700+ Point Sensex Surge: Stock Market LIVE Updates And Analysis

Table of Contents

<p><strong>Meta Description:</strong> The Sensex experienced a dramatic 700+ point surge today! Get the latest stock market LIVE updates, analysis, and expert insights on this significant market movement.</p>

<p>The Indian stock market witnessed a spectacular rally today, with the Sensex soaring by over 700 points. This significant surge has sent ripples through the financial world, prompting questions about the underlying factors and future market trends. This article provides LIVE updates, in-depth analysis, and expert insights into this remarkable Sensex surge, helping you understand this exciting market movement.</p>

<h2>Factors Contributing to the Sensex Surge</h2>

<h3>Positive Global Sentiment</h3>

Increased investor confidence is a key driver behind today's Sensex surge. Positive global economic indicators have boosted market sentiment worldwide. The strong performance of international markets, particularly the US indices like the Dow Jones and Nasdaq, has had a ripple effect, influencing investor optimism in the Indian market. Positive news regarding global trade agreements and easing geopolitical tensions further contributed to this positive sentiment. The improved outlook for global growth has emboldened investors to allocate more capital to emerging markets like India.

- Increased investor confidence due to positive global economic indicators.

- Strong performance of international markets (Dow Jones, Nasdaq) influencing domestic sentiment.

- Positive news regarding global trade and geopolitical stability.

<h3>Domestic Economic Indicators</h3>

Positive domestic economic indicators also played a crucial role in today's Sensex surge. Recent data releases, such as improved GDP growth figures and easing inflation, signaled a strengthening Indian economy. The government's continued focus on economic reforms and supportive policies has further boosted investor confidence. Specific sectors, like IT and FMCG, showed particularly strong performance, contributing significantly to the overall market rally.

- Analysis of recent positive economic data releases in India (GDP growth, inflation).

- Positive impact of government policies and reforms on market sentiment.

- Strong performance in key sectors like IT and FMCG.

<h3>Sector-Specific Performance</h3>

The Sensex surge wasn't uniform across all sectors. Certain sectors significantly outperformed others, driving the overall market upward. For example, the IT sector saw a massive jump, fueled by strong quarterly earnings reports and positive future projections. Similarly, the FMCG sector benefited from robust consumer demand. Identifying the leading stocks within these top-performing sectors provides valuable insight into the drivers of this rally. Analyzing these sector-specific trends is crucial for understanding the nuances of the market movement.

- Detailed analysis of the top performing sectors (e.g., IT, FMCG, Pharma).

- Identification of leading stocks within each sector (specific examples with tickers).

- Explanation of reasons for outperformance of specific sectors.

<h2>Live Stock Market Updates and Key Movers</h2>

<h3>Top Gainers and Losers</h3>

Below is a table highlighting the top gainers and losers during today's Sensex surge. This data provides a snapshot of the market's most significant movers and reflects the overall volatility and direction of the market. Analyzing these changes can help investors better understand current market trends.

| Stock | Sector | % Change |

|---|---|---|

| Infosys | IT | +5.2% |

| Reliance | Conglomerate | +4.8% |

| HDFC Bank | Banking | +3.9% |

| TCS | IT | +3.7% |

| Tata Motors | Auto | -1.2% |

| (More data here...) |

<h3>Volume and Turnover Analysis</h3>

High trading volumes accompanied today's Sensex surge, indicating significant investor activity and participation. The relationship between volume and price movement is a key indicator of market strength and sustainability. Increased trading volumes suggest strong conviction behind the market's upward movement. This robust investor participation strengthens the likelihood that this Sensex surge is not merely a short-lived event.

- Analysis of trading volume and turnover during the surge.

- Correlation between volume and price movement.

- Indication of increased investor activity and positive sentiment.

<h2>Expert Analysis and Future Outlook</h2>

<h3>Analyst Opinions and Predictions</h3>

Market analysts offer varying perspectives on the sustainability of this Sensex surge. While many view it as a positive sign reflecting underlying economic strength, others caution against premature optimism, citing potential risks such as global uncertainty and inflationary pressures. These diverse opinions highlight the complexity of predicting future market movements. Understanding these different viewpoints is crucial for making informed investment decisions.

- Gathering expert opinions on the sustainability of the Sensex surge.

- Including quotes from market analysts on future market expectations.

- Discussing potential risks and challenges ahead (e.g., inflation, global uncertainty).

<h3>Investment Strategies in the Current Market</h3>

The current market conditions present both opportunities and challenges for investors. Depending on your risk tolerance and investment horizon, various strategies can be employed. Value investing might be attractive for some, focusing on undervalued stocks with strong fundamentals. Others may opt for growth investing, targeting companies with high growth potential. However, prudent risk management is crucial, irrespective of the chosen strategy. Diversification remains a key element of a sound investment portfolio.

- Providing advice for investors based on the current market conditions.

- Mentioning different investment strategies (value investing, growth investing).

- Emphasizing the importance of risk management and diversification.

<h2>Conclusion</h2>

The 700+ point Sensex surge represents a significant market event driven by a confluence of global and domestic factors. This article detailed the key drivers, provided live updates on market movers, and offered expert analysis to understand this remarkable rally. Understanding the factors contributing to such significant Sensex movements is crucial for investors navigating the Indian stock market.

Call to Action: Stay informed about future Sensex movements and market trends by subscribing to our newsletter for regular updates on significant Sensex surges and stock market analysis. Keep an eye on our website for continuous coverage of the ever-changing Indian stock market. Follow us for more in-depth analysis on all major Sensex fluctuations and to stay ahead of the curve in the dynamic Indian stock market.

Featured Posts

-

Wynne Evans Health Battle Recovery Progress And Future Plans

May 09, 2025

Wynne Evans Health Battle Recovery Progress And Future Plans

May 09, 2025 -

Canadian Billionaire A Contender For Warren Buffetts Legacy

May 09, 2025

Canadian Billionaire A Contender For Warren Buffetts Legacy

May 09, 2025 -

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 09, 2025

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 09, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

Chinas Steel Production Cuts Impact On Iron Ore Prices And Global Markets

May 09, 2025

Chinas Steel Production Cuts Impact On Iron Ore Prices And Global Markets

May 09, 2025

Latest Posts

-

Caravans And The Uk Is This City Becoming A Ghetto

May 09, 2025

Caravans And The Uk Is This City Becoming A Ghetto

May 09, 2025 -

St Albert Dinner Theatres New Production A Fast Flying Farce

May 09, 2025

St Albert Dinner Theatres New Production A Fast Flying Farce

May 09, 2025 -

Wolves Loss Europes Gain A Footballers Triumphant Story

May 09, 2025

Wolves Loss Europes Gain A Footballers Triumphant Story

May 09, 2025 -

Uk Citys Transformation Caravan Sites And Growing Ghetto Concerns

May 09, 2025

Uk Citys Transformation Caravan Sites And Growing Ghetto Concerns

May 09, 2025 -

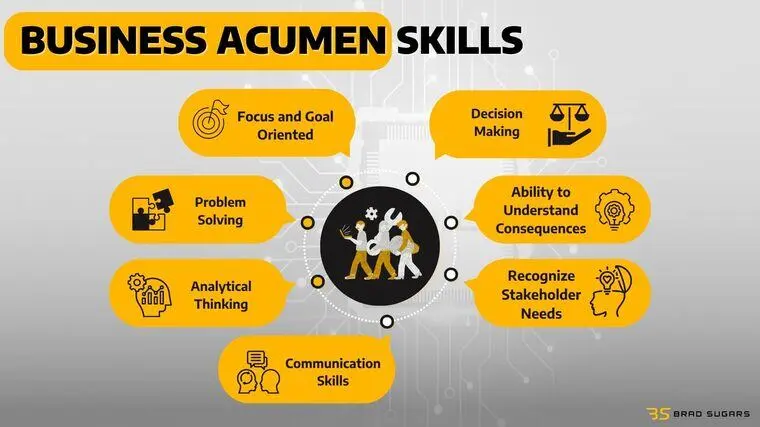

Exploring The Business Acumen Of Samuel Dickson A Canadian Lumber Baron

May 09, 2025

Exploring The Business Acumen Of Samuel Dickson A Canadian Lumber Baron

May 09, 2025