Analysis: House Republicans' Trump Tax Plan Breakdown

Table of Contents

Key Proposals within the House Republicans' Trump Tax Plan

The House Republicans' Trump Tax Plan encompassed a broad range of proposed changes impacting both individual and corporate taxpayers. Let's examine the core proposals:

Individual Income Tax Changes

The plan proposed substantial alterations to the individual income tax system. Key changes included:

- Revised Tax Brackets: The plan suggested adjustments to the existing tax brackets, potentially lowering rates for some income levels. The exact details varied across proposed versions of the plan.

- Standard Deduction Increase: An increased standard deduction was proposed, aiming to simplify tax filing for many individuals. This change could benefit lower- and middle-income taxpayers.

- Child Tax Credit Modification: Alterations to the Child Tax Credit were also suggested, potentially increasing the credit amount or expanding eligibility.

- Deduction Elimination/Reduction: The plan considered the elimination or significant reduction of certain deductions, such as the state and local tax (SALT) deduction. This change generated considerable debate, with implications for taxpayers in high-tax states.

The impact on different income levels varied widely. While some lower- and middle-income taxpayers potentially benefited from the increased standard deduction and Child Tax Credit, the elimination of deductions disproportionately affected higher-income taxpayers in certain areas. The overall distributional effects remain a subject of ongoing analysis and considerable debate. Further research is needed to fully understand the impact on charitable giving and other itemized deductions affected by these changes. This included a comprehensive review of the tax code and its implications for taxpayers in various circumstances.

Corporate Tax Rate Reduction

A cornerstone of the plan was a significant reduction in the corporate tax rate. The proposed cut aimed to stimulate economic growth by incentivizing businesses to invest and expand.

- Lower Corporate Tax Rate: The plan proposed a substantial reduction from the previous rate (e.g., from 35% to a significantly lower percentage).

- Impact on Investment and Job Creation: Supporters argued that the lower rate would lead to increased corporate profits, boosting investment in new equipment, technology, and hiring.

- Potential Downsides: Critics raised concerns about potential downsides, including an increased national debt due to reduced tax revenue, and the possibility of exacerbating income inequality.

- International Competitiveness: Proponents argued the lower rate would enhance US competitiveness in the global market, attracting foreign investment and encouraging domestic businesses to expand.

Pass-Through Business Tax Changes

The plan also included modifications to the taxation of pass-through entities – sole proprietorships, partnerships, and S corporations.

- Deductions and Tax Rates: Proposed changes included adjustments to deductions and tax rates specifically for pass-through businesses. Specific proposals varied across iterations of the plan.

- Impact on Small Businesses and Self-Employed: The changes were designed to benefit small business owners and the self-employed, easing their tax burden. However, the net effect for these businesses remained a topic of ongoing discussion.

Economic Impact and Predictions

The economic consequences of the House Republicans' Trump Tax Plan were widely debated. Economic modeling and forecasting played a crucial role in analyzing potential outcomes.

Projected Economic Growth

Supporters projected significant GDP growth as a result of the tax cuts, stimulating the economy through increased investment and consumer spending. However, the magnitude of this projected growth varied substantially among different economic forecasts. Each forecast relied on different underlying assumptions regarding consumer behavior, business investment, and other economic factors. The potential for multiplier effects, where initial tax cuts lead to further rounds of economic activity, was also considered, albeit with differing conclusions.

Impact on National Debt

A major concern surrounding the plan was its potential impact on the federal budget deficit and the national debt. The significant tax cuts were projected to reduce government revenue, leading to concerns about long-term fiscal sustainability. Various analyses provided varying projections, creating uncertainty regarding the extent of the fiscal impact. This led to further debate on the need for fiscal responsibility and appropriate levels of government spending.

Distributional Effects

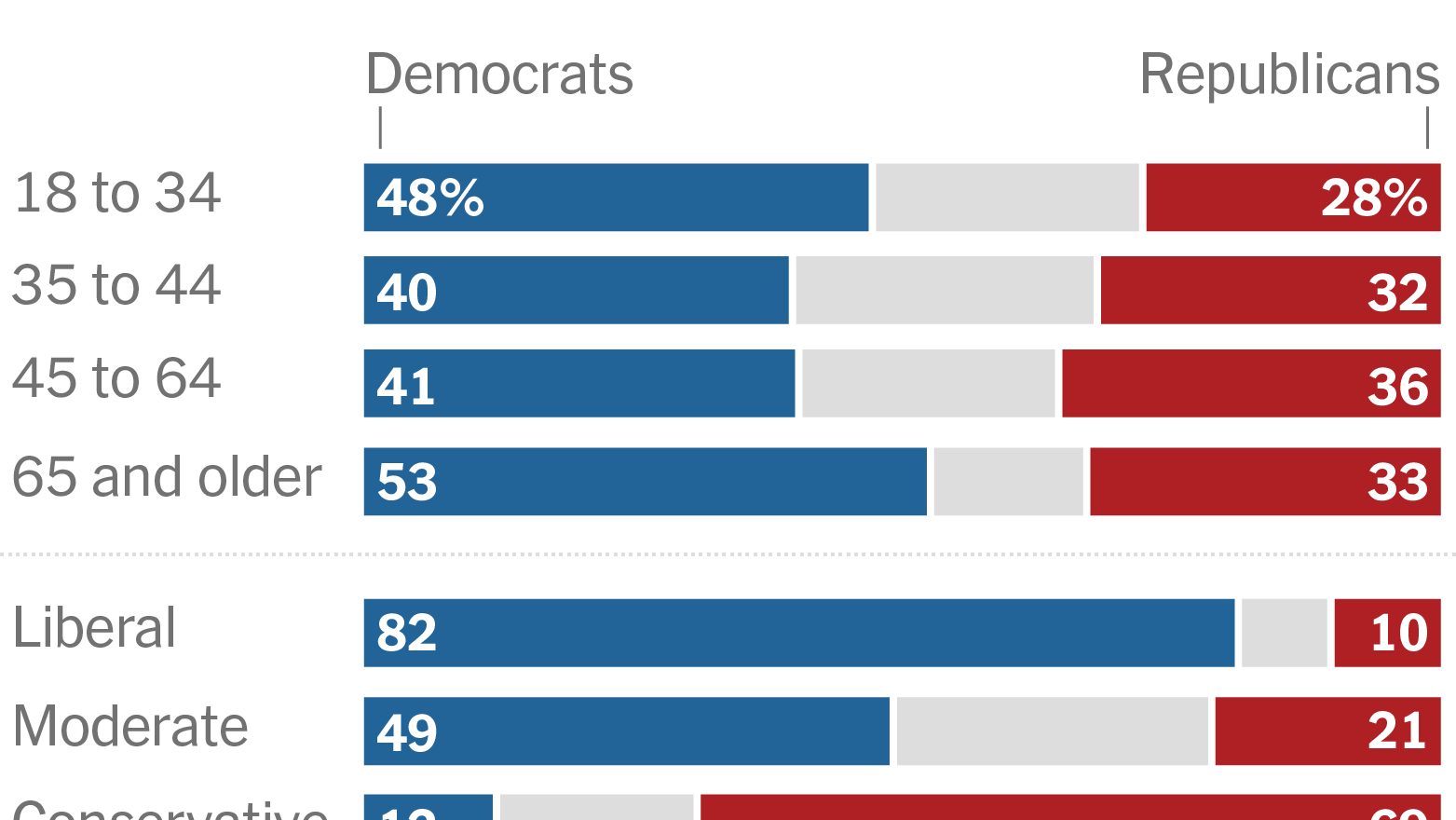

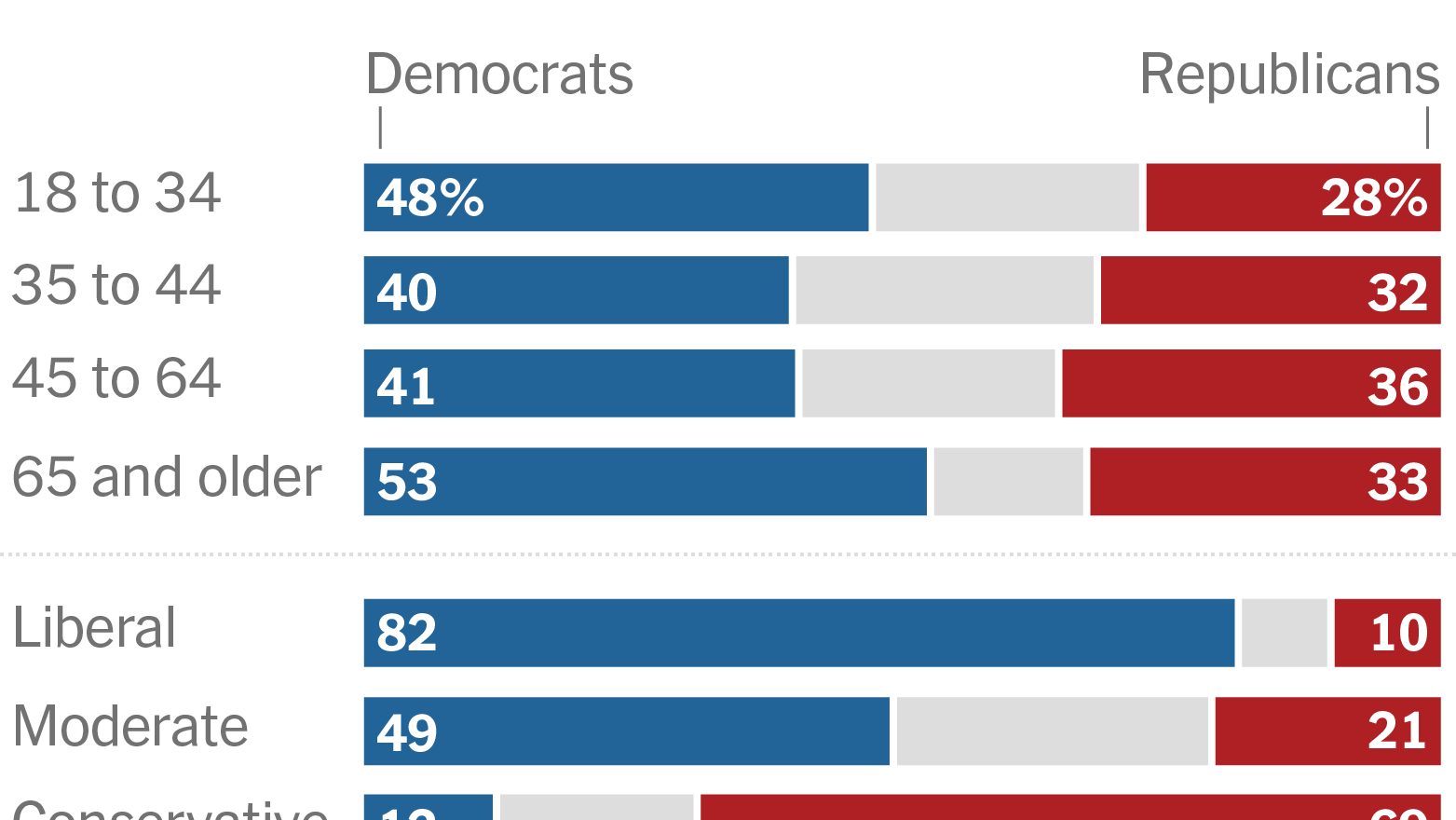

The plan's distributional effects, or how it would affect different income groups, were a key point of contention. While some argued the tax cuts would benefit all income groups, others countered that the benefits would disproportionately favor higher-income individuals and corporations. Charts and graphs illustrating the projected effects on income inequality provided visual representations of these competing arguments, but often reflected differing methodologies and assumptions.

Political Ramifications and Public Opinion

The political landscape surrounding the House Republicans' Trump Tax Plan was highly polarized.

Congressional Support and Opposition

The plan faced significant challenges in securing sufficient congressional support for passage. Bipartisan consensus proved elusive, with many Democrats expressing strong opposition and raising concerns about its fiscal implications and distributional effects. The political dynamics significantly influenced the plan's trajectory and ultimate fate.

Public Perception and Reactions

Public opinion polls and surveys revealed a mixed reaction to the proposed tax plan. Different media outlets and commentators presented contrasting narratives, influencing public perception and shaping political discourse. This created a complex environment of differing opinions and further complicated the political calculations surrounding the legislation. The potential political consequences for the Republican party were also heavily debated, depending largely on the economic and social outcomes realized after the tax reform.

Conclusion

This analysis has dissected the key elements of the House Republicans' Trump Tax Plan, exploring its proposed changes to individual and corporate taxation, along with its projected economic and political ramifications. The plan offered significant tax cuts, but its long-term effects on the national debt and income inequality remained subjects of intense debate. The plan's complexities and far-reaching potential implications highlighted the importance of thorough analysis and informed public discourse regarding tax reform and tax cuts.

Call to Action: To stay informed about the lasting impacts and ongoing discussions surrounding the House Republicans' Trump Tax Plan and its effect on your finances, continue following reputable news sources and participate in informed conversations. Understanding the intricacies of this significant tax reform is essential for navigating your future financial landscape.

Featured Posts

-

The New York Knicks Impressive Depth Without Jalen Brunson

May 15, 2025

The New York Knicks Impressive Depth Without Jalen Brunson

May 15, 2025 -

La Liga And Fan Code Forge Strategic Multi Year Partnership

May 15, 2025

La Liga And Fan Code Forge Strategic Multi Year Partnership

May 15, 2025 -

Stocks Up 10 On Bse Sensex Rally Detailed

May 15, 2025

Stocks Up 10 On Bse Sensex Rally Detailed

May 15, 2025 -

Partido Venezia Napoles Transmision En Vivo

May 15, 2025

Partido Venezia Napoles Transmision En Vivo

May 15, 2025 -

Knicks Upset Celtics In Overtime Thriller Game One Victory

May 15, 2025

Knicks Upset Celtics In Overtime Thriller Game One Victory

May 15, 2025