Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV Calculation And Analysis

Table of Contents

This guide provides a comprehensive overview of the Amundi MSCI World II UCITS ETF USD Hedged Dist and explains how its Net Asset Value (NAV) is calculated and analyzed. Understanding NAV is crucial for investors looking to track performance, manage risk, and make informed decisions regarding this popular, diversified world equity ETF. We'll break down the key components and offer insights into interpreting this crucial metric for successful investment in this hedged ETF.

What is the Amundi MSCI World II UCITS ETF USD Hedged Dist?

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund (ETF) designed to track the performance of the MSCI World Index. This index represents a broad selection of large and mid-cap equities from developed markets across the globe, providing investors with significant diversification. The "UCITS" designation means it complies with the Undertakings for Collective Investment in Transferable Securities directive, a regulatory framework within the European Union ensuring investor protection and standardized investment practices. The "USD Hedged" aspect is a key feature: it aims to mitigate the risk associated with fluctuations in the exchange rate between the US dollar and other currencies. This is particularly beneficial for US dollar-based investors, as it helps to stabilize returns in their home currency.

- Tracks the MSCI World Index: Providing broad global equity market exposure.

- UCITS compliant: Meeting EU regulatory standards for investor protection.

- Hedged against USD currency fluctuations: Reducing currency risk for USD investors.

- Diversified global equity exposure: Reducing overall portfolio risk through diversification.

- Low-cost investment option: Offering efficient access to a global portfolio at competitive expense ratios.

Understanding Net Asset Value (NAV) Calculation

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist represents the value of the ETF's underlying assets per share. Its calculation involves several key components:

-

Market Value of Holdings: This is determined by calculating the total market value of all the securities (stocks, bonds, etc.) held within the ETF's portfolio. This is done daily using the closing prices of these securities on major exchanges.

-

Liabilities: This includes any expenses associated with running the ETF, such as management fees, administrative costs, and other operational expenses. These are deducted from the market value of the holdings.

-

Currency Hedging Impact: The USD hedging strategy influences the NAV. The effect of the hedging strategy on the NAV will depend on the performance of the currencies relative to the USD. If the currencies of the underlying assets appreciate against the USD, the hedge will generally reduce the NAV; conversely, if they depreciate, the hedge will often increase the NAV.

-

Daily Calculation: The NAV is calculated daily, providing investors with a frequent update on the value of their investment.

-

Transparency: The NAV is readily accessible through the Amundi website, major financial data providers (such as Bloomberg or Refinitiv), and many brokerage platforms.

-

Factors Affecting NAV: Various factors influence the NAV, including market fluctuations (price changes in the underlying securities), currency exchange rates (especially for unhedged portions, if any), dividends received by the ETF from its holdings, and the expense ratio.

Analyzing the NAV and its Significance for Investors

Analyzing the NAV changes over time is essential for understanding the ETF's performance. Investors can track the NAV to monitor returns and compare them to the benchmark (MSCI World Index).

- Performance Tracking: Compare the daily, weekly, or monthly NAV changes to assess the ETF's performance against its benchmark. A close correlation indicates effective tracking.

- Risk Assessment: Significant and frequent NAV fluctuations can indicate higher market risk, reflecting volatility in the underlying assets.

- Investment Decisions: Investors often use NAV information alongside the market price to make informed buy or sell decisions. Comparing NAV to the market price helps identify potential arbitrage opportunities or discrepancies.

- Comparison with competitors: Compare the NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist to similar ETFs tracking the MSCI World Index or other global equity indices. This enables comparative analysis of investment strategies and expense ratios.

Tracking error, the difference between the ETF's performance and the benchmark's performance, is an important consideration. Causes of tracking error include transaction costs, the infrequent rebalancing of the portfolio, and any differences in the composition of the ETF compared to the index.

Common NAV-Related Questions Answered

- How often is the NAV calculated? The NAV is typically calculated daily, at the close of the relevant markets.

- Where can I find the NAV? The NAV is available on the Amundi website, through financial data providers, and on most brokerage platforms.

- What is the difference between NAV and the market price? While ideally, the ETF's market price should closely track its NAV, there can be minor discrepancies due to market supply and demand.

- How does currency hedging affect the NAV? The currency hedge aims to minimize the impact of exchange rate fluctuations on the NAV, providing greater stability for USD-based investors.

Conclusion

Understanding the Net Asset Value (NAV) is vital for monitoring the performance and managing the risk associated with the Amundi MSCI World II UCITS ETF USD Hedged Dist. We've covered the components of NAV calculation and how to interpret this information for effective investment decision-making. By regularly reviewing the NAV and understanding its relationship to the market price and the benchmark index, investors can make informed choices about their investment in this diversified global equity ETF.

Ready to learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV? Continue your research by visiting the Amundi website or consulting with a financial advisor. For further insights into managing your investment portfolio with the Amundi MSCI World II UCITS ETF USD Hedged Dist and effectively analyzing its NAV, explore additional resources available online.

Featured Posts

-

Brbs Acquisition Of Banco Master A Public Private Banking Powerhouse Emerges In Brazil

May 24, 2025

Brbs Acquisition Of Banco Master A Public Private Banking Powerhouse Emerges In Brazil

May 24, 2025 -

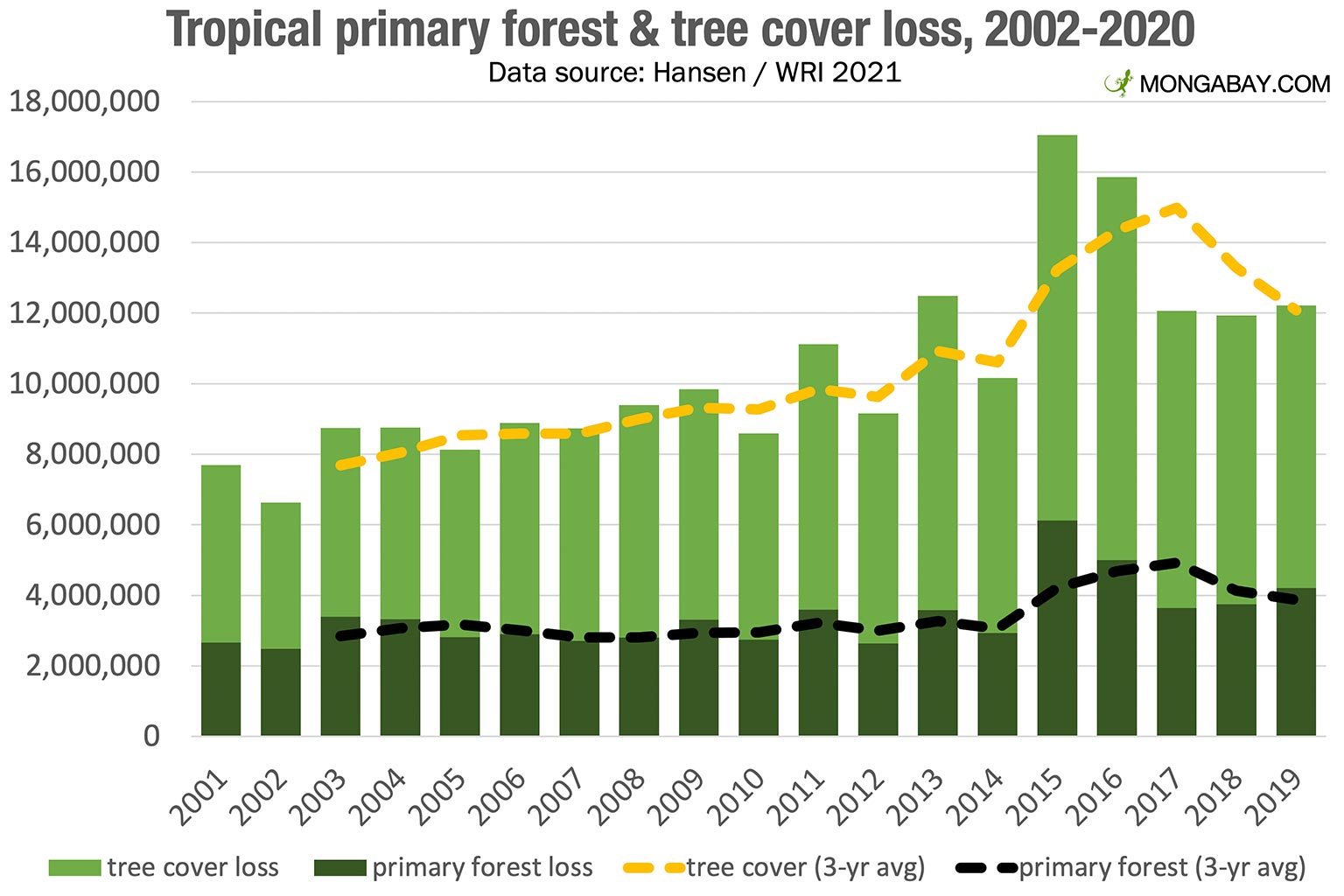

Rising Global Forest Loss Wildfires And The Fight For Conservation

May 24, 2025

Rising Global Forest Loss Wildfires And The Fight For Conservation

May 24, 2025 -

Rybakina Probilas V Tretiy Krug Turnira V Rime

May 24, 2025

Rybakina Probilas V Tretiy Krug Turnira V Rime

May 24, 2025 -

Conchita Wursts Esc 2025 Concert Eurovision Village Appearance With Jj

May 24, 2025

Conchita Wursts Esc 2025 Concert Eurovision Village Appearance With Jj

May 24, 2025 -

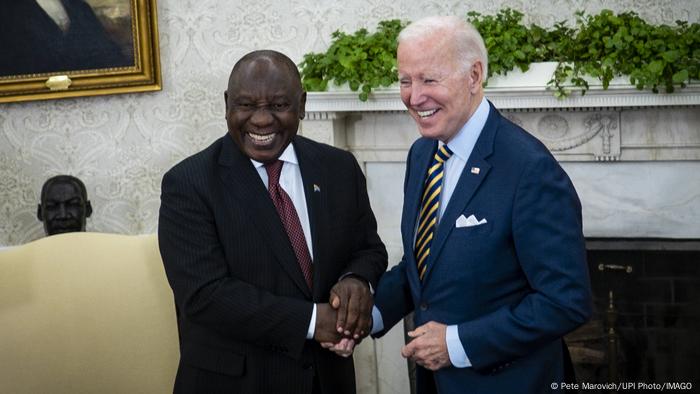

Analyzing Ramaphosas White House Encounter Could He Have Handled It Differently

May 24, 2025

Analyzing Ramaphosas White House Encounter Could He Have Handled It Differently

May 24, 2025