Amsterdam Market Tanks 7% At Open: Trade War Weighs Heavily

Table of Contents

The Immediate Impact of the Trade War on Amsterdam Market

The escalating trade war has had an immediate and severe impact on the Amsterdam Market, triggering a significant sell-off. This section explores the specific areas hit hardest and the resulting market volatility.

Sector-Specific Losses

Several sectors within the Amsterdam Market suffered disproportionately. Export-oriented industries, heavily reliant on international trade, bore the brunt of the decline.

- Technology: The tech sector experienced a particularly sharp decline, with a reported 9% drop, reflecting anxieties around disrupted supply chains and reduced consumer demand. Companies like [Insert Example Company Name] saw their market capitalization plummet by [Percentage]%.

- Manufacturing: The manufacturing sector, a cornerstone of the Dutch economy, faced a 8% decrease. This is attributed to the increased cost of imported raw materials and the uncertainty surrounding future export opportunities. [Insert Example Company Name] saw a [Percentage]% drop in its share price.

- Financials: Even the usually stable financial sector felt the impact, recording a 6% decrease, indicating a widespread lack of investor confidence.

[Link to relevant financial news source 1] [Link to relevant financial news source 2]

Investor Sentiment and Market Volatility

The sharp drop in the Amsterdam Market reflects a widespread panic among investors. The uncertainty surrounding the trade war's outcome fueled massive sell-offs, leading to significant market volatility.

- Fear and Uncertainty: Investors reacted to the escalating trade tensions with fear and uncertainty, triggering a wave of panic selling. This behavior is typical in times of heightened geopolitical risk.

- Decreased Investor Confidence: The trade war has eroded investor confidence, leading to a flight to safety and a reduction in overall market liquidity.

- Algorithmic Trading: Algorithmic trading, while often stabilizing, can exacerbate market downturns by amplifying sell-offs based on pre-programmed trading strategies.

Underlying Causes of the Amsterdam Market Decline Beyond the Trade War

While the trade war is the primary driver of the Amsterdam Market's decline, other underlying factors contribute to the overall market uncertainty.

Geopolitical Instability

Geopolitical instability beyond the trade war further compounds the negative pressure on the Amsterdam Market.

- Brexit Fallout: The ongoing uncertainty surrounding Brexit continues to weigh on investor sentiment, impacting cross-border trade and investment flows.

- Global Political Tensions: Rising political tensions in various regions of the world increase overall market uncertainty and risk aversion among investors. These factors create a negative feedback loop, amplifying the impact of the trade war.

Domestic Economic Factors

Internal economic weaknesses within the Netherlands also contribute to the market’s vulnerability.

- Housing Market: The Dutch housing market’s recent slowdown could signal broader economic weakness, impacting investor confidence.

- Dependence on Global Trade: The Netherlands’ strong reliance on global trade makes it particularly susceptible to disruptions caused by trade wars and other international conflicts.

Potential Long-Term Consequences for the Amsterdam Market and Dutch Economy

The 7% drop in the Amsterdam Market signals potential long-term consequences for both the market and the Dutch economy.

Economic Growth Projections

The current market downturn could significantly impact Dutch economic growth.

- GDP Growth Forecast: Reputable economic institutions predict a potential slowdown in GDP growth, with some forecasting a contraction in the coming quarters. [Link to economic forecast].

- Recession Risk: The severity and duration of the trade war could push the Dutch economy into a prolonged recession.

Government Response and Mitigation Strategies

The Dutch government is likely to implement measures to stabilize the market and mitigate the economic fallout.

- Fiscal Stimulus: The government may announce fiscal stimulus packages to boost economic activity and consumer confidence.

- Monetary Policy Adjustments: The Dutch central bank might adjust its monetary policy to support lending and investment.

Opportunities Amidst the Crisis

While the situation is challenging, the market downturn also presents opportunities.

- Undervalued Assets: The decline may create opportunities for investors to acquire undervalued assets at attractive prices for long-term gains.

- Mergers and Acquisitions: Companies facing difficulties might become targets for mergers and acquisitions, leading to industry consolidation.

Conclusion

The 7% plunge in the Amsterdam Market underscores the devastating impact of the escalating trade war. The decline is not solely attributed to trade tensions but is amplified by other geopolitical and domestic economic factors. The potential long-term consequences for the Dutch economy are significant, requiring careful monitoring and proactive government intervention. Understanding the intricacies of the Amsterdam Market and its vulnerability to global trade conflicts is crucial for investors. Stay informed about the evolving situation in the Amsterdam Market and the global trade war by regularly monitoring news and analysis to make informed decisions regarding your investments in the Amsterdam Market and related markets. This is key to navigating this turbulent period and capitalizing on potential opportunities within the Amsterdam Market.

Featured Posts

-

Zeka Duenyasinda Burclarin Siralamasi En Akilci Burclar

May 24, 2025

Zeka Duenyasinda Burclarin Siralamasi En Akilci Burclar

May 24, 2025 -

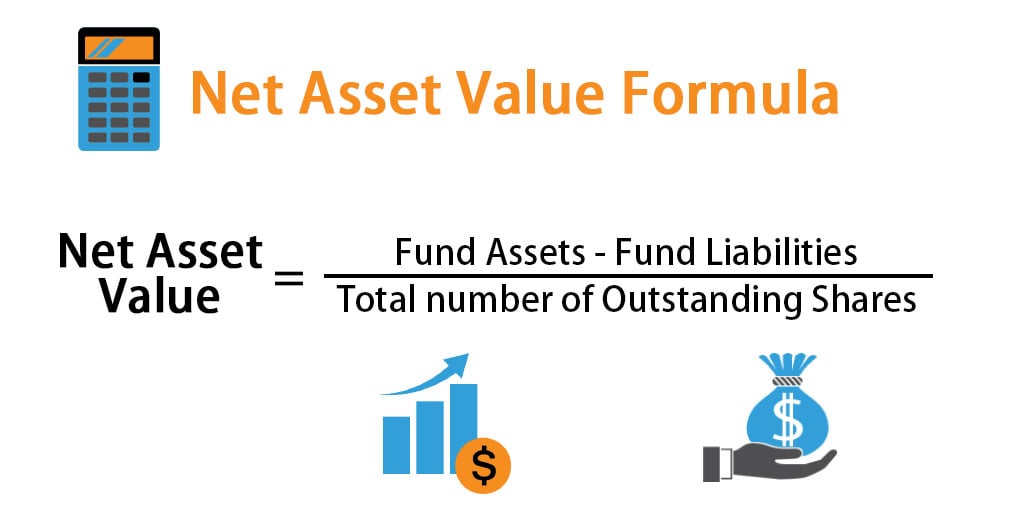

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

Nyi Rafdrifinni Porsche Macan Allt Sem T Hu T Harft Ad Vita

May 24, 2025

Nyi Rafdrifinni Porsche Macan Allt Sem T Hu T Harft Ad Vita

May 24, 2025 -

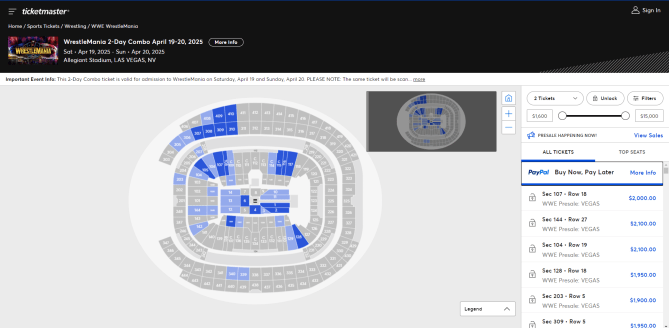

Secure Your Wrestle Mania 41 Golden Belts And Tickets This Memorial Day

May 24, 2025

Secure Your Wrestle Mania 41 Golden Belts And Tickets This Memorial Day

May 24, 2025 -

Top 10 Us Beaches 2025 Dr Beachs Expert Selection

May 24, 2025

Top 10 Us Beaches 2025 Dr Beachs Expert Selection

May 24, 2025