Amundi Dow Jones Industrial Average UCITS ETF: A NAV Analysis

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the underlying value of an ETF's assets minus its liabilities, per share. Simply put, it's the net worth of the ETF divided by the number of outstanding shares. This calculation considers the market value of all the securities held within the ETF, less any expenses or liabilities. Understanding NAV is crucial because it provides a true reflection of the ETF's intrinsic value.

-

Importance for ETF Investors: Tracking the NAV is vital for several reasons:

- Measuring Investment Returns: It allows you to accurately gauge your investment's performance over time. By comparing the change in NAV over a specific period, you can calculate your returns.

- Benchmarking: Comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF to its benchmark (the Dow Jones Industrial Average itself) allows you to assess how effectively the ETF tracks its index.

- Comparative Analysis: You can use NAV data to compare the performance of this ETF with other similar ETFs tracking the Dow Jones Industrial Average or other indices.

-

NAV vs. Market Price: While NAV reflects the intrinsic value, the market price is the actual price at which the ETF is traded on the exchange. Discrepancies can occur due to supply and demand forces, market sentiment, and trading volume. A higher market price compared to the NAV may indicate market optimism, while a lower price might suggest pessimism.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors directly impact the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these helps in predicting potential NAV fluctuations and making better investment decisions.

Underlying Asset Performance:

The performance of the 30 constituent companies of the Dow Jones Industrial Average directly dictates the ETF's NAV. A strong performance by these companies generally leads to a higher NAV, while underperformance results in a lower NAV.

- Sectorial Influences: The performance of different sectors within the Dow (e.g., technology, finance, healthcare) will significantly affect the overall NAV. A boom in the technology sector, for instance, would likely boost the ETF's NAV.

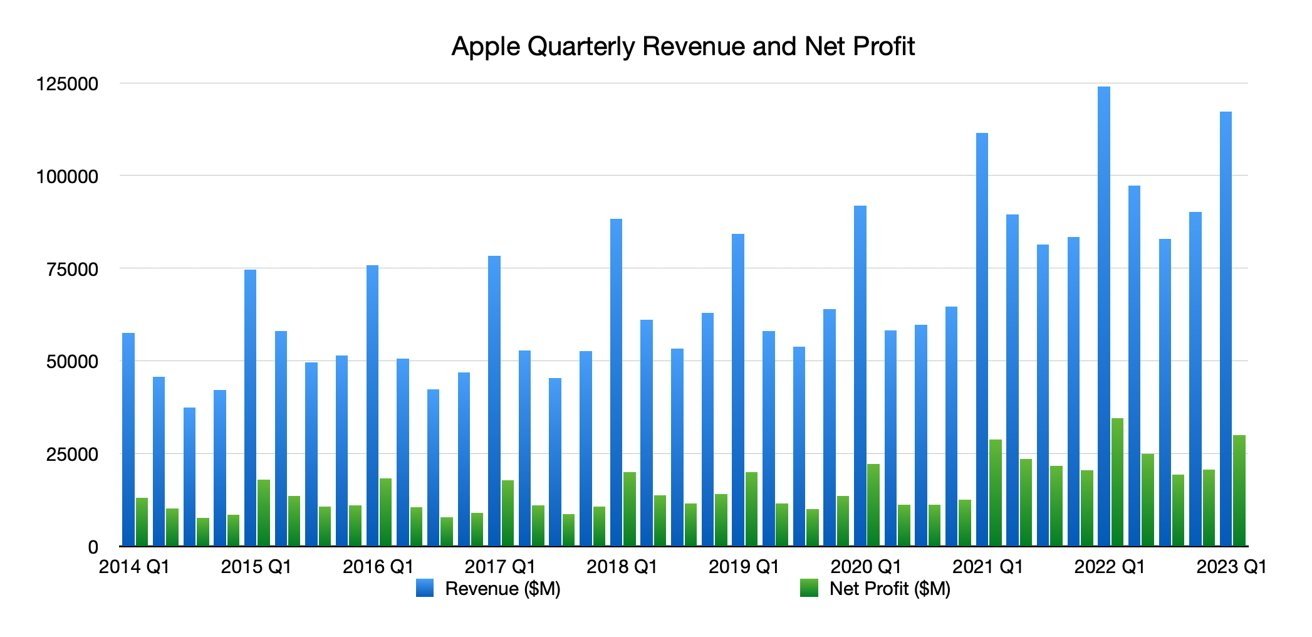

- Individual Company Impacts: Strong performance by major Dow components like Apple or Microsoft can significantly influence the overall ETF NAV, while underperformance by others may offset these gains.

Currency Fluctuations:

While the Amundi Dow Jones Industrial Average UCITS ETF is denominated in a specific currency (likely Euros, given the UCITS designation), fluctuations in exchange rates can impact the NAV for investors holding the ETF in a different currency.

- Hedging Strategies: The ETF provider may implement hedging strategies to mitigate the impact of currency fluctuations. However, these strategies can also introduce complexities, and their effectiveness varies.

Expense Ratio:

The expense ratio represents the annual fee charged by the ETF provider for managing the fund. This expense ratio gradually erodes the NAV over time.

- Comparative Analysis: Comparing the expense ratio of the Amundi Dow Jones Industrial Average UCITS ETF to other similar ETFs tracking the Dow Jones Industrial Average is crucial for identifying cost-effective investment options.

Analyzing Historical NAV Data for the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing historical NAV data is crucial for understanding past performance and identifying potential future trends.

Data Sources:

Reliable sources for historical NAV data include:

- Amundi's Website: The official website of Amundi is a primary source for accessing this information.

- Financial Data Platforms: Reputable financial data providers like Bloomberg, Refinitiv, or Yahoo Finance often provide historical ETF data, including NAV.

Charting and Trend Analysis:

Visualizing NAV data using charts (line graphs are particularly effective) helps to identify trends such as:

- Growth Trends: Sustained upward trends indicate strong performance.

- Decline Trends: Downward trends might suggest market weakness or underlying issues within the index.

- Volatility: Significant fluctuations indicate higher risk associated with the ETF.

Benchmarking:

Comparing the ETF's NAV performance to the Dow Jones Industrial Average itself provides a measure of how well the ETF tracks its benchmark. Furthermore, comparing it to other similar ETFs allows you to assess its relative performance.

Practical Implications and Investment Strategies

Understanding NAV data empowers investors to make informed decisions.

Using NAV for Investment Decisions:

Monitoring NAV changes can inform buy/sell decisions. A consistently rising NAV suggests a favorable investment climate, while a persistent decline may signal a need to re-evaluate the investment.

Dollar-Cost Averaging (DCA):

Dollar-cost averaging involves investing a fixed amount at regular intervals regardless of the NAV. This strategy can mitigate the risk of investing a lump sum at a market peak.

Risk Management:

Regularly monitoring the NAV helps in managing investment risk. Significant NAV declines can trigger rebalancing or diversification strategies to reduce overall portfolio risk.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for assessing its performance and making informed investment decisions. Factors such as underlying asset performance, currency fluctuations, and expense ratios all play a significant role in shaping the NAV. By analyzing historical NAV data, comparing it to benchmarks, and utilizing strategies like dollar-cost averaging, investors can enhance their risk management and potentially achieve better investment outcomes. Regularly reviewing the Amundi Dow Jones Industrial Average UCITS ETF's NAV is crucial for successful long-term investment strategies. Start your NAV analysis today!

Featured Posts

-

Apple Stock Dip Key Levels Under Pressure Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Under Pressure Before Q2 Earnings

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025 -

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen

May 24, 2025

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen

May 24, 2025 -

Master Chef Season 13 Dallas Chef Tiffany Derry Judges

May 24, 2025

Master Chef Season 13 Dallas Chef Tiffany Derry Judges

May 24, 2025 -

Pre Q2 Earnings Apple Stock Under Pressure At Key Support Levels

May 24, 2025

Pre Q2 Earnings Apple Stock Under Pressure At Key Support Levels

May 24, 2025