65 Hudson's Bay Leases Attract Significant Buyer Interest

Table of Contents

Strategic Location and Prime Retail Space

These 65 Hudson's Bay leases represent a unique opportunity to acquire prime retail space in high-demand locations across Canada. The strategic placement of these properties is a key factor driving buyer interest.

High-traffic Areas and Footfall

A significant draw for potential buyers is the location of these leases. They are strategically situated in areas with high foot traffic and strong consumer activity.

- Many locations are situated in major city centers and shopping malls. This ensures high visibility and accessibility for potential customers, maximizing the potential for retail success.

- Strong demographics and consumer spending power in surrounding areas. These properties are not just in high-traffic areas; they are in areas with significant purchasing power, ensuring a strong customer base.

- Proximity to public transportation increases accessibility for shoppers. Easy access via public transit further enhances the appeal of these locations for both retailers and consumers. This ensures maximum convenience and reach for businesses operating from these spaces.

Desirable Lease Terms and Conditions

Beyond location, the terms and conditions of these Hudson's Bay leases are also incredibly attractive to buyers.

- Competitive rental rates compared to similar properties in the market. The rental rates offered are designed to be competitive, making these leases particularly attractive investment opportunities.

- Flexible lease agreements catering to diverse business needs. The flexibility built into these lease agreements allows for a wider range of retail businesses to operate successfully from these locations. This broadens the potential buyer pool significantly.

- Potential for lease extensions and renegotiations. The potential for future extensions and renegotiations adds further value and security for long-term investors in these properties.

Growing Demand for Retail Space in Key Markets

The surge in interest for these Hudson's Bay leases reflects a broader trend in the Canadian commercial real estate market.

Re-emergence of Brick-and-Mortar Retail

Despite the rise of e-commerce, brick-and-mortar retail is experiencing a resurgence, particularly for businesses emphasizing experiential shopping.

- Growing preference for in-person shopping and brand experiences. Consumers are increasingly seeking out in-person experiences, leading to renewed demand for physical retail spaces.

- E-commerce integration and omnichannel strategies are driving demand for physical storefronts. Many businesses are recognizing the synergy between online and offline retail, requiring a physical presence to complement their e-commerce operations. This creates a strong demand for retail spaces like those offered in these Hudson's Bay leases.

Strategic Investment Opportunities

The acquisition of these leases presents a compelling investment opportunity for various entities.

- Potential for capital appreciation and strong rental yields. Investing in these prime retail spaces offers the potential for significant returns on investment, both through rental income and potential capital appreciation.

- Diversification opportunities within a stable commercial real estate sector. These leases provide an opportunity to diversify an investment portfolio within a historically stable sector of the real estate market.

- Potential for value-add renovations and lease improvements. Many buyers see the potential to enhance the value of these properties through renovations and improvements, tailoring them to specific business needs.

The Role of Hudson's Bay Company (HBC) in the Transaction

Hudson's Bay Company's (HBC) involvement shapes the nature of this real estate opportunity.

Strategic Asset Disposition

HBC's decision to lease these properties reflects a strategic shift in its business model.

- Focus on core business operations and enhancing profitability. This move allows HBC to streamline its operations and focus on its core business activities, improving overall profitability.

- Reallocation of capital to other growth initiatives. The proceeds from these lease acquisitions allow HBC to invest in other strategic growth initiatives, further strengthening the company.

Attracting Qualified Buyers

HBC is taking a careful approach to selecting buyers for these valuable leases.

- Due diligence and stringent vetting procedures are implemented to protect its brand. HBC is ensuring that only reputable and financially sound buyers acquire these leases, safeguarding its brand image.

- Focus on long-term tenancy and responsible business practices. HBC prioritizes long-term tenants who align with its values and commitment to responsible business practices.

Conclusion

The significant buyer interest in the 65 Hudson's Bay leases underscores the enduring appeal of prime retail spaces and the strong investment potential within the Canadian commercial real estate market. The combination of strategic locations, attractive lease terms, and a robust retail environment is driving this unprecedented demand. For those seeking lucrative investment opportunities in high-growth markets, exploring the available Hudson's Bay leases represents a compelling prospect. Don't miss out on this opportunity to secure your share of these highly sought-after Hudson's Bay leases. Contact a commercial real estate specialist today to learn more about available properties and investment options in this exciting market.

Featured Posts

-

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changing Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changing Move

Apr 24, 2025 -

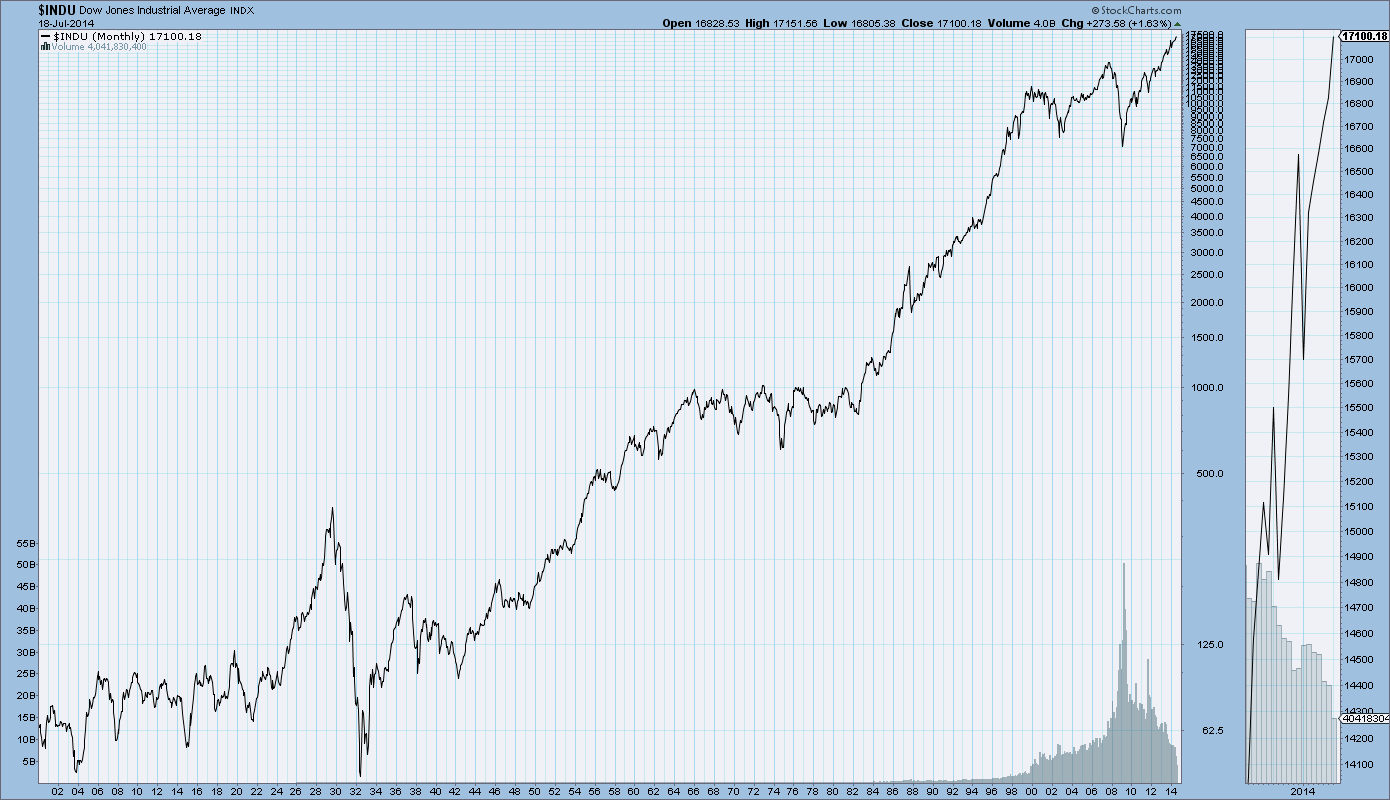

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025 -

Deciphering The Liberal Platform A Critical Analysis By William Watson

Apr 24, 2025

Deciphering The Liberal Platform A Critical Analysis By William Watson

Apr 24, 2025 -

Palisades Fire Aftermath A List Of Celebrities Who Lost Homes

Apr 24, 2025

Palisades Fire Aftermath A List Of Celebrities Who Lost Homes

Apr 24, 2025