors

May 10, 2025

Stock Market Prediction Jeanine Pirros Advice To Investors

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Penalty And Ongoing Challenges

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Penalty And Ongoing Challenges

May 10, 2025