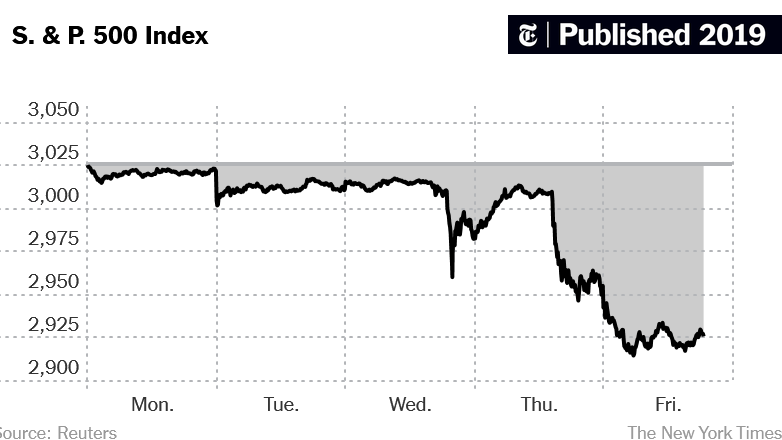

Amsterdam Stock Market Crash: 7% Plunge Amidst Trade War Fears

Table of Contents

The Severity of the Amsterdam Stock Market Crash

The Amsterdam stock market crash represents a significant event, severely impacting investor confidence. The AEX index, a key indicator of the Dutch stock market's performance, suffered a dramatic fall, underscoring the widespread nature of the downturn. This sharp decline needs to be understood within its historical context.

- Specific percentage drop in the AEX index: A 7% single-day drop in the AEX index represents a substantial loss of value.

- Number of points lost: [Insert the actual number of points lost – this will need to be updated based on the actual event]. This significant point loss reflects the scale of the market's downturn.

- Comparison to previous significant drops in the AEX: [Insert comparison data here, referencing past significant drops and their context. E.g., "This is the largest single-day drop since [date of previous significant drop], which was triggered by [reason for previous drop]."]

- Impact on individual stocks within the index (mention examples): Companies like [mention specific companies and their percentage drops, e.g., ASML, Unilever] experienced considerable losses, reflecting the broad-based nature of the sell-off. This widespread impact highlights the market’s sensitivity to current global uncertainties.

This dramatic fall in the AEX index signals a significant loss of investor confidence and necessitates a thorough analysis of the underlying causes.

Trade War Fears as the Primary Catalyst

The primary catalyst for the Amsterdam stock market crash is widely attributed to escalating trade war fears. The ongoing trade disputes, particularly the US-China trade war and the complexities of EU trade policies, have created an environment of profound uncertainty and risk aversion. This uncertainty has directly translated into a significant market correction.

- Specific trade policy announcements that triggered the downturn: [Insert specific announcements here, e.g., "The announcement of new tariffs on [product] by [country] appears to have been the immediate trigger for the sell-off."]

- Impact of trade uncertainty on global economic outlook: The prolonged trade war has cast a shadow over the global economic outlook, fueling concerns about slowed growth and decreased investor confidence worldwide.

- How investor behavior shifted due to trade war concerns: Investors have moved towards a risk-off strategy, selling off equities and seeking safer havens like government bonds, as fear of further trade escalations increases.

- Mention any specific companies heavily impacted due to trade-related issues: Companies heavily reliant on international trade, particularly those with significant exposure to [mention specific regions or industries affected by trade disputes], have suffered disproportionately.

Impact on Dutch Economy and Global Markets

The Amsterdam stock market crash's ripple effects extend beyond the Dutch stock exchange, potentially impacting the broader Dutch economy and triggering consequences in interconnected global markets.

- Potential impact on Dutch GDP growth: The stock market crash could negatively impact consumer confidence and business investment, potentially leading to a slowdown in Dutch GDP growth.

- Effect on employment within the Dutch financial sector: The downturn could result in job losses within the Dutch financial sector, as firms grapple with reduced trading volumes and investment activity.

- Influence on investor confidence in European markets: The crash has likely shaken investor confidence across European markets, creating a domino effect that could lead to further market instability.

- Potential spillover effects on other global stock exchanges: The interconnected nature of global financial markets means that the Amsterdam stock market crash could contribute to volatility in other major stock exchanges worldwide.

Expert Reactions and Market Analysis

Financial analysts and economists have offered diverse perspectives on the crash, highlighting the complexity of the situation.

- Quotes from key financial experts: [Insert quotes from reputable financial analysts and economists, attributing them correctly].

- Summarized analysis from reputable financial news sources: [Summarize analyses from sources like the Financial Times, Bloomberg, etc.].

- Short-term market predictions: Many analysts predict continued volatility in the short term, with potential for further corrections depending on developments in the trade war.

- Long-term outlook for the Amsterdam stock market and Dutch economy: The long-term outlook remains uncertain, contingent on the resolution of trade disputes and the overall global economic environment.

Strategies for Investors in the Aftermath

Navigating market volatility requires a strategic approach.

- Diversification strategies for minimizing losses: Diversifying investment portfolios across different asset classes is crucial to mitigate potential losses during periods of market uncertainty.

- Importance of long-term investment planning: Maintaining a long-term investment horizon can help investors weather short-term market fluctuations and avoid making impulsive decisions.

- Reliable sources for staying updated on market news: Staying informed through reputable financial news sources is essential for making informed investment decisions.

- Advice on adjusting investment portfolios based on current market conditions: Investors may need to adjust their portfolios based on the evolving market conditions, potentially shifting towards less risky assets during times of increased uncertainty.

Conclusion: Understanding and Navigating the Amsterdam Stock Market Crash

The Amsterdam stock market crash, characterized by a significant 7% plunge, underscores the impact of escalating trade war fears on global markets. The interconnectedness of global finance means that events like this can have far-reaching consequences for the Dutch economy and beyond. Understanding the complexities of the situation, including the role of investor sentiment, trade policy uncertainties, and broader global economic trends, is vital for navigating future market fluctuations. Stay updated on the latest developments in the Amsterdam stock market and mitigate potential risks through informed investment strategies. Understanding the complexities of the Amsterdam stock market crash and its causes is vital for navigating future market fluctuations. Conduct thorough Amsterdam stock market analysis to make informed decisions.

Featured Posts

-

Apple Stock Q2 Earnings Loom Key Support Levels Tested

May 24, 2025

Apple Stock Q2 Earnings Loom Key Support Levels Tested

May 24, 2025 -

The Ultimate Escape To The Country Everything You Need To Know

May 24, 2025

The Ultimate Escape To The Country Everything You Need To Know

May 24, 2025 -

Paid Access Guaranteed Anonymity Inside Trumps Memecoin Event

May 24, 2025

Paid Access Guaranteed Anonymity Inside Trumps Memecoin Event

May 24, 2025 -

Tavan Asili Porsche 956 Bir Tasarim Harikasi

May 24, 2025

Tavan Asili Porsche 956 Bir Tasarim Harikasi

May 24, 2025 -

Dutch Stocks Continue Decline Amidst Escalating Us Trade War

May 24, 2025

Dutch Stocks Continue Decline Amidst Escalating Us Trade War

May 24, 2025