After A 400% Rise, Where Does XRP Go From Here? A Market Analysis

Table of Contents

Analyzing the Factors Behind XRP's 400% Surge

Several factors have contributed to XRP's remarkable price increase. Let's delve into the key elements driving this surge:

The Ripple Effect: Legal Battles and Community Sentiment

Ripple's ongoing legal battle with the Securities and Exchange Commission (SEC) has cast a long shadow over XRP's price. While the SEC alleges XRP is an unregistered security, positive developments in the case have often resulted in significant price rallies.

- Positive Legal Developments: Favorable court rulings or settlements could significantly boost XRP's price, as it would remove a major uncertainty hanging over the cryptocurrency.

- Community Sentiment: The strong and active XRP community plays a significant role. Positive news and community support can fuel buying pressure, driving up the price.

- Potential Outcomes: The legal battle's outcome remains uncertain, and its impact on XRP's future price is difficult to predict with certainty. A positive resolution could lead to substantial growth, while a negative outcome might trigger a sharp correction.

Increased Institutional Interest

The growing interest from institutional investors is another significant factor driving XRP's price. Large-scale investments can inject substantial liquidity into the market and push prices higher.

- Evidence of Institutional Adoption: Although not explicitly confirmed in many cases, increased trading volume and on-chain analysis suggest that institutional players are gradually entering the XRP market.

- Trading Volume Analysis: A surge in trading volume alongside price increases often indicates significant institutional involvement. Analyzing these trends can provide valuable insights into future price movements.

- Potential Future Investment: Continued institutional interest could lead to sustained upward pressure on XRP's price, potentially driving further significant gains.

Market Sentiment and Speculation

Overall market sentiment and speculation play a crucial role in XRP's price volatility. Positive news cycles, social media trends, and general market optimism can fuel speculative buying, pushing the price higher.

- News Cycles: Positive news related to Ripple, XRP, or the broader cryptocurrency market can trigger price rallies. Conversely, negative news can lead to sell-offs.

- Social Media Influence: Social media platforms are powerful tools for disseminating information and influencing market sentiment. Positive or negative sentiment expressed online can affect XRP's price.

- General Market Trends: The overall performance of the cryptocurrency market significantly impacts XRP's price. A bullish market tends to boost XRP's price, while a bearish market can lead to declines.

Potential Future Scenarios for XRP

Predicting the future price of any cryptocurrency is inherently speculative. However, we can explore three potential scenarios for XRP:

Bullish Scenario: Continued Upward Trend

A bullish scenario suggests XRP could continue its upward trajectory.

- Reasons for Continued Growth: A positive resolution in the SEC lawsuit, increased institutional adoption, and a broader bullish cryptocurrency market could all contribute to sustained growth.

- Price Targets: While difficult to pinpoint, a bullish scenario might see XRP reaching significantly higher price levels, potentially exceeding previous all-time highs.

- Supporting Factors: Strong community support, technological advancements within the Ripple ecosystem, and increasing utility of XRP could further fuel the upward momentum.

Bearish Scenario: Price Correction

Conversely, a bearish scenario suggests a potential price correction for XRP.

- Potential Catalysts for a Downturn: An unfavorable outcome in the SEC lawsuit, reduced institutional interest, or a broader cryptocurrency market downturn could all trigger a price correction.

- Price Targets: A bearish scenario could see XRP's price retracing a significant portion of its recent gains.

- Risk Factors: Regulatory uncertainty, market manipulation, and technological vulnerabilities remain significant risk factors.

Neutral Scenario: Price Consolidation

A neutral scenario suggests XRP might consolidate its recent gains, experiencing sideways price movement.

- Factors Contributing to Sideways Movement: A period of consolidation could allow the market to absorb recent gains and establish a new support level before potentially resuming its upward or downward trend.

- Price Ranges: In a neutral scenario, XRP's price might fluctuate within a defined range, neither experiencing significant gains nor substantial losses.

- Timeline Predictions: The duration of a consolidation phase is difficult to predict, but it could potentially last for several weeks or even months.

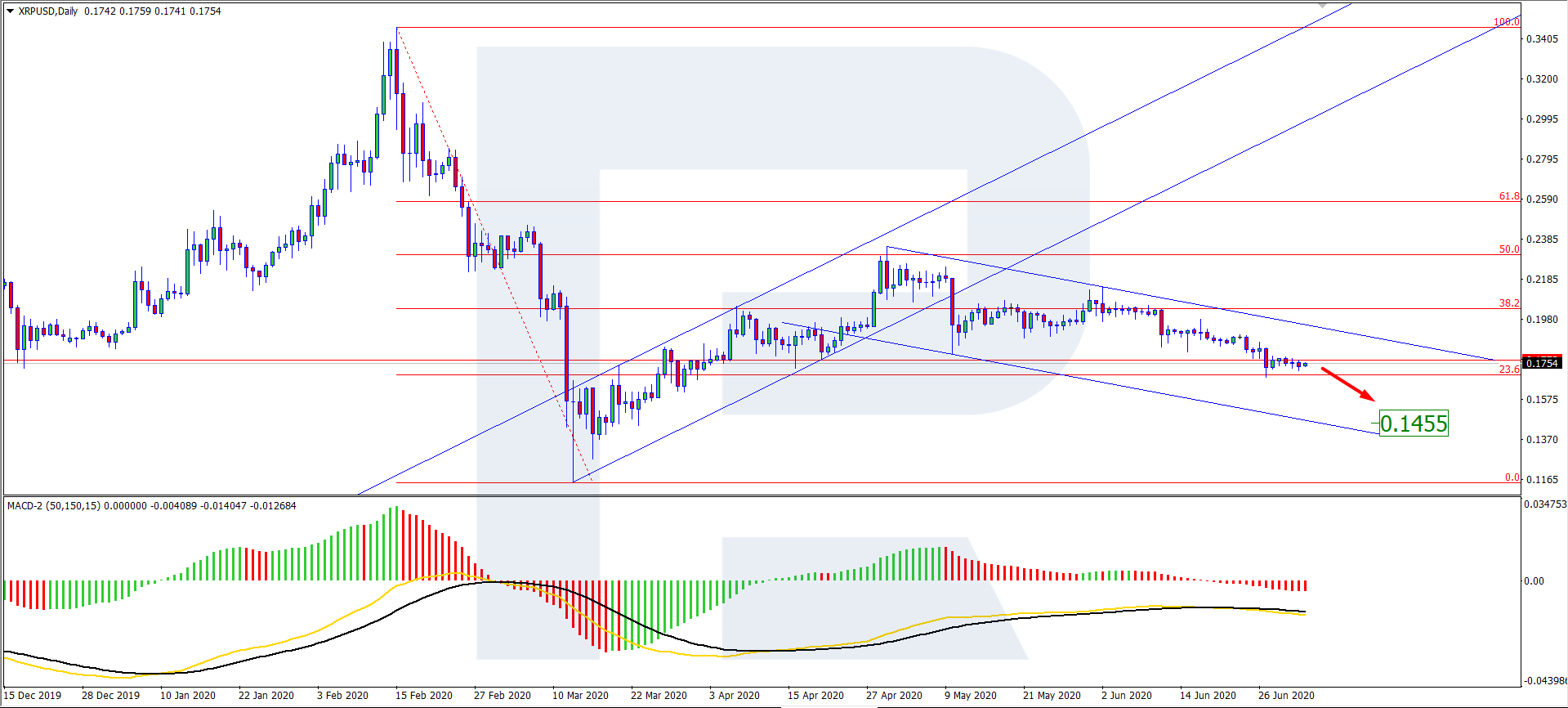

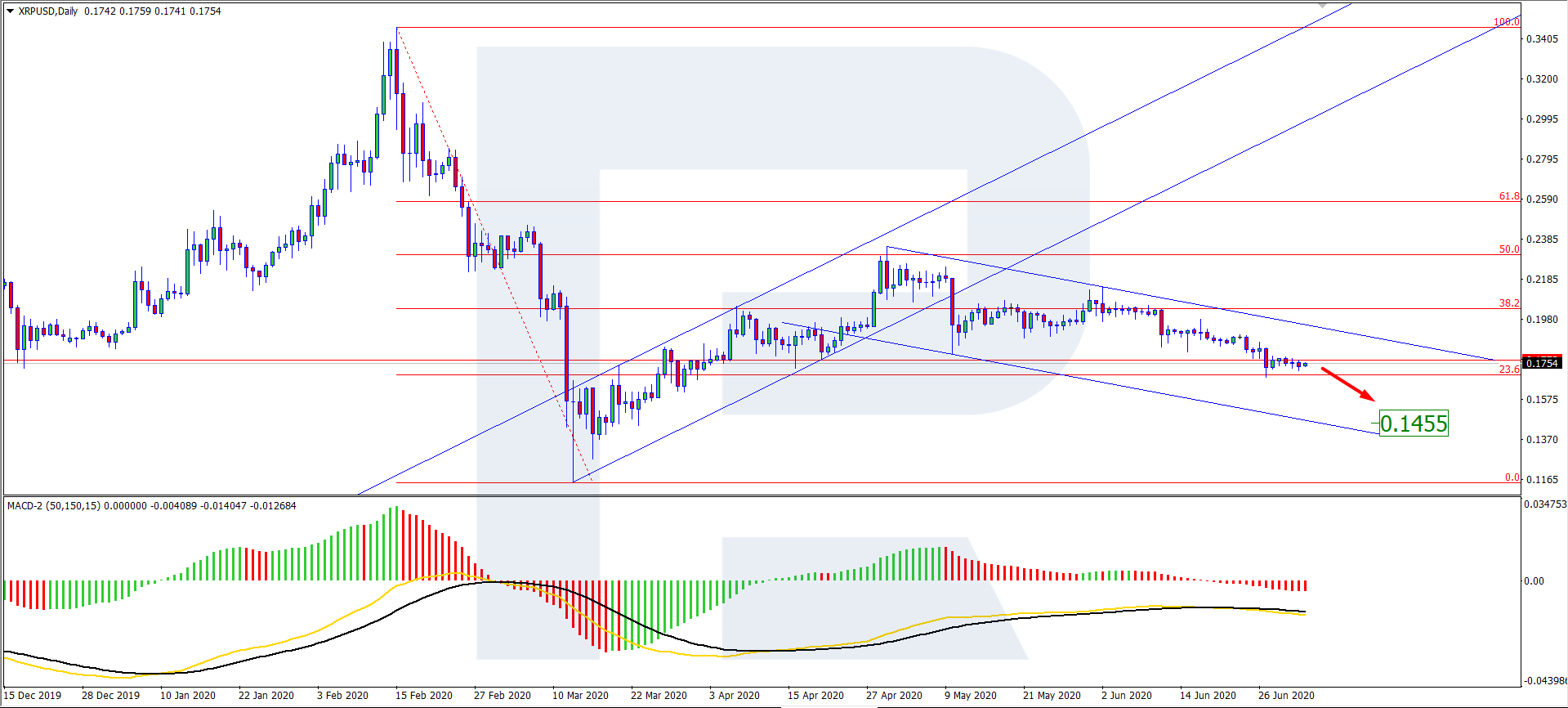

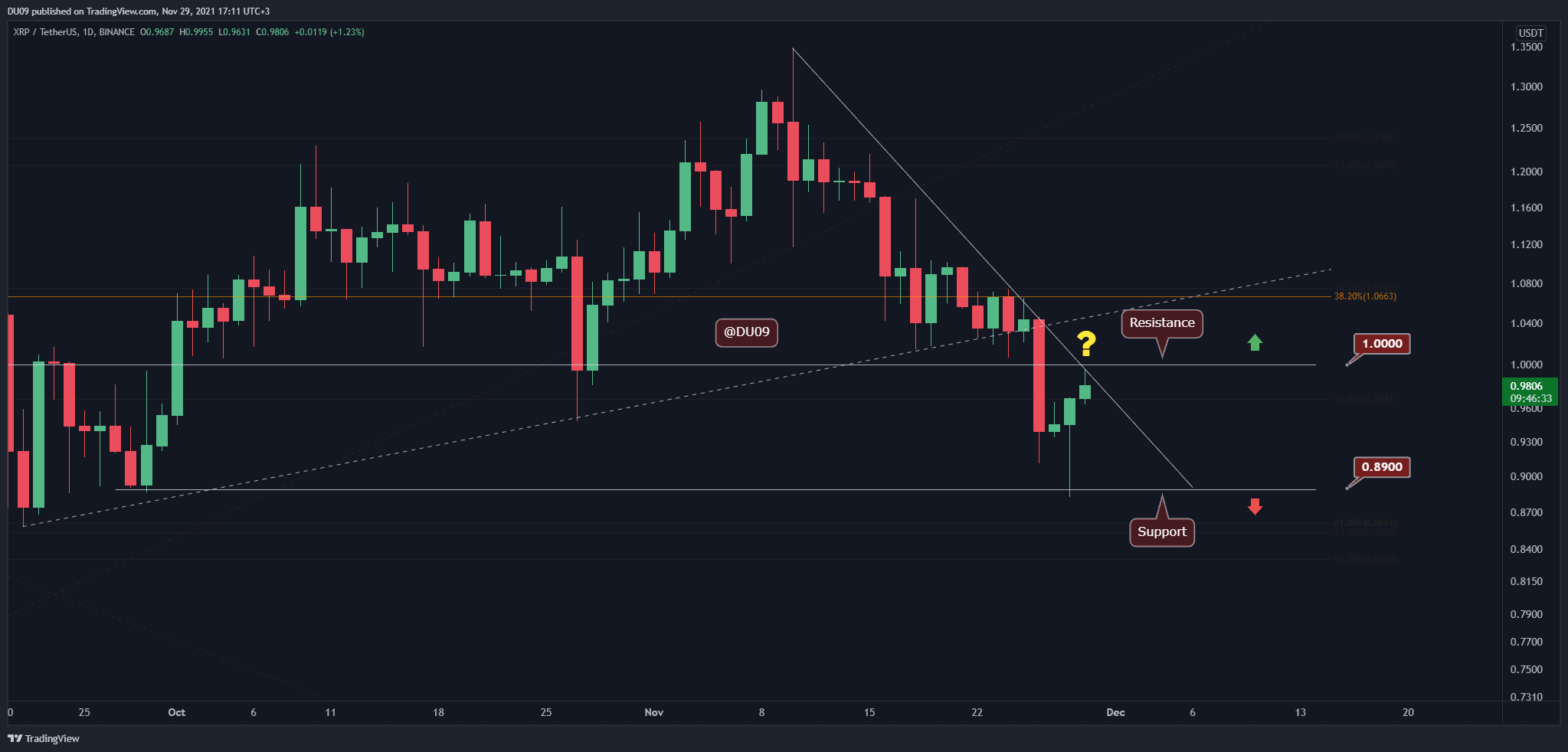

Technical Analysis of XRP's Chart

Technical analysis offers another perspective on XRP's potential future price movements.

Key Support and Resistance Levels

Identifying key support and resistance levels is crucial for assessing potential price reversals or breakouts.

- Chart Patterns: Analyzing chart patterns like head and shoulders, triangles, or flags can offer insights into potential future price movements.

- Technical Indicators (e.g., RSI, MACD): Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help gauge momentum and identify potential overbought or oversold conditions.

- Implications: Breaking through key support or resistance levels often indicates a significant shift in market momentum.

Trading Volume and Momentum

Analyzing trading volume alongside price movements provides further context.

- Volume Spikes: Significant volume spikes accompanying price changes often confirm the strength of the move.

- Trend Confirmation: High volume accompanying an upward trend confirms the bullish momentum, while high volume during a downward trend reinforces the bearish pressure.

- Potential Future Price Action: By combining price action with volume analysis, traders can get a clearer picture of the potential future price action.

Conclusion: XRP's Path Forward – A Cautious Outlook

XRP's recent surge has been dramatic, but its future remains uncertain. Our analysis reveals potential bullish, bearish, and neutral scenarios, each with its own set of supporting factors and risks. The ongoing legal battle with the SEC, institutional adoption, and overall market sentiment remain key variables influencing XRP's price.

Remember, investing in cryptocurrencies like XRP carries significant risk. Conduct thorough research and only invest what you can afford to lose. Before making any investment decisions, consider consulting a financial advisor. Stay tuned for further updates on XRP's price, monitor the XRP market closely, and conduct your own research before investing in XRP.

Featured Posts

-

The Taiwan Dollars Ascent And The Urgent Need For Economic Change

May 08, 2025

The Taiwan Dollars Ascent And The Urgent Need For Economic Change

May 08, 2025 -

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025 -

Lahwr Ky Ahtsab Edaltwn Ka Khatmh Kya Yh Fyslh Drst Tha

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Ka Khatmh Kya Yh Fyslh Drst Tha

May 08, 2025 -

Restaurante Cantina Canalla Resena Y Guia Completa En Malaga

May 08, 2025

Restaurante Cantina Canalla Resena Y Guia Completa En Malaga

May 08, 2025 -

Is The Xrp Recovery Stalling Derivatives Market Insights

May 08, 2025

Is The Xrp Recovery Stalling Derivatives Market Insights

May 08, 2025

Latest Posts

-

Dwp Update Important Information Regarding Your Bank Account And 12 Benefits

May 08, 2025

Dwp Update Important Information Regarding Your Bank Account And 12 Benefits

May 08, 2025 -

Dwp Issues Warning Secure Your 12 Benefits Bank Account Action Needed

May 08, 2025

Dwp Issues Warning Secure Your 12 Benefits Bank Account Action Needed

May 08, 2025 -

Why Scholar Rock Stock Dropped On Monday A Detailed Analysis

May 08, 2025

Why Scholar Rock Stock Dropped On Monday A Detailed Analysis

May 08, 2025 -

12 Dwp Benefits At Risk Verify Your Bank Details Now

May 08, 2025

12 Dwp Benefits At Risk Verify Your Bank Details Now

May 08, 2025 -

Action Needed Dwps Four Word Warning Letter And Uk Benefit Changes

May 08, 2025

Action Needed Dwps Four Word Warning Letter And Uk Benefit Changes

May 08, 2025