Investors Are Piling Into This Hot New SPAC Stock: Should You Follow Suit?

Table of Contents

SPACs, essentially shell companies that raise capital to acquire private companies, offer a potentially lucrative path to high returns. However, they also carry significant risks. This leads to our central question: Should you, as an investor, jump on this bandwagon? Let's explore.

Understanding the Hype Surrounding This Particular SPAC Stock

The excitement surrounding this hot new SPAC stock stems from a confluence of factors. Let's dissect the key elements driving this investment frenzy:

Analyzing the Target Company's Potential

This unnamed SPAC is poised to merge with a company operating in the rapidly expanding [Insert Target Company Industry, e.g., renewable energy] sector. This sector benefits from:

- High-Growth Potential: The [Target Company Industry] market is projected to experience [Insert Growth Percentage]% growth over the next five years, presenting significant opportunities for expansion.

- Disruptive Technology: The target company possesses a [Describe Key Technology/Innovation], giving it a substantial competitive advantage in the market.

- Strong Market Position: The company holds a [Market Share Percentage]% market share and is rapidly gaining traction. Recent press releases highlight [mention specific achievements/milestones]. Analyst reports predict [mention specific analyst predictions].

Examining the SPAC's Management Team

A key driver of investor confidence is the SPAC's management team. This team boasts:

- Experienced Management: The team comprises seasoned professionals with extensive experience in [relevant industry/finance].

- Proven Track Record: Members have a history of successfully identifying and executing profitable acquisitions in the [relevant industry].

- Strong Network: The team possesses an extensive network of contacts within the [relevant industry], facilitating access to lucrative deals.

Assessing the SPAC's Financial Health

The SPAC's financial standing is crucial. Key indicators suggest:

- Strong Financials: The SPAC holds substantial cash reserves of [Insert Amount], providing ample capital for the acquisition and post-merger operations.

- Low Debt: The SPAC has minimal debt, reducing financial risk.

- Trust Account Transparency: Funds are held securely in a trust account, guaranteeing investor protection until the acquisition is completed.

The Risks Associated with Investing in SPACs

Despite the allure, SPAC investments come with inherent risks:

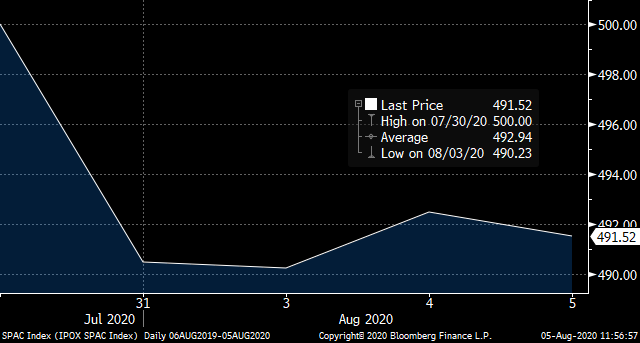

Volatility and Market Uncertainty

- Market Risk: SPAC valuations are highly susceptible to market fluctuations. A downturn in the broader market can significantly impact the SPAC's stock price.

- Volatility: SPAC stock prices can be highly volatile, experiencing dramatic price swings. This necessitates careful risk assessment and a long-term investment perspective.

- Price Fluctuations: Pre-merger SPACs are often traded at a premium, and these premiums can decline significantly if the merger fails to materialize or if the target company underperforms.

Lack of Transparency and Due Diligence Challenges

- Due Diligence: Conducting thorough due diligence on a pre-merger SPAC can be challenging due to limited information about the target company.

- Information Asymmetry: Investors may not have the same level of information as the SPAC's sponsors, leading to potential information asymmetry.

- Investment Risk: This lack of transparency increases the investment risk significantly.

Potential for Management Conflicts of Interest

- Conflict of Interest: Potential conflicts of interest can arise between the SPAC's management and investors, particularly regarding sponsor compensation and deal structuring.

- Sponsor Compensation: SPAC sponsors often receive substantial compensation, which can create conflicts of interest.

- Alignment of Interests: It's crucial to assess the alignment of interests between the sponsors and the investors to mitigate potential conflicts.

Should You Invest? A Balanced Perspective

Weighing the Pros and Cons

| Pros | Cons |

|---|---|

| High-growth potential of the target company | High volatility and market risk |

| Experienced management team | Lack of transparency and due diligence challenges |

| Strong financial position of the SPAC | Potential for management conflicts of interest |

| Potential for significant returns | Risk of merger failure |

Diversification and Risk Tolerance

Investing in a hot new SPAC stock should be part of a well-diversified portfolio. Align your investment strategy with your individual risk tolerance. Don't put all your eggs in one basket.

Alternative Investment Opportunities

Before investing in this hot new SPAC stock, consider exploring alternative investment avenues that better align with your risk profile and financial goals.

Conclusion: Making Informed Decisions About Hot New SPAC Stocks

Investing in a hot new SPAC stock presents the possibility of substantial returns but also comes with considerable risk. While the potential of this particular SPAC is enticing, it is crucial to acknowledge the significant risks involved. Thorough due diligence, understanding your risk tolerance, and diversifying your portfolio are critical aspects of successful investment management. Before making any investment decision related to this or any other hot new SPAC stock, carefully consider the information presented, conduct your own thorough research, and, if necessary, seek the advice of a qualified financial advisor. Remember, responsible investment always begins with informed decisions.

Featured Posts

-

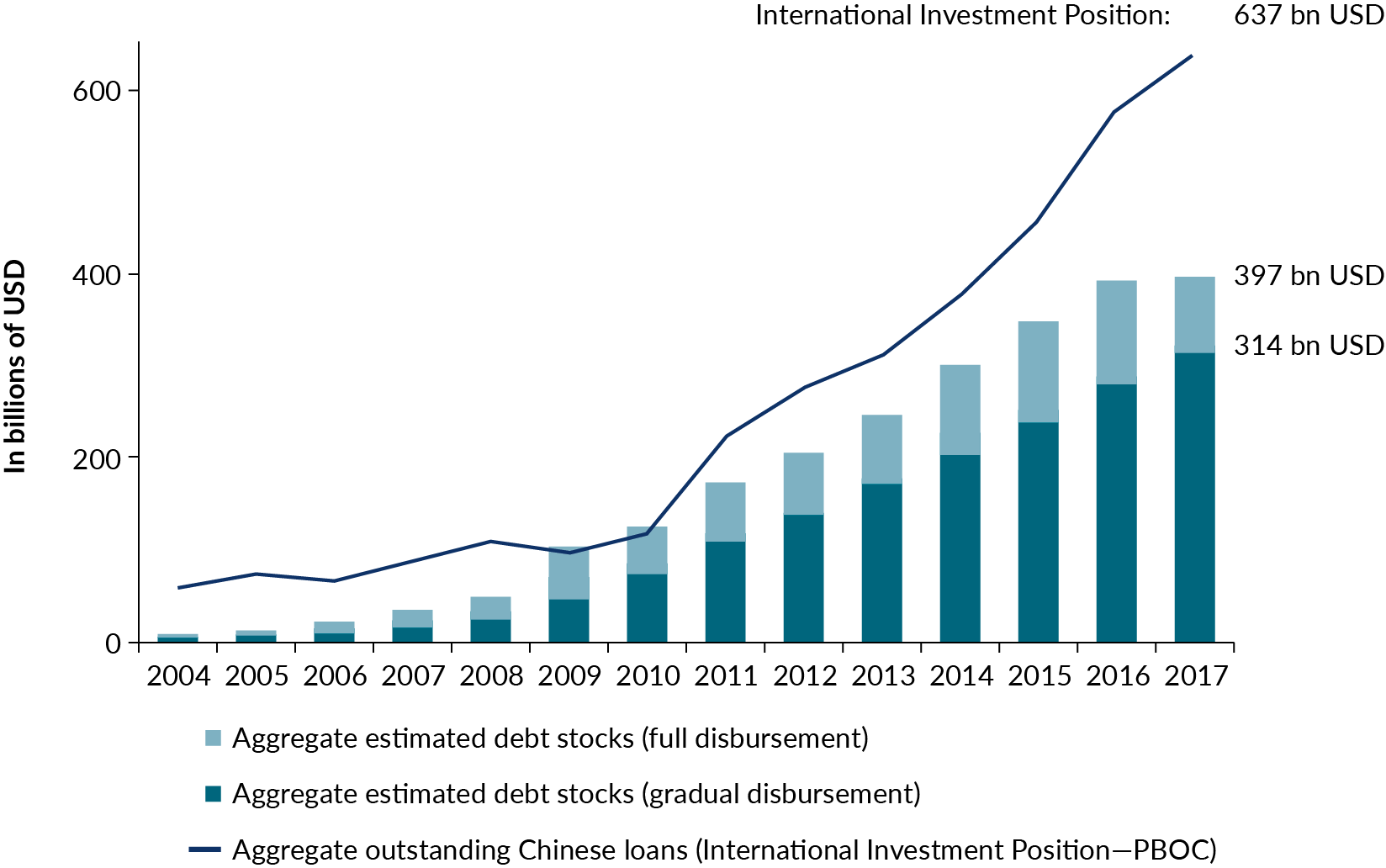

Analyzing Chinas Rate Cuts And Increased Bank Lending In Response To Tariffs

May 08, 2025

Analyzing Chinas Rate Cuts And Increased Bank Lending In Response To Tariffs

May 08, 2025 -

La Temporada Historica Del Betis Un Hito Para El Club

May 08, 2025

La Temporada Historica Del Betis Un Hito Para El Club

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Myn Nakamy Ewam Ka Ahtjaj

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Myn Nakamy Ewam Ka Ahtjaj

May 08, 2025 -

Ripple Xrp Price Surge Will It Reach 3 40

May 08, 2025

Ripple Xrp Price Surge Will It Reach 3 40

May 08, 2025 -

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Latest Posts

-

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025 -

Defaite De Dijon Face A Concarneau 0 1 En National 2 04 04 2025

May 09, 2025

Defaite De Dijon Face A Concarneau 0 1 En National 2 04 04 2025

May 09, 2025 -

National 2 Dijon Concede La Defaite Face A Concarneau 0 1

May 09, 2025

National 2 Dijon Concede La Defaite Face A Concarneau 0 1

May 09, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

Uk Immigration Policy Update Restrictions On Visa Applications

May 09, 2025

Uk Immigration Policy Update Restrictions On Visa Applications

May 09, 2025