Amundi MSCI All Country World UCITS ETF USD Acc: NAV Calculation And Implications

Table of Contents

Deconstructing the Amundi MSCI All Country World UCITS ETF USD Acc NAV Calculation

The Amundi MSCI All Country World UCITS ETF USD Acc NAV, like that of any ETF, represents the net value of its assets per share. Understanding its calculation provides crucial insight into your investment’s performance.

Components of the NAV

Several factors contribute to the daily NAV calculation of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Market Values of Underlying Assets: This is the primary component, reflecting the current market prices of all the stocks, bonds, and other securities held within the ETF. Fluctuations in these prices directly impact the NAV. For example, a rise in the value of major holdings will increase the NAV, while a decline will decrease it.

- Currency Exchange Rates (USD Implications): Because the ETF is denominated in USD, fluctuations in exchange rates against the currencies of the underlying assets significantly influence the NAV. A strengthening US dollar can reduce the NAV expressed in USD, even if the underlying assets maintain their value in their respective currencies.

- Accrued Income and Expenses: The ETF generates income from dividends and interest payments from its holdings. This accrued income is added to the NAV. Conversely, expenses such as management fees are deducted, affecting the final NAV figure.

- Management Fees: These fees, charged by Amundi for managing the ETF, are deducted from the total asset value before calculating the NAV per share. These fees represent the cost of professional fund management.

The Calculation Process

The NAV calculation is a precise process involving several steps:

- Data Collection and Verification: Amundi gathers market data from reliable sources for all the underlying assets. This data is meticulously checked for accuracy.

- Valuation of Assets: Each asset's market value is determined based on the closing prices of the respective exchanges.

- Calculation of Total Assets: The sum of all asset values constitutes the total asset value of the ETF.

- Deduction of Liabilities: Any liabilities, including outstanding expenses and payable fees, are subtracted from the total assets.

- Division by the Number of Outstanding Shares: The result from step 4 is divided by the total number of outstanding ETF shares, yielding the NAV per share.

Frequency of NAV Calculation

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is typically calculated daily at the close of market hours. This daily calculation ensures that the NAV reflects the most up-to-date market values. The NAV is disseminated to investors through official channels, including the Amundi website and major financial news platforms. Accurate and timely NAV updates are essential for transparency and informed investment decisions.

Implications of NAV Fluctuations for Amundi MSCI All Country World UCITS ETF USD Acc Investors

Understanding NAV fluctuations is vital for managing expectations and making sound investment choices.

Understanding NAV Changes

Several factors drive NAV changes:

- Impact of Global Market Trends: Broad market movements, such as bull or bear markets, significantly influence the NAV. Positive market sentiment generally leads to NAV appreciation, while negative sentiment can result in depreciation.

- Influence of Currency Fluctuations: Changes in exchange rates, particularly the USD, have a considerable impact. A weakening dollar can boost the NAV (in USD terms), while a strengthening dollar can decrease it.

- Effect of Individual Stock Performance: The performance of individual stocks within the ETF's portfolio directly influences the overall NAV. Strong performance by key holdings can lift the NAV, and underperformance can have the opposite effect.

NAV and Investment Returns

NAV changes directly translate to investor returns:

- Capital Appreciation vs. Income Generation: Increases in the NAV represent capital appreciation. Investors also receive income from dividends distributed by the underlying holdings.

- Calculating Returns Based on NAV Changes: Returns are calculated by comparing the change in NAV over a specific period, considering both capital appreciation and income distributions.

- Importance of Long-Term Investment Strategy: While short-term NAV fluctuations can be volatile, a long-term investment strategy allows investors to ride out market cycles and benefit from the potential for long-term growth.

NAV and ETF Trading

The NAV plays a critical role in ETF trading:

- Tracking Error and its Potential Impact: The difference between the ETF's market price and its NAV is known as the tracking error. This discrepancy can be influenced by factors like trading volume and market liquidity.

- Premium/Discount to NAV and its Causes: Sometimes, an ETF's market price trades at a premium or discount to its NAV. This can be due to supply and demand dynamics or market sentiment.

- Buy and Sell Decisions in Relation to NAV: While NAV is not the sole determinant of buy/sell decisions, understanding its movement provides valuable context for evaluating investment opportunities.

Accessing and Interpreting Amundi MSCI All Country World UCITS ETF USD Acc NAV Data

Reliable data is key to informed decisions.

Official Sources for NAV Information

For accurate and up-to-date NAV information, always refer to the official Amundi website. Financial news websites and brokerage platforms often provide this data as well.

Interpreting NAV Charts and Graphs

NAV charts and graphs visually represent NAV movements over time. Learning to interpret these charts helps in understanding trends and patterns in the ETF's performance.

Comparing NAV to Other ETFs

Comparing the NAV performance of the Amundi MSCI All Country World UCITS ETF USD Acc to similar global ETFs offers valuable context for benchmarking its performance.

Conclusion: Making Informed Decisions with Amundi MSCI All Country World UCITS ETF USD Acc NAV Data

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV calculation and its implications is essential for successful investing. Regular monitoring of the NAV, alongside a comprehensive understanding of market dynamics, allows investors to make well-informed decisions. Remember to consult with a qualified financial advisor before making any investment choices. Stay informed about your investments by regularly checking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc and understanding its implications for your portfolio.

Featured Posts

-

Close Calls And Crashes A Visual Exploration Of Airplane Safety

May 24, 2025

Close Calls And Crashes A Visual Exploration Of Airplane Safety

May 24, 2025 -

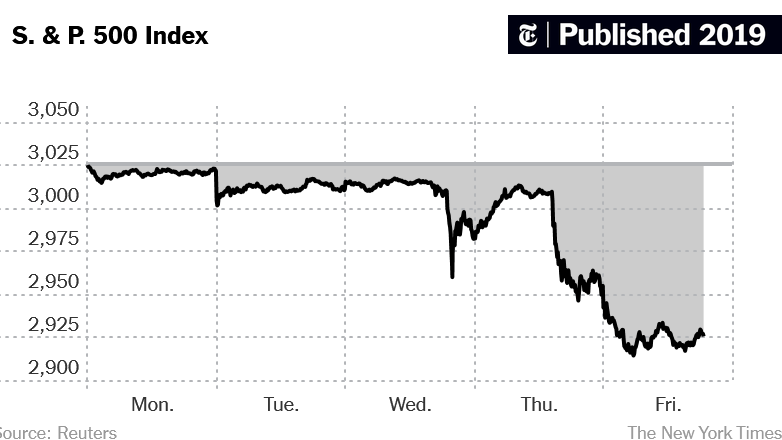

Dutch Stocks Continue Decline Amidst Escalating Us Trade War

May 24, 2025

Dutch Stocks Continue Decline Amidst Escalating Us Trade War

May 24, 2025 -

Urban Green Spaces As Refuges One Womans Seattle Experience During Covid 19

May 24, 2025

Urban Green Spaces As Refuges One Womans Seattle Experience During Covid 19

May 24, 2025 -

Dylan Dreyers Family Life New Post With Brian Fichera Creates Conversation

May 24, 2025

Dylan Dreyers Family Life New Post With Brian Fichera Creates Conversation

May 24, 2025 -

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025