Analysis: How Trump And The Fed Are Affecting The Bitcoin Price

Table of Contents

Trump's Policies and their Ripple Effect on Bitcoin

Trump's presidency was marked by significant policy shifts that inadvertently impacted the Bitcoin price, often through influencing investor sentiment and market uncertainty.

Trade Wars and Uncertainty

Trump's trade policies, characterized by tariffs and trade disputes with major economies, created significant economic uncertainty. This uncertainty often drove investors towards safe-haven assets, including Bitcoin, as a hedge against potential market downturns. Investors, fearing losses in traditional markets, sought alternative, less correlated assets.

- Example 1: The escalating trade war with China in 2018 led to increased market volatility and a surge in Bitcoin's price as investors sought refuge from the uncertainty.

- Example 2: Similarly, trade tensions with other countries impacted global markets, fostering a "flight to safety" phenomenon that boosted demand for Bitcoin and other alternative assets.

- While precise correlation figures require sophisticated econometric modeling, anecdotal evidence and market analysis strongly suggest a link between trade war escalations and Bitcoin price increases during periods of heightened uncertainty.

Regulatory Uncertainty and its Impact

Trump's administration's approach to cryptocurrency regulation was often inconsistent, creating both opportunities and challenges for Bitcoin. A lack of clear regulatory frameworks contributed to volatility.

- Regulatory Ambiguity: The absence of clear, unified regulatory guidelines across different government agencies created uncertainty among investors.

- Varying International Approaches: Different countries adopted diverse approaches to cryptocurrency regulation, further complicating the landscape and impacting investor confidence. This international variation influenced the flow of Bitcoin investment across borders.

- Periods of perceived regulatory crackdown saw Bitcoin prices dip, while periods of more lenient rhetoric or inaction often saw a price rise.

The Federal Reserve's Monetary Policy and its Influence on Bitcoin

The Federal Reserve's monetary policies, particularly interest rate adjustments and quantitative easing (QE) programs, significantly impact the US dollar and, consequently, the Bitcoin price.

Interest Rate Hikes and Bitcoin's Value

Interest rate hikes by the Fed typically strengthen the US dollar. Since Bitcoin is often priced in USD, a stronger dollar generally puts downward pressure on Bitcoin's price in terms of other currencies.

- Higher Interest Rates: Increased interest rates make traditional investments like bonds and savings accounts more attractive, diverting capital away from riskier assets like Bitcoin.

- Inflationary Pressures: Interest rate hikes are often implemented to combat inflation. While this can stabilize the dollar, the price of Bitcoin might still be impacted by broader market reactions to inflation.

- Data from previous interest rate hike cycles demonstrates a correlation between increased interest rates and periods of lower Bitcoin prices.

Quantitative Easing (QE) and Bitcoin as a Hedge

Quantitative easing (QE) involves the Fed injecting liquidity into the financial system by buying assets. This can lead to inflation and currency devaluation, driving investors towards alternative assets, including Bitcoin, as a hedge.

- Increased Money Supply: QE increases the money supply, potentially diminishing the value of fiat currencies.

- Inflationary Concerns: The fear of inflation prompts some investors to seek assets perceived as inflation hedges, with Bitcoin often included in this category.

- Historical data shows periods of QE often coincide with increased interest in Bitcoin and upward price trends, as investors seek to protect their wealth from potential currency devaluation.

Inflation and Bitcoin as a Store of Value

Bitcoin is often touted as a store of value, particularly during inflationary periods. This argument rests on the idea that Bitcoin's fixed supply acts as a hedge against the erosion of purchasing power caused by inflation. However, Bitcoin's own volatility significantly challenges this assertion.

- Inflation Hedge Argument: Proponents suggest that Bitcoin's limited supply makes it a desirable alternative to fiat currencies during inflationary times.

- Volatility Counterargument: Critics point to Bitcoin's extreme price fluctuations as a significant drawback, rendering it an unreliable store of value.

- Market analysis reveals differing viewpoints on Bitcoin's role as a store of value, with experts presenting compelling arguments on both sides of the debate.

The Interplay Between Trump's Policies, the Fed, and Bitcoin Price

The combined effects of Trump's policies and the Fed's actions created a complex environment that influenced Bitcoin's price in unpredictable ways. These factors often interacted, sometimes synergistically, sometimes antagonistically.

- For instance, periods of high trade war uncertainty (Trump) coincided with QE programs (Fed), creating a complex situation that saw Bitcoin prices rise due to the hedging effect of QE outweighing the uncertainty related to trade.

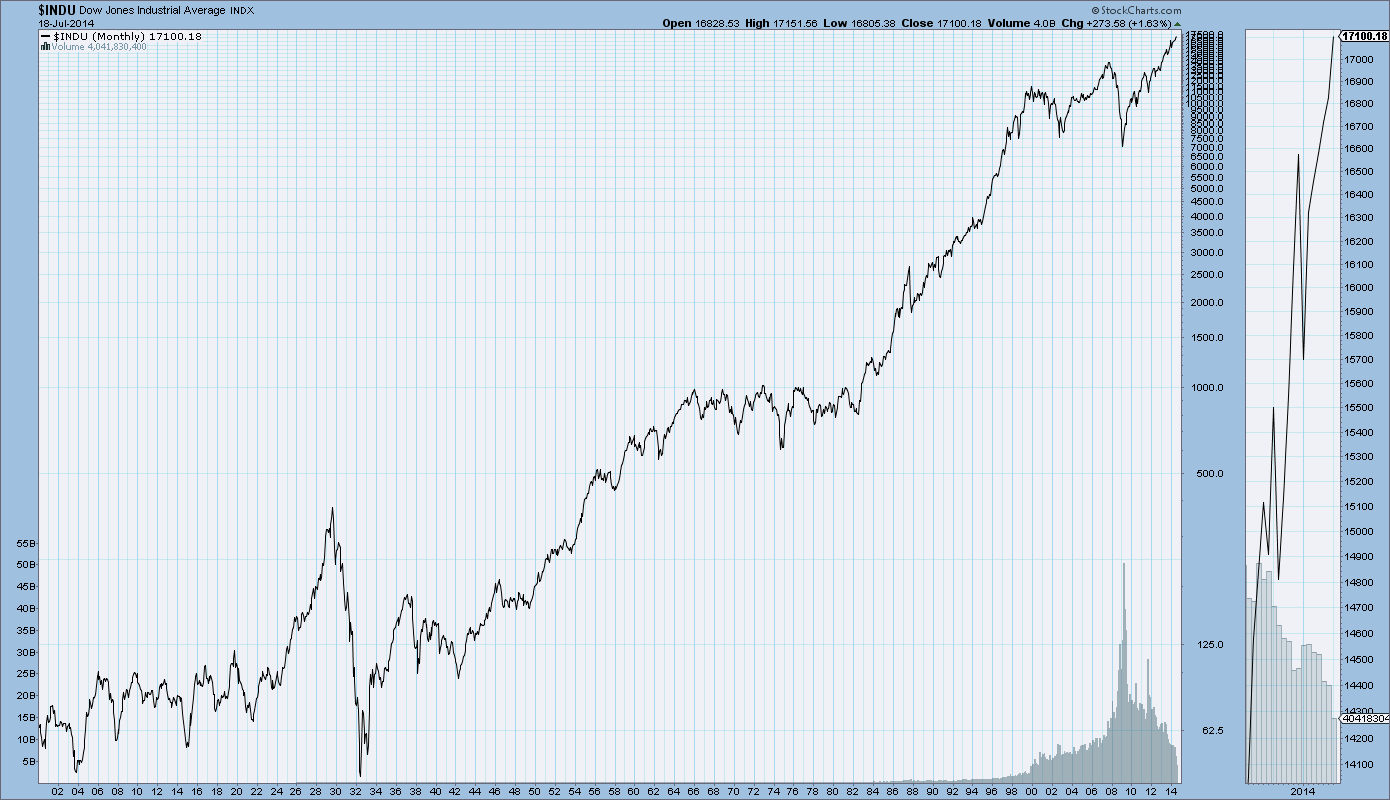

- Conversely, periods where the Fed raised interest rates to combat inflation driven (partially) by trade war-related supply chain disruptions led to decreased Bitcoin valuations, as investors flocked to safer, higher-yielding assets. (Note: A visual representation, such as a chart showing correlations, would be beneficial here if appropriate data were readily available.)

Conclusion

Trump's policies and the Federal Reserve's monetary decisions significantly influenced the Bitcoin price, often indirectly through channels such as investor sentiment, market uncertainty, and inflation expectations. Understanding this complex relationship is paramount for navigating the volatile cryptocurrency market. Both the regulatory landscape and macroeconomic factors play a critical role in shaping Bitcoin's price trajectory. Stay informed about macroeconomic trends, Federal Reserve actions, and regulatory changes to make better-informed decisions regarding your Bitcoin investments. Continue to follow our analysis of the Bitcoin price and its influencing factors to stay ahead of the curve in this dynamic market.

Featured Posts

-

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 24, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 24, 2025 -

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

Apr 24, 2025

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025 -

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 24, 2025