Analysis: $67M Ethereum Liquidation And The Implications For The Market

Table of Contents

Understanding the $67M Ethereum Liquidation Event

What constitutes a Liquidation in the Crypto Market?

A liquidation, in simple terms, is the forced selling of assets to cover losses on a leveraged position. In the context of cryptocurrency trading, this often involves margin trading, where traders borrow funds to amplify their potential profits. However, leveraged positions are inherently risky. If the market moves against the trader, their losses can quickly exceed their initial investment.

- Margin Trading and Leverage: Traders use borrowed funds (leverage) to magnify potential returns, but this also magnifies potential losses. A 5x leverage means a 20% price drop wipes out the entire investment.

- Liquidations in DeFi: Decentralized finance (DeFi) platforms utilize smart contracts to automatically liquidate positions when the collateral value falls below a certain threshold. This automated process aims to protect lenders from excessive losses.

- Common Reasons for Liquidations: Price drops, unexpected market volatility, sudden large sell-offs, and insufficient collateral are primary triggers for liquidations.

Details of the $67M Ethereum Liquidation:

While the precise details of specific liquidation events are often difficult to pinpoint due to the decentralized nature of many platforms, it is generally understood that large liquidations occur when a significant portion of overleveraged positions are simultaneously unwound due to price movements below the liquidation threshold. In this instance, a $67 million ETH liquidation event occurred on [Insert Date and Time of Event, if available. If not, remove this sentence]. The event likely involved multiple DeFi platforms, with [mention specific platforms if known, otherwise, remove this sentence and rephrase to reflect that the exact platform(s) involved may be unknown]. Primarily ETH was liquidated, though other assets may have been involved in some traders’ portfolios. The event was likely triggered by [Mention suspected cause, e.g., a rapid and significant drop in Ethereum's price].

Immediate Impact on Ethereum Price and Market Sentiment

Short-Term Price Volatility:

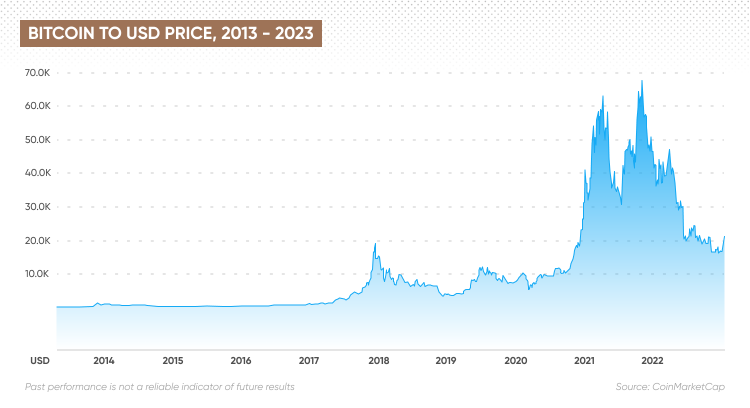

The $67 million Ethereum liquidation immediately caused significant short-term price volatility. [Insert a chart or graph visualizing the price fluctuation around the time of the liquidation]. The sharp drop in price had a considerable psychological impact on traders and investors, triggering fear and uncertainty. The speed and magnitude of the event amplified the impact.

- Panic Selling: The liquidation triggered a wave of panic selling, further exacerbating the price drop.

- Stop-Loss Orders: Many traders had stop-loss orders, automatically selling their assets at a predetermined price, which contributed to the price decline.

- FUD (Fear, Uncertainty, and Doubt): News of the significant liquidation spread rapidly, fueling FUD and negatively influencing market sentiment.

Impact on Market Sentiment and Trader Confidence:

The liquidation event significantly dampened market sentiment. The scale of the liquidation served as a stark reminder of the risks inherent in leveraged trading within the crypto market.

- Investor Confidence: Investor confidence in Ethereum, and the broader cryptocurrency market, was shaken. Many investors may have reevaluated their risk tolerance.

- Social Media Sentiment: Social media platforms saw a surge in discussions about the liquidation, with many expressing concerns about market stability.

- News Coverage: The event received widespread news coverage, highlighting the volatility of the cryptocurrency market and the potential for significant losses.

Long-Term Implications and Future Market Predictions

Systemic Risk Assessment:

Large-scale liquidation events like this raise concerns about systemic risk within the DeFi ecosystem. The interconnectedness of DeFi protocols means that one liquidation could potentially trigger a cascade of others, creating a domino effect that destabilizes the market.

- Cascading Liquidations: A significant risk is the potential for cascading liquidations, where one liquidation triggers others, amplifying the negative impact.

- Ethereum Network Resilience: The Ethereum network itself proved resilient in this instance. The blockchain continued to function despite the market volatility.

- DeFi Ecosystem Stability: The incident highlights the need for robust risk management practices within DeFi protocols to mitigate the potential for future large-scale liquidations.

Future Price Predictions and Market Outlook:

Predicting the future price of Ethereum is inherently challenging, especially in the aftermath of such an event. However, several potential scenarios are worth considering.

- Recovery Scenario: Ethereum’s price could recover, possibly even exceeding its previous highs, as the market absorbs the shock. Long-term adoption of ETH will play a significant role.

- Continued Volatility: The market may experience increased volatility in the short-to-medium term, as investors adjust to the heightened risk.

- Regulatory Responses: Regulatory scrutiny of DeFi and leveraged trading may increase, leading to new rules and regulations.

Conclusion

The $67 million Ethereum liquidation event served as a stark reminder of the inherent volatility within the cryptocurrency market and the risks associated with leveraged trading in DeFi. The event triggered short-term price volatility, impacted market sentiment, and raised concerns about systemic risk. While the Ethereum network itself proved resilient, the long-term implications for the DeFi ecosystem and the broader crypto market remain to be seen. Understanding the dynamics of Ethereum liquidation events is crucial for navigating the complex landscape of cryptocurrency investment. Stay informed on future Ethereum liquidation events to navigate the crypto market effectively and always conduct thorough due diligence before investing in any cryptocurrency.

Featured Posts

-

Affleck Commends Damons Strategic Approach To Acting Roles

May 08, 2025

Affleck Commends Damons Strategic Approach To Acting Roles

May 08, 2025 -

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025 -

Trump Described As Transformational By Carney A D C Meeting Report

May 08, 2025

Trump Described As Transformational By Carney A D C Meeting Report

May 08, 2025 -

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025 -

Forza Horizon 5 Ps 5 Precise Release Date And Time Details

May 08, 2025

Forza Horizon 5 Ps 5 Precise Release Date And Time Details

May 08, 2025

Latest Posts

-

Die Lottozahlen Des 6aus49 Vom 12 April 2025

May 08, 2025

Die Lottozahlen Des 6aus49 Vom 12 April 2025

May 08, 2025 -

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025