Addressing Investor Anxiety: BofA's View On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's market analysis provides a crucial lens through which to view the current high stock market valuations. Their reports often cite a combination of factors contributing to these elevated levels. Understanding these factors is key to managing investor anxiety effectively.

-

Summary of BofA's recent reports: BofA's recent research frequently highlights the interplay between low interest rates, strong corporate earnings, and sustained technological innovation as primary drivers of high stock valuations. They acknowledge that these factors contribute to increased investor confidence, leading to higher demand and, consequently, inflated prices. Specific reports should be referenced here, linking directly to BofA's published material for SEO purposes. (Example: Link to BofA report on Market Valuation - Insert Link Here)

-

BofA's economic forecasts: BofA's economic forecasts play a vital role in shaping their market outlook. Their predictions regarding inflation, economic growth, and potential interest rate hikes significantly influence their assessment of market risks and opportunities. For example, if BofA anticipates a period of moderate inflation and sustained economic growth, their outlook on stock valuations might be more positive compared to a scenario predicting rapid inflation and a potential recession.

-

Key factors contributing to high valuations: Beyond the factors mentioned above, BofA might also highlight other influences such as government stimulus packages, global supply chain dynamics, and shifts in consumer spending habits. Understanding these contributing factors allows investors to assess the sustainability of current valuations and to better anticipate potential market shifts.

-

Potential risks: BofA's analysis invariably includes a discussion of potential risks. These could include:

- Inflation: High inflation erodes purchasing power and can lead to interest rate hikes, impacting stock valuations.

- Interest rate hikes: Increased interest rates can decrease corporate profits and make borrowing more expensive, potentially triggering a market correction.

- Geopolitical uncertainties: Global political instability and international conflicts can create significant market volatility and uncertainty.

Identifying Potential Investment Opportunities Amidst Anxiety

While high stock market valuations present challenges, BofA’s analyses also identify potential investment opportunities for discerning investors. A well-defined strategy is crucial to address investor anxiety effectively.

-

Identifying undervalued stocks or sectors: BofA may suggest focusing on specific sectors or companies that demonstrate strong fundamentals despite the broader market's high valuations. This requires careful analysis of financial statements, industry trends, and competitive landscapes.

-

Portfolio diversification strategies: Diversification is paramount in mitigating risk. BofA might recommend diversifying across different asset classes (stocks, bonds, real estate, commodities) and geographic regions to reduce the overall portfolio's sensitivity to market fluctuations.

-

Long-term investment strategies: BofA likely emphasizes the importance of a long-term investment horizon. Short-term market fluctuations should be viewed within the context of a broader, long-term investment plan. This perspective can significantly reduce investor anxiety.

-

Risk-adjusted returns: The focus should shift from chasing short-term gains to prioritizing risk-adjusted returns. This involves understanding and accepting a certain level of risk in pursuit of higher potential rewards, but always within the parameters of one's risk tolerance.

-

Attractive sectors and asset classes: Specific sectors or asset classes that BofA might consider relatively attractive during periods of high valuations could include (examples only – based on hypothetical BofA recommendations): companies with strong defensive characteristics, certain emerging markets, or specific types of bonds offering yield in a low-interest-rate environment.

Managing Investor Anxiety and Risk Mitigation Strategies

Investor anxiety is a natural response to market volatility. However, effective risk management strategies can significantly reduce this anxiety and protect portfolios.

-

Managing emotional responses: BofA might advise investors to avoid emotional decision-making during periods of market uncertainty. Sticking to a well-defined investment plan, regardless of short-term market fluctuations, is critical.

-

Portfolio protection strategies: Strategies like hedging (using derivatives to offset potential losses) or employing stop-loss orders (automatically selling assets when they reach a predefined price) can help protect portfolios during market downturns.

-

Importance of a well-defined investment plan: A robust investment plan tailored to individual risk tolerance and financial goals is essential. This plan should outline investment objectives, asset allocation strategies, and risk management measures.

-

Financial planning's role: Comprehensive financial planning plays a crucial role in managing investor anxieties by providing a long-term perspective and ensuring financial security. It helps to develop a plan that addresses all aspects of one’s financial life, beyond just investments.

-

Seeking professional financial advice: When investor anxiety becomes overwhelming, or when navigating complex investment decisions, seeking advice from a qualified financial advisor is highly recommended.

Conclusion

High stock market valuations are understandably causing investor anxiety. BofA's analysis provides valuable insights into navigating this challenging market environment. By understanding their assessment of current conditions, potential risks, and suggested strategies, investors can make more informed decisions and manage their portfolios effectively. Remember, a well-diversified portfolio and a long-term investment strategy are crucial in mitigating risk and achieving financial goals.

Call to Action: Don't let investor anxiety paralyze you. Learn more about BofA's perspective on high stock market valuations and develop a robust investment strategy that aligns with your risk tolerance and financial objectives. Take control of your financial future and address your investor anxiety proactively.

Featured Posts

-

B And B April 9 Recap Steffy Blames Bill Finns Icu Status Liams Demand For Secrecy

Apr 24, 2025

B And B April 9 Recap Steffy Blames Bill Finns Icu Status Liams Demand For Secrecy

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025 -

Guilty Plea Lab Owner Falsified Covid 19 Test Results

Apr 24, 2025

Guilty Plea Lab Owner Falsified Covid 19 Test Results

Apr 24, 2025 -

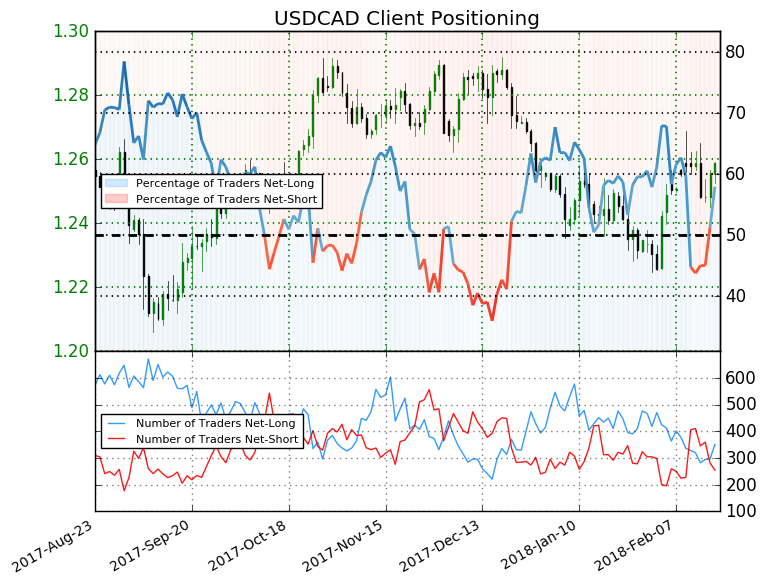

Recent Shifts In The Canadian Dollar Exchange Rate

Apr 24, 2025

Recent Shifts In The Canadian Dollar Exchange Rate

Apr 24, 2025