Activision Blizzard Acquisition: FTC's Appeal And Future Uncertainties

Table of Contents

The FTC's Arguments Against the Acquisition

The Federal Trade Commission (FTC) launched an antitrust lawsuit to block Microsoft's acquisition of Activision Blizzard, citing serious concerns about anti-competitive practices. Their central argument revolves around the potential for Microsoft to leverage its control over Activision Blizzard's vast portfolio of games, especially the immensely popular Call of Duty, to stifle competition.

- Loss of competition in the gaming console market: The FTC argues that Microsoft's acquisition would significantly reduce competition in the console market, giving Microsoft an unfair advantage over rivals like Sony and Nintendo.

- Potential for Microsoft to exclude rivals from accessing Activision Blizzard's titles: A key concern is that Microsoft could make Call of Duty and other popular titles exclusive to its Xbox ecosystem, thereby harming competitors and potentially limiting consumer choice. This relates directly to the FTC lawsuit and the broader concerns around Microsoft monopoly power in the gaming sector.

- Concerns about pricing strategies post-acquisition: The FTC worries that Microsoft could use its increased market power to inflate prices for Activision Blizzard games or implement anti-competitive pricing strategies.

- The FTC's proposed remedies and why they were rejected: The FTC initially proposed remedies to mitigate these concerns, but Microsoft rejected these proposals, leading to the ongoing legal battle.

Microsoft's Defense and Counterarguments

Microsoft has vehemently defended the acquisition, arguing that the FTC's concerns are unfounded and that the merger will ultimately benefit gamers and developers. Their counterarguments focus on maintaining competitive practices and consumer choice.

- Promises to keep Call of Duty on PlayStation and other platforms: Microsoft has repeatedly pledged to continue releasing Call of Duty on PlayStation consoles and other competing platforms, ensuring that gamers on rival systems won't be left out. This addresses a core element of the Microsoft acquisition defense strategy.

- Arguments against the claim of a significant market share loss: Microsoft maintains that the acquisition won't significantly alter the competitive landscape, arguing that its market share remains relatively small compared to other major players. This relates to their arguments against claims of gaming market share dominance.

- Highlighting the benefits of the acquisition for gamers and developers: Microsoft emphasizes the potential for innovation and expanded game development opportunities as a result of the merger.

- Discussion of Microsoft's proposed concessions: To appease regulators, Microsoft has offered various concessions, including long-term contracts to keep Call of Duty on PlayStation, but these have not fully satisfied the FTC.

The Appeal Process and Potential Outcomes

The FTC's appeal against the judge's ruling in favor of the acquisition is now underway. This legal process will likely be lengthy and complex, potentially spanning several months or even years.

- Explanation of the legal procedures involved in the FTC's appeal: The appeals process involves detailed legal arguments, evidence submissions, and potential court hearings before a higher court.

- Potential scenarios: FTC wins, Microsoft wins, settlement reached: Several outcomes are possible: the FTC could prevail, reversing the lower court's decision; Microsoft could win, solidifying its acquisition; or a settlement could be reached between the parties.

- Impact of the appeal on the gaming industry's future: The outcome will profoundly impact the future of the gaming industry, setting a significant precedent for future mergers and acquisitions in the sector.

- Potential implications for future mergers and acquisitions in the tech sector: This case has broad implications beyond gaming, potentially influencing regulatory approaches towards mergers and acquisitions in other technology sectors.

International Regulatory Approvals

The Activision Blizzard acquisition has also faced scrutiny from regulatory bodies worldwide. The EU and the UK, among others, have also undertaken their investigations.

- Successes and failures in different jurisdictions: While some jurisdictions have approved the merger, others have expressed concerns, leading to a fragmented regulatory landscape.

- How international approvals could impact the overall outcome: International regulatory decisions could significantly influence the ultimate outcome of the acquisition, either accelerating or derailing the process. The differing approaches to EU competition law and UK CMA regulations highlight the complexities involved.

Conclusion

The FTC's appeal against the Microsoft-Activision Blizzard acquisition presents a crucial juncture for the gaming industry. The FTC's concerns about anti-competitive practices, particularly regarding Call of Duty exclusivity, stand in contrast to Microsoft's arguments about fostering innovation and maintaining competition. The appeal process, involving legal intricacies and international regulatory variations, will shape the future of gaming mergers and acquisitions. The potential outcomes – FTC victory, Microsoft victory, or a negotiated settlement – carry significant weight, impacting not only the gaming landscape but also setting precedents for future tech sector mergers.

Keep track of the latest developments in the Activision Blizzard acquisition to stay ahead of the curve on this landmark case shaping the future of gaming. Understanding the nuances of this complex legal battle is vital for anyone invested in the future of the gaming industry and its regulatory environment.

Featured Posts

-

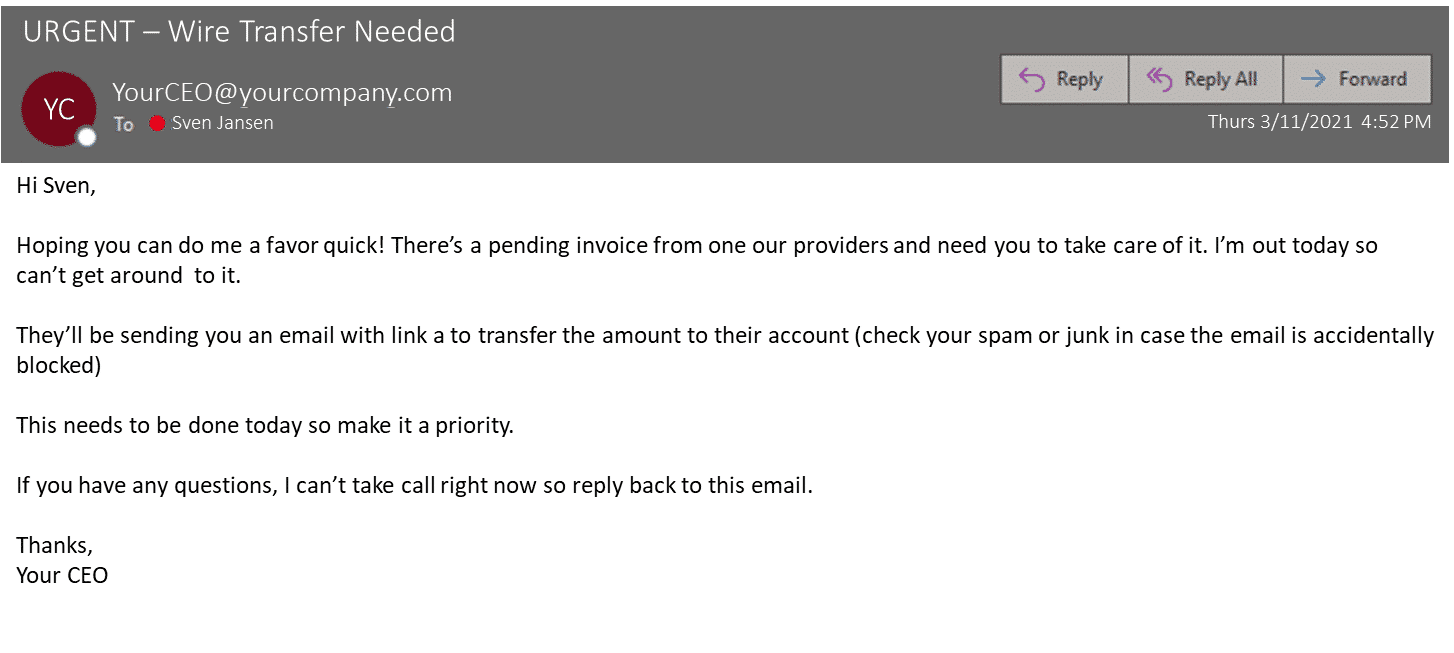

Federal Investigation Millions Stolen Through Office365 Executive Email Compromise

Apr 24, 2025

Federal Investigation Millions Stolen Through Office365 Executive Email Compromise

Apr 24, 2025 -

The Untapped Potential Of Middle Management Maximizing Their Contribution To Business Growth

Apr 24, 2025

The Untapped Potential Of Middle Management Maximizing Their Contribution To Business Growth

Apr 24, 2025 -

Watch John Travolta Savor A Pulp Fiction Steak In Miami

Apr 24, 2025

Watch John Travolta Savor A Pulp Fiction Steak In Miami

Apr 24, 2025 -

Oblivion Remastered Official Release Date And Details

Apr 24, 2025

Oblivion Remastered Official Release Date And Details

Apr 24, 2025 -

Fewer Border Crossings At Canada U S Border White House Report

Apr 24, 2025

Fewer Border Crossings At Canada U S Border White House Report

Apr 24, 2025