XRP's $2 Support: Price Prediction And Market Outlook

Table of Contents

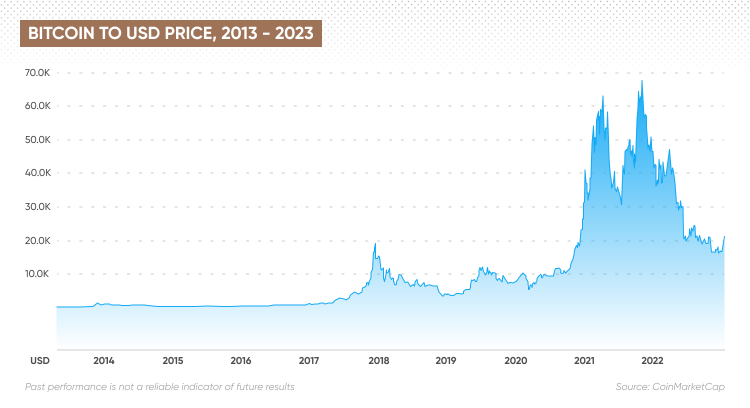

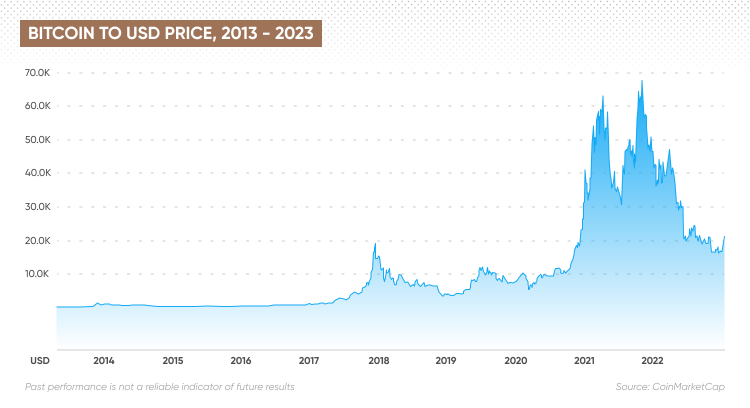

Technical Analysis of XRP's $2 Support

Analyzing XRP's price action around the $2 support level requires a multifaceted approach, combining various chart patterns and technical indicators.

Chart Patterns and Indicators

Examining key chart patterns can provide valuable insights into the strength of the $2 support. We can look at patterns like head and shoulders, triangles, and flags to predict potential breakouts or breakdowns. Crucially, we also need to consider the readings of technical indicators such as the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and Bollinger Bands. These indicators help gauge momentum and potential reversals.

- RSI: At the time of writing, the RSI sits around 45, suggesting a potential oversold condition. This could indicate a possible bounce back from the $2 support.

- MACD: The MACD histogram shows [insert current MACD data - e.g., a bearish crossover, a bullish divergence, etc.]. This suggests [insert interpretation based on the MACD data - e.g., potential bearish pressure, a potential reversal].

- 20-Day Moving Average: The 20-day moving average is currently [insert current position relative to $2 - e.g., approaching the $2 level, crossing below $2, etc.], potentially providing further support or resistance.

- 50-Day Moving Average: The longer-term 50-day moving average is at [insert current level]. A break below this level could signal a more significant bearish trend.

Volume Analysis

Analyzing trading volume around the $2 support is crucial. High volume accompanying a price drop below $2 would signal strong selling pressure and a bearish signal. Conversely, low volume during a price decline might suggest a weakening downtrend and potential for a bounce.

- High Volume on Breakdown: A significant increase in trading volume during a drop below $2 would be a strong bearish signal, indicating conviction among sellers.

- Low Volume on Breakdown: Conversely, low volume during a break below $2 could suggest a lack of conviction and the potential for a swift recovery.

- Volume Spikes at $2: Monitoring volume spikes specifically at the $2 level can provide insights into the strength of buyers and sellers battling for control.

Support and Resistance Levels

Beyond the immediate $2 support, other key levels influence XRP's price. Identifying these levels helps us anticipate potential price targets.

- Potential Support: If the $2 support breaks, $1.80 and $1.50 could become the next crucial support levels.

- Potential Resistance: If XRP manages to break above $2, the next resistance levels to watch are $2.50 and $3.00. Breaking above $3.00 could signal a stronger bullish trend.

Fundamental Factors Affecting XRP Price

Beyond technical analysis, fundamental factors significantly impact XRP's price.

Ripple's Legal Battle

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) is a dominant factor influencing XRP's price. A positive outcome for Ripple could significantly boost investor confidence and propel XRP's price upward. Conversely, a negative outcome could lead to further price declines.

- Potential Positive Outcomes: A favorable court ruling could lead to a surge in XRP's price due to increased investor confidence and reduced regulatory uncertainty.

- Potential Negative Outcomes: An unfavorable ruling could severely impact XRP's price and lead to further sell-offs. The impact would depend on the specifics of the ruling.

- Settlement Possibilities: A potential settlement between Ripple and the SEC could have a mixed impact on price, depending on the terms of the settlement.

Adoption and Partnerships

The adoption of XRP in payment systems and cross-border transactions is a key driver of its long-term price. New partnerships and integrations with financial institutions could significantly increase demand.

- On-Chain Activity: Increased on-chain activity, such as transaction volume and the number of unique addresses, reflects growing adoption and usage.

- Strategic Partnerships: New partnerships with financial institutions or payment processors are vital catalysts for price increases, showcasing real-world applications.

- Global Payments Usage: The extent to which XRP is utilized in actual cross-border payments directly influences its value and adoption.

Regulatory Landscape

The regulatory landscape surrounding cryptocurrencies is constantly evolving. Clearer regulatory frameworks in key jurisdictions could boost investor confidence and positively influence XRP's price.

- US Regulation: The SEC's stance on XRP significantly affects its price. Greater clarity on XRP's regulatory status in the US is crucial.

- International Regulation: Regulatory developments in other major jurisdictions, such as the EU, also influence XRP's market sentiment and adoption.

XRP Price Prediction and Market Outlook

Based on the technical and fundamental analysis, we can formulate a price prediction and market outlook for XRP.

Short-Term Outlook

In the short term, the $2 support level is crucial. A successful break above this level, accompanied by increased volume, could trigger a rally towards $2.50. However, a sustained break below $2 could lead to further declines towards $1.80 or even lower.

- Bullish Scenario: Breaking above $2 with strong volume could signal a short-term price target of $2.50-$3.00.

- Bearish Scenario: A break below $2 with high volume could lead to further declines, potentially targeting $1.80 or lower.

Long-Term Outlook

The long-term outlook for XRP is highly dependent on the outcome of the Ripple lawsuit and the overall adoption of the cryptocurrency. Wider adoption in the payment industry and positive regulatory developments could contribute to significant long-term price appreciation. However, continued regulatory uncertainty or increased competition could negatively impact its long-term growth.

- Positive Regulatory Developments: Clearer regulations and reduced regulatory uncertainty could significantly enhance investor confidence and drive long-term price growth.

- Increased Adoption: Wider adoption by businesses and financial institutions could fuel strong long-term growth.

Risk Factors

Several risk factors could negatively influence the XRP price prediction.

- Regulatory Uncertainty: The ongoing legal battle and the uncertain regulatory landscape pose significant risks.

- Market Volatility: The cryptocurrency market is inherently volatile, making accurate price predictions challenging.

- Competition: Competition from other cryptocurrencies with similar functionalities could also impact XRP's growth.

Conclusion

The XRP $2 support level is a critical point to watch for XRP investors. While the ongoing legal battle and regulatory uncertainty present significant risks, potential adoption and positive developments in the legal case and in the broader crypto market could significantly influence XRP’s future price. By carefully monitoring technical indicators, fundamental factors, and news concerning the Ripple lawsuit, investors can make more informed decisions about their XRP holdings. Remember to always conduct your own thorough research before investing in XRP or any other cryptocurrency. Stay informed about the latest developments concerning the XRP $2 support and continue to monitor the market closely to make the best investment choices.

Featured Posts

-

Ripples Xrp Analysis And Potential For 3 40 Price Target

May 08, 2025

Ripples Xrp Analysis And Potential For 3 40 Price Target

May 08, 2025 -

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025 -

Play Station Plus Your March 2024 Premium And Extra Games

May 08, 2025

Play Station Plus Your March 2024 Premium And Extra Games

May 08, 2025 -

Oklahoma City Thunder Portland Trail Blazers March 7th Game Information

May 08, 2025

Oklahoma City Thunder Portland Trail Blazers March 7th Game Information

May 08, 2025 -

Inter Milan Midfielder Zielinski Faces Weeks On The Sidelines With Calf Problem

May 08, 2025

Inter Milan Midfielder Zielinski Faces Weeks On The Sidelines With Calf Problem

May 08, 2025

Latest Posts

-

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

Dwps April May Universal Credit Refunds Understanding The 5 Billion Cut Impact

May 08, 2025

Dwps April May Universal Credit Refunds Understanding The 5 Billion Cut Impact

May 08, 2025 -

Scholar Rock Stock Performance Mondays Negative Trend

May 08, 2025

Scholar Rock Stock Performance Mondays Negative Trend

May 08, 2025 -

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Understanding The Recent Decline In Scholar Rock Stock Price

May 08, 2025

Understanding The Recent Decline In Scholar Rock Stock Price

May 08, 2025