Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

Table of Contents

Underlying Causes of the Amsterdam Stock Exchange's Decline

Several interconnected factors are contributing to the sustained Amsterdam Stock Exchange heavy losses. These can be broadly categorized into global economic uncertainty, sector-specific challenges, and fluctuating investor sentiment.

Global Economic Uncertainty

The current global economic climate is characterized by significant headwinds impacting markets worldwide, including the AEX. These include:

- High inflation rates: Persistently high inflation in major economies like the US and Europe is forcing central banks to aggressively raise interest rates.

- Aggressive interest rate hikes: These hikes increase borrowing costs for businesses and consumers, slowing economic growth and impacting investment decisions.

- Geopolitical instability: The ongoing war in Ukraine continues to disrupt global supply chains, drive up energy prices, and fuel uncertainty in the market. The conflict's impact on global trade and energy security is significantly impacting investor confidence.

- China's economic slowdown: Concerns over China's economic growth and its potential impact on global demand are adding to the overall market uncertainty.

Sector-Specific Challenges

The decline in the AEX isn't uniform across all sectors. Some are experiencing more significant losses than others:

- Energy sector: The energy sector has been particularly hard hit, with a 5% drop today, largely attributed to fluctuating oil and gas prices driven by the geopolitical situation and concerns about energy security.

- Technology sector: The tech sector is also facing headwinds due to rising interest rates, impacting valuations of growth-oriented companies. Concerns over a potential tech recession are contributing to losses in this space.

- Financial sector: The financial sector is grappling with increased regulatory scrutiny and the impact of rising interest rates on lending and profitability.

Investor Sentiment and Market Volatility

The prevailing investor sentiment is one of caution and uncertainty. This negative sentiment, coupled with the volatile global economic conditions, is driving increased market volatility. Financial analysts are expressing concerns about further potential declines. As stated by leading financial analyst, Jan de Vries, "The current market conditions are extremely challenging, and we may see further volatility before stabilization occurs." This uncertainty is impacting trading volumes and exacerbating the Amsterdam Stock Exchange heavy losses.

Impact of the Losses on Dutch Businesses and Economy

The ongoing decline on the AEX has significant repercussions for Dutch businesses and the overall economy.

Effect on Company Valuations

The market capitalization of many listed companies on the AEX has decreased substantially. For example, [insert example of a specific company and its percentage loss]. This decline in valuation affects companies' ability to raise capital and invest in future growth.

Implications for Investments and Pensions

Investors, particularly those with pension funds invested in the AEX, are facing losses in their portfolios. This could lead to concerns about retirement security and could have long-term consequences for individuals' financial planning. A prolonged period of Amsterdam Stock Exchange heavy losses could also contribute to a wider economic slowdown and potential job losses.

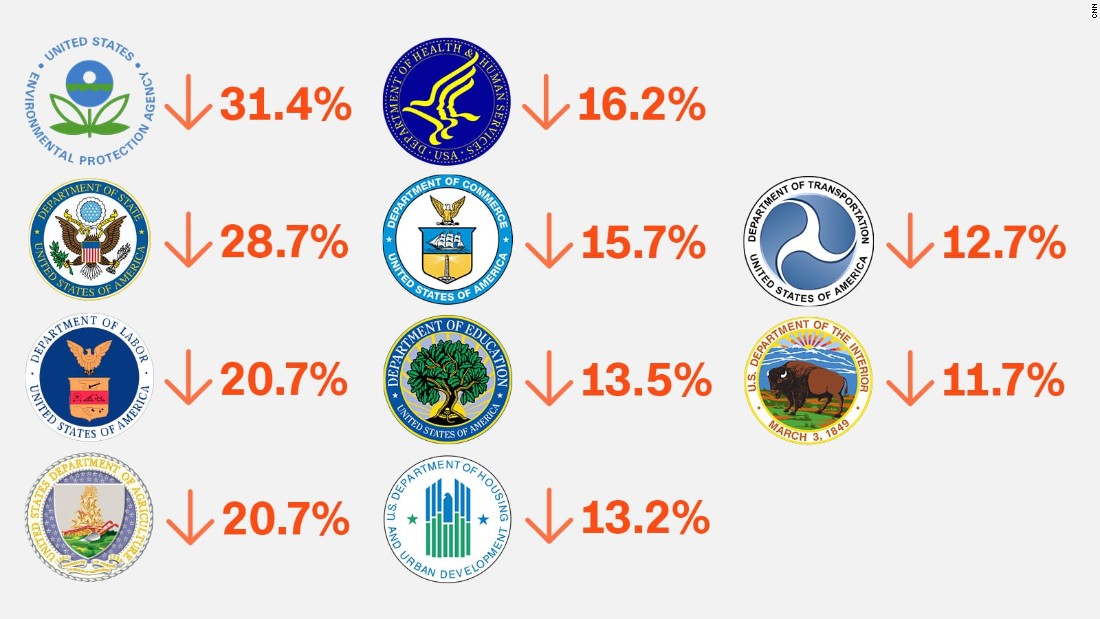

Government Response and Potential Interventions

The Dutch government is closely monitoring the situation. While no major interventions have been announced yet, potential measures could include fiscal stimulus packages to boost economic growth or measures to support specific sectors hard hit by the downturn. The effectiveness of such interventions remains to be seen.

Looking Ahead: Predictions and Future Outlook for the Amsterdam Stock Exchange

Predicting the future performance of the AEX is challenging, given the current uncertainties.

Analyst Predictions and Forecasts

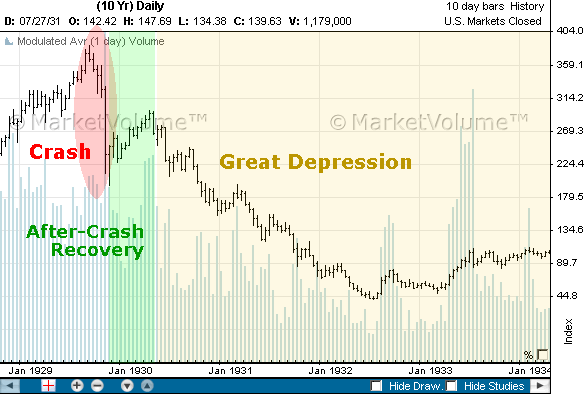

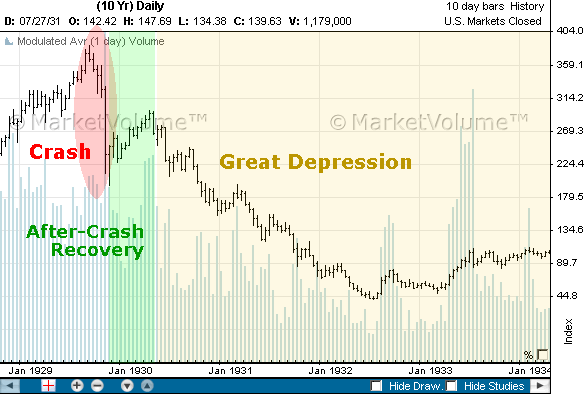

Financial analysts offer a range of predictions, from a cautious outlook anticipating further short-term declines to more optimistic scenarios suggesting a potential recovery in the medium term. The most likely scenario appears to involve continued volatility with gradual stabilization as global economic conditions improve.

Potential Recovery Strategies

A recovery will likely depend on a combination of factors, including:

- Global economic stabilization: A reduction in inflation and greater certainty in the global economy would significantly boost investor confidence.

- Government policies: Effective government intervention to support businesses and stimulate growth can contribute to a faster recovery.

- Improved investor sentiment: A shift towards more positive investor sentiment is crucial for attracting investment and stabilizing the market.

Conclusion: Navigating the Amsterdam Stock Exchange's Heavy Losses

The three consecutive days of Amsterdam Stock Exchange heavy losses are a result of a confluence of factors, including global economic uncertainty, sector-specific challenges, and negative investor sentiment. This decline has significant implications for Dutch businesses, investors, and the overall economy. The future outlook remains uncertain, but a combination of global economic stabilization, effective government policies, and improved investor confidence is crucial for recovery. Stay informed about the evolving situation on the Amsterdam Stock Exchange and consult with a financial advisor to navigate these challenging market conditions. Understanding the factors driving these Amsterdam Stock Exchange heavy losses is crucial for making informed investment decisions.

Featured Posts

-

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025 -

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025 -

Artfae Daks Alalmany Atfaqyt Altjart Byn Alwlayat Almthdt Walsyn Keaml Ryysy

May 24, 2025

Artfae Daks Alalmany Atfaqyt Altjart Byn Alwlayat Almthdt Walsyn Keaml Ryysy

May 24, 2025 -

Uncovering Hidden Value Is News Corp Truly Undervalued

May 24, 2025

Uncovering Hidden Value Is News Corp Truly Undervalued

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Nav Calculation And Implications

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Nav Calculation And Implications

May 24, 2025