Activision Blizzard Deal Faces FTC Appeal

Table of Contents

The FTC's Concerns Regarding the Activision Blizzard Acquisition

The FTC's primary concern centers around the potential for anti-competitive behavior stemming from Microsoft's control over Activision Blizzard's vast portfolio of games, most notably the immensely popular Call of Duty franchise. The commission argues that this acquisition could lead to a monopoly, giving Microsoft undue market dominance and negatively impacting consumers. Their arguments rest on several key pillars:

-

Reduced competition in the console gaming market: The FTC worries that Microsoft could leverage its ownership of Activision Blizzard to hinder competitors like Sony PlayStation, potentially creating an uneven playing field and limiting consumer choice. This concern is particularly acute given the popularity of Call of Duty.

-

Potential for higher prices for gamers: With less competition, the FTC argues that Microsoft could justify raising prices for Activision Blizzard games, including Call of Duty, impacting gamers' wallets.

-

Limited consumer choice: By controlling key franchises like Call of Duty, the FTC believes Microsoft could make those titles exclusive to its Xbox ecosystem, thereby limiting consumer choice and potentially forcing gamers to switch platforms.

-

Microsoft's potential to leverage its ownership of Activision Blizzard to harm competitors: The FTC argues that Microsoft could use its newly acquired power to disadvantage rival game developers and publishers, creating a less competitive and innovative gaming market. This includes the potential for exclusive content deals and anti-competitive pricing practices. Keywords: anti-competitive, monopoly, market dominance, Call of Duty exclusivity, price increases.

Microsoft's Defense of the Activision Blizzard Deal

Microsoft strongly refutes the FTC's claims, asserting that the acquisition will ultimately benefit consumers through increased innovation and enhanced gaming experiences. Their key arguments include:

-

The merger will benefit consumers through innovation and enhanced gaming experiences: Microsoft promises to invest heavily in Activision Blizzard's franchises, leading to improved game quality, more frequent updates, and ultimately a richer gaming experience for consumers.

-

Microsoft's commitment to keeping Call of Duty available across multiple platforms: Microsoft has repeatedly pledged to continue releasing Call of Duty on PlayStation and other competing platforms, aiming to alleviate the FTC's concerns about exclusivity.

-

The merger will foster competition within the broader gaming market: Microsoft argues that the combined strengths of Microsoft and Activision Blizzard will lead to greater competition within the gaming market, driving innovation and benefiting consumers with more choices and better value. Keywords: innovation, competition, consumer benefit, Call of Duty availability, cross-platform gaming.

The Potential Outcomes of the FTC Appeal and its Impact on the Gaming Industry

The FTC's appeal could result in several outcomes: a complete FTC victory blocking the merger, a Microsoft victory upholding the acquisition, or a negotiated settlement. Each scenario will have far-reaching implications for the gaming industry:

-

FTC Victory: This would set a significant precedent for future mergers and acquisitions in the tech sector, potentially increasing regulatory scrutiny and making large-scale acquisitions more difficult. It could also lead to increased price competition and more cross-platform gaming.

-

Microsoft Victory: This would allow the merger to proceed, potentially leading to increased consolidation in the gaming industry. The long-term effects on competition and consumer prices remain uncertain.

-

Negotiated Settlement: A compromise could involve Microsoft agreeing to certain concessions, such as stricter commitments to cross-platform game availability, to appease the FTC and secure approval for the merger.

The outcome will undoubtedly influence:

- Future game pricing strategies.

- Console market share dynamics.

- Game development and distribution models.

- The regulatory landscape for future antitrust cases in the tech sector. Keywords: antitrust implications, merger approval, regulatory landscape, future acquisitions, gaming market dynamics.

The Future of the Activision Blizzard Deal and its Implications

The FTC's appeal against the Microsoft-Activision Blizzard merger presents a critical juncture for the gaming industry. The arguments put forth by both sides highlight the complex interplay between market competition, innovation, and consumer welfare. The outcome will shape the future of gaming mergers and acquisitions and set a precedent for antitrust regulations in the tech sector. While predicting the ultimate outcome is challenging, the potential impacts are far-reaching and will undoubtedly impact gamers and the gaming industry for years to come. Follow the Activision Blizzard merger saga; stay updated on the FTC appeal and learn more about the antitrust implications of the Activision Blizzard deal. Share your opinions on this landmark case and contribute to the ongoing discussion.

Featured Posts

-

Addressing Stock Market Valuation Anxiety Insights From Bof A

Apr 29, 2025

Addressing Stock Market Valuation Anxiety Insights From Bof A

Apr 29, 2025 -

Teen Guilty Of Murder After Fatal Rock Throwing

Apr 29, 2025

Teen Guilty Of Murder After Fatal Rock Throwing

Apr 29, 2025 -

The Rise Of Disaster Betting Examining The Market For Wagers On The Los Angeles Wildfires

Apr 29, 2025

The Rise Of Disaster Betting Examining The Market For Wagers On The Los Angeles Wildfires

Apr 29, 2025 -

Cassidy Hutchinson Memoir Details Of Her Jan 6 Testimony Revealed

Apr 29, 2025

Cassidy Hutchinson Memoir Details Of Her Jan 6 Testimony Revealed

Apr 29, 2025 -

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

Latest Posts

-

Nine Fatalities Reported After Vehicle Strikes Crowd At Vancouvers Filipino Festival

Apr 29, 2025

Nine Fatalities Reported After Vehicle Strikes Crowd At Vancouvers Filipino Festival

Apr 29, 2025 -

Car Plows Into Crowd At Vancouver Filipino Festival Leaving Nine Dead

Apr 29, 2025

Car Plows Into Crowd At Vancouver Filipino Festival Leaving Nine Dead

Apr 29, 2025 -

Vancouver Filipino Festival Tragedy Nine Dead After Car Incident

Apr 29, 2025

Vancouver Filipino Festival Tragedy Nine Dead After Car Incident

Apr 29, 2025 -

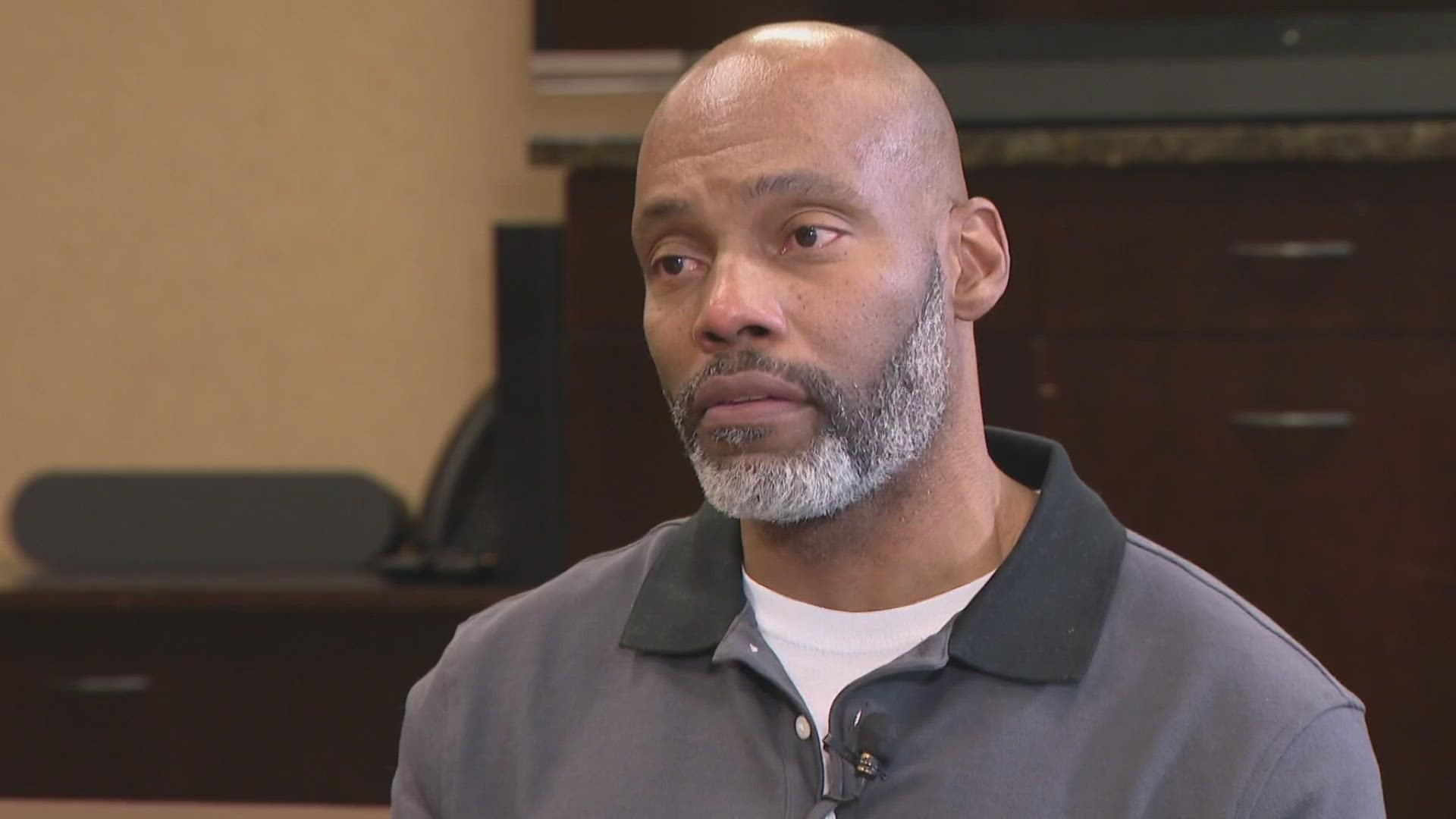

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025