Stock Market Update: Nasdaq, S&P 500, And Dow Jones Gains

Table of Contents

Nasdaq Performance Analysis

Nasdaq Composite Index Gains

The Nasdaq Composite Index saw a robust increase, closing at [Insert Closing Value] representing a [Insert Percentage]% gain. This positive performance was largely driven by strong results from the technology sector, reflecting a renewed optimism in the tech industry's growth potential.

- Specific technology stocks that significantly contributed to the gains: Companies like [Example: Apple, Microsoft, NVIDIA] saw substantial increases in their share prices, contributing significantly to the overall Nasdaq surge. These gains reflect strong investor confidence in these tech giants' continued innovation and market dominance.

- Relevant news or events impacting the Nasdaq's performance: Positive earnings reports from several key technology companies, coupled with encouraging news regarding [mention specific news, e.g., easing inflation concerns or positive regulatory developments], boosted investor sentiment and fueled the rally.

- Sector-wise performance within the Nasdaq: The software and semiconductor sectors were particularly strong performers, showcasing the continued strength and resilience of these key technology sub-sectors. Biotechnology also experienced positive growth, reflecting renewed interest in the sector.

Impact of Tech Sector Growth on Nasdaq

The technology sector's performance was the primary driver of the Nasdaq's impressive gains. The [Insert Percentage]% increase in the tech sector contributed significantly to the overall index's positive performance.

- Influence of specific tech giants on the index: The strong performance of mega-cap technology companies like [Example: Google, Amazon, Meta] had a disproportionate impact on the Nasdaq's overall growth trajectory. Their influence underscores the outsized role of these tech giants in shaping the index's direction.

- Future prospects of the tech sector and its impact on the Nasdaq: The continued innovation, strong demand for technology products and services, and the ongoing digital transformation across various industries all point to a positive outlook for the tech sector and, consequently, for the Nasdaq's future performance.

S&P 500 Market Rally

S&P 500 Index Growth

The S&P 500, a broader measure of the US stock market, also experienced a notable increase, closing at [Insert Closing Value], representing a [Insert Percentage]% gain. This growth builds upon the recent positive market trend and signals a growing sense of optimism among investors.

- Performance of various sectors within the S&P 500: While technology played a role, gains were observed across multiple sectors, including consumer discretionary, energy, and financials. This suggests a broad-based market rally rather than a sector-specific surge.

- Specific companies within the S&P 500 that experienced notable growth: Several companies, including [Example: Company names and sectors], witnessed significant increases in their share prices, contributing to the overall S&P 500 growth.

- Broad market sentiment reflected in the S&P 500 performance: The S&P 500's positive performance reflects a general improvement in investor confidence and a growing belief in the continued strength of the US economy.

Economic Indicators and S&P 500 Movement

The S&P 500's positive movement correlates with recent positive economic data. Lower-than-expected inflation figures and a stable unemployment rate helped bolster investor sentiment and fuel the market rally.

- Recent economic reports that might have influenced investor behavior: The release of [mention specific reports, e.g., the Consumer Price Index (CPI) or the employment report] significantly influenced investor behavior, contributing to the market's positive response.

- Potential future impact of economic factors on the S&P 500: Continued positive economic data and stable growth are likely to support further gains in the S&P 500, while any negative economic surprises could trigger a market correction.

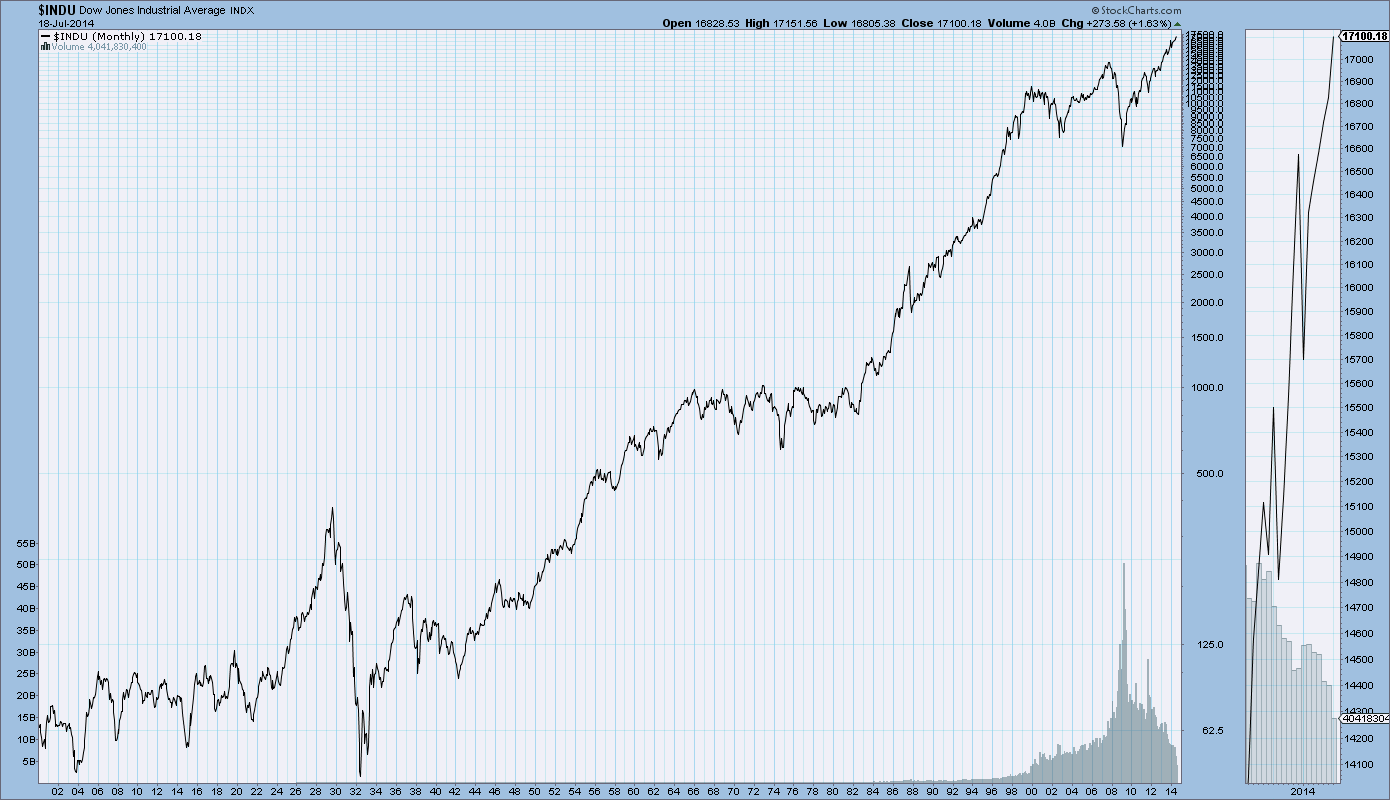

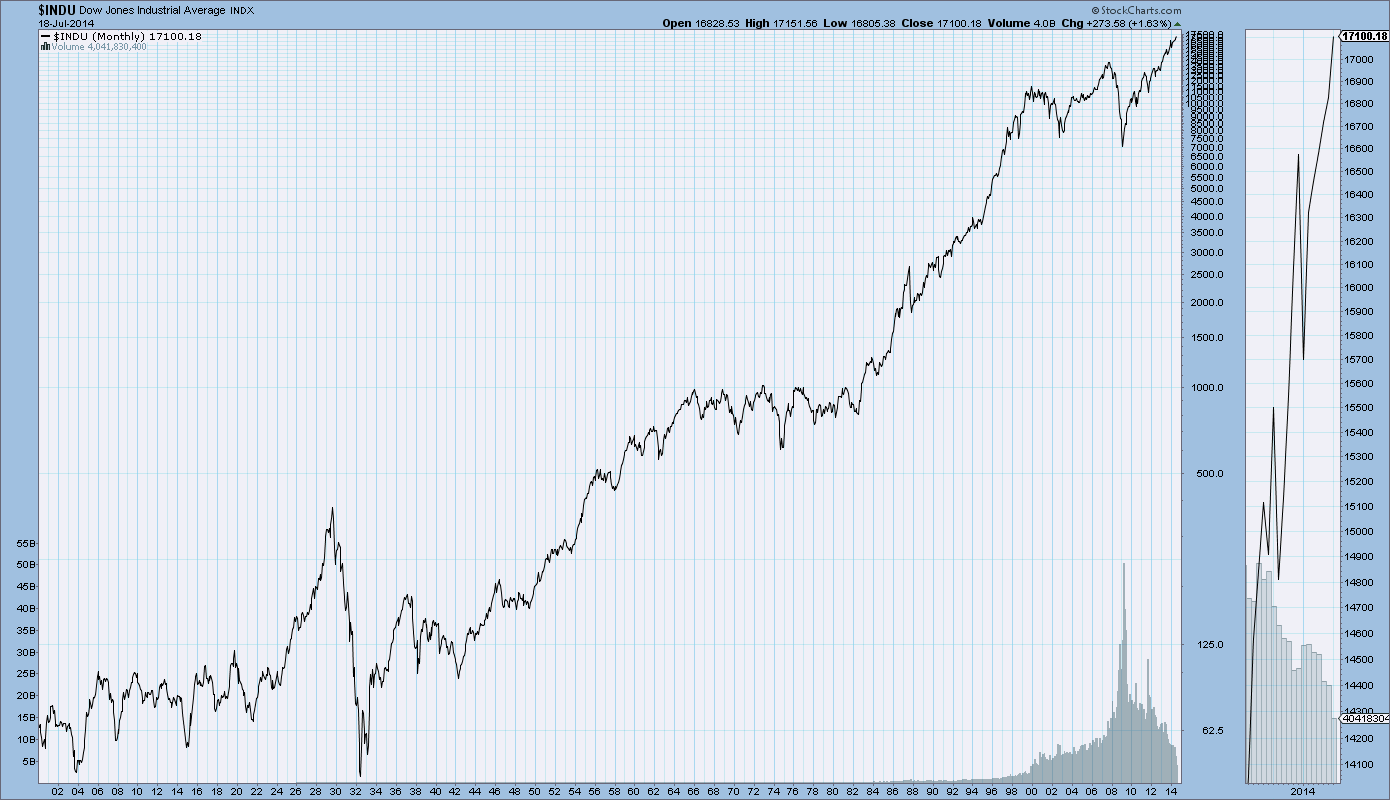

Dow Jones Industrial Average Climb

Dow Jones Performance and Key Contributors

The Dow Jones Industrial Average, a price-weighted average of 30 large, publicly owned companies, also experienced a significant increase, closing at [Insert Closing Value], a [Insert Percentage]% gain. Several blue-chip companies were major contributors to this positive performance.

- Top-performing companies in the Dow Jones and their contribution to the overall gain: Companies such as [Example: Company names and sectors] played a significant role in driving the Dow's upward trajectory.

- Impact of global events on the Dow Jones performance: Positive global economic news and developments in international trade contributed positively to investor sentiment, supporting the Dow's rise.

- Comparison of the Dow's performance against other major global indices: The Dow's performance mirrored positive movements observed in other major global indices, suggesting a global sentiment of market optimism.

Dow Jones Long-Term Outlook

The current positive momentum suggests a potentially positive outlook for the Dow Jones. However, several factors could influence its future trajectory.

- Factors that could contribute to continued growth or potential corrections: Continued economic stability, corporate earnings growth, and investor confidence will be crucial for sustaining the upward trend. Conversely, geopolitical uncertainties or unexpected economic downturns could trigger a market correction.

- Overall market risk and reward associated with investing in the Dow Jones: Investing in the Dow Jones, like any market investment, involves risk. While the current trends are positive, potential volatility remains.

Conclusion

Today's stock market update reveals significant gains across major indices: the Nasdaq, S&P 500, and Dow Jones all experienced substantial increases, driven primarily by strong corporate earnings, positive economic indicators, and renewed investor confidence. The technology sector played a dominant role in the Nasdaq's performance, while the S&P 500 reflected broad-based market strength. The Dow Jones's gains were supported by strong performances from blue-chip companies. Understanding these market movements is crucial for informed investment strategies.

Key Takeaways: Positive economic data, strong corporate earnings, and overall improved investor sentiment contributed to the significant gains observed across major indices. While the outlook appears positive, market volatility remains a factor to consider.

Call to Action: Stay tuned for our next stock market update to track the continued performance of the Nasdaq, S&P 500, and Dow Jones. Understand the market better by [link to relevant resource/service – e.g., a financial news website or investment platform].

Featured Posts

-

Recent Gains In Indias Nifty Market Trends And Future Outlook

Apr 24, 2025

Recent Gains In Indias Nifty Market Trends And Future Outlook

Apr 24, 2025 -

Building Contamination Following Ohio Train Derailment The Long Term Presence Of Toxic Chemicals

Apr 24, 2025

Building Contamination Following Ohio Train Derailment The Long Term Presence Of Toxic Chemicals

Apr 24, 2025 -

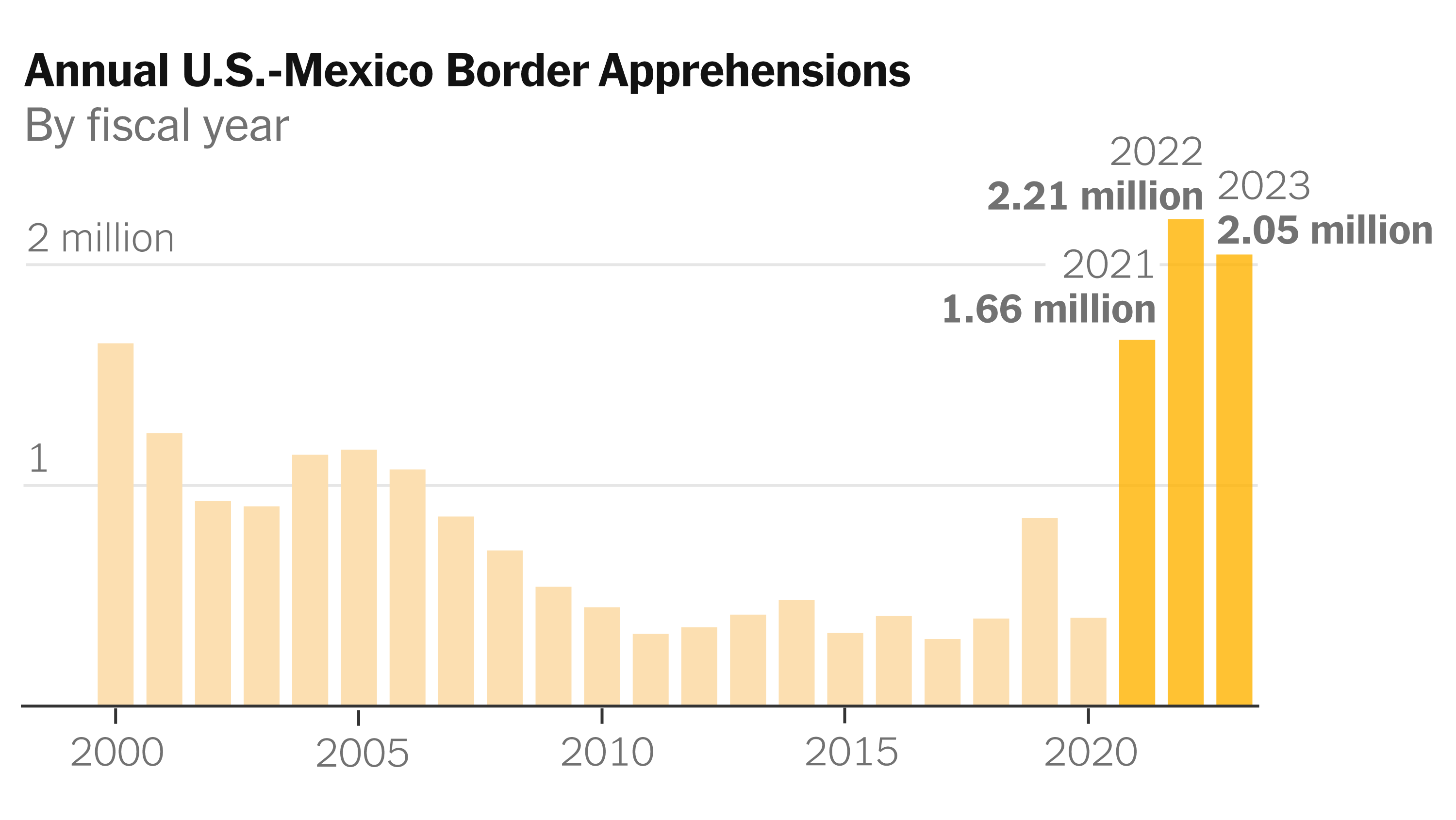

Drop In Illegal Border Crossings Between U S And Canada White House Data

Apr 24, 2025

Drop In Illegal Border Crossings Between U S And Canada White House Data

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Stock Market Valuation Concerns Why Bof A Remains Optimistic

Apr 24, 2025

Stock Market Valuation Concerns Why Bof A Remains Optimistic

Apr 24, 2025