Ace Your Private Credit Job Interview: 5 Essential Tips

Table of Contents

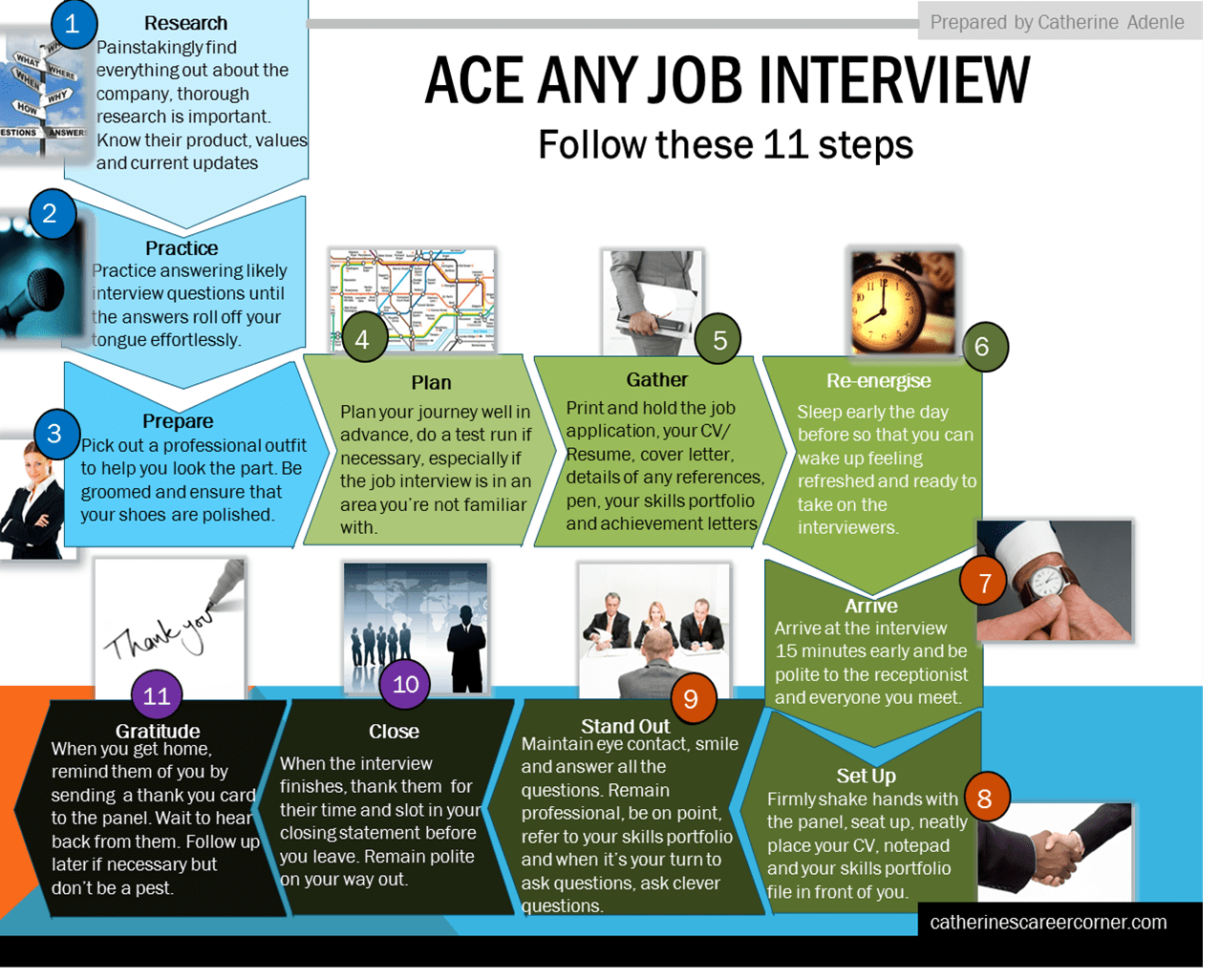

Research the Firm and the Role Thoroughly

Understanding the firm's investment strategy, portfolio companies, and recent transactions is crucial for a successful private credit job interview. Demonstrating your knowledge showcases your initiative and genuine interest. Go beyond simply reading their website; delve into their recent activities to understand their current focus and challenges.

- Analyze the firm's website and recent press releases: Look for details about their investment thesis, target sectors, and recent fund closings. This demonstrates your understanding of their current market positioning and investment strategy within the broader private credit landscape.

- Research the team members you'll be interviewing with on LinkedIn: Understanding their backgrounds and experience will allow you to tailor your responses and ask more relevant questions. This shows you've done your homework and are genuinely interested in the specific team and its culture.

- Identify key competitors and understand the firm's competitive advantage: Knowing the competitive landscape demonstrates your market awareness and analytical skills. Highlight your understanding of how the firm differentiates itself in the competitive private credit market.

- Prepare insightful questions to demonstrate your genuine interest: Asking thoughtful questions about their investment process, portfolio companies, or challenges faced is crucial. This shows your proactive nature and deep interest in the firm and the role. Avoid generic questions easily answered through basic online research.

Showcase Your Financial Modeling and Analytical Skills

Private credit roles demand strong financial modeling and analytical capabilities. Be ready to discuss your experience with specific examples, showcasing your proficiency in relevant software and your ability to analyze complex financial information. Employers are looking for candidates who can not only build models but also interpret the results and draw meaningful conclusions.

- Quantify your achievements whenever possible using metrics and data: Use concrete examples to illustrate your impact. For example, "Increased portfolio yield by 15% through improved credit risk assessment."

- Discuss your experience with financial statement analysis, valuation, and credit risk assessment: Highlight your expertise in interpreting financial statements, conducting valuations using various methodologies (DCF, precedent transactions, etc.), and assessing credit risk. Mention specific software you are proficient in (Excel, Bloomberg Terminal, Argus, etc.).

- Be prepared to walk through a complex financial model or case study: Practice explaining your modeling approach and assumptions clearly and concisely. This is a key skill in private credit.

- Emphasize your ability to identify key risks and opportunities: Demonstrate your critical thinking skills by highlighting instances where you identified potential problems or opportunities and the actions you took.

Demonstrate Understanding of Credit Risk and Due Diligence

Private credit inherently involves significant credit risk. Highlighting your understanding of credit analysis methodologies and your experience with due diligence processes is vital. This demonstrates your ability to assess risk accurately and make informed investment decisions. Focus on practical experience rather than theoretical knowledge.

- Explain your approach to assessing creditworthiness and identifying red flags: Outline your methodology for analyzing borrowers' financial statements, assessing their management team, and identifying potential red flags. Mention specific credit metrics you utilize (e.g., leverage ratios, interest coverage ratios, debt service coverage ratios).

- Discuss your experience with various credit metrics (e.g., leverage ratios, coverage ratios): Be prepared to explain how different metrics provide insights into a borrower's creditworthiness and risk profile.

- Demonstrate an understanding of different types of credit facilities and their associated risks: Discuss your familiarity with senior secured loans, subordinated debt, mezzanine financing, and other credit instruments. Highlight your understanding of the risks associated with each type of facility.

- Mention any relevant certifications or training you have completed: Certifications like the CFA, CAIA, or other relevant training programs demonstrate your commitment to professional development in the finance industry.

Highlight Your Networking and Relationship-Building Skills

Success in private credit often hinges on strong relationships with borrowers, investors, and colleagues. Showcase your ability to build rapport, negotiate effectively, and manage relationships – these soft skills are highly valued. Use the STAR method to illustrate your skills with concrete examples.

- Provide specific examples of how you've built and maintained relationships in previous roles: Detail how you've developed relationships with clients, colleagues, or other stakeholders to achieve a positive outcome.

- Emphasize your ability to communicate complex information clearly and concisely: Private credit deals often involve complex financial structures. Show how you can translate these into easily understandable terms for various audiences.

- Describe your experience working in team environments and contributing to collaborative success: Private credit involves teamwork; highlighting your collaborative spirit is essential.

- Demonstrate your ability to handle challenging conversations and resolve conflicts professionally: Conflicts are inevitable; demonstrate your ability to address these professionally and find mutually agreeable solutions.

Prepare Thoughtful Questions to Ask the Interviewers

Asking insightful questions shows your engagement and genuine interest in the opportunity. Focus on questions that reveal your understanding of the firm, the role, and the industry—avoiding those easily answered through basic research.

- Prepare questions about the firm's investment strategy and future plans: Show you are thinking strategically about their direction in the private credit market.

- Inquire about the team dynamics and mentorship opportunities: Demonstrate your interest in learning and growing within the firm's culture.

- Ask about the firm's culture and work-life balance: This demonstrates your concern for long-term fit and well-being within the organization.

- Seek clarification on any aspects of the role that are unclear: This shows your attentiveness to detail and proactive nature.

Conclusion

Acing your private credit job interview requires preparation, practice, and a clear understanding of the industry. By following these five essential tips – thorough research, showcasing your analytical skills, demonstrating your understanding of credit risk, highlighting your networking abilities, and asking thoughtful questions – you'll significantly improve your chances of securing your dream role. Remember to practice your responses and tailor them to each specific opportunity. Mastering these techniques will help you successfully navigate the private credit job interview process and land the position you desire. Start preparing today to ace your next private credit job interview!

Featured Posts

-

Tragedy Strikes North Carolina University Shooting Results In Fatalities And Injuries

Apr 29, 2025

Tragedy Strikes North Carolina University Shooting Results In Fatalities And Injuries

Apr 29, 2025 -

Arson In Germany Georgian Man Detained Wife The Victim

Apr 29, 2025

Arson In Germany Georgian Man Detained Wife The Victim

Apr 29, 2025 -

What We Learned About Treasuries On April 8th

Apr 29, 2025

What We Learned About Treasuries On April 8th

Apr 29, 2025 -

Anthony Edwards And Ayesha Howard Custody Battle Concludes

Apr 29, 2025

Anthony Edwards And Ayesha Howard Custody Battle Concludes

Apr 29, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 29, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 29, 2025

Latest Posts

-

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 29, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 29, 2025 -

Hudsons Bay Liquidation Sale Final Markdowns Up To 70

Apr 29, 2025

Hudsons Bay Liquidation Sale Final Markdowns Up To 70

Apr 29, 2025 -

Hudsons Bay Closing Sales Up To 70 Off At Remaining Stores

Apr 29, 2025

Hudsons Bay Closing Sales Up To 70 Off At Remaining Stores

Apr 29, 2025 -

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 29, 2025

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 29, 2025 -

Yukon Politicians Cite Contempt Over Mine Managers Evasive Answers

Apr 29, 2025

Yukon Politicians Cite Contempt Over Mine Managers Evasive Answers

Apr 29, 2025