Pre-Q2 Earnings: Apple Stock Under Pressure At Key Support Levels

Table of Contents

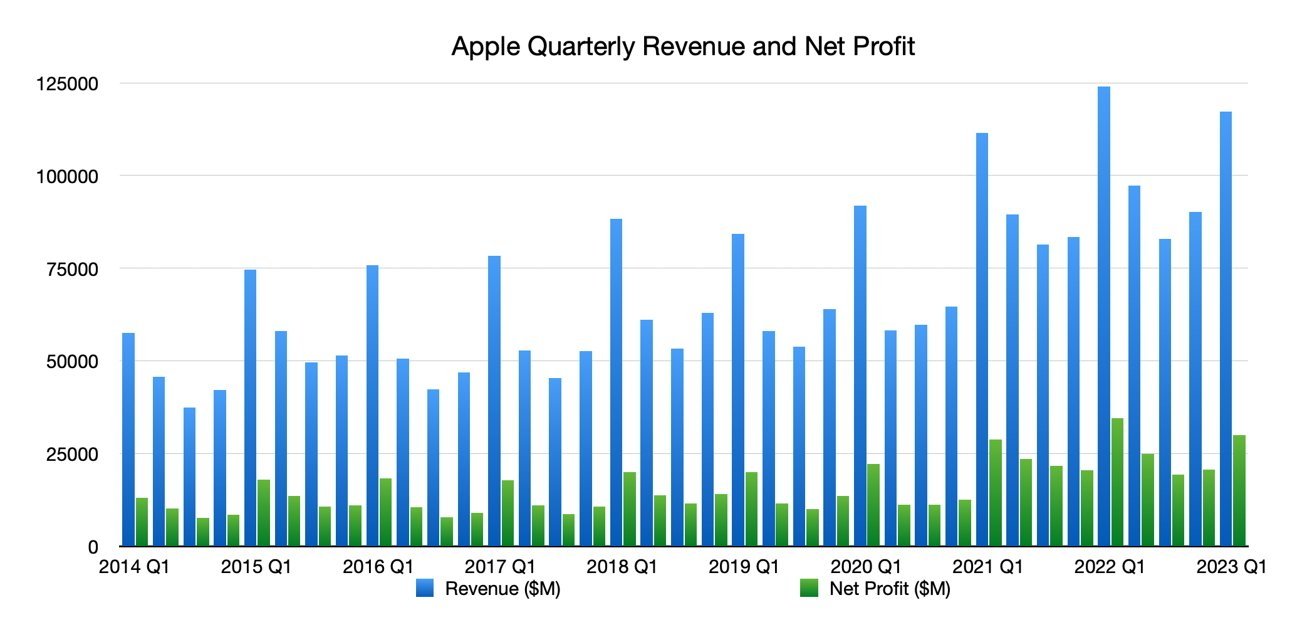

Apple's Recent Performance and Market Sentiment

Apple's stock price has exhibited considerable volatility in recent weeks, leading up to the anticipated Q2 earnings report. This fluctuation reflects broader market trends and specific concerns about Apple's performance. Analyzing Apple stock performance requires a close look at these recent movements.

- May 15th, 2024: A noticeable drop in Apple stock price following a less-than-stellar forecast from a major Wall Street analyst.

- May 22nd, 2024: A slight rally following positive news regarding pre-orders for a new product.

- June 5th, 2024: A significant dip linked to growing concerns about global economic slowdown.

Overall market sentiment towards Apple and the tech sector has been cautious. Concerns about inflation, rising interest rates, and potential supply chain disruptions contribute to the prevailing uncertainty impacting Apple stock price volatility. The overall market sentiment has impacted Apple stock performance significantly.

Key Support Levels and Their Significance

Understanding "key support levels" is crucial for interpreting Apple's current stock price predicament. In stock trading, support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. For Apple, several key support levels have been identified.

- $165: This level represents a significant psychological support point, representing a previous low.

- $155: This level coincides with a key moving average, offering a strong technical support.

- $145: A breach below this level could signal a more significant downturn, triggering further selling pressure.

The technical analysis behind these support levels involves studying moving averages, Fibonacci retracements, and other indicators. A breach of these key support levels would likely negatively impact investor confidence, potentially leading to further price drops and increased market volatility within the Apple stock price.

Factors Affecting Q2 Earnings Expectations

Several factors will influence Apple's Q2 earnings report, impacting the subsequent reaction of the Apple stock price. These factors range from internal company performance to broader macroeconomic trends. Predicting the Q2 earnings forecast requires careful consideration of these elements.

- Supply Chain Issues: Ongoing global supply chain disruptions could impact production and sales.

- Demand for New Products: The success of newly launched products like the iPhone 15 and the Apple Watch Series 9 will significantly affect revenue projections.

- Economic Conditions: Consumer spending is highly sensitive to economic conditions. A downturn could negatively impact demand for Apple products.

- Market Competition: Intense competition from other tech companies in various market segments could affect Apple’s market share and profitability.

Investor Strategies Ahead of Q2 Earnings

Investors face several options as they navigate the uncertainty surrounding Pre-Q2 earnings and the pressure on Apple stock. The optimal strategy depends heavily on individual risk tolerance and investment goals.

- Buy: Investors with a long-term outlook and a high-risk tolerance may consider buying at current support levels, anticipating a rebound after the Q2 earnings release.

- Hold: Those with a moderate risk tolerance might choose to hold their existing Apple stock, awaiting the Q2 earnings report before making any decisions.

- Sell: Investors with a low-risk tolerance may consider selling to avoid potential losses if the stock price falls below key support levels.

Options trading strategies can also play a role, allowing investors to manage risk and profit from price fluctuations. However, options trading is complex and carries significant risks, thus requiring careful research and understanding. It's also crucial to remember the importance of portfolio diversification, ensuring that your investments aren't overly concentrated in a single stock. Finally, always consult a reputable financial advisor to help craft a financial plan that aligns with your individual circumstances and risk tolerance.

Conclusion: Pre-Q2 Earnings: Navigating the Pressure on Apple Stock

The pressure on Apple stock ahead of the Q2 earnings announcement is undeniable. The stock is currently testing key support levels, and the upcoming earnings report will significantly influence its future trajectory. Several factors, from supply chain issues to broader economic conditions, will determine the success of the Q2 earnings report and consequently the performance of Apple stock. Investors need to understand the significance of support and resistance levels in technical analysis and the different factors influencing the Q2 earnings forecast to formulate a suitable investment strategy. Remember that understanding Pre-Q2 earnings and the pressure on Apple stock requires careful consideration of market sentiment, technical analysis, and potential factors that might impact the company's financial performance.

Stay informed about Pre-Q2 earnings and the pressure on Apple stock by following reputable financial news sources and consulting with financial advisors to make informed decisions. Understanding the key support levels and potential impacts on Apple stock price is crucial for navigating this period of uncertainty. Conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding Apple stock.

Featured Posts

-

Mamma Mia Review Of The New Ferrari Hot Wheels Sets

May 24, 2025

Mamma Mia Review Of The New Ferrari Hot Wheels Sets

May 24, 2025 -

Country Escape Balancing Rural Living With Modern Amenities

May 24, 2025

Country Escape Balancing Rural Living With Modern Amenities

May 24, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025 -

Frankfurt Stock Exchange Dax Holds Steady Post Record High

May 24, 2025

Frankfurt Stock Exchange Dax Holds Steady Post Record High

May 24, 2025 -

Shooting Near Jewish Museum In Washington Israeli Embassy Employees Killed

May 24, 2025

Shooting Near Jewish Museum In Washington Israeli Embassy Employees Killed

May 24, 2025