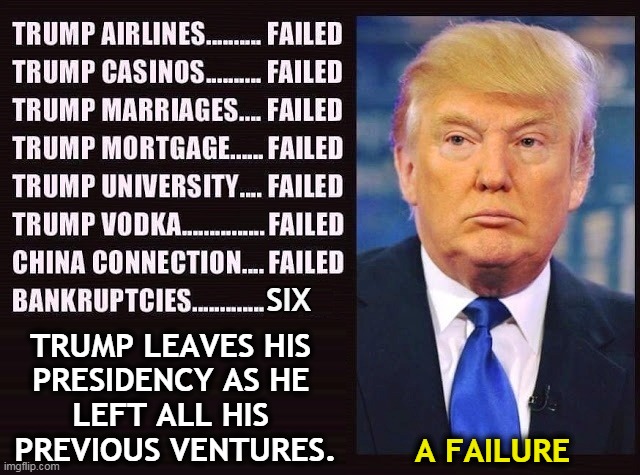

A Look Back: This Week's Business Failures

Table of Contents

The Rise and Fall of "RetailCo": A Case Study in Retail Failure

Financial Mismanagement and Poor Strategic Decisions

RetailCo, a once-promising retail chain, filed for bankruptcy this week, a stark example of business failures stemming from internal issues. Their downfall can be attributed to a confluence of factors:

- Excessive Debt: RetailCo burdened itself with significant debt to fund aggressive expansion, leaving it vulnerable to economic downturns.

- Poor Cash Flow Management: Inefficient inventory management and slow payment collection led to persistent cash flow problems.

- Failed Investments: Investments in unproven technologies and online platforms yielded poor returns, draining valuable resources.

- Ignoring E-commerce Trends: RetailCo failed to adapt to the rapid growth of online shopping, losing market share to more agile competitors.

Lessons Learned from RetailCo's Demise

RetailCo's failure underscores the importance of several key business practices:

- Proactive Financial Planning: Robust financial models and careful budgeting are essential to avoid excessive debt and ensure consistent profitability. Effective financial planning helps prevent business failures.

- Adaptable Business Strategies: Businesses must remain flexible and adaptable to changing market conditions and consumer preferences. Ignoring emerging trends is a recipe for disaster.

- Market Research and Competitive Analysis: Thorough market research and understanding the competitive landscape are vital for informed decision-making and strategic planning.

"TechNova"'s Bankruptcy: A Warning Sign for the Tech Sector

The Impact of Supply Chain Disruptions

TechNova, a tech startup specializing in innovative hardware, declared bankruptcy this week, largely due to supply chain disruptions.

- Component Shortages: Global supply chain issues led to significant delays and shortages of crucial components, halting production and delaying product launches.

- Increased Costs: The scarcity of components drove up prices, squeezing profit margins and impacting the company's ability to compete.

- Ineffective Contingency Planning: TechNova lacked robust contingency plans to mitigate the impact of supply chain disruptions.

The Importance of Diversification and Supply Chain Resilience

TechNova's experience highlights the critical need for:

- Supply Chain Diversification: Relying on a single supplier or region increases vulnerability. Diversification across multiple suppliers and geographical locations is crucial.

- Supply Chain Resilience: Businesses need to develop strategies to anticipate and respond to potential disruptions, including building safety stock and exploring alternative sourcing options.

- Strategic Partnerships: Collaborating with reliable suppliers and building strong partnerships can strengthen supply chain resilience.

"GreenEnergyCorp"'s Liquidation: A Symptom of a Broader Economic Trend?

Analyzing the Role of Rising Interest Rates

GreenEnergyCorp, a renewable energy company, entered liquidation this week, partly due to the impact of rising interest rates.

- Increased Borrowing Costs: Higher interest rates increased the cost of borrowing, making it difficult for the company to service its debt.

- Reduced Investment: Rising interest rates also made it more expensive for investors to fund new projects, limiting growth opportunities.

- Decreased Consumer Spending: Higher interest rates can lead to decreased consumer spending, impacting demand for GreenEnergyCorp's products.

Navigating Economic Uncertainty: Strategies for Survival

To navigate economic uncertainties, businesses should consider:

- Cost Optimization: Identifying and eliminating unnecessary expenses is crucial for improving profitability during tough economic times.

- Cash Reserve Management: Maintaining strong cash reserves provides a buffer against unexpected economic shocks.

- Access to Credit: Securing access to credit lines or other forms of financing can provide crucial support during periods of economic instability.

- Effective Communication: Open and honest communication with stakeholders is essential for maintaining trust and confidence during challenging times.

Conclusion

This week's business failures serve as stark reminders of the inherent risks in the business world. From financial mismanagement to external economic pressures, a combination of factors can contribute to a company's downfall. By understanding the causes behind these failures – analyzing cases of poor financial planning, supply chain vulnerabilities, and the impact of economic downturns – businesses can learn valuable lessons and implement strategies to improve their own resilience and mitigate risks. Staying informed about the latest trends in business failures is crucial for long-term success. Continue to monitor news related to business failures to identify potential pitfalls and stay ahead of the curve. Understanding the complexities surrounding business failures is paramount for safeguarding your business's future.

Featured Posts

-

Is Refinancing Federal Student Loans Worth It

May 17, 2025

Is Refinancing Federal Student Loans Worth It

May 17, 2025 -

Global Oil Market News And Price Analysis May 16 2024

May 17, 2025

Global Oil Market News And Price Analysis May 16 2024

May 17, 2025 -

Josh Cavallos Post Coming Out Success Inspiration And Impact

May 17, 2025

Josh Cavallos Post Coming Out Success Inspiration And Impact

May 17, 2025 -

Mariners Vs Tigers Series Injury Report March 31 April 2

May 17, 2025

Mariners Vs Tigers Series Injury Report March 31 April 2

May 17, 2025 -

First Look Ralph Laurens Fall 2025 Riser Presentation

May 17, 2025

First Look Ralph Laurens Fall 2025 Riser Presentation

May 17, 2025

Latest Posts

-

Choosing The Best Crypto Casino In 2025 Jack Bits Features And Benefits

May 17, 2025

Choosing The Best Crypto Casino In 2025 Jack Bits Features And Benefits

May 17, 2025 -

Best Bitcoin Casino 2025 Jack Bit A Comprehensive Review

May 17, 2025

Best Bitcoin Casino 2025 Jack Bit A Comprehensive Review

May 17, 2025 -

Jack Bit Review Is It The Best Crypto Casino For 2025

May 17, 2025

Jack Bit Review Is It The Best Crypto Casino For 2025

May 17, 2025 -

Top Bitcoin Online Casino 2025 Why Jack Bit Is The Best Crypto Casino

May 17, 2025

Top Bitcoin Online Casino 2025 Why Jack Bit Is The Best Crypto Casino

May 17, 2025 -

Find The Best Crypto Casinos In 2025 Compare Top Bitcoin Casinos With Easy Withdrawals

May 17, 2025

Find The Best Crypto Casinos In 2025 Compare Top Bitcoin Casinos With Easy Withdrawals

May 17, 2025