China's Steel Production Cuts: Impact On Iron Ore Prices And Global Markets

Table of Contents

The Scale of China's Steel Production Cuts and Their Underlying Reasons

China's recent reductions in steel production are substantial. While precise figures fluctuate, reports from organizations like the World Steel Association indicate a significant percentage decrease in steel output compared to previous years. For example, [cite source with specific data]. This isn't a minor adjustment; it represents a considerable shift in global steel supply. Several interconnected factors contribute to this dramatic reduction:

- Stringent Environmental Regulations: The Chinese government has intensified its efforts to curb carbon emissions and improve environmental quality. These policies include stricter regulations on steel mills, limiting their operational capacity and forcing them to adopt cleaner technologies. Keywords: China steel production, steel output reduction, environmental regulations, carbon emissions.

- Weakening Domestic Demand: China's economic growth has slowed in recent years, leading to reduced demand for steel in construction, infrastructure projects, and manufacturing. This decreased domestic consumption directly impacts the country's steel production needs. Keywords: China steel production, economic slowdown, domestic demand, construction industry.

- Soaring Energy Prices: The increased cost of energy, particularly coal and electricity, significantly impacts the profitability of steel production. Higher energy prices make it less economical for steel mills to operate at full capacity. Keywords: Steel production costs, energy prices, coal prices, electricity costs.

- Scrutiny of Carbon Footprint: Growing global concerns about climate change have put the steel industry under increased pressure to reduce its carbon footprint. China, as the largest producer, faces intense scrutiny and is actively pursuing decarbonization strategies, impacting production levels in the short term. Keywords: Carbon footprint, steel industry sustainability, decarbonization.

Direct Impact on Iron Ore Prices: Supply and Demand Dynamics

The relationship between China's steel production and iron ore demand is inextricably linked. Iron ore is a crucial raw material in steelmaking; thus, reduced steel production directly translates into lower demand for iron ore. This decrease in demand has had a noticeable impact on iron ore prices, leading to:

- Price Drops: The reduced demand from China has created a surplus of iron ore in the market, pushing prices downward. [cite source with price data]. Keywords: Iron ore price, iron ore demand, commodity prices, price volatility.

- Market Volatility: The uncertainty surrounding China's future steel production levels and the ongoing economic slowdown contribute to significant volatility in iron ore prices. This makes it challenging for producers and buyers to plan effectively. Keywords: Market volatility, iron ore price prediction, commodity market trends.

- Supply-Demand Imbalance: The decreased demand from China has disrupted the global supply-demand balance for iron ore. Major producers are now facing reduced sales and revenue, impacting their operations and investments. Keywords: Supply chain disruption, iron ore supply, global iron ore market.

Wider Implications for Global Iron Ore Markets and Related Industries

The impact of China's steel production cuts extends far beyond iron ore prices. The ripple effects are felt throughout the global economy:

- Impact on Major Iron Ore Producers: Australia and Brazil, the world's leading iron ore exporters, are significantly affected by reduced Chinese demand. This impacts their mining operations, employment, and national economies. Keywords: Global iron ore market, Australian mining industry, Brazilian mining industry, mining economics.

- Shipping and Logistics: The decreased volume of iron ore transported globally affects shipping and logistics companies, reducing their cargo capacity and potentially impacting their profitability. Keywords: Shipping industry, logistics, freight rates, transportation costs.

- Mining Equipment Manufacturers: The downturn in the iron ore market also impacts manufacturers of mining equipment and related technologies, as demand for their products declines. Keywords: Mining equipment, heavy machinery, capital expenditure, mining technology.

- Global Trade and Economic Growth: The interconnectedness of global markets means that the slowdown in China's steel industry and the subsequent impact on iron ore prices contribute to broader economic uncertainty and potentially slower global growth. Keywords: International trade, global economics, economic growth, commodity markets.

Forecasting Future Trends: Predictions for Steel Production and Iron Ore Prices

Predicting future trends in China's steel production and iron ore prices is challenging, but several factors point towards potential scenarios:

- Government Policies: Future government policies regarding environmental regulations and economic stimulus packages will significantly influence steel production and, consequently, iron ore demand. Keywords: Government policy, economic stimulus, environmental regulations, industrial policy.

- Economic Recovery: The pace of China's economic recovery will play a crucial role in determining future steel demand and, therefore, iron ore prices. A quicker recovery could lead to a rebound in prices. Keywords: Economic recovery, market forecast, China's economic outlook.

- Technological Advancements: Technological advancements in steel production, such as the adoption of more efficient and environmentally friendly processes, could influence production levels and market dynamics. Keywords: Steel industry technology, sustainable steel production, innovation in steelmaking.

Experts offer varied predictions, with some forecasting a continued decline in iron ore prices while others anticipate stabilization or even a potential rebound. Careful monitoring of these factors is critical for effective decision-making. Keywords: Iron ore price prediction, steel industry outlook, future trends, market analysis.

Conclusion: Navigating the Shifting Landscape of China's Steel Production Cuts

China's steel production cuts have demonstrably impacted iron ore prices and reverberated across global markets. The interconnectedness of these markets highlights the importance of understanding the underlying factors driving these changes. The future trajectory of steel production and iron ore prices remains uncertain, depending on evolving government policies, economic growth, and technological innovation. To navigate this dynamic landscape, staying informed about developments in China's steel sector and consulting with experts in commodity markets is crucial. Understanding the impact of China's steel production is vital for informed decision-making in related industries. Continue to monitor industry news and analysis to effectively manage risks and opportunities within this ever-evolving market.

Featured Posts

-

R3

May 09, 2025

R3

May 09, 2025 -

Fluctuations In Elon Musks Net Worth A Look At Us Economic Factors

May 09, 2025

Fluctuations In Elon Musks Net Worth A Look At Us Economic Factors

May 09, 2025 -

R3 2

May 09, 2025

R3 2

May 09, 2025 -

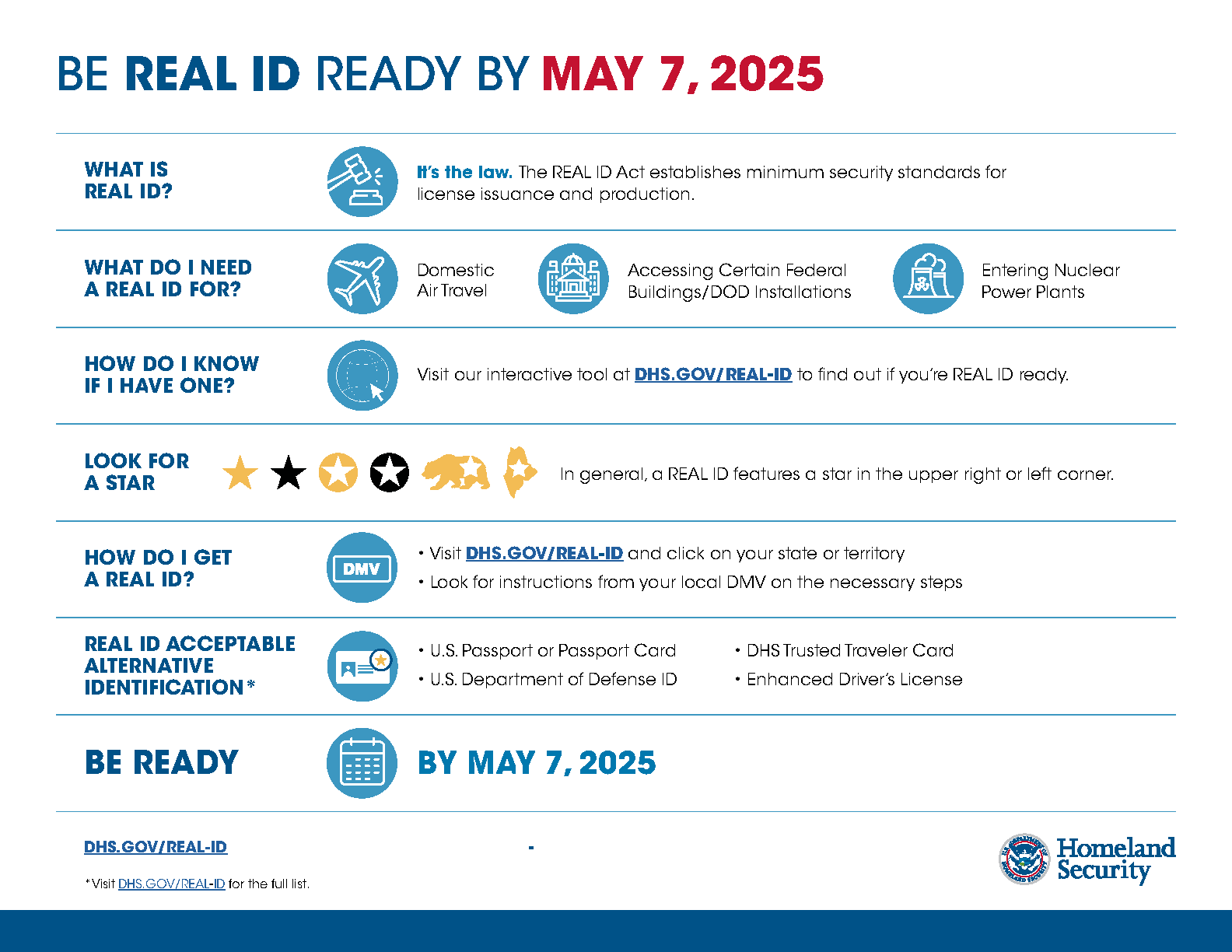

Summer Travel 2024 Navigating Real Id Requirements

May 09, 2025

Summer Travel 2024 Navigating Real Id Requirements

May 09, 2025 -

Finding The Real Safe Bet A Practical Guide To Secure Investing

May 09, 2025

Finding The Real Safe Bet A Practical Guide To Secure Investing

May 09, 2025

Latest Posts

-

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025 -

Mental Health Violence And The Media Deconstructing The Monster Narrative

May 09, 2025

Mental Health Violence And The Media Deconstructing The Monster Narrative

May 09, 2025 -

Severe Mental Illness And Violence Addressing The Academic Failures In Understanding

May 09, 2025

Severe Mental Illness And Violence Addressing The Academic Failures In Understanding

May 09, 2025 -

The Misrepresentation Of Mentally Ill Killers A Critical Analysis

May 09, 2025

The Misrepresentation Of Mentally Ill Killers A Critical Analysis

May 09, 2025 -

Nottingham Attack Survivors Break Silence Recount Ordeal

May 09, 2025

Nottingham Attack Survivors Break Silence Recount Ordeal

May 09, 2025