$800 Million Week 1 Target: Analyzing The Impact Of XRP ETF Approval

Table of Contents

The Potential for Explosive Growth: Why $800 Million is a Realistic Target

The potential for an XRP ETF to generate $800 million in its first week of trading stems from several key factors. This explosive growth isn't unprecedented; similar surges have been observed in other crypto markets following ETF approvals.

Increased Institutional Investment

Institutional investors, with their vast capital reserves, are key players in driving market growth. The approval of an XRP ETF would significantly reduce barriers to entry for these large funds.

- Increased Legitimacy: ETF approval lends an air of legitimacy to XRP, making it more appealing to risk-averse institutional investors who previously hesitated due to regulatory uncertainty.

- Reduced Barriers to Entry: ETFs provide a streamlined and regulated way for institutional investors to gain exposure to XRP, eliminating the complexities and risks associated with direct crypto purchases.

- Diversification Benefits: For institutions seeking portfolio diversification, an XRP ETF offers a new asset class, potentially reducing overall portfolio risk.

While precise figures are difficult to predict, the influx of institutional capital after ETF approvals in other crypto markets has been substantial, suggesting a similar pattern could unfold with XRP. Data from [cite relevant source if available] shows a [percentage]% increase in institutional investment in [similar crypto asset] following its ETF approval.

Retail Investor FOMO (Fear Of Missing Out)

The psychology of retail investors is crucial in driving market trends. The approval of an XRP ETF would likely trigger significant FOMO.

- Increased Media Attention: ETF approval would garner significant media attention, attracting the attention of retail investors who might otherwise be unfamiliar with XRP.

- Social Media Hype: The news will undoubtedly spread rapidly on social media platforms, creating a buzz and further amplifying the FOMO effect.

- Potential Price Surges: Early price increases following ETF approval can create a self-fulfilling prophecy, driving further investment as more individuals fear missing out on potential gains.

Examples like the [mention relevant example of FOMO driving crypto market trends] demonstrate the powerful influence of FOMO on retail investor behavior.

Increased Liquidity and Trading Volume

ETF approval dramatically increases liquidity in the market, leading to higher trading volumes.

- Easy Access Through Traditional Brokerage Platforms: Investors can access XRP through established brokerage accounts, eliminating the need for crypto exchanges, increasing accessibility for the average investor.

- Increased Accessibility for Average Investors: ETFs simplify XRP investment, making it more accessible to a broader range of investors who may lack the technical expertise to navigate crypto exchanges directly.

Historical data from other asset classes shows a significant increase in liquidity and trading volume after ETF approvals. For instance, [cite relevant data on liquidity and trading volume changes following ETF approvals in other markets]. This indicates a strong correlation between ETF listings and increased market activity.

Factors that Could Influence the $800 Million Target

While the potential for significant growth is considerable, several factors could influence whether the $800 million week 1 target is met.

Regulatory Landscape and SEC Approval

The regulatory landscape plays a significant role. SEC approval is crucial, and any delays or conditions imposed could impact the initial trading volume.

- Potential Delays: The SEC review process can be lengthy, potentially delaying the launch and thus affecting the initial trading volume.

- Conditions for Approval: The SEC may impose conditions on the ETF's structure or trading parameters, potentially limiting its immediate impact.

- Impact of Overall Regulatory Environment: The overall regulatory climate surrounding cryptocurrencies will significantly influence investor confidence and the success of the XRP ETF.

Market Volatility and External Factors

The crypto market is inherently volatile, susceptible to various internal and external factors.

- Macroeconomic Conditions: Global economic events, such as inflation or recessionary pressures, can significantly impact investor sentiment and XRP's price.

- Overall Crypto Market Sentiment: Broader trends in the cryptocurrency market will also influence XRP's performance.

- Competing Assets: The emergence of competing cryptocurrencies or alternative investment opportunities could divert investor interest away from XRP.

XRP's Underlying Technology and Use Cases

XRP's functionality and use cases play a crucial role in shaping investor perception and demand.

- Cross-border Payments: XRP's efficiency in facilitating cross-border payments is a key selling point for investors.

- Its Role in RippleNet: RippleNet's expanding network of financial institutions enhances XRP's utility and appeal.

- Potential for Wider Adoption: The wider adoption of XRP by businesses and institutions can drive its price and trading volume.

Analyzing the Long-Term Implications of XRP ETF Approval

The approval of an XRP ETF would have far-reaching consequences, extending beyond the initial trading volume surge.

Price Predictions and Market Capitalization

While predicting price movements is speculative, the approval of an XRP ETF could significantly boost its price and market capitalization. [Include charts and graphs to illustrate potential price trajectories (if available), with appropriate disclaimers about the speculative nature of such predictions].

Impact on the Broader Cryptocurrency Market

The success of an XRP ETF could trigger a positive ripple effect across the broader crypto market.

- Potential Increased Adoption of Cryptocurrencies: The increased legitimacy and accessibility associated with XRP ETF approval could encourage greater mainstream adoption of cryptocurrencies in general.

- Competition Among Different Assets: The success of an XRP ETF could spark increased competition among other cryptocurrencies, prompting further innovation and development within the sector.

XRP's Role in the Decentralized Finance (DeFi) Ecosystem

XRP's integration into the DeFi ecosystem is another crucial aspect to consider.

- Increased Accessibility for DeFi Applications: An ETF could make XRP more accessible to DeFi applications, potentially broadening its utility and driving further development within the DeFi space.

- Potential Use Cases within DeFi Protocols: XRP's properties could be leveraged within various DeFi protocols, creating new opportunities for innovation and growth.

Conclusion

The approval of an XRP ETF holds immense potential, with the possibility of reaching a $800 million week 1 trading target. However, this projection is contingent on several factors, including regulatory approval, market conditions, and XRP's continued development. We've explored the key drivers for this potential growth and also the potential challenges.

Call to Action: Stay informed about the evolving regulatory landscape and market trends surrounding XRP and its potential ETF approval. Further research into the potential impact of XRP ETF approval is crucial for navigating this exciting and dynamic market. Learn more about the potential implications of XRP ETF approval and its impact on your investment strategy.

Featured Posts

-

Proposed Doj Changes Could Severely Damage User Trust In Google Search

May 08, 2025

Proposed Doj Changes Could Severely Damage User Trust In Google Search

May 08, 2025 -

Py Ays Ayl Trafy Lahwr Myn Jshn W Hngamh

May 08, 2025

Py Ays Ayl Trafy Lahwr Myn Jshn W Hngamh

May 08, 2025 -

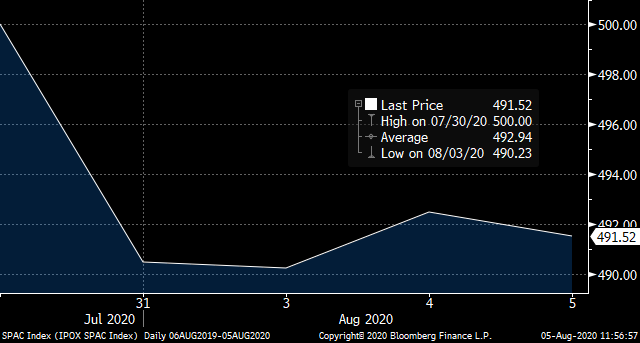

Investors Are Piling Into This Hot New Spac Stock Should You Follow Suit

May 08, 2025

Investors Are Piling Into This Hot New Spac Stock Should You Follow Suit

May 08, 2025 -

16 April 2025 Daily Lotto Winning Numbers Announced

May 08, 2025

16 April 2025 Daily Lotto Winning Numbers Announced

May 08, 2025 -

Nuggets Player Responds To Russell Westbrook Trade Rumors

May 08, 2025

Nuggets Player Responds To Russell Westbrook Trade Rumors

May 08, 2025

Latest Posts

-

Dwp Benefit Stoppage 355 000 Affected 3 Month Warning Issued

May 08, 2025

Dwp Benefit Stoppage 355 000 Affected 3 Month Warning Issued

May 08, 2025 -

Universal Credit Refund Dwp Explains 5 Billion Cuts And April May Payments

May 08, 2025

Universal Credit Refund Dwp Explains 5 Billion Cuts And April May Payments

May 08, 2025 -

Dwp Home Visit Increase Concerns For Benefit Claimants

May 08, 2025

Dwp Home Visit Increase Concerns For Benefit Claimants

May 08, 2025 -

Urgent Dwp Issues 3 Month Warning On Benefit Cessation For 355 000 Claimants

May 08, 2025

Urgent Dwp Issues 3 Month Warning On Benefit Cessation For 355 000 Claimants

May 08, 2025 -

Are You Getting A Universal Credit Refund Dwp Payments After 5 Billion Cuts April May

May 08, 2025

Are You Getting A Universal Credit Refund Dwp Payments After 5 Billion Cuts April May

May 08, 2025